Summary:

- Apple Inc. shares have received two major rating downgrades due to macro concerns and lackluster hardware performance.

- The iPhone business has likely reached its penetration ceiling, with slowing demand and declining market share.

- Apple’s App Store practices face regulatory scrutiny and the Google/Apple trial poses a substantial threat to its bottom line.

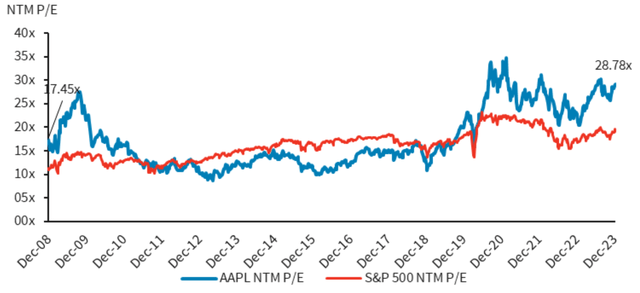

- Apple shares trade very expensive, at a NTM P/E of approximately 29x, compared to about 20x for the S&P 500.

- Considering risks against valuation, I rate Apple stock a “Sell.”

husayno/iStock Editorial via Getty Images

Apple Inc. (NASDAQ:AAPL) shares have suffered two major rating downgrades in the first trading week of January, with Piper Sandler and Barclays cutting their recommendation to neutral and underweight, respectively. Analysts at the investment banks pointed to macro concerns, including a challenging economic backdrop in China, as well as a lackluster hardware business, notably the sluggish demand performance of the iPhone 15 line unveiled in September. Moreover, Timothy Long (Barclays) also highlighted a perceived “lack of bounce back” in the Macs, iPads, and wearables business lines, despite Apple’s introduction of new Macs with M3 processors in October and several other Macs in January.

While I share the concerns pointed out by Barclays and Piper Sandler, I also highlight Apple’s challenges relating to App Store antitrust issues and the Department of Justice’s trial over Apple’s relationship with Google in the context of Traffic Acquisition Costs (TAC). Despite all this negativity, Apple shares trade very expensively, at an NTM P/E of approximately 29x, compared to about 20x for the S&P 500 (SP500).

The iPhone Business Has Likely Fully Matured

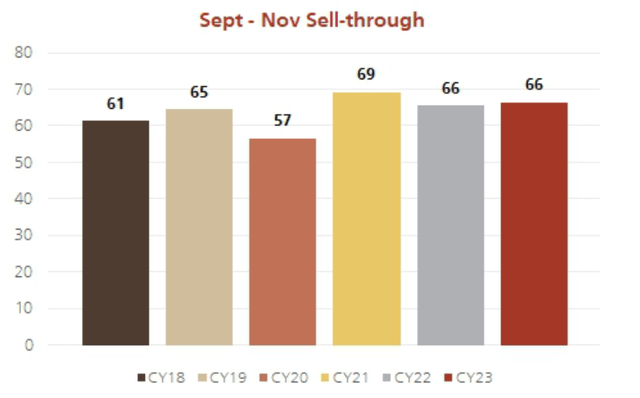

Apple’s iPhone business accounts for approximately 50% of the company’s total sales and has historically been a key growth driver for the company. However, looking at the sales performance of the iPhone over the past 12-24 months, it is hard to see how the iPhone can maintain the image as a growth engine. In fact, most recent insights, point to a slowing demand backdrop after the iPhone business has arguably grown to its penetration ceiling: November’s iPhone sell-through hit 21.4 million units, up 1.7% YoY but down 18% MoM. In that context, the U.S. saw a nearly 13% YoY decline, while China faced a 6% YoY drop. Meanwhile, India’s 8% growth YoY growth fails to support investor confidence about the iPhone’s outlook going into 2024, as Apple’s global share of phones decreased 50 basis points YoY, with a substantial 320 bps decline in China.

On a trailing three-month basis, Sept-Nov’s sales numbers were approximately flat vs. 2022 and down almost 5% compared to 2021. Source: UBS equity research note on Apple dated 1st January 2024: iPhone sell-through in Nov up ~2% YoY but the US and China are soft.

Based on this data, I view it as highly unlikely that 2024 will be a bullish year for the iPhone.

Apple’s App Store Practices May Be Subject To Regulatory Adjustments

Looking beyond the iPhone, Apple’s App Store business shines as the primary growth driver for the company, contributing about 25% of Apple’s total top-line volume and a likely even higher share of profits. That said, Apple’s App Store revenues have shown a notable 21% CAGR from 2017 through 2021, outpacing the 9% CAGR of Apple’s non-App Store business.

Given the App Store’s increasing importance for Apple’s equity story, it is concerning to note that Apple’s App Store practices face heightened regulatory scrutiny due to potential antitrust issues. Apple’s control over app distribution, strict guidelines for developers, and high commission rates (take rates of between 15% to 30%) have prompted legal battles and ongoing investigations. In that context, a recent court ruling against Google’s (GOOG) similar practices in its Play Store raised concerns about the App Store’s future, potentially leading to policy changes that could significantly Apple’s revenue and profit growth.

While Apple has not disclosed operating profitability metrics for the App Store, it is highly likely that the EBIT margin for the segment is trending above 50%, perhaps even 70%, given that the App Store distributes products on very low COGS and operates on minimal SG&A. This means that a 1 percentage point reduction in take rates would likely result in an operating earnings loss equal to ~$500 million.

Apple’s Risk Amidst Google/AAPL DoJ Trial

As a likely additional headwind for Apple in 2024, I argue that the scrutiny from the Google/AAPL Department of Justice (DoJ) trial over Traffic Acquisition Costs (TAC) poses a substantial threat to Apple’s bottom line. For reference, Google pays fees to OEMs, including Apple, to secure its status as the default search engine on their devices. The lawsuit, which commenced its initial hearing on Tuesday, 12th September, alleges that these agreements breach antitrust regulations due to their exclusivity. According to the DOJ’s assertions, Google allocates roughly $10 billion annually to uphold its default search engine status across various devices and browsers. However, further investigation hints that this amount might be notably higher, potentially reaching 2-3 times the DOJ’s estimation, with approximately $18 billion directed specifically to Apple.

While anticipating the trial’s outcome is challenging, the risk to this highly lucrative TAC revenue stream for Apple is undeniable. A possible ruling favoring the DoJ could impact Apple’s EPS by 10%, assuming the TAC receipts flow directly to the company’s earnings, estimating that most of the ~$18 billion TAC payments translate directly into operating earnings.

Expect Muted Growth In 2024…

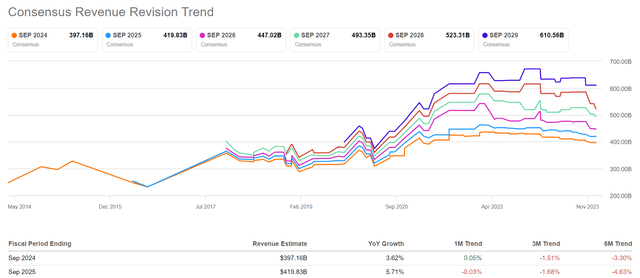

As the iPhone business has arguably reached its penetration ceiling, and risks relating to Apple’s non-iPhone businesses keep piling up, the outlook for Apple in 2024 is not rosy. In fact, analyst consensus estimates project that for the fiscal period ending September 2024, Apple may only see 3.6% YoY earnings growth, with revisions trending downwards.

… Inadequate To Justify Valuation

In my opinion, 3.6% YoY top-line growth, is not enough to justify Apple’s rich valuation. Apple shares currently trade at an expensive NTM P/E of approximately 29x, compared to about 20x for the S&P 500. Also benchmarked against itself over time, Apple stock is currently trading expensive, as mapped by Barclay’s analysts (Source: Barclays Equity Research note on Apple, dated 27th December: Apple, Inc. Downgrade to UW; Time for a Breather). Investors should also note that Apple traded at a lower multiple than the S&P 500 through most of the 2010-2020 decade. While it is hard to peg Apple’s intrinsic worth to a stock multiple, I would argue that any valuation >20x P/E may be risky for an asset growing <5% CAGR.

Upside Variables

Variables potentially contributing to Apple’s stock upside, and thus contradicting my core thesis, may include (1) accelerated growth in novel product offerings, such as supportive demand for Apple’s Vision Pro, (2) the successful launch of a new product category like the Apple Car, (3) as well as an (unexpected) significant rebound in iPhone unit sales.

Conclusion

The recent rating downgrades for Apple by Piper Sandler and Barclays highlight macroeconomic worries and sluggish hardware performance, particularly concerning the lackluster demand for the iPhone 15. In fact, The iPhone business seems to have plateaued, casting doubt on Apple’s future growth potential. Beyond these issues, Apple faces challenges related to its App Store practices and the Google/AAPL trial over Traffic Acquisition Costs. Despite these concerns, Apple’s stock remains highly priced at around 29x NTM P/E, notably higher than the S&P 500’s 20x. Considering risks against valuation, I rate Apple stock a “Sell,” and I believe more analysts will follow Piper Sandler’s and Barclay’s lead in downgrading Apple stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.