Apple’s Q1 2023: This Earnings Report Might Be Different

Summary:

- On the backdrop of both supply and demand challenges, I am concerned about Apple’s upcoming earnings release for the December 2022 quarter.

- According to the latest IDC data, which estimates that iPhone shipments fell close to 15% year over year in the December quarter.

- Given the data, I believe it will be difficult for Apple to meet the analyst consensus estimates, which I believe are overly optimistic.

- Although I still maintain a long-term target price of $200.59/share, I downgrade my recommendation for Apple to a temporary ‘Hold’.

Nikada/iStock Unreleased via Getty Images

Thesis

I continue to be a long-term Apple (NASDAQ:AAPL) bull. In my opinion, the company’s strong brand equity, paired with the desire to innovate, offers an exceptional platform for further business expansion. However, looking at the upcoming earnings release (2nd February post-market close) for Apple’s December 2022, I am slightly worried – the first time since late 2018 that I can remember feeling such a unease towards the world’s leading consumer brand going into earnings reporting. For reference, for the previous quarter, when other FAANGS such as Microsoft (MSFT), Google (GOOG), Meta (META), and Amazon (AMZN) missed spectacularly, I even argued that “Apple’s earnings are unlikely to disappoint”.

In my opinion, there have been simply too many macro challenges for Apple to comfortably meet analyst consensus estimates, which excessively optimistic in my view. Although I continue to defend a fair implied target price of $200.59/share, as a function of Q1 2023 concerns, I downgrade Apple to a (expected) temporary ‘Hold’.

Apple’s Q1 2023 Earnings Preview

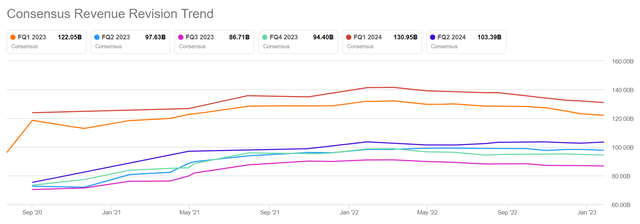

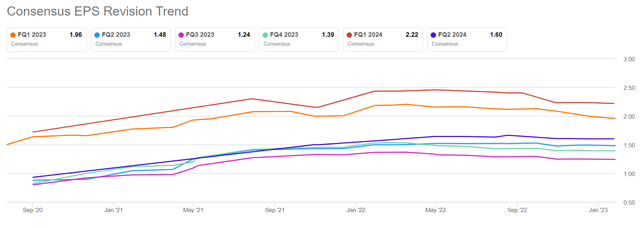

According to data from Seeking Alpha, as of January 28th, 33 analysts have provided their estimates for Apple’s Q1 2023 results. They expect total sales to be between $112.11 billion and $129.38 billion, with an average estimate of $122.05 billion. Assuming the average analyst consensus estimate as a benchmark, it is suggested that Apple’s Q1 2023 sales may decrease by only less than 2%, compared to the same quarter in 2021. Additionally, analysts have provided EPS estimates ranging from $1.71 to $2.17. Admittedly the range is quite wide, but assuming an average of $1.96, analysts expect ‘only’ a 6.8% EPS contraction as compared to the same period one year prior.

Referencing consensus analyst expectations, I would like to point out that revenue estimates have not deteriorated during the past 12 months, with Q1 2023 sales expectations now being approximately flat as compared to the same estimates made one year prior.

Similarly, EPS expectations for Q1 2023 have not moved much in the past few months. In fact, analysts expect EPS of close to $2, which has already been predicted in late 2021, when the macro situation was exceptionally wonderful.

Why Expectations Might Be Too Optimistic

Demand Concerns

It is no secret that the December 2022 was a period of exceptional macroeconomic uncertainty and pressure. And in such a context, it might have been difficult for Apple to maintain strong sales numbers — especially considering the company’s premium pricing strategy. The assumption is confirmed by the latest IDC data, which estimates that iPhone shipments fell close to 15% year over year in the December quarter. With that frame of reference, IDC research analyst Nabila Popal commented (emphasis added):

We have never seen shipments in the holiday quarter come in lower than the previous quarter. However, weakened demand and high inventory caused vendors to cut back drastically on shipments …

… Heavy sales and promotions during the quarter helped deplete existing inventory rather than drive shipment growth. Vendors are increasingly cautious in their shipments and planning while realigning their focus on profitability.

Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China. What this holiday quarter tells us is that rising inflation and growing macro concerns continue to stunt consumer spending even more than expected.

Needless to say, if the IDC report is correct, then Apple’s revenue shortfall will likely not meet expectations of only less than 2% yoy sales contraction.

Supply Concerns

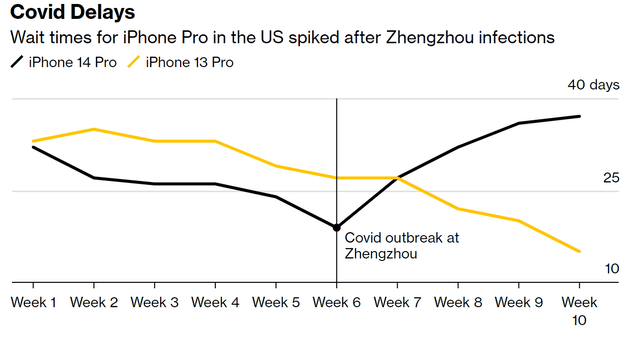

Even if the demand for iPhones has not deteriorated, and this is a proud assumption to make, investors should consider that Apple’s topline has undoubtedly been pressured by supply concerns. As a reminder, it is estimated that 90% of Apple’s hardware manufacturing is done in Asia, with a significant portion in China. That said, the challenging COVID situation in China (pre reopening) has likely severely impacted the company’s supply chain. Reflecting on amongst others violent protests at Foxconn facilities, some analysts anticipated a Q1 2023 iPhone units production shortfall of approximately 6 million. Moreover, delivery wait times for the iPhone 14 Pro, which is a high margin product for Apple, have spiked.

The Juice Will Likely Be In The Guidance

Investors should keep in mind that the risk to Apple’s Q1 2023 earnings release might not be limited only to the company’s 2022 December quarter, but might also extend to guidance for early 2023. Or, in other words, guidance may fail against (or exceed) expectations.

So far, Apple is the only FAANG giant that has not yet announced cost-cutting programs, including layoffs. This doesn’t mean, however, that the company is not planning to do so. If Apple announces a major cost saving program, how will the market react? Will the market celebrate a margin expansion, or will the market fear about Apple’s growth prospects in 2023? I think the latter is more likely.

On a more positive note, I am excited about Apple’s 2023, as I expect the company to release more information about the company’s AR/ VR ambitions. Until proven otherwise, and knowing about Apple’s consumer focus, I am bullish on the launch. But of course, the product might also disappoint against competitor products such as Meta’s Quest Pro — which, in my opinion, set the standards quite high and have captured the product lead.

Conclusion

On the backdrop of both supply and demand challenges, I am concerned about Apple’s upcoming earnings release for the December 2022 quarter. Specifically, I believe it will be difficult for Apple to meet the analyst consensus estimates, which I believe are overly optimistic. And accordingly, although I still maintain a long term target price of $200.59/share, I downgrade my recommendation for Apple to a temporary ‘Hold’.

For reference, while Apple has a strong history of outperforming the broad market, the company’s shares started to underperform against the S&P 500 (SPY) in late November, early December. For the past twelve months, Apple shares are down about 8%, as compared to a loss of slightly less than 6% for the SPY. A warning signal?

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advise