Summary:

- Apple is expected to report a slight decline in EPS and revenue for Q3, leading to concerns about overvaluation.

- EPS estimates have been steadily declining, with 16 out of 26 revisions being downward.

- Apple’s forward multiple and PEG ratio indicate overvaluation compared to other tech giants.

- iPhone 15 rumors are swirling and I am looking forward to hearing from the company.

- While stock may be overvalued here, I suggest having an exposure to Apple almost always.

Nikada/iStock Unreleased via Getty Images

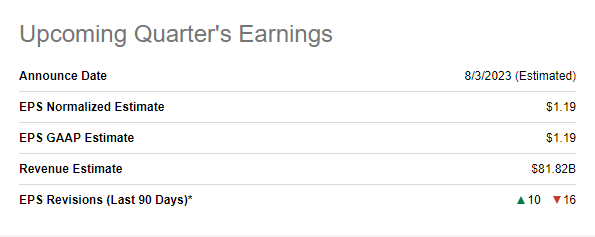

Apple Inc. (NASDAQ:AAPL) is expected to report results for its Q3 that ended July 1st, 2023, post-market on Thursday, August 3rd. Analysts expect Apple to report an EPS of $1.19 on revenue of $81.82 billion. Should Apple meet these numbers, that would represent a slight decline on both EPS and revenue. In other words, Apple is not expected to grow YoY this particular quarter. But is that end of the world, especially when the stock is trading at premium valuation? Let’s find out.

AAPL Q3 Estimates (Seekingalpha.com)

In my last coverage on Apple, I argued that the stock was overvalued despite the company’s strengths, urging investors to hold rather than buy the stock. Since then, the stock has gained about 1% compared to the market’s 3%.

With that background out of the way, let’s preview Apple’s Q3 without any further ado.

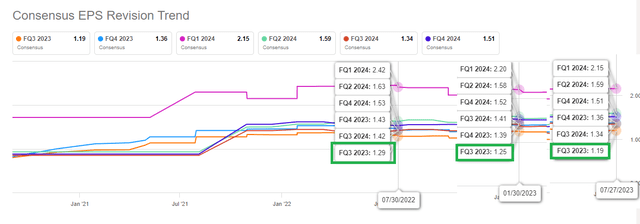

Slowly Decreasing Expectations

Q3’s EPS estimates have been on a steady decline, as shown below. It is surprising to note this given the stock’s strong run over the last 6 months and YTD. As shown below, EPS estimate has gone from $1.29/share to $1.25 to $1.19, marking an 8% decline in one year. That’s significant for a company that is restricted by the law of large numbers. To put that into context, an 8% decline in expectations, when converted to annual basis, would result in an EPS of $6 instead of about $6.50.

AAPL Q3 Revisions (Seekingalpha.com)

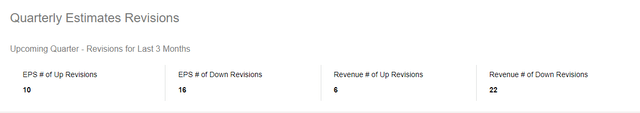

16 out of 26 EPS revisions have been to the downside and 22 out of 28 revenue revisions have been to the downside as well. This is in sharp contrast to other tech giants I previewed recently, including Alphabet Inc. (GOOG), which had see-sawing but up trending expectations and Amazon.com (AMZN), which has steadily increasing expectations.

AAPL Q3 Revisions Count (Seekingalpha.com)

Based on the data above, I’d say this is one of the most muted quarters in terms of expectations that I recall with Apple. Add to it the fact that the expected EPS and revenue are flat to slightly down YoY, Mr. Market may really be souring on Apple here due to overvaluation.

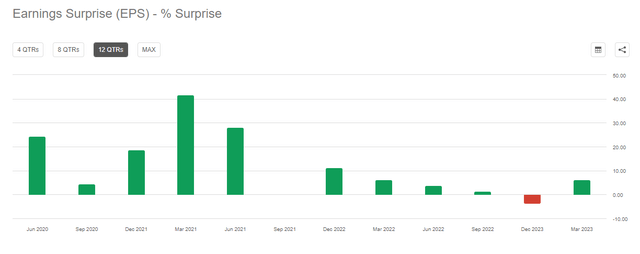

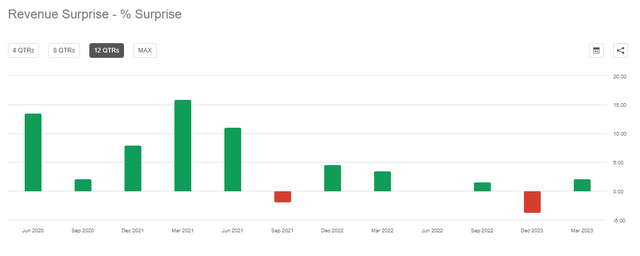

Beat or Miss? I Say A Small Beat

In the last 12 quarters, Apple has beaten EPS estimates 10 times and revenue estimates 9 times. While that sounds encouraging on paper, Apple’s recent history is full of minor misses to minor beats. To put that range into context, in the 5 quarters since the beginning of 2022, Apple’s EPS surprise has ranged from a miss by 3.67% to a beat by 6.21%. Revenue surprise has an even tighter range between a miss by 3.71% and a beat by 3.49%.

There is no crystal ball in investing but trend is usually your friend. Hence, I predict that Apple will report an EPS between $1.15 and $1.22 with revenue coming in between $79 billion and $85 billion.

AAPL EPS Surprise (Seekingalpha.com)

AAPL Revenue Surprise (Seekingalpha.com)

Main Stories – Q3 Products, iPhone 15, Vision Pro and AI

Apple released the following three products during Q3 and it will be interesting to see their impact on Q3’s financials.

- Mac Pro (M2 Ultra chip)

- 15-inch MacBook Air (M2 chip)

- Mac Studio (M2 Max and M2 Ultra chips)

It will also be interesting to see if the company provides more details about the expected Vision Pro launch in early 2024 and other delayed AR/VR products. Many analysts believe that Apple has already fallen way behind in building up excitement towards its AI and AR/VR initiatives. While Tim Cook has a proven legacy in operational excellence and general leadership, I am unsure that he can build up excitement towards new products even during product launches, let alone during an earnings conference call.

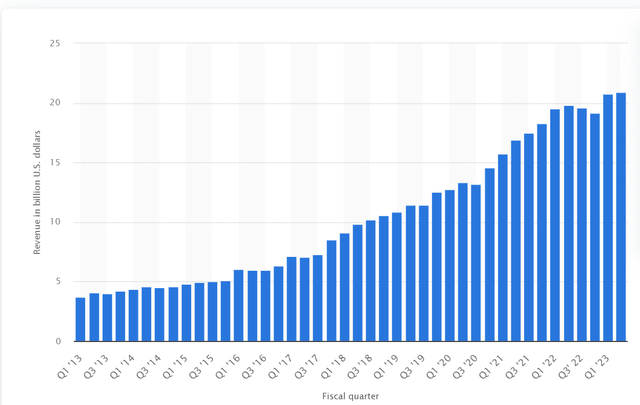

iPhone will undoubtedly be the cornerstone of this report as well despite Q3 typically being the last full quarter before the new iPhone release. Services is likely to show another strong but slowly flattening growth. Q2 2023 showed a 5.50% YoY increase in services revenue and I expect Q3’s services revenue to come in at a similar growth rate to report between $20.5 billion and $21 billion.

AAPL Services (statista.com)

Given Apple’s typical September timeline of launching the new iPhones, I expect analysts to be curious about iPhone 15’s launch in general and forecasted demand in particular. There are rumors swirling that the launch maybe delayed until October and the only way to confirm or deny that is to hear it from the horse’s mouth.

Valuation – Almost The Worst Among The Big Boys

Heading into earnings, Apple’s forward multiple of nearly 33 is far worse in my view than Alphabet Inc. (GOOG) as 24, Meta Platforms, Inc. (META) at 24.50, and even Microsoft Corporation (MSFT) at 30.70. By “even” Microsoft, I am referencing the fact that among the big boys, Microsoft has made the most exciting headlines and progress as well towards the next big revenue generator, AI. Only Amazon.com (AMZN), unsurprisingly, has a higher forward multiple at 82.

However, in my opinion, current valuation should always be judged against the future expected earnings growth. Apple arrives dead-last in this comparison among the big boys, with a Price-Earnings/Growth (“PEG”) of 4 based on expected earnings growth. Microsoft has a PEG slightly above 2, while Alphabet comes in at 1.40, Amazon at 1.26, while Meta Platforms is the lowest (meaning, the most attractive) at 0.8. While Apple and Microsoft are much stronger, all-weather companies than the likes of Meta Platforms, an over-valuation by a factor of 5 (that is, Apple’s PEG of ~4 compared to Meta’s 0.8) may be a stretch.

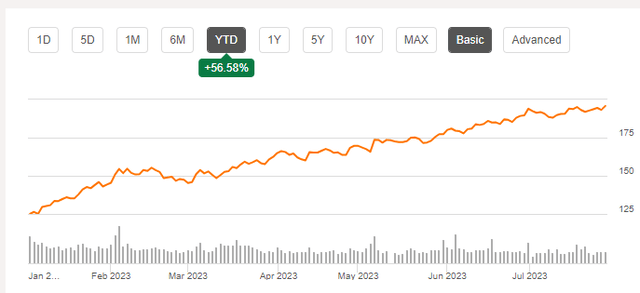

The mega-cap technology stocks have been on such a magical run this year that Microsoft at 41% is the worst performer with Alphabet at 48%, Apple at 56%, and Amazon 54%. Meta, which had a far worse 2022 than the other names, is up 160% YTD. Even if Apple reports strong Q3 earnings and Q4 guidance, I am wondering how much of that is already priced in given the run mega-caps have been this year.

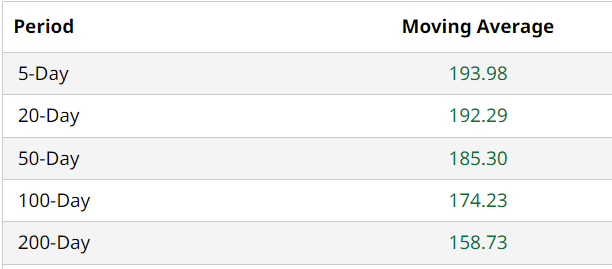

Technical Strength – Strong But Be Wary

Apple’s stock is solidly above all the commonly used moving averages as shown below. Especially impressive is the fact that the current price is 22% above the 200-Day moving average, which shows overall uptrend. However, that does not mean it will only keep going up from here, especially if earnings and guidance disappoint.

AAPL Moving Avgs (Barchart.com)

AAPL Chart (Seekingalpha.com)

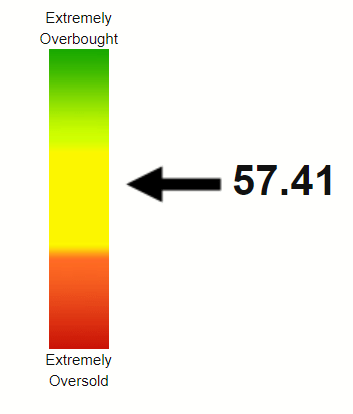

The stock’s Relative Strength Index (“RSI”) of 57.41 has me surprised me a little, given the near 60% run YTD shown above. In the unlikely event that Apple surprises to the upside heavily, this offers the stock more room to run technically. But the fundamentalist in me will get even more cautious if the stock were to make a run-up after earnings.

AAPL RSI (Stockrsi.com)

Conclusion

With Apple being nearly 8% of the S&P 500 index, it won’t be an understatement to say that even those without direct Apple ownership would want the company to do well. I am almost 100% sure the company would have done well in Q3 but that does not make the stock a buy here. Not even Apple deserves such a premium to trade at price-earnings/growth (“PEG”) of 4.17 based on expected earnings in my view.

Given the expected YoY decline in both revenue and EPS, the easiest but safest recommendation is to hold the stock. I’d also suggest trimming your position, especially if you have massive gains in tax-deferred accounts. However, Apple is one of the few stocks that I’d suggest everyone to have an exposure to at all times. If not directly, at least through 401k and/or indexing.

What’s your take on Apple’s upcoming Q3 and its future in general? Please leave your comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, GOOG, META, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.