Summary:

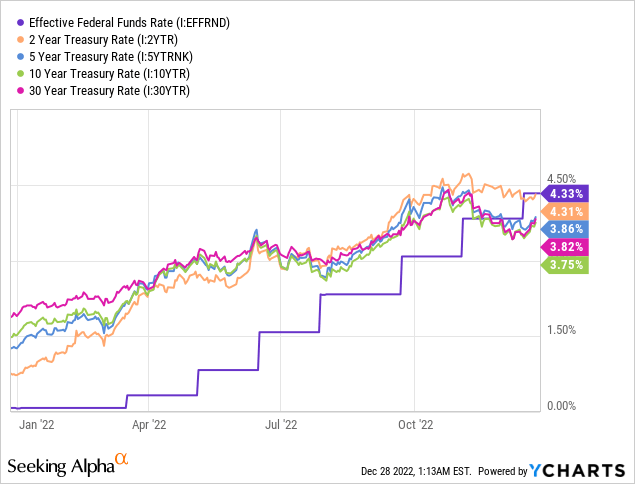

- Treasury bonds are moving all over the place, with 10-year Treasury bond yield now sneaking back up to 3.88% yesterday after dropping below 3.5% for a brief period in December.

- On the other hand, the two-year Treasury yield is now lower than the Effective Federal funds rate. Overall, the Treasury yield curve is still deeply inverted, indicating an imminent recession.

- Post a stunning rally from mid-October to late November, equity markets have been declining since the Fed’s FOMC meeting in December.

- Apple has broken a key support level at June lows, and selling pressure could intensify from here. Technically, Microsoft is looking weak too.

- I continue to prefer short-duration bonds to park my cash (earmarked for future equity purchases). Additionally, I rate Apple and Microsoft “Neutral/Avoid/Hold” at current levels.

DNY59

Introduction

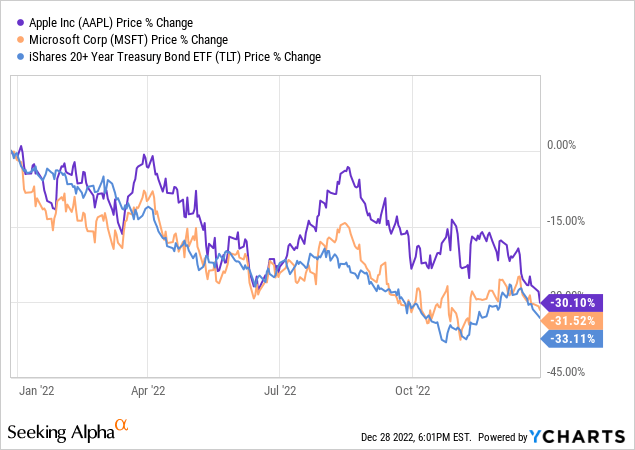

Over the last decade or so, Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) have earned the status of safe havens in a zero-interest rate world. However, with the interest rate environment undergoing a seismic shift in 2022, both Apple and Microsoft have gotten crushed, down more than 30% YTD.

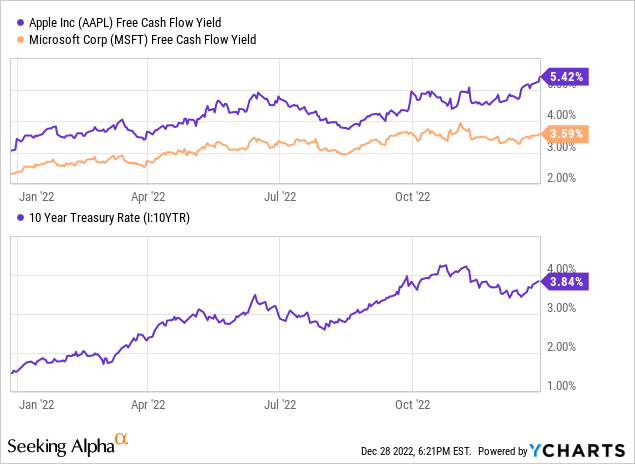

Now, some of you may argue that Apple and Microsoft are still safe havens because even the long-duration treasury bonds are down as much or more. I have a different view here – Apple and Microsoft are down 30% each, and yet their equity risk premium has declined, i.e., the stocks have become more expensive relative to bonds.

With an earnings recession on the horizon, Apple and Microsoft’s premium valuations (relative to S&P 500 (SPX) and Treasuries (TLT)) make no little to no sense to me. As we have seen in the past, these safe haven stocks have four major headwinds:

- High starting valuations

- Growth slowdown

- Buybacks becoming ineffective & balance sheets getting less robust

- Rising interest rates

For the purpose of brevity, I won’t discuss these headwinds in detail today. However, you can go through my past coverage of this battle to learn more:

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-2

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-3

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-4

In today’s note, we will discuss recent market action and do some technical analysis on Apple and Microsoft to enhance our understanding of where these stocks are right now and to see where they may be headed in the near to medium term. We have already discussed the business fundamentals for these companies in great detail in the notes shared above, and you can find more of my research on SA:

Hence, we won’t be talking about business fundamentals today. With that out of the way, let’s get started!

What’s Mr. Market Telling Us?

There’s a famous saying in the market – “Don’t fight the tape,” which means traders/investors should not bet against the market trend. As a long-term investor, I couldn’t care less about Mr. Market’s short-term shenanigans. However, I do like to analyze market action from time to time as that allows me to optimize my investing operations.

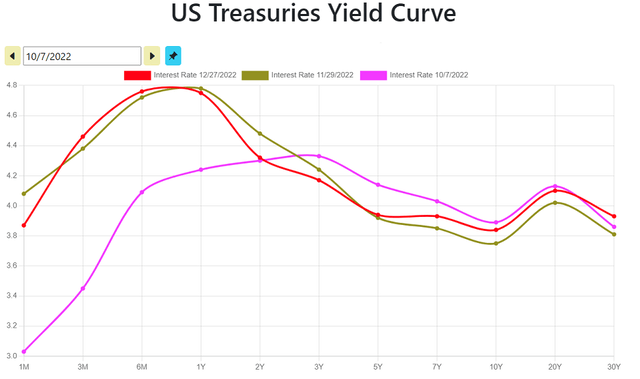

The Fed’s rate hikes have undeniably impacted the markets this year, leading to a broader inversion of the treasury yield curve in July. As seasoned investors know, when there’s an inverted yield curve – a recession may be looming. With over twice as much notional value held by the debt market compared to equity markets, now more than ever, we must pay attention to what the bond market is telling us.

ustreasuryyieldcurve.com

For months, the bond market has been screaming “Recession Ahead.” However, these screams have fallen on deaf ears so far, with consumers still spending freely and the Fed responding with tighter monetary policy. Yes, goods inflation is collapsing, and that’s good news. However, we still have full employment, and wages are growing at ~7.2% (annualized), which means the fears of a price-wage spiral are not unwarranted. The Fed’s current stance is higher interest rates for longer, and if they follow through, inflation is going to get crushed next year. The only problem is the collapse in inflation will be accompanied by a collapse in consumer demand (and higher unemployment).

Even after the Fed’s FOMC meeting in mid-December, long-duration treasuries were holding below 3.5% (after a drastic drop of ~90 bps in November) until recently. However, the 10-year Treasury yields have shot up by 50 bps from ~3.4% to ~3.9% in recent days. In the bond world, that’s a big sell-off. After fighting the Fed for a bit there, the bond market is repricing according to Fed’s guidance. However, the Fed is looking to raise interest rates up to ~5.1% and hold at that level for the entirety of next year. With this forward rate expectation in mind, the two-year bond yield at ~4.35% just doesn’t sit right, and I expect short-term bond yields to rise further in H1’23.

cnbc

Despite long-duration bonds sold off far more than short-duration bonds in the last few sessions, the 2yr/10yr spread is still highly negative, and the treasury yield curve remains deeply inverted. The bond market is still in the recession camp, and I am too.

Based on leading economic indicators and Fed’s aggressive monetary tightening, I expect a recession to hit the US economy sometime in 2023. However, I’m not sure of the timeline. All signs point to an imminent recession; however, with full employment, the recession may not materialize until the second half of next year. That said, markets are forward-looking, and a recession will be priced into the market before the recession happens.

And we are seeing some of that much-needed repricing in the bond and equity markets over the last couple of weeks. For the purpose of this article, I will stick to Apple, Microsoft, and treasury bonds, but if you are interested in my view on broader markets, feel free to check out the following notes:

- Powell Turns Into The Grinch, Equities Tumble On Reality Check (SPX)

- What Is The 2023 Forecast For Tech Stocks? (NASDAQ: QQQ)

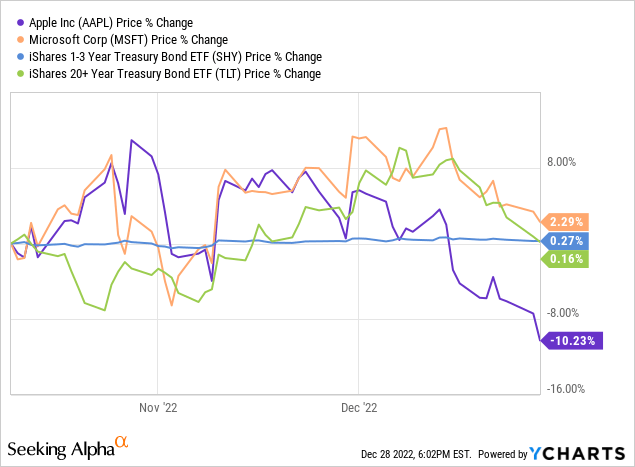

Since my last update on “The Battle Of Safe Havens” in late November, short and long-duration bonds are pretty much flat, Microsoft is up ~2%, and Apple is down ~10%.

Apple has underperformed massively, and as shown in the chart above, Microsoft is also losing its relative outperformance rapidly in recent sessions. The near-term outlook for equities remains grim as they face a double whammy of multiple contraction and an earnings recession in 2023.

So, is this a bad time to be an investor? No, not at all. Bear markets bring fantastic investment opportunities, and this bear market is no different. In my view, there are fantastic opportunities in individual stocks. That said, bear markets bring a lot of volatility, and investing during this period requires lots of patience and an affinity for risk management. At my marketplace service, we pursue bold, active investing with proactive risk management.

And here’s how we have done since inception on 2nd September 2022 in a very challenging market:

| TQI’s Portfolio | Portfolio RTD (%) | Benchmark RTD (%) | Alpha (%) |

| GARP | -11.82% | QQQ: -11.88% | +0.06% |

| Buyback-Dividend | -1.47% | SPY: -3.97% | +2.50% |

| Moonshot Growth | -11.67% | QQQ: -11.88% | +0.27% |

Source: The Quantamental Investor (as of market close on 12/28/2022)

On an absolute basis, TQI’s Buyback-Dividend portfolio is barely in the red, with a return-to-date performance of -1.47%. Compared to its benchmark, i.e., S&P 500 (SPY), TQI’s Buyback-Dividend portfolio is outperforming by +2.50%. In my view, this financially-engineered portfolio strategy is performing exceptionally well in a challenging market and serves as proof that financial engineering works brilliantly in equity markets if done right!

Since TQI’s inception in early September, TQI’s growth-oriented strategies have not performed well, with growth stocks continuing to remain under pressure in a challenging macroeconomic environment. In context with the market, TQI’s GARP and Moonshot Growth portfolio are performing in line with their benchmark (QQQ). Since our growth strategies have a higher beta, I think these portfolios are holding up just fine too.

Heading into 2023, we are ~50-65% in equities, 10%-15% in options-based hedges, and ~30%-35% in cash across our core portfolios shared above. And I think such a conservative positioning is warranted in the current environment. After all, Apple lost nearly $350B in market capitalization this month!

Let us now take a deeper look at the recent action in Apple.

What’s Wrong With AAPL Stock?

Apple’s production issues in China are set to result in a miss on iPhone sales, and analysts have been cutting Q4 estimates in recent weeks. However, the bigger issue for Apple is the potential demand destruction the Fed’s aggressive monetary policy will unleash in 2023. Apple was a big beneficiary during the 2020-21 liquidity boom, and its hardware revenues could come under severe pressure next year.

As you may have noticed, Tesla’s (TSLA) stock has slid by ~40% in the last month on fears of a reverse gamma squeeze, insider selling, demand concerns, and Musk’s recession strategy to sacrifice margin for unit sales. The bearish argument for Tesla (trading at 20x forward P/E, similar to Apple) is that it is a car manufacturer (hardware company) and hence should be priced lower. Well, by that logic, Apple is a hardware company too. Furthermore, Apple has far less growth compared to Tesla.

Is Apple’s premium valuation of ~20.5x P/E justified? I don’t think so, but we will let the market (and time) be the judge of that. For now, let’s focus on Apple’s technical chart to see what the market is telling us through price action.

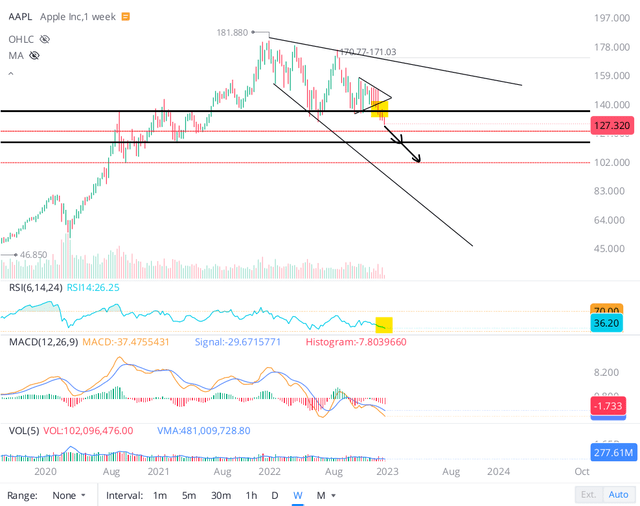

In my recent research note on Apple (Apple Stock: A Troublesome Tryst With Technicals), I wrote the following conclusion:

As an investor, I like to buy and hold companies for the long haul, and Apple is an incredible business to own. That said, I have reservations about its current valuation, as shared in multiple articles in the past. Apple is one of the strongest consumer discretionary businesses on the face of this planet; however, it ain’t a recession-proof business or stock and shouldn’t be priced like a utility (as it’s being priced right now).

Today’s technical analysis exercise showed that – Apple’s stock is ripe for a big near-term move within the bearish megaphone pattern formed on the chart. A breakout to the upside from the symmetrical triangle pattern (~$150 level) could send Apple’s stock soaring up to ~$165-170. On the other hand, a breakdown of the $134 level could send the stock tumbling down to the $80-110 zone. Clearly, the risk/reward here is tilted in favor of bears. Also, we saw that Apple’s stock had been rejected from the 200-DMA level multiple times in recent weeks, and that’s a bearish signal.

If you follow my work, you know that I do not take short positions in individual stocks, and I am not going to start now (especially with Apple). However, I see a precarious technical setup in Apple’s chart, and I wouldn’t buy here. The conclusion of today’s technical analysis is in alignment with my fundamental view on Apple’s stock, which can be found in this note: Is Apple Stock A Good Pick If The Economy Enters A Recession?

Since presenting this precarious technical setup on 8th December, I have been watching Apple closely, and yesterday we got a break of the June lows at $128. With that confirmation, I now see Apple hitting the downside target range of $80-110 as a high-probability outcome.

WeBull Desktop

The move lower may not be linear and may not materialize at all. As you know, I don’t short stocks ever, and I am certainly not going to do that with an incredible company like Apple. However, I think Apple’s precarious technical setup renders it a strong “Avoid” for the near-term future.

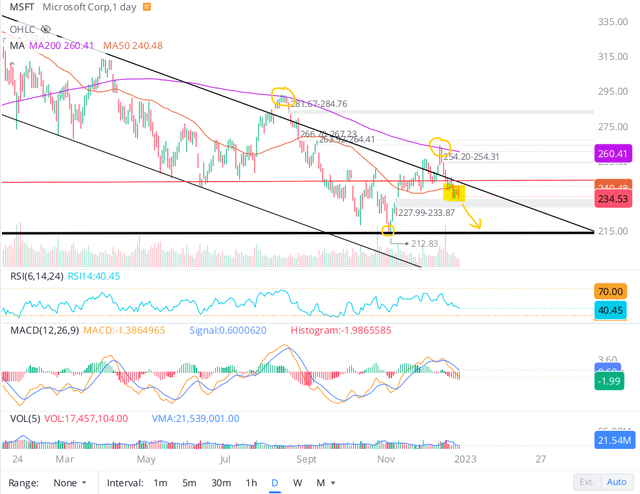

Technically, MSFT Is Looking Weak Too

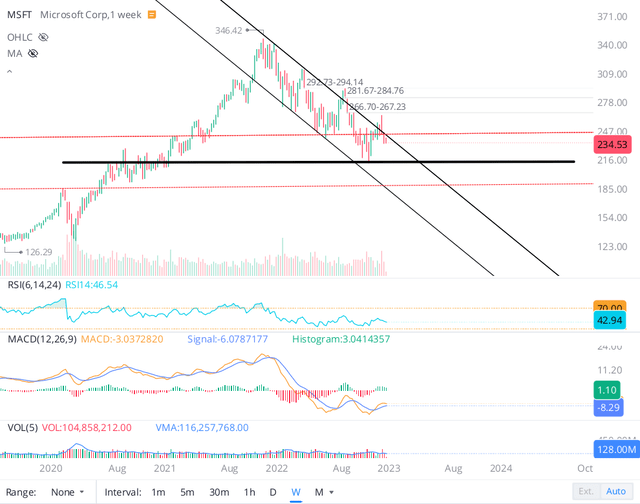

The selling in Microsoft has been far more measured, and thankfully, we’re not looking at a massive megaphone pattern in this counter like Apple.

WeBull Desktop

That said, Microsoft has just broken back into its falling channel pattern in recent days after a rejection from its 200-DMA, and a re-test of mid-October lows at ~$212 looks to be on the cards.

WeBull Desktop

At ~25x P/E, Microsoft is not cheap. In fact, it still has a premium valuation compared to the market. Hence, the stock lacks a valuation-based floor, and a breakdown of the $215 level could easily send the stock tumbling down to the mid-100s. Microsoft’s business is far more resilient compared to most tech companies on the planet; however, it is not immune to the macroeconomic environment. Big tech stocks have been falling one after another like dominoes, and Apple’s breaking below its June lows is an ominous sign. In my view, Apple is the penultimate domino in tech, and Microsoft will be the last one to get the hairdryer treatment from Wall Street!

Final Thoughts

At TQI, we own a little bit of both Apple and Microsoft within our Buyback-Dividend portfolio. However, we’re not adding more capital to these names despite having a large cash (treasury) position of ~33% of AUM in our portfolio. And here’s why:

| TQI’s Fair Value Estimate | Current Price | Upside (+) / Downside (-) | |

| Apple | $105.98 | $126.10 | -15.96% |

| Microsoft | $156.27 | $234.53 | -33.36% |

Source: Author’s SA Marketplace – The Quantamental Investor

According to TQI’s Valuation Model, Apple and Microsoft have a downside of ~16% and ~33%, respectively. And these models do not account for a severe recession, which we could end up in (if Fed sticks to its stated path).

Considering the fact that we’re no longer operating in the era of free money, Apple and Microsoft’s stocks offer little to no margin of safety at all. With the 2-Year Treasury Rate at ~4.35%, the equity risk premium on offer from Apple (FCF yield: 5.4%) and Microsoft (FCF yield: 3.5%) is virtually non-existent! In my view, the risk/reward for a near to medium-term investment in Apple and Microsoft remains highly unfavorable.

For long-term DGI investments, Apple and Microsoft are decent buys. However, there’s not much to get excited about at these levels. If I had to pick one, I would go with Apple (trading at ~20.6x P/E) over Microsoft (trading at ~25.2x P/E).

Here’s the call I made in early October (and repeated in late November):

In the “Battle of Safe Havens,” cash has been the winner so far; however, surging treasury rates are making treasury bonds a viable alternative to equities. If I had to choose between Apple, Microsoft, and the 2-yr treasury bond, I would go with the 2-yr treasury bond for the medium term.

Source: Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-4

With the Fed still planning additional rate hikes and intending to hold them higher for longer, I continue to like the idea of buying short-term treasuries over long-term bonds, Apple, and Microsoft to ride out an inevitable economic recession. In the past, I have suggested buying 2-yr treasury bonds; however, the gap between 2-yr treasury yields and FED’s forward rates guidance means we are better off buying 3-month or 6-month T-bills yielding ~4.7%.

Key Takeaway: I continue to prefer short-duration bonds to park my cash (earmarked for future equity purchases). Additionally, I rate Apple and Microsoft “Neutral/Avoid/Hold” at current levels.

Thanks for reading, and happy investing. Please share your thoughts, questions, and/or concerns in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to shield your portfolio against a potential market crash in 2023?

At TQI, we pursue bold, active investing with proactive risk management. If you would like to read our detailed market outlook and access our positioning for this challenging market environment, join our community today.

We’re currently running a “Holiday Sale” event at The Quantamental Investor, and annual membership is just $399 (or $49 per month) if you sign-up before 2nd January. The membership prices will be raised to $899 per year (or $99 per month) once this sale ends.