Summary:

- Apple’s overexposure to China has become its major vulnerability.

- While the company’s stock has a chance to further appreciate in the following months thanks to improvement in market sentiment, its upside remains limited in the long run.

- Apple could become the next major casualty of the potential Sino-American confrontation in the future, which makes me avoid its stock at the current levels.

Eric Thayer

There is every reason to believe that Apple’s (NASDAQ:AAPL) stock could keep its momentum and appreciate further thanks to the change in market sentiment as now there’s a potential that we might avoid a global recession thanks to the reopening of China and the start of the deflationary process. However, as I’ve already noted in my previous article on the company, Apple’s overexposure to China could make the company a casualty of a potential Sino-American confrontation in the future. Add to this the fact that the company’s stock continues to trade above its fair value and it becomes obvious that Apple’s stock presents a minimal upside for long-term investors at the current levels. Therefore, I continue to be neutral on Apple’s stock even after the release of the recent earnings report for Q1 and believe that there are better growth and value opportunities in the market.

Beijing Saves The Day

At the end of last year, there were fears that a hard global recession is unavoidable as the rising interest rates coupled with monetary tightening and the closure of China could prevent the global economy from growing in 2023. However, in the last couple of months, Beijing has made a U-turn regarding the zero-Covid policy and at the same time sacked its wolf warrior diplomats to pursue a more constructive foreign policy that’s aimed at improving its relations with the Western world. I have explained in great detail those changes in one of my articles on Alibaba (BABA) and highlighted how they would be able to lead to a better-than-expected performance of the global economy in the coming months.

For Apple, this is good news due to the globalized nature of its business. The reopening of China has already made it possible not only to avoid a hard landing but also to avoid a global recession in any form as Beijing’s policy pivot, coupled with the beginning of the disinflationary process, has all the chances to revive the growth story and ensure that businesses such as Apple are able to improve the performances of their businesses this year.

Let’s not forget that Tim Cook has recently noted how Apple was affected by the 800 basis point foreign exchange headwind that prevented growth across the majority of the markets in which it operates. The same is true for Apple’s Big Tech peers such as Google (GOOG)(GOOGL) as well who were negatively affected by the strong U.S. dollar. That’s why the potential improvement of the global economy has all the chances to minimize FX risks in the following months and help Apple to outperform expectations.

The company’s stock has already appreciated since the start of 2023 thanks to the developments highlighted above, and if the macroeconomic fears continue to subside, then its shares have all the chances to keep their momentum and further appreciate in the foreseeable future solely thanks to the change of the market sentiment.

Apple’s Stock Performance (Seeking Alpha)

It’s Still Too Soon To Celebrate Victory

While the improvement of the market sentiment could give Apple’s stock an additional boost in the short to near term, the company nevertheless is likely to disappoint its investors over the long run.

As I’ve already noted in my latest article on the company, the ability to access the cheap labor of China in the last two decades has been one of the major driving forces behind Apple’s success. In addition, the establishment of the consumer market within China itself also allowed Apple to accelerate its expansion and improve its margins at a relatively minimal cost. However, as the geopolitical landscape changes, being overexposed to China is now becoming the company’s major vulnerability as globalization is starting to unravel.

While Apple began to tackle this new reality by kicking off the process of diversifying its supply chains and moving its production to countries like India and Vietnam, the company nevertheless is likely to face significant challenges that would prevent it from significantly improving its performance in the foreseeable future. Apple has already begun postponing launches of major new products as it diversifies its supply chains, while at the same time it’s already facing additional production issues that could lead to an increase in costs to solve them. What’s worse is that some reports indicate that it would take Apple eight years to move just 10% of its production capacity out of China which makes the company a hostage of Beijing’s domestic policy and a potential casualty of any future Sino-American confrontation.

Even though I’m bullish on China and the global economy in 2023 as was explained in my article on Alibaba due to the change of Beijing’s domestic and foreign policies, there are still questions about whether the potential Sino-American confrontation has become unavoidable in the future. Just recently, China has sanctioned major American defense contractors while the Biden administration is looking to implement additional restrictions on U.S. investments in China. If the decoupling accelerates and hawkish foreign policies will nevertheless take an upper hand beyond 2023, then Apple’s business model will be at risk of further disruption due to its overexposure to China and the inability to quickly move its production to other countries.

As a result, there’s a case to be made that while Apple’s stock could appreciate further in the short to near term due to the change in sentiment, there’s a real possibility that the upside nevertheless is limited in the long term. The geopolitical challenges along with a relatively weak performance in Q1 already made Apple’s stock less attractive and made me update my DCF model from December.

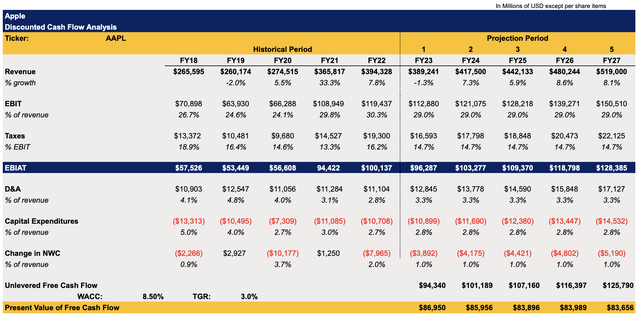

The only two but also the most significant changes were made to Apple’s forecasted top-line growth rate and the expected EBIT as a percentage of revenue both of which were lowered due to the disappointment in Q1 and are now closely in line with the street estimates. The WACC in the updated model remains at 8.5% while the terminal growth rate is 3%.

Apple’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

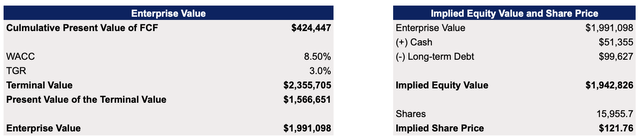

The updated model shows that Apple’s fair value is $121.76 per share, which is below the previous valuation of $126.73 per share. While this new valuation is on the lower end of the Street consensus, the relatively weak performance in Q1 coupled with long-term geopolitical challenges justifies the downside to the company’s stock. Even though it doesn’t mean that Apple would depreciate to that level or that it won’t exceed the expectations that would require an upward revision of assumptions in the model, I nevertheless decide to stick with my HOLD rating for the stock since there are better and safer investments out there in the current environment.

Apple’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

There are reasons to believe that Apple’s stock has all the chances to keep its momentum and appreciate further in the following months if the market sentiment remains bullish thanks to the potential improvement of the macroeconomic environment. However, due to its overexposure to China along with the vulnerable business model that relies on globalization remaining intact, there’s a case to be made that Apple is unlikely to create significant shareholder value over the long run if the Sino-American relations deteriorate. As a result, I don’t have any position in Apple since a simple change in market sentiment can limit the upside of its stock while an increase in geopolitical tensions creates too many risks for my portfolio especially since the company’s shares already trade above their fair value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!