Apple: A Value Stock With A Growth Stock Valuation

Summary:

- Our house view here is that markets’ next major move is up. And if markets are going to move up, so too is Apple stock, due to its index weighting.

- We rate Apple stock at Hold as a result.

- As a single-stock pick, we choose to not own it in staff personal accounts, because it looks for all the world like a value play priced like a growth name.

- And there are many indicators in the numbers that tell you the company is maturing, perhaps inexorably so. We think Apple’s hegemonic days are numbered.

Stock chart is the Apple on the left. Fundamentals are the Apple on the right.

luigi giordano/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It Will At Some Point Be About The Numbers

We’ve written two notes here on Seeking Alpha lately covering the December quarter earnings from the tech behemoths in which we declared – it’s not about the numbers. For both Intel (INTC) and Meta Platforms (META), there are multiple factors at work than we believe can drive the stocks up from here, almost none of which are to do with the fundamentals. And the same is true in the near term for Apple (NASDAQ:AAPL). But not, we fear, in the longer term.

Our house view on the major indices is that they will each make new all-time highs in the next 12-24 months. The underlying driver of this is the upcoming 2024 Presidential election. (Want a second term? Give people the good feeling. So let’s assume that as we enter Q2 of 2024, food costs less, gas costs less, and stocks are worth more. Once the second term is won, if that happens? It don’t matter diddly. And if the second term is lost, with all that good feeling gone to waste? It still don’t matter diddly). The surface logic is falling inflation, flat or maybe falling base rates, strong jobs growth and good GDP numbers. Oh and the major dumpage that took place in 2022 meaning the indices can run up from a very dark place to a happy sunlit upland. And since Apple is such a big chunk of the indices and their ETFs – then if this is to happen, Apple stock is going to go up too. So we cannot in all conscience look anyone in the eye and say, smart money be dumping its Apple stock right now. Hence we rate it at Hold.

We don’t, however, own the name in staff personal accounts. If Apple moves up we get the benefit through long index ETF positions; moves down, through short index ETF positions. And right now, because we’re messing about with directionless trade methods, we have an experimental position worth about two SBUX lattes of Apple options, in a long straddle expiring next week with a $150 strike on both the call and the put. That will make money or it won’t. Research. But own the stock? No thanks.

Here’s why.

The numbers.

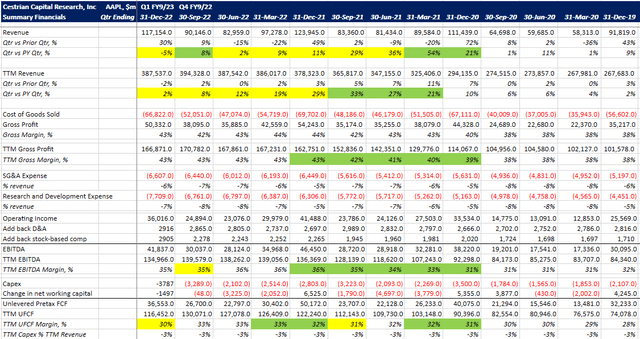

AAPL Fundamentals Table I (Company SEC Filings, YCharts, Cestrian Analysis)

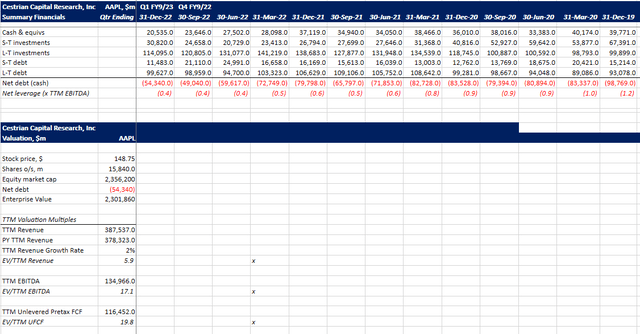

AAPL Fundamentals II & Valuation Table (Company SEC filings, YCharts.com, Cestrian Analysis)

First up, yes we know the reason that growth was awful was the Fed’s fault – that pesky dollar – and suppliers’ fault – pesky smartphone supply chain snafus. Definitely not Apple’s fault. No.

(Let’s say that Qualcomm (QCOM), a smartphone supply chain participant, which just said that their weakness was due to weak end-market smartphone demand, were mistaken. Or they were both right. Whatever.)

But the fact is that set of numbers looks like a value play.

- Longstanding trend of declining revenue growth

- Cash flow margins which have held up well but are now starting to fall, because in the end you do need revenue growth in order to maintain margins.

- A balance sheet which is moving towards a net debt position because the company is levering up to pay for buybacks and such.

- Declining share count because of those buybacks and the lack of desire to use the stock as a currency to acquire their way into higher growth segments of the tech market.

That ladies and gentlemen looks like an ex-growth business that will grow old gracefully as part of anyone’s retirement account. Doing the whole dividends and buyback and warm’n’fuzzy feeling thing. And that’s fine.

But not at 6x TTM revenue and 20x TTM unlevered pretax free cash flow, when revenue is nigh on flat and cash flow is declining.

Oh also did we mention that the growth is coming from the services side, or, put another way, extracting monopoly rents from the captive installed base. That’s a wonderful game for a while – a long while usually, just ask any now-retired IBM sales executive whose handsome home with the good white picket fence was funded far more by captive lease contracts that it was by anything tricky like an actual computer.

In short, the numbers cause us to believe the days of Apple’s hegemony are numbered, and as a single stock name we’d sooner avoid it at this price. Price drops to reflect the fundamentals? No problem, we’ll buy it. But that’s not today. Hold rating for the index weighting alone.

Oh by the way – we thought Apple was toast in 2012 when it went ex-Jobs, and again in 2018/2019 when it went ex-Ives. So we’re probably wrong.

Still don’t want to buy the stock though.

Cestrian Capital Research, Inc – 3 February 2023.

Disclosure: I/we have a beneficial long position in the shares of AAPL, META, INTC, MSFT either through stock ownership, options, or other derivatives. Business relationship disclosure: See disclaimer text at the top of this article.

Additional disclosure: Cestrian Capital Research, Inc staff personal accounts hold long positions in META, INTC, MSFT; and long positions in AAPL $150 strike 10 Feb 2023 expiry puts, and long positions in AAPL $150 strke 10 Feb 2023 expiry calls.

NEW – LOW COST NEWSLETTER FROM CESTRIAN CAPITAL RESEARCH

Our premium Growth Investor Pro service remains the #1 trending service on all of Seeking Alpha. You can learn all about it here – and until Feb 14 you can join for the half-off price of just $999/yr.

But if you’re one of the many people who love our free notes and want to take the a first step with us – at a rock-bottom price – we suggest you join our new Newsletter service here on SA – from just $49/yr. Learn more here.