Summary:

- Applied Materials stock has shown strong performance, with a growth of 87.39% in the past year and 369.06% in the past five years.

- The demand for AMAT’s Centura Sculpta patterning machine is expected to be higher than expected, as it reduces chip production costs and energy consumption.

- AMAT’s service revenue and the OLED market are potential sources of growth that are not fully reflected in the current stock price.

Monty Rakusen/DigitalVision via Getty Images

Thesis

Applied Materials, Inc. (NASDAQ:AMAT), a semiconductor company that manufactures equipment that produces chips, OLED displays, and other electronics, has had strong and consistent price movement over the past year, up almost 90%. This is mainly attributable to its consistent financial growth and high liquidity levels as well as its diverse semiconductor equipment portfolio that serves the rapidly growing ICAPS industry (IoT, Communications, Automotive, Power, and Sensors). However, I still think the stock has more room to grow, fueled by the potential growth coming from patterning machine Centura Sculpta, AMAT service revenue, and the OLED market.

Catalysts

Demand for Centura Sculpta Will Be Stronger than Expected

On Feb. 28, 2023, AMAT announced their new technology that transforms semiconductor patterning. Centura Sculpta is a machine that allows for reduced steps in chip production, allowing for only one cycle of pattern printing instead of two. This greatly reduces chip capital costs by an estimated amount of $250 million per 100K wafers per month and decreases chip manufacturing costs by about $50 per wafer. More importantly, this new technology will contribute to green initiatives by allowing the saving of more than 15 kWh of energy, 0.35 kg of CO2, and 15 liters of water, per wafer. This is what I believe the major value of Centura Sculpta comes from—its ability to save loads of different types of energy and resources in chip manufacturing, an energy-intensive industry.

Chip manufacturing requires a lot of energy and water. TSMC (TSM), the world’s largest chipmaker, used 6% of Taiwan’s total power and produced about 15 million tons of carbon in 2020. In addition, the company also used 193,000 tons of water per day, which is about 70 billion liters of water in one year, in 2020. Combined with climate change, it’s not surprising that Taiwan experienced its worst drought in over 50 years between 2020 to 2021.

With that being said, semiconductor manufacturers are constantly looking to improve their operations to achieve minimal environmental impact, as demonstrated in TSMC’s 2022 Sustainability Report. I believe Centura Sculpta’s ability to not only make production more efficient but also reduce energy consumption is going to attract a lot more demand than what the critics are currently claiming.

Accelerated Service Revenue Growth

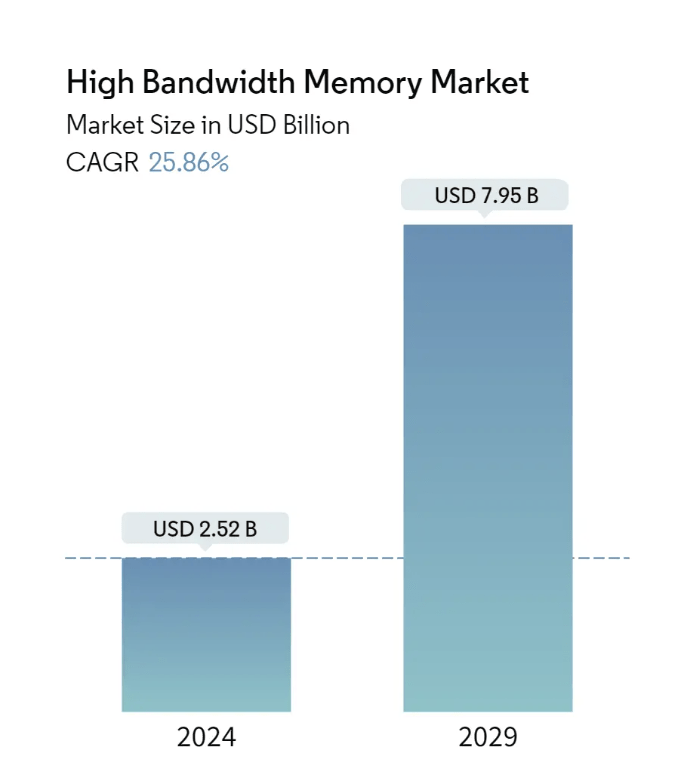

I believe another driver for AMAT’s future growth comes from the rapidly expanding high-bandwidth memory (HBM) packaging technology.

HBM packaging allows for 3-D stacking of memory chips, allowing them to be more energy-efficient and to be more compact. Currently, the market expects a huge wave of growth in the HBM market, growing from a $2.52 billion market size to $7.95 B from 2024 to 2029 with a CAGR of 25.86%. In the earnings call, they demonstrated confidence in their ability to capture this rapidly growing market with their existing technologies, stating that they expect their HBM packaging revenue to reach $0.5 billion in fiscal 2024—four times as large as that in fiscal 2023.

Motor Intelligence

In addition to AMAT’s growth in HBM packaging technologies, I believe there will also be tremendous growth in AMAT’s Applied Global Services (AGS) segment that accompanies the growth in HBM. AGS offers services that support customers with the installment and maintenance of AMAT’s machines. HBM technologies require particular maintenance due to higher machine utilization: the production of HBM chips requires additional steps and a more complex procedure that causes higher machine utilization which leads to higher demand due to more wear and tear for the machines. In addition, the integration of HBM packaging technologies into companies’ current manufacturing facilities can also pose a challenge.

These factors will boost the demand for AMAT’s maintenance services. As machines are constantly in need of maintenance, the demand for AMAT’s services is sticky. In the 2023 annual report, AMAT’s service revenue, 22% of total revenue for the year 2023, grew 3% growth from last year. However, I predict that with the rapid growth of the HBM market, AMAT’s service revenue will grow at a rate of 8 – 10% in the future. With AMAT’s historical operating margin for their service segment sitting at around 30%, this surge in service revenue will effectively be translated into bottom-line earnings, potentially exceeding market expectations and boosting the stock’s value.

Rapid Growth in the OLED Segment

Despite AMAT’s Display and Adjacent Markets segment, a business unit that mainly produces equipment that manufactures flat panel display products, facing a steady decline over the past three years, I think that AMAT’s Display and Adjacent Markets business segment will actually experience a turnaround growth phase through increased machine sales, specifically machines that manufacture organic light-emitting diode display screens (OLED). AMAT is currently a market leader in the Flat Panel Display-Specific Equipment market, owning the biggest piece of the pie—18.75% revenue share— in a market of $4.2 billion.

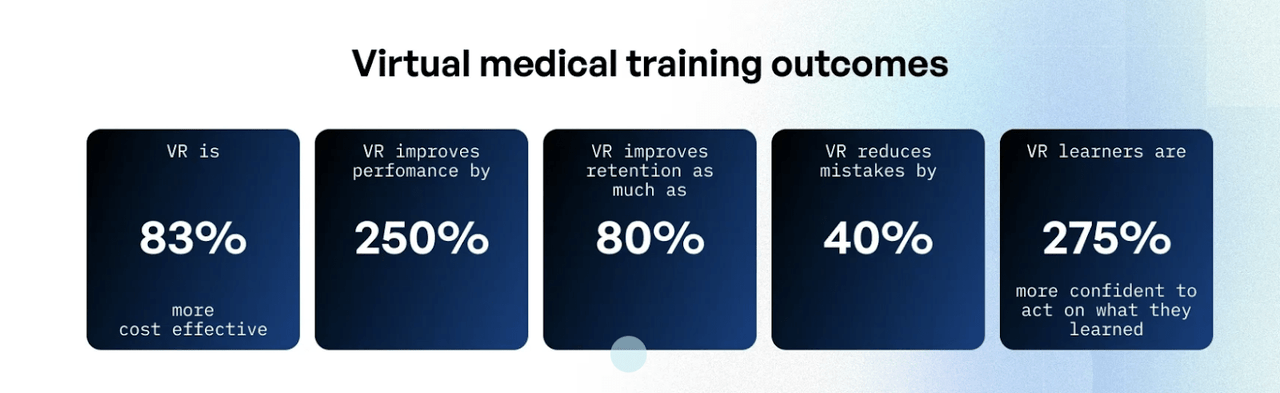

I believe there are plenty of opportunities for AMAT to capture in the OLED market, which is projected to grow at a CAGR of 22.5% from now to 2030. In the future, we will see an unexpected surge in demand for OLED because of the need for AR/VR technologies, specifically AR/VR in healthcare, that depend heavily on OLED displays. While the AR/VR market is expected to grow at a CAGR of 11% from now to 2028, the healthcare AR/VR market is expected to grow at a much higher pace.

According to Statista, the healthcare AR/VR market has been the strongest in North America, valued at $477 million in 2028 and estimating an astonishing $4.6 billion in 2025, placing North America as the fastest growth hub for healthcare AR/VR. Another report projected a CAGR of 18.2% for the global healthcare AR/VR market, increasing from $2.8 billion to $14.9 billion from 2024 to 2034. Therefore, there’s tremendous potential for AR/VR healthcare technologies as well as OLED display manufacturing in the future, positioning AMAT in a favorable position.

AR/VR technology is crucial to the future of healthcare because of its ability to revolutionize medical training. A study showed that the provision of an AR/VR environment actually increases engagement and retention in medical training than those without the environment. Another study showed that surgeons trained in VR environments make 40% fewer mistakes than those without the environment. Given those studies and trends, I believe that there will be an increase in reliance on AR/VR technologies from the healthcare industries thus boosting OLED sales in the process, and growing AMAT’s Display and Adjacent Market segment.

I estimate that, for 2024, the company’s display sales will increase to 5% of total revenue from the previous 3% and continue to increase at about 2 percentage points per year through 2026, reversing the previous trend of segment revenue share reduction and grow gradually along with the healthcare AR/VR market.

Valuation

My Financial Projections

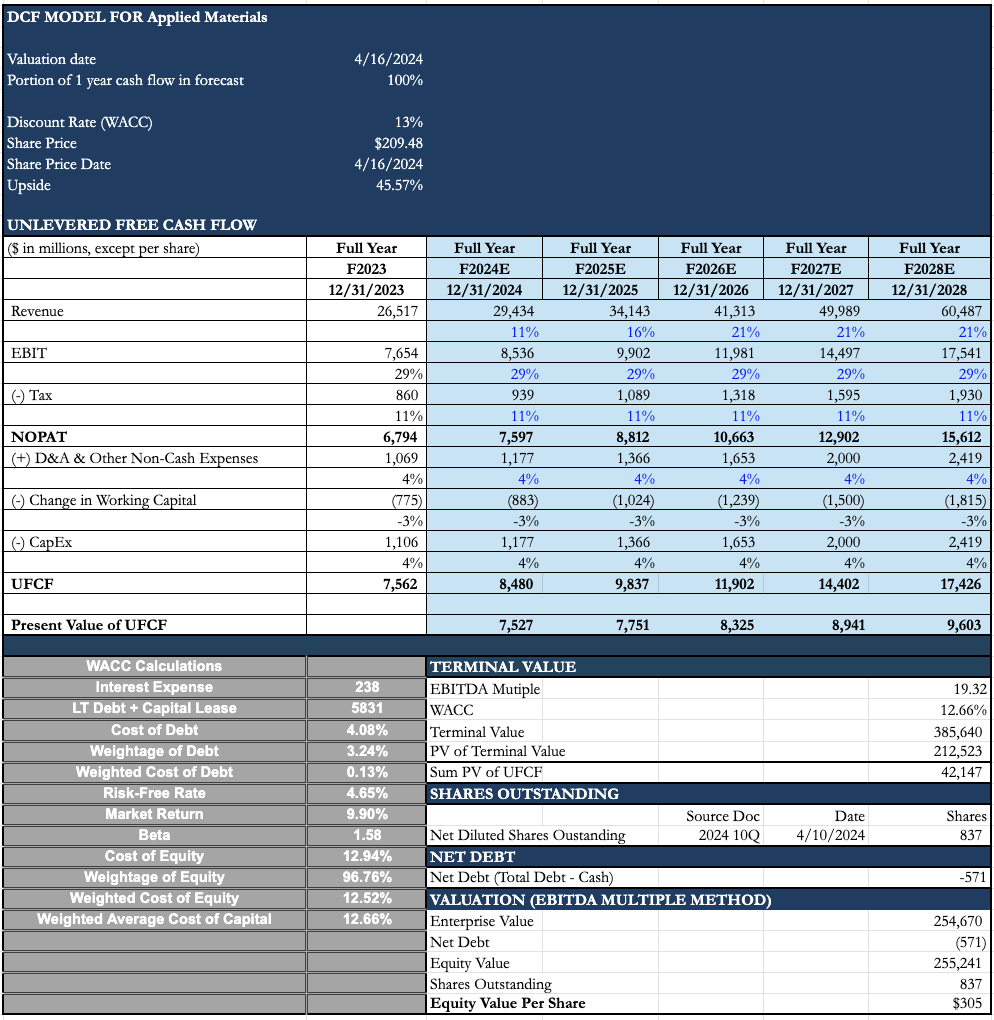

Revenue Growth Rate Projections

In my DCF model, I first averaged the annual revenue growth rates for the company’s past five years to get a base-case revenue growth rate of 11% for 2024. Then, based on the three catalysts mentioned above as well as the future growth of the semiconductor industry, I increased the predicted revenue growth rate for 2025 to 16% and to 21% for the three years after that. Furthermore, I assumed a constant EBIT margin of 29% and a constant D&A and CapEx expense as a percentage of revenue, as I believe AMAT will continue to commit to capital innovation to solidify and advance its market position.

Terminal Value Projections

I then proceeded with the EBITDA multiple method to calculate the PV of the terminal value. I first assumed a terminal growth rate of 3%, which is on par with historical GDP growth rates, because AMAT relies heavily on demand for end products such as automotive, consumer electronics, data centers, and OLED displays that are strongly associated with GDP growth. For the exit EBITDA multiple, I used an EBITDA multiple of 19.32x, which is slightly above the industry average.

Weighted Average Cost of Capital (WACC)

To calculate WACC, I first divided interest expenses from long-term debt and capital leases; I then multiplied by the weightage of debt to find a 0.13% Weighted Cost of Debt. I exercised a similar process to solve for the Cost of Equity, where the 30-year treasury bond is the risk-free rate, the SPY historical average return is the market return, and I used PayPal’s beta of 1.58. After multiplying by the Weightage of Equity, I arrived at a 12.52% Weighted Cost of Equity. Lastly, I added both the weighted cost of debt and the weighted cost of equity to get a WACC of 12.66%.

Intrinsic Value

I finally summed the 5 years of projected cash flows and present terminal value to find the enterprise value and subtracted it from net debt. After dividing by total shares outstanding, I was led to a target price of $305 per share, representing a 46% potential upside.

Risks

Lack of Funding From Government

AMAT recently faced a significant challenge regarding its $4 billion semiconductor research facility that was planning to be built in 2026. Despite the $52.7 billion funds promised by Biden’s CHIPS Act, the recent reallocation of federal funding excluded companies like AMAT that are not involved with the direct manufacturing of semiconductors. The giant project, involving the collaboration of multiple universities and public and private semiconductor companies, is forced to be postponed or canceled. However, with AMAT’s strong commitment towards innovation which is evident by their consistent spending in R&D and CapEx, I believe the project will be postponed instead of completely terminated.

Conclusion

I would like to conclude this report with a Buy Recommendation for AMAT stock, with a target price of $305. I believe this price is justified by three important yet unexpected catalysts: the growth in the new patterning technology Centura Sculpta, the rise in service revenue driven by the rapid expansion of the HBM market, and the growth in the display segment driven by the expansion of AR/VR to facilitate medical training. Those factors, in my opinion, will contribute to driving AMAT’s future growth. Although the company is facing a lack of funding from the U.S. government, this is not going to stop AMAT from continuing to stride towards endless innovation, securing its position as a market leader in semiconductor equipment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.