Summary:

- Apple’s share price is down by more than 27% and Microsoft’s price is down by more than 29% over the last year.

- Apple has a significant Free Cash Flow advantage but Microsoft’s margins are much higher.

- Generally speaking, Apple and Microsoft compete in different markets.

- Both companies have a bright future over the long term.

gremlin/E+ via Getty Images

Overview:

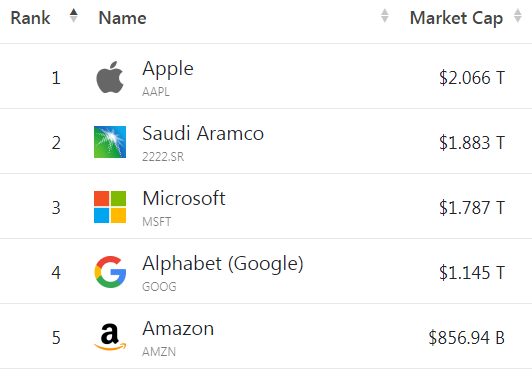

Apple, Inc. (NASDAQ:AAPL) and Microsoft Corporation (NASDAQ:MSFT) are two of the largest companies in the world by market value currently ranking #1 and #3.

companiesmarketcap.com

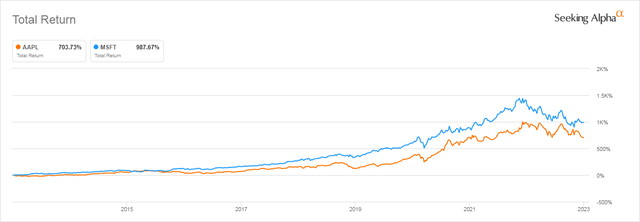

Both companies generate huge amounts of revenue and profit and have been two of the best-performing stocks in the last 10 years. Over that time period, MSFT is up more than 900% and Apple is up more than 700%.

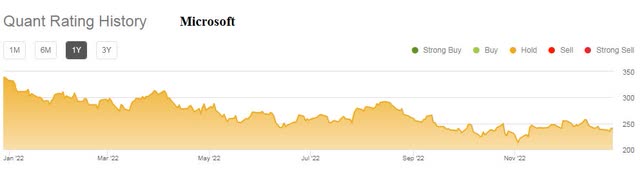

However, price-wise, both companies have suffered over the last year with Apple dropping 27% and MSFT 29%.

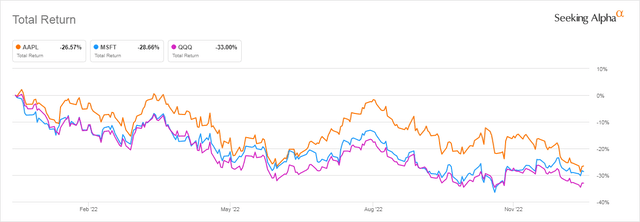

To see how bad it has been for tech stocks in general over the last 12 months, the next chart adds Invesco QQQ Trust (QQQ) as a proxy for the tech market in general.

QQQ has done worse than either Apple or MSFT, falling a significant 34%.

Despite the bad year, few believe that these two tech stalwarts are not going to outperform most stocks over the coming years.

In this article, I will compare Apple and Microsoft to see which one is the better long-term investment.

AAPL And MSFT Stock Key Metrics

Historically, MSFT has consistently had a much higher Price/Sales ratio than Apple as the following 10-year chart shows. However, it appears from the chart that MSFT Price/Sales ratio is dropping considerably faster than AAPL.

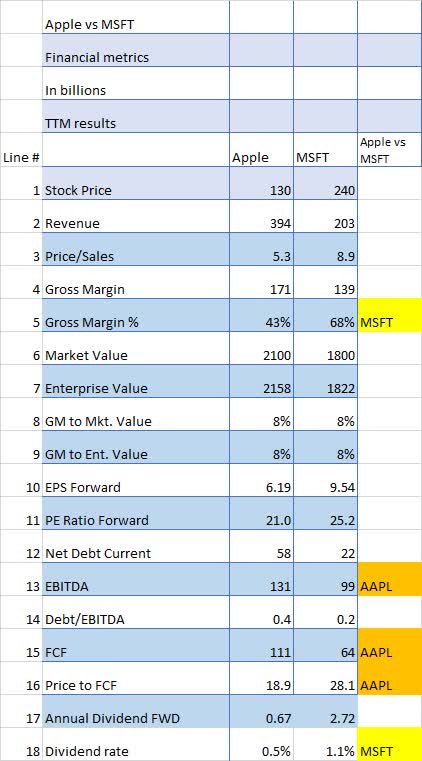

As you can easily see in the table below, Apple is a much larger company based on revenue (Line 2). But when it comes to Price/Sales (Line 3) Apple appears to be a much better value with a ratio of 5.3x versus MSTF’s 8.9x.

Gross Margins (Lines 5, 8 and 9) are also interesting with MSFT having a much better gross margin overall (Line 5) 68% to 43%, but identical GM percentage (8%) when compared to Market Value (Line 8) and Enterprise Value (Line 9).

This could imply that Apple is relatively underpriced compared to MSFT.

The PE Ratio (Line 11) is relatively close though again, Apple’s PE ratio is somewhat lower than MSFT’s ratio.

Seeking Alpha and author

Another significant difference is Apple’s huge EBITDA which is 31% higher than MSFT’s.

Free cash flow (FCF) is another metric where APPL outperforms MSFT, in this case 70% higher than Microsoft’s FCF. That puts the Price/FCF ratio strongly in Apple’s favor.

Both dividend rates are insignificant, but MSFT’s rate is more than double Apple’s.

Based on financial metrics, Apple has better numbers than MSFT.

Is MSFT A Direct Competitor To Apple?

Although Apple and Microsoft compete at the fringes, in general, they have taken different paths to their respective successes.

Below is the revenue breakdown of each company from their most recent 10Ks.

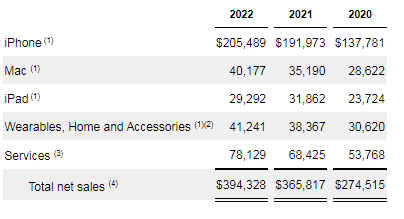

Apple:

Apple 10K

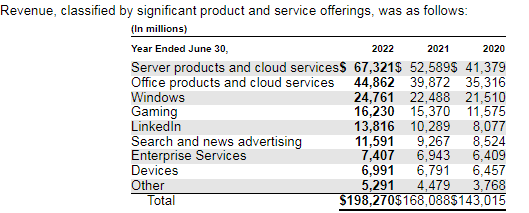

Microsoft:

Microsoft 10K

In Apple’s case, we can see that devices, i.e. hardware, represents almost 80% of revenue. Services represent the other 20%.

However, in MSFT’s case, services are a much larger proportion of revenue representing 67% of the total revenue. When it comes to hardware (Devices) we see a minuscule 3% of revenue.

So direct head-to-head competition between the two would appear to be minimal.

How Are Apple And MSFT Stock Different?

The biggest difference between MSFT and Apple revolves around Apple’s iPhone. For Apple, almost everything they sell starts with the iPhone. For example, I would be curious to know how many iPad and Mac users, not to mention wearable users, do not have an iPhone.

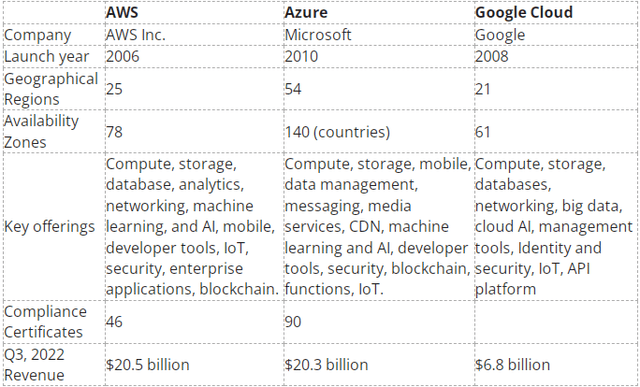

For Microsoft, cloud services are the big item and those services have a more general user base. Competition in the cloud includes Amazon and Google.

Generally speaking, Apple and MSFT operate in different markets.

Are These Stocks Fairly Valued?

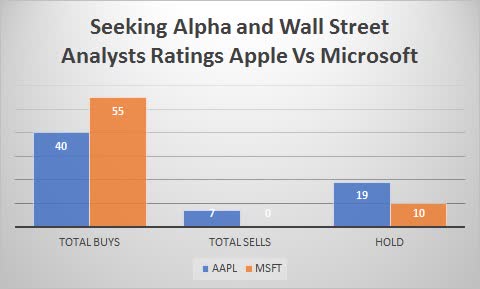

If we look at analysts’ ratings for both stocks we see that MSFT is highly rated and Apple not so much. MSFT has 55 Buy recommendations and zero Sell recommendations. That is impressive.

Apple on the other hand has 40 Buys but a bothersome seven Sells including two Strong Sell recommendations. Obviously, some analysts are less than enamored with Apple’s plans and performance.

Seeking Alpha

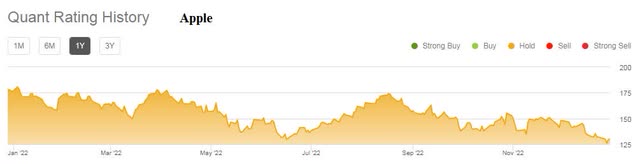

But looking at the quant ratings both companies currently have a Hold rating.

Do the quants know something the analysts don’t?

Perhaps quants want to wait until they are sure the recession has passed or is non-existent.

In my opinion, both these stocks are underrated based on historical performance and the inevitable turnaround will show up in the next year or two.

Having said that, I would rate Microsoft as a better value at this point based on more service revenue and higher margins.

Is Apple Or MSFT Stock A Better Long-Term Buy?

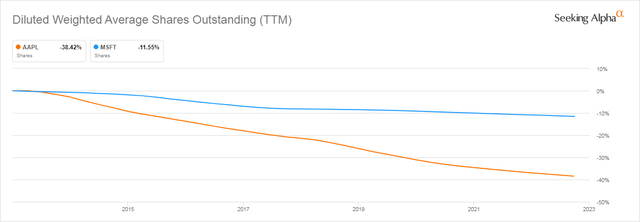

One of the advantages Apple has over MSFT is the consistent share buyback plan that has been in place for years. Looking at the share comparison between the two companies we can see that Apple’s share count has dropped by 38% over the last 10 years while MSFT’s has only dropped by 12%.

As we saw in the Financial metrics section above, MSFT has a modest advantage when it comes to the dividend with a current yield of 1.1% versus 0.5% for AAPL.

The future is bright for both companies because the products and services they provide are only going to grow over time. Therefore, the question becomes which one is likely to do better

An interesting stat shows that the two best brand names in the world are, you guessed it, Apple #1 and Microsoft #2. In fact, as the following chart shows the top-4 brands are also in the top-5 in market value shown in the chart at the beginning of this article.

The obvious investment question is whether now is the time to buy either MSFT or Apple. Both have shown significant share price losses over the last year.

For the long term, both are excellent choices but I believe Microsoft is the better choice because of its much higher Gross Margins and the world’s insatiable demand for more data should result in significantly more high-margin service revenue from cloud users going forward.

At its current price, MSFT is a Buy with a price target of $350 by the end of 2024.

Apple is a Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.