Summary:

- Apple had one of the best decades in the history of commercial endeavors. However, a constellation of macro and idiosyncratic risks is casting an ominous shadow over future earnings.

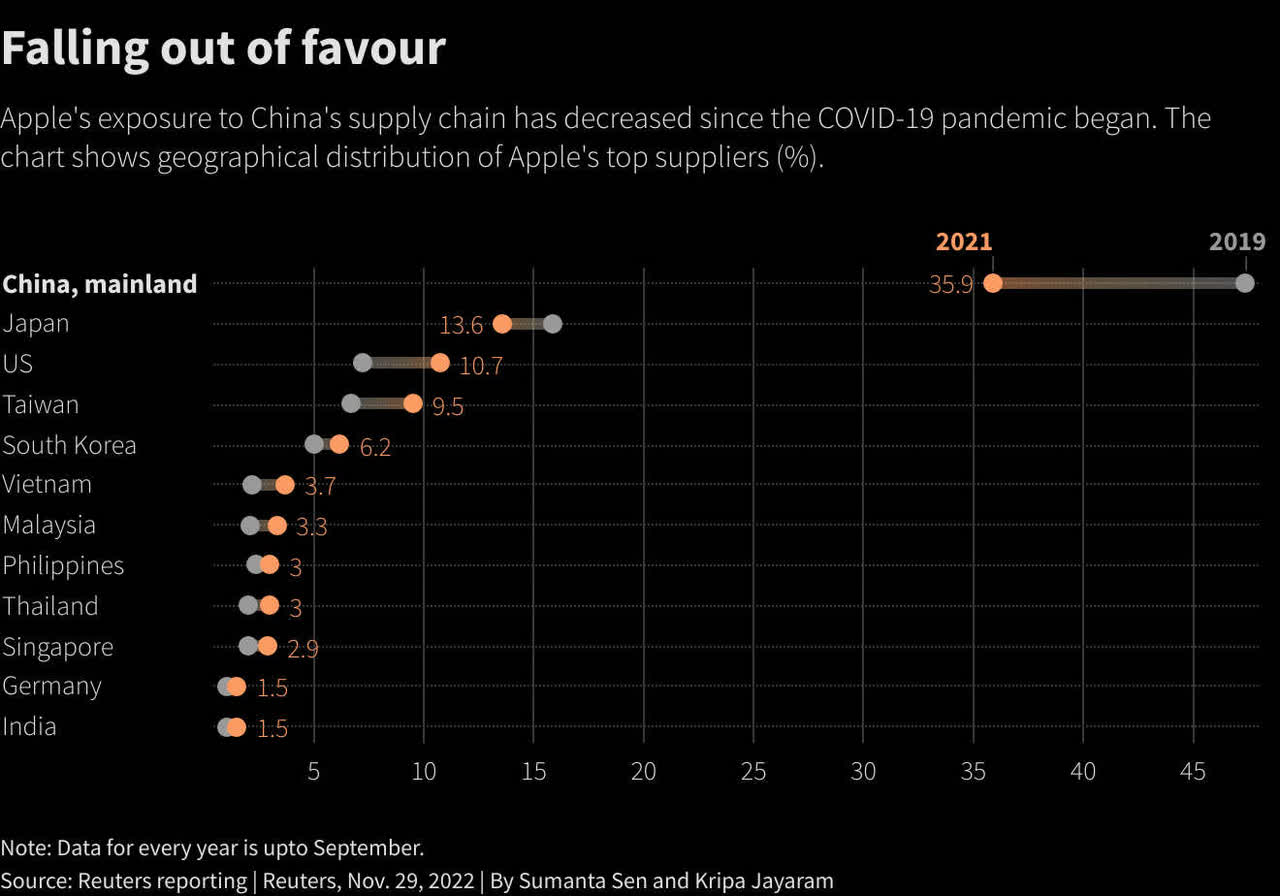

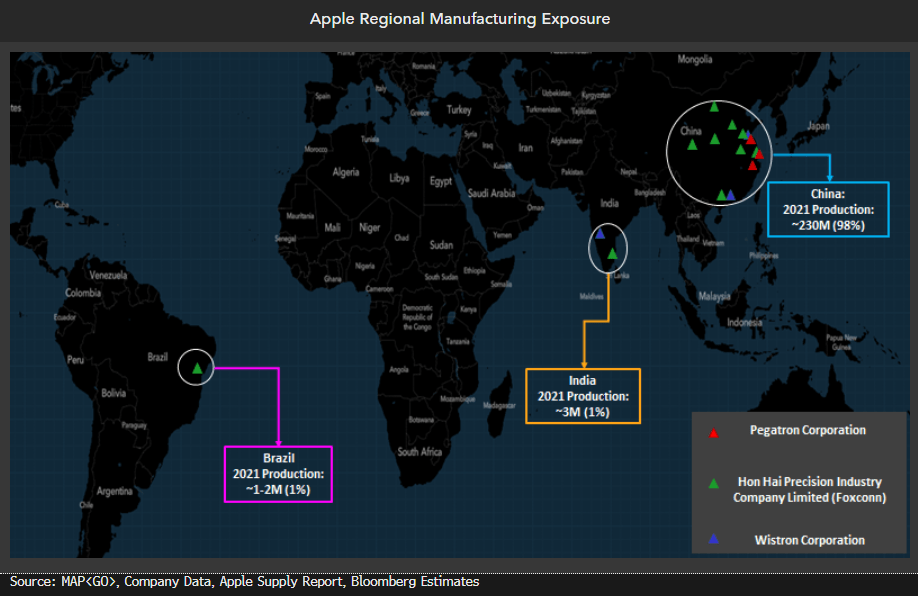

- A lynchpin of Apple’s success in the 2010s was low costs and spartan reliability from its prodigious (and hard to copy) manufacturing cluster in China, which is now a headwind.

- Apple’s efforts to diversify supply chains and ongoing political upheaval in China will pressure the stock’s valuation and the company’s margins for the foreseeable future.

- Apple has dialed back goals and release dates for its car and AV headset, likely reflecting the reality that costs for core drivers will be going up.

Editor’s note: Seeking Alpha is proud to welcome Christopher Robb as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Nikada/iStock Unreleased via Getty Images

Accelerating Supply Chain Diversification From China Shows Desperation, Not Mastery

Three Chinese curses illustrate the dichotomy of “blessings” in our perpetually uncertain world. What are blessings today may be a curse tomorrow and vice versa. Apple (NASDAQ:AAPL) navigated the challenges of COVID-19 supply chains better than many thought, but the changing situation in China means this historic source of stability and competitive advantage will now likely become a drag on margin and revenue growth. Though recent catalysts have brought Apple’s concentration in China to the fore, it has been consistently cited as one of the major risks of owning this stock. It is no longer a hypothetical risk; it’s eating into next quarter’s earnings as you read this. Despite Apple’s solid track record of superior management and operational excellence, it can’t turn back the inexorable demographic and political challenges that its essential partner now faces.

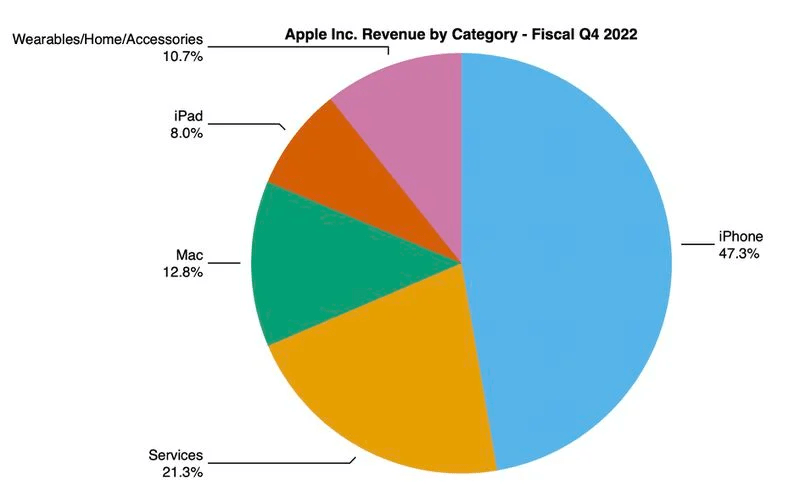

Big Tech firms steep themselves in profound and enticing narratives, and over the last decade they have continually proved doubters wrong. In doing so, they assumed one of the most exalted positions of any industry ever. But Apple in particular needs seamless manufacturing on a massive scale in order to drive sales, particularly of the iPhone, which has a back-breaking product life cycle and comprises nearly 50% of revenue. Rare warnings were issued for delays of leading-edge iPhone 14 Pro models in recent weeks. The company’s core revenue driver is now experiencing its biggest threat since it was introduced in 2007.

MacRumor.com

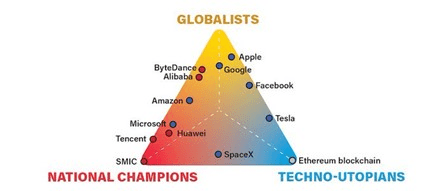

Apple’s iPhone product has been one of the most profound and successful ever introduced. But a key ingredient in that success will now serve as an ongoing impediment. In some ways, Big Tech firms have even come to replace the state as the primary driver of social and technological change. But the state is now undoubtedly resurgent. War, protectionism, and industrial policy have replaced the openness, cooperation, and free trade that came before it. The latter environment is where Apple flourished. It will struggle in an environment of receding globalization and rising trade barriers. Apple sources components from 43 countries, and it all goes to China to then be assembled.

Apple is particularly exposed to domestic political strife in China. Despite recent efforts to diversify the supply chain and a recent announcement to accelerate those efforts, Apple will be unable to untangle its fortunes with that of the Chinese state and its increasingly restless constituents. This will be a headwind for earnings in the immediate future and almost necessarily means rising costs and margin pressure. Bloomberg estimated it would take eight years to move only 10% of Apple’s production capacity out of China.

Bloomberg

The violent riot at Apple’s Zhengzhou plant, nicknamed iPhone city, is just one of the latest events contributing to the erosion of the veneer of perfection that permeated the discourse of tech in the 2010s. Apple has been more shielded than Meta (META) in terms of public scorn, but a previously awe-inspired populous is growing keener to the downsides of Big Tech’s wares.

The externalities of mega-cap tech are coming into stark relief, particularly as the state reasserts its authority over commerce on both sides of the Pacific and Atlantic and as global cooperation is steadily replaced by acrimony and great-power conflict. Big Tech has gone from a feather in the cap of politicians and leaders to a favored whipping boy in the public square.

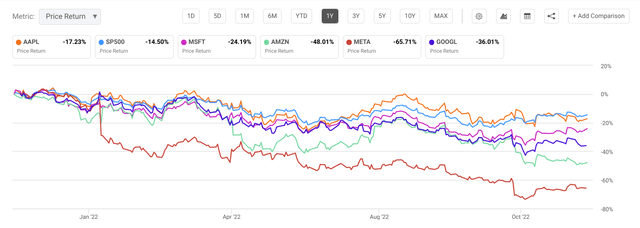

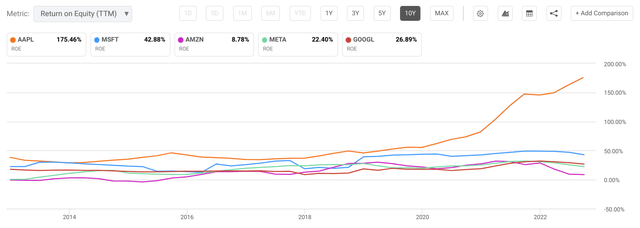

There is a constellation of risks facing Apple in particular. Macro headwinds have been building as the Fed tightening puts pressure on valuations, and much of tech has languished. Apple has so far been spared relative to its tech general peers.

China Was Good Until It Wasn’t

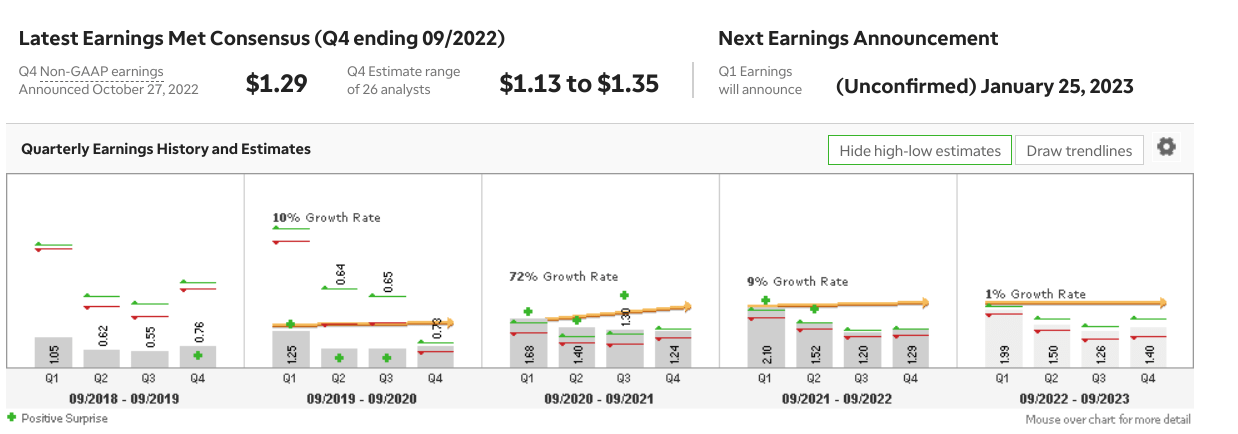

Manufacturing Problems Paired With Tough Comps Should Cap Upside in the Medium Term

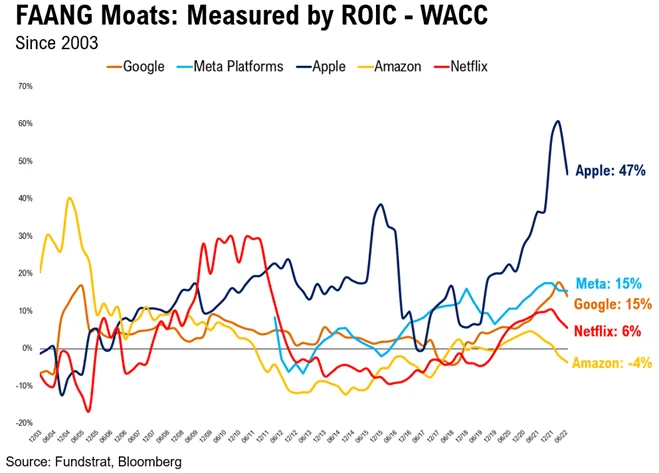

As you can see, the company has been a pristine steward of shareholder capital over the last decade and has a crack management team. However, just as mean reversion looks like it has begun in the company’s superior ROIC-WACC spread (a proxy for the economic value being created by a firm), the company’s astounding outperformance will start to revert. The anomalously high spread relative to peers should continue to revert to a historical mean as the company diverts resources it had slated for other purposes to the accelerated diversification of its contract manufacturing.

Fundstrat, Bloomberg

Apple has the world’s most valuable brand, and consumers love the product, but revenue contraction will occur if you can’t produce what you need. Recent disruptions will likely result in a 10% to 20% (or more) disruption to shipments, which is not small potatoes, and it’s adversely affecting the vital first quarter of Apple’s fiscal year, about a third of Apple’s total annual revenue over the last five years.

The production issues in China and the subsequent efforts to diversify them at an accelerated pace means that the only direction for costs over the next couple of years will be up, at the expense of increasingly superior shareholder returns relative to peers. The product cycle depends on new models to sustain demand, so the interruption in the most advanced models is especially concerning and potentially very problematic. Already there are reports that Apple’s next model will require the largest price hike in the history of the iPhone. Apple must avoid losing its high-tempo iPhone product cadence at all costs. And cost it will.

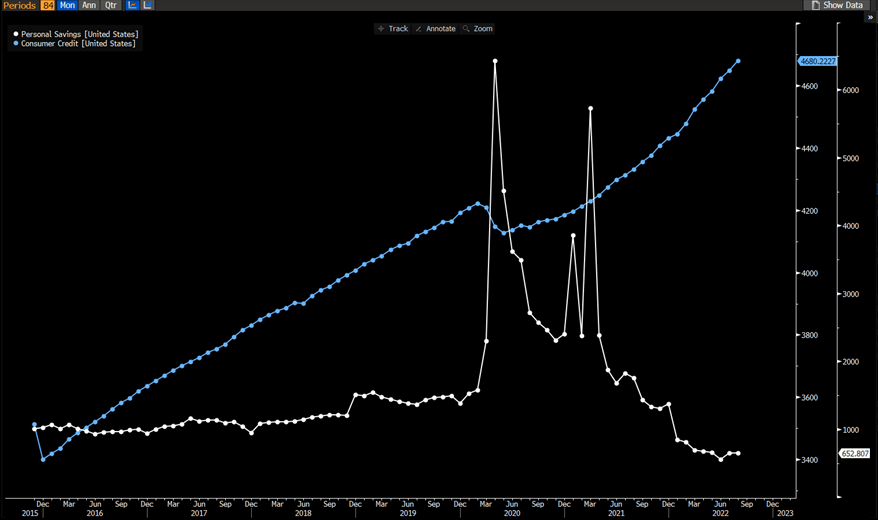

It’s not just the rising costs as Apple disentangles itself from China. The company was a COVID-19 beneficiary, particularly from the trend of consumers purchasing anomalously high amounts of goods relative to services. This trend is reversing, and demand might be lighter in coming quarters as so many consumers likely used stimulus to buy expensive products they can now forego. A potential recession in the U.S. could dent Apple’s largest market for iPhone sales. The U.S. consumer has less savings and is more reliant on credit for purchases.

Bloomberg

So, it’s the natural COVID-19 hangover (tough comps) that Apple will experience in the form of lower earnings growth in addition to a potential recession and a consumer with far less firepower. There is also a potential hit from Chinese demand. While the “Zero-COVID” policies have only been recently lifted, it appears that the Omicron variant is sweeping across the vulnerable country. This could quickly inundate the healthcare system in China, which is still pretty underdeveloped in many rural and interior areas, and simultaneously cost the company on the demand and supply sides.

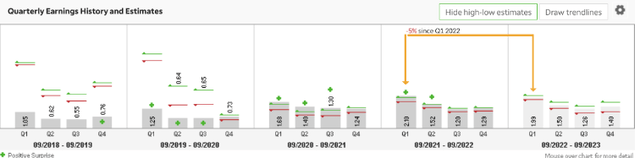

TD Ameritrade TD Ameritrade TD Ameritrade

May You Live in Interesting Times

Apple’s Commercial Fate Has Been Indelibly Intertwined With Chinese Political Outcomes

Steve Jobs was one of the forefathers of the modern computing revolution, and while some CEOs might have never lived down reading lyrics from “The Times, They Are A-Changin'” in a product release (for the Macintosh in 1984), the man delivered on his promise of a commercial revolution that would forever change the human experience.

Jobs succeeded at many things, but creating advanced manufacturing processes wasn’t one of them. This rare shortcoming was made whole by Tim Cook, Apple’s master of modern global contract manufacturing. The fact that Jobs chose Cook as his successor also highlights the importance of Apple’s Chinese operations to its continued viability.

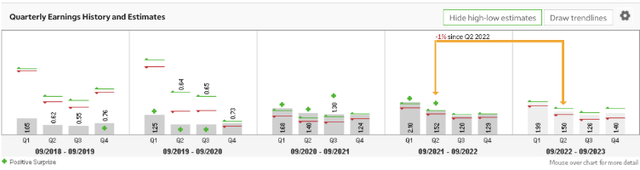

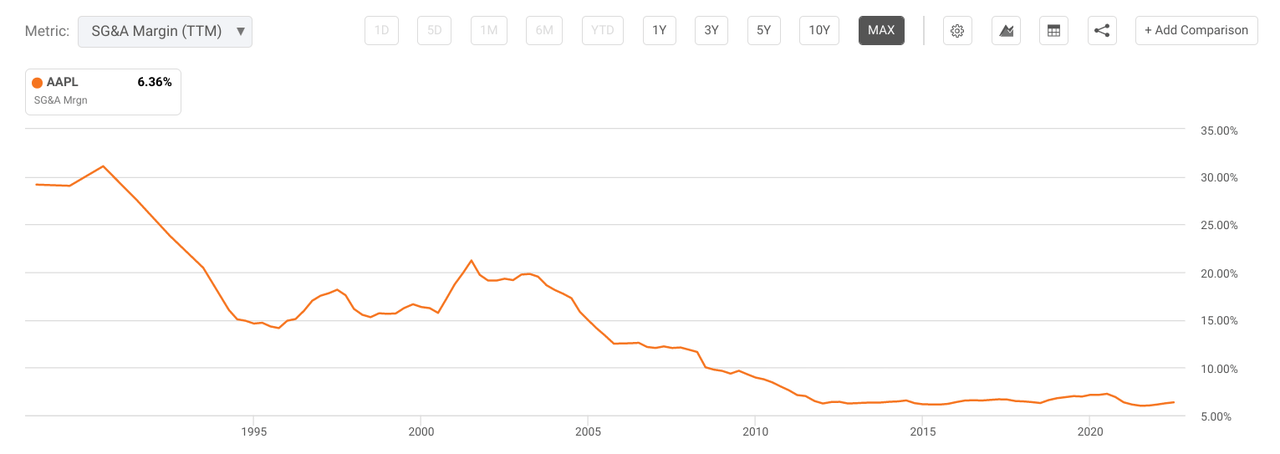

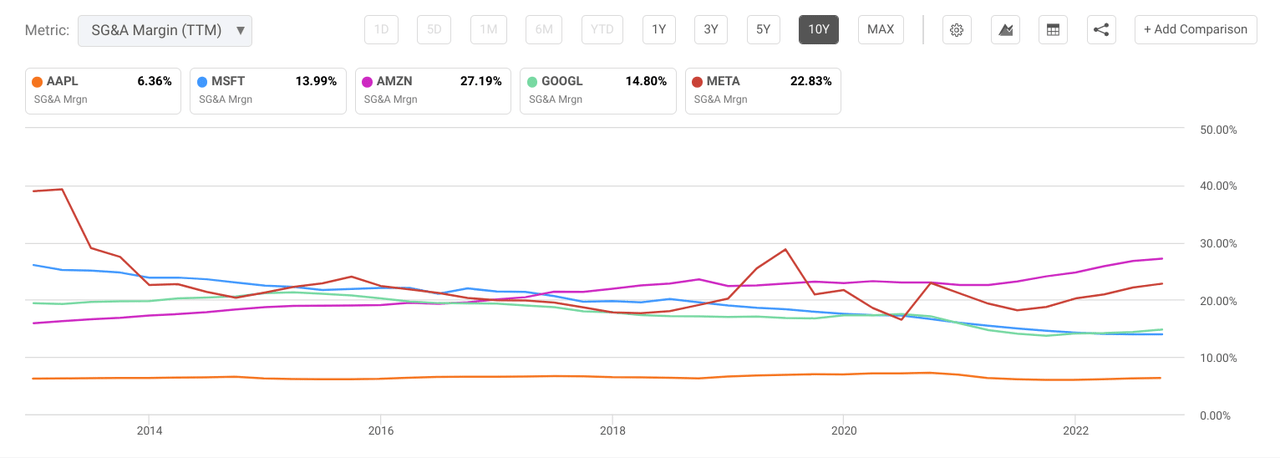

In 2001, Apple began its fortuitous relationship with China and its costs have collapsed and steadied since then, providing an essential element of its success with shareholders over the past decade. This has been one of their major advantages over their mega-cap competitors. Apple shut down its last U.S. manufacturing facility in 2004 when the costs started to really fall. They continued to fall and remained in a stable range relative to its peers for much of the 2010s. I think Apple is a sell because I think this trend will dramatically reverse, potentially in a fashion that catches many sanguine analysts off guard.

SeekingAlpha.com SeekingAlpha.com

However, the times have changed dramatically, with the world’s two largest economies locked in a political, military, and technological competition that won’t likely end soon. There is a high potential for nasty surprises (like last month’s riot at “iPhone City”) and rising costs eating into margins. Now, Apple is in a good position to weather temporary interruptions given its financial strength, but even a commercial Goliath like Apple will face financial consequences for having the bedrock of its superior cost structure shaken to its core.

Bloomberg

The Wall Street Journal recently reported on Apple’s decision to accelerate its supply chain diversification. In this article, the authors commented that, due to Apple’s demanding manufacturing specs and regular product releases, “It must keep flying the plane while replacing an engine.” Apple’s task is much more daunting than even this colorful metaphor implies.

Of all the tech companies, Apple was the most dependent on a smooth global operating environment marked by cooperation. The digital marvels that Apple’s most crucial product connects us to, the iPhone, can mask the fact that it is still a piece of hardware with the necessary production footprint and a brisk cadence of a product cycle perhaps never equaled in terms of scale and speed. However, Apple’s margins will likely compress without the stability and scale enabled by their Chinese partners. Apple is a global creature that will inevitably suffer as the tide of globalization and international cooperation continues to roll out.

Ian Bremmer Bulletin

May You Get Everything You Wish For

Apple Got What It Wished for in China, but the Cost Was Total Dependence on CCP Subsidization

“The entire supply chain is in China now. Do you need a thousand rubber gaskets? That’s the factory next door. You need a million screws? That factory is a block away. You need that screw made a little bit different? It will take three hours.” – Anonymous Apple executive in 2012

Apple used to have a factory in California that produced its products and even used to make using American labor a central messaging strategy. That all changed as the 21st century began. Apple executives had their hair blown back by the level of efficiency in China compared to other markets.

Eventually, Apple came to favor the spartan attitude the Chinese had toward manufacturing so much that they became wholly dependent on it. This partnership was absolutely central to Apple’s success, and for years it seemed too good to be true. However, there is no free lunch, and the Chinese Communist Party is increasingly putting Apple in compromising positions (and has been for years) as it tries to collect its due. Apple got what it wished for, and its deal’s savings and stability resulted in dominating smartphone profits. But that stability is now gone, shattered irreparably by the recent riot at Zhengzhou.

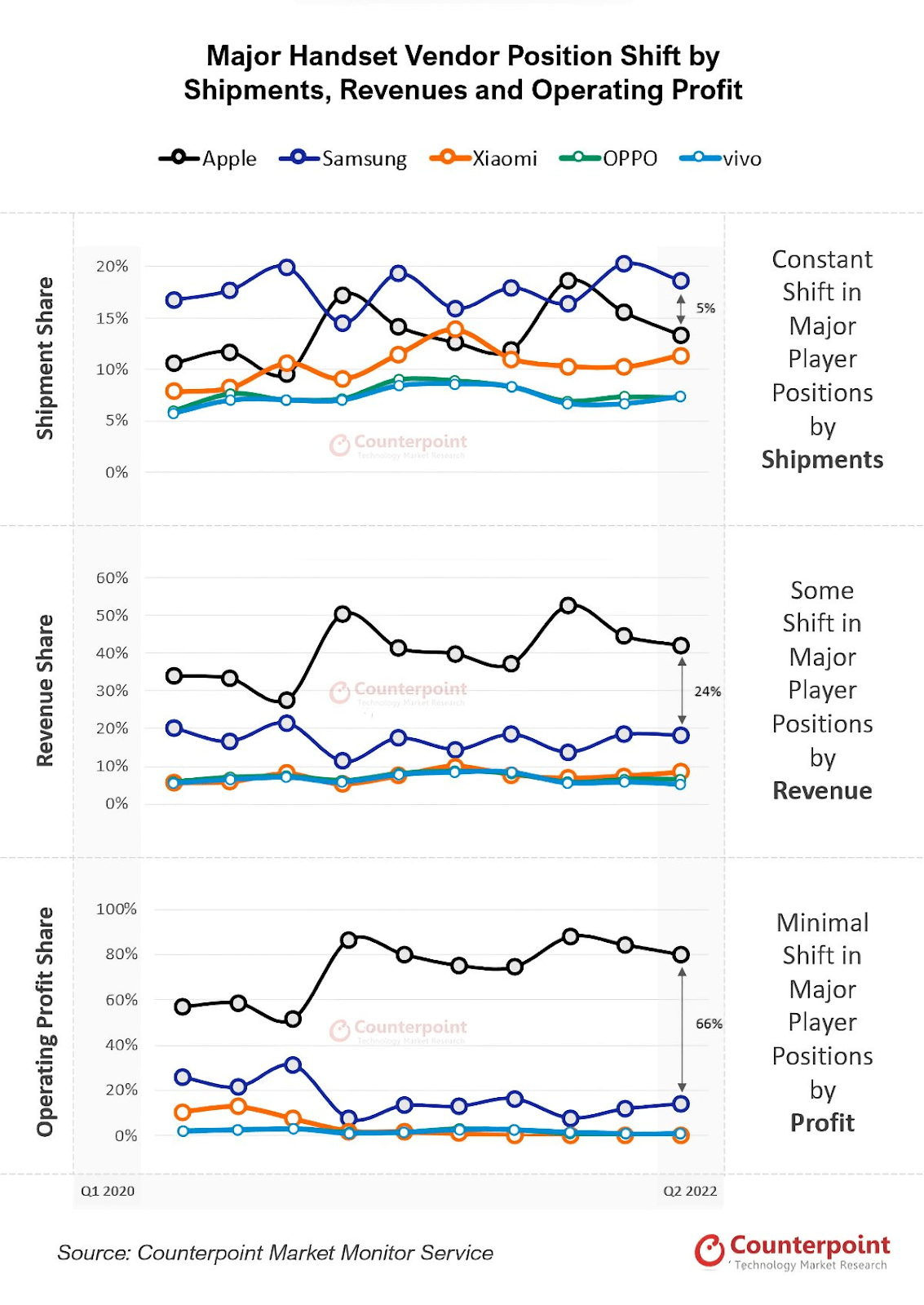

Counterpoint Market Monitor Service

So, this all means that Apple’s production costs are going up. One of its main advantages over competitors for its most important product, the iPhone, has been massive profitability relative to peers. The low costs, in no small part enabled by Apple’s cozy relationship with China and its ability to charge a premium price because of brand power, means that Apple has only about 20% of the market share for smartphones but generates about 80% of the total profits from global smartphone sales.

SeekingAlpha.com

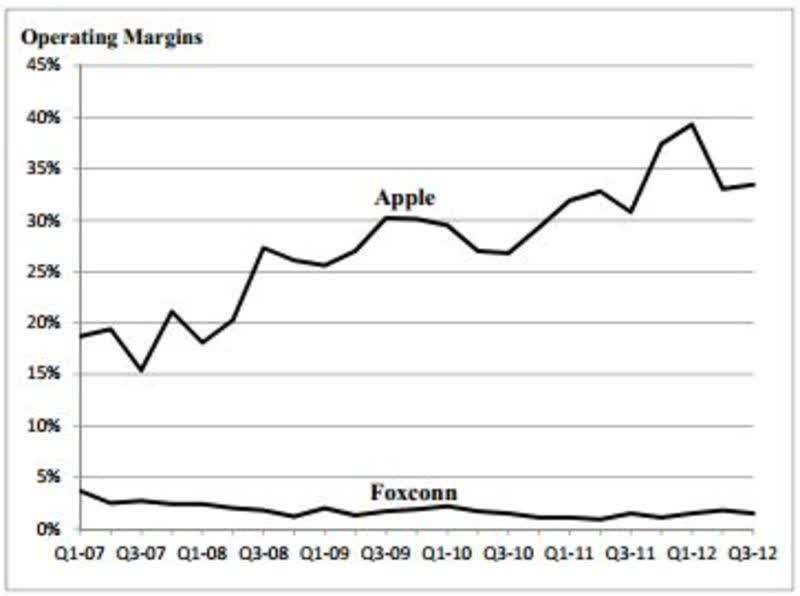

The costs have already begun rising from a 10-year low of around 6% near the peak of tech’s outperformance. Given the importance of China to low and stable costs, one side of Apple’s magic formula enabling super profits is likely to change, and I suspect these costs will continue rising considerably above the 7.25% area it peaked at during COVID-19.

The process of Apple hurriedly diversifying its supply chain will also entail a change in the balance of power between Apple and its suppliers, all else being equal. Apple’s relationship with Chinese firms has involved being able to exert great pressure on them to secure its own margins, given its sheer economic heft. Now the shoe will be on the other foot in many cases.

The Politics of Global Production, Apple, Foxconn, and China’s New Middle Class

Suppliers pushing back and extracting more concessions from Apple will also raise costs as the company moves toward an accelerated shift out of China. The problem is that a large part of Apple’s intangible value is tied up in its supply chain. Not only will the benefits of vertical innovation be compromised in this hurried shift, but suppliers will be able to potentially grab a bigger size of the iPhone pie than they have traditionally been entitled to.

The rising costs for Apple will erode its relative advantage over peers, at least until the market can better see through the increasing uncertainty. Maybe Chinese woes will subside, and the excellent management team at Apple will regain control of margins, but I see obstacles to this occurring. Reduced production capacity might threaten expansion efforts into more ripe markets for iPhone penetration and will make growth more expensive.

May You Be Recognized by Powerful People

The CCP Increasingly Pressuring Apple, Anti-Trust Efforts Emerging in the U.S. and Elsewhere

“You can take every tool and die maker in the United States and probably put them in a room that we’re currently sitting in. In China, you would have to have multiple football fields.” – Tim Cook on 60 Minutes in 2015

The blessing part of this section is obvious. When Apple first came to China, the Chinese Communist Party literally moved mountains for the firm. Their speed and resolve to give Apple everything it needed in a fashion so timely it was awe-inspiring has become central to how the company gets its products to market. Many businesses have been relocating their Chinese operations elsewhere, and investment has been leaving China at a hefty pace. Only 57% of businesses surveyed by PwC have a positive five-year outlook on commercial prospects in China. That is the lowest level in the survey’s 23-year history. But this is an exacerbation of an ongoing trend, as you can see below. Apple has known it was dramatically overconcentrated in China since at least 2014 and hired staff to help it diversify operational risk.

Statista

In the past, when the political leadership prioritized making China attractive to foreign investors, the cost-benefit analysis of operating in China was too appealing to refuse. Now it is too essential and ingrained to stop, as Apple’s operations in China are a large source of its value. It’s not just about cheap labor; it’s not just about geographic proximity. The most essential element is the talent and know-how the Chinese have, which is an essential component of the iPhone (and other products) success, according to Cook. Key partners, problematic in some ways, have also invested in improvements that they crafted through their knowledge of a close working relationship with the firm.

Apple still enjoys favorable treatment from the Chinese Communist Party in some ways, like when they recently exerted their considerable power to plug holes in the assembly line at Zhengzhou. They bussed in military veterans and party members to get on the line at Apple’s largest iPhone factory after capacity was limited by a lack of workers.

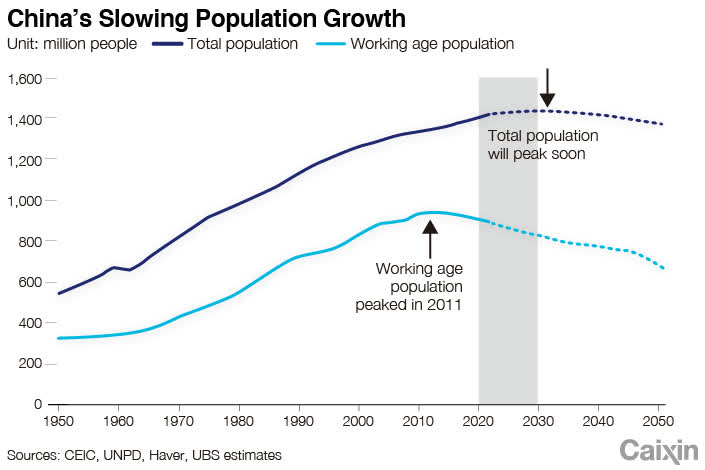

This is one small example of party subsidization that has fueled Apple’s low costs. But the political challenges facing the party are acute and building, and increasingly it is seeing Apple as a means to assist its repression and self-preservation. China is facing significant demographic challenges, but also has a rural uneducated workforce that will pose obstacles to increasing the share of GDP driven by consumption, which it will likely have to do to avoid a debt crisis.

Caixin Global

So, China has Apple hooked. It’s not just about one of the world’s most impressive technology clusters being replaced; it’s that right now, as things stand, it’s seemingly impossible to replace. Some have pointed out problems with Vietnam being too small to support the scale of production that China affords. Others have pointed out the many challenges of doing business in the world’s largest democracy, India, and how many industries have suffered from capital being stranded when the government, local or federal, changes the rules after investments have been made.

We would argue there’s an even more fundamental problem, though. The roads and power grids that make the jewel of Apple’s manufacturing empire would not be possible without the massive level of investment the CCP conducts. The level of subsidization China provides is simply not possible anywhere else:

According to the World Bank, investment typically makes up around 25 percent of global GDP, ranging from 17 to 23 percent for more mature economies to 28 to 32 percent for developing economies in their high-growth stages. For a decade, however, China has invested an amount equal to 40 to 50 percent of its annual GDP every year. It must reduce this unusually high level by a lot, but with growth so dependent on investment, it probably cannot do so without a sharp slowdown in overall economic activity.

India and Vietnam, and other Asian economies, will simply not be able to offer the seamless and heavily subsidized manufacturing experience that China could. Apple’s Chinese cluster has all the supporting power infrastructure and roads it could ever need. This will be a challenge in other Asian economies, especially concurrent with the ongoing slowdown. Also, there is an increasingly blurring line between Chinese companies and the Chinese state. The U.S. is attempting to bring manufacturing back, and Apple has said it will be a part of it, but this will almost certainly mean higher costs.

Recent product delays and scaled-back goals in Apple’s AR headset and the oft-talked-about iCar suggest Apple’s management knows the golden decade is over. All else being equal, the rising costs will make meaningful revenue from moonshot projects delayed. We’d also point out that Apple’s previous product successes included genre-changing products that didn’t compromise on quality or functionality. These recent product scale backs mean that Apple will get products to market sooner, but will also face stiffer competition.

Conclusion

Apple is an amazing company and has a capable management team that very well could end up navigating the China challenge successfully, but it is the biggest challenge they’ve faced in the last decade. The chance of further production interruptions is very elevated. Thus, the chances of the type of superior shareholder returns offered over the last decade are significantly reduced by such a profound risk.

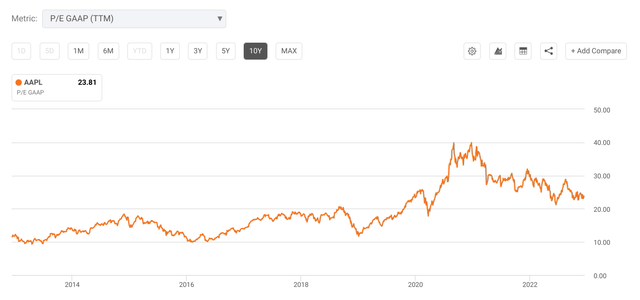

From an intrinsic value standpoint, both near-term earnings and longer-term earnings are threatened by Apple’s increasing costs of replacing its vital China footprint and the potential havoc this process could reap on the company’s core revenue driver. Apple has had a trailing P/E ratio of less than 20 for most of the last decade, and I think that for the next five years this will also be the case.

Remember, at a P/E of 20, the earnings yield is 5%, which is right around where the Fed’s terminal rate is likely to be. So, Apple benefitting from “there is no alternative” (TINA) will be on hold until the Fed ends tightening. After this occurs, we will revisit the stock. Until then, it’s very difficult to envision a scenario where Apple’s P/E starts moving back toward or above 30. Valuation should be constrained in the short term. Ideally, if you’re able to sell the stock and deploy the capital elsewhere, there are likely better opportunities for alpha.

Apple is a massive company, and while its outperformance will likely diminish, if you have a big position you’ll likely have time to make some decisions. I realize not everyone can exit their Apple position on a dime. If the price starts to erode, it should enjoy some support on the way down, at which point you can evaluate whether or not the market is losing confidence in the world’s largest company with more information at hand.

Also, from the perspective of the crowd liking Apple, this won’t change overnight either. However, I suspect reputational and operational hiccups will continue eroding the confidence the stock currently enjoys. Of course, if you get a 1789-type situation in China, the bottom will fall out in a big way. This isn’t a high-probability outcome, though.

I recognize selling a core position isn’t always practical or easy, so if you have a large position in Apple, you can mitigate potential downside by purchasing puts or selling covered calls. One of the advantages of stock ownership in such a titan is liquid and robust derivatives markets. I recommend taking some action to mitigate the potential downside.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.