Summary:

- Rumors of Salesforce acquiring Informatica have caused a stir in the market.

- Salesforce has seen significant growth and profitability, leading to speculation about further acquisitions.

- Informatica, a data-management software provider, denies any current discussions about being acquired.

- If we break down the factors of these rumors, we can gain some understanding of the path Salesforce is walking and what returns shareholders may expect.

Sundry Photography

Salesforce Considering Informatica

A whirlwind of rumors about Salesforce (NYSE:CRM) in deep talks to acquire data-management software provider Informatica (NYSE:INFA) has ignited the Market for the past ten days.

“Finally, an acquisition!”, some cheered, while others, more skeptically, seemed to be saying: “Oh no, here we go again!”.

In particular, a little over a year ago, activist investors such as Elliott and Starboard Value circled Salesforce asking the company’s co-founder and CEO Marc Benioff to focus on profitability and performance. What happened is well known: Marc Benioff pivoted and a year later, Salesforce impressed Wall Street not only because of a double-digit revenue growth rate (which is quite common for the company) but also because of operating margin expansion of 1,110 bps and diluted EPS growth of 1,900%, with operating cash flow up 44% YoY. On top of this, Salesforce guided operating cash flow growth above 21% for its fiscal year 2025.

The cherry on top of the cake was that Salesforce announced that, in addition to its $7.7 billion already spent on buybacks, it increased by $10 billion its share repurchases while instating its first-ever quarterly dividend of $0.40 per share.

So, as things started pointing in the right direction for Salesforce, new rumors stirred the market hinting that the company may not be done with costly acquisitions.

Unsurprisingly, these talks about Informatica fizzled out over the weekend, when the Wall Street Journal reported the companies couldn’t agree on terms. Informatica then provided a business and financial update to announce it is not currently engaged in any discussions to be acquired. Therefore, the stock is down more than 9%.

Indeed, it is a rollercoaster of rumors and half-truths, which has been a pain in the neck for all those investors who require Salesforce to stop pouring billions into big acquisitions rather than focusing on its organic growth and free cash flow generation.

As someone who is invested in Salesforce and who welcomed the pivot towards profitability, I followed the news, making a few considerations I would now want to share with SA readers.

What Is Informatica?

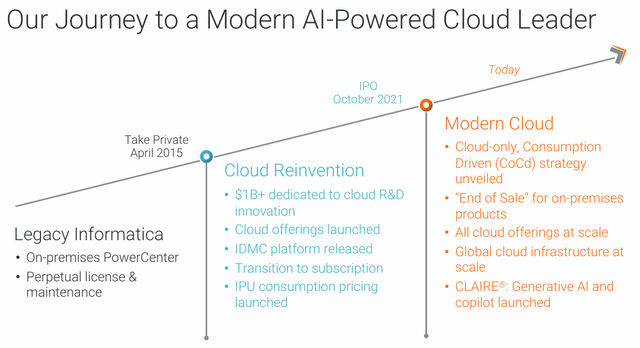

I admit, I had not heard about this company since this piece of news came out. In fact, the company was once publicly traded, but it then was taken private in 2015 in a $5.3 billion deal where Permira Adviserss LLC and the Canada Pension Plan Investment Board agreed to buy it. In 2021, it IPO’ed once it had fully transitioned from an on-premise, license-based business model to a cloud-only, consumption-driven SaaS business model, as the slide below shows.

INFA Q4 2024 Earnings Presentation

The company operates now in enterprise cloud data management. As we can read in Informatica’s last 10-K, the company declares it owns “the industry’s only artificial intelligence-powered data management cloud platform in a multivendor, multi-cloud, hybrid approach”. Informatica is proud to have pioneered a new category of software called Intelligent Data Management Cloud (IDMC).

Informatica 10-K

So, what does Informatica do? What needs does it provide a solution for? The company explains it well in its annual report:

As enterprises embrace data to modernize their business, data fragmentation has proliferated across a myriad of systems, including cloud and self-managed data warehouses, data lakes, databases, and applications. These different data repositories store data in unique formats, both structured and unstructured, with specific characteristics. This data is often consumed and ingested in real-time, making it increasingly challenging to aggregate data in a normalized, consistent, and high-quality format. Despite these challenges, as data has become one of the most valuable assets for enterprises, it has become embedded in highly complex operational use cases and is at the heart of new data-driven digital strategies. To address these challenges, we have pioneered a new way for businesses to accurately track where their data resides, understand what relationships exist across their different data repositories, and understand who is accessing the data and how it is being used-all at enterprise scale.

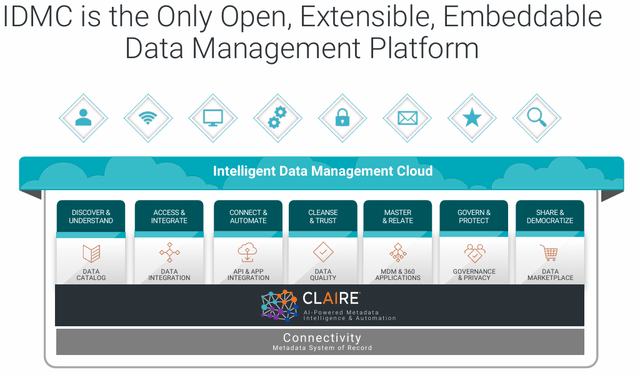

Thanks to the company’s AI engine CLAIRE, Informatica offers its customers the possibility to access their data faster and uncover novel insights about their business.

Informatica shows in this slide why IDMC is unique: it unifies together into one platform any kind of data, understanding them, producing a data catalog while integrating them to then offer new ways to rely on these cleansed data.

INFA Q4 2024 Earnings Presentation

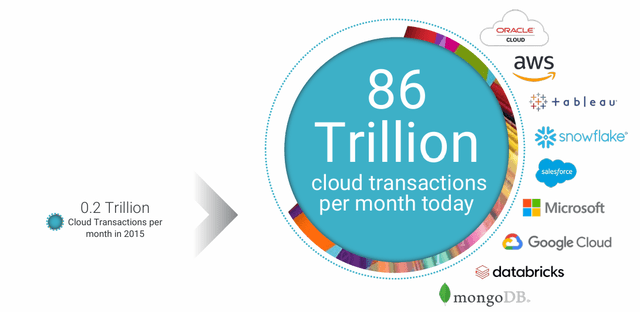

Informatica is cloud-neutral, meaning it can operate and scale through the entire cloud ecosystem. No matter if a company is working with AWS, Azure, or Google Cloud, Informatica’s IDMC can offer its services.

INFA Q4 2024 Earnings Presentation

Why Does Salesforce Want To Buy Informatica?

Salesforce is after data, just like many other companies. But the data Salesforce wants is those of its customers. Take notice, there is no theft. However, Salesforce owns tons of data on its cloud that helps it deliver specific updates and enhancements to its services. Thanks to the integration with Informatica, Salesforce would complete its data cloud offering, placing its hands one step ahead of the chain compared to other cloud companies. Moreover, it would be able to be among the first companies to unify all its data in one platform. As the analyst William Blair wrote, “Informatica will help enhance the volume and relevance of data that is inside Salesforce Data Cloud, which should drive value for customers who are looking to Salesforce to provide more holistic services to help power their gen AI applications”.

Even though the deal probably won’t go through, we can infer a few things:

Salesforce is not idle M&A-wise. The company seems to have laid its eyes on the field of gen-AI and data cloud management. This can be interpreted in two ways: Salesforce is either seeing stronger-than-expected demand and needs a partner to speed up its growth pace, or it is falling behind in terms of know-how and technological expertise, leading it to fill the gap with an acquisition. Personally, my educated guess is inclined to think the first option is closer to the truth. I don’t see any sign of Salesforce being outpaced by competitors.

Would The Informatica Deal Be Good For CRM?

We have read of an acquisition price between $11 and $14 billion. Would this money be worth to a company such as Informatica? For sure, its product is interesting and fits with Salesforce’s business. But what exactly would Salesforce buy in terms of operations and financial performance?

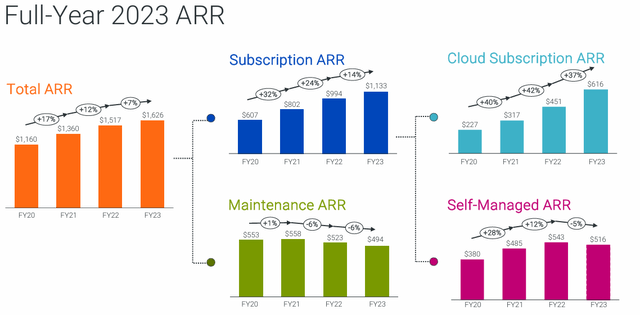

Informatica proudly shows its ARR revenues going up over time, moving from $1.16 billion in FY2020 to $1.63 billion at the end of FY2023. Even more important, its cloud subscription ARR is growing very fast and almost tripled over the last four years, from $227 million in 2020 to $616 million in 2023. At the same time, lower quality revenues such as maintenance ARR and self-managed ARR have decreased their overall weight on total revenues. Cloud subscription ARR now makes up 38% of the total ARR. Customers with subscriptions worth over $100k are almost 2,000, while 240 signed a $1+ million subscription. This proves there is a large customer momentum.

INFA Q4 2024 Earnings Presentation

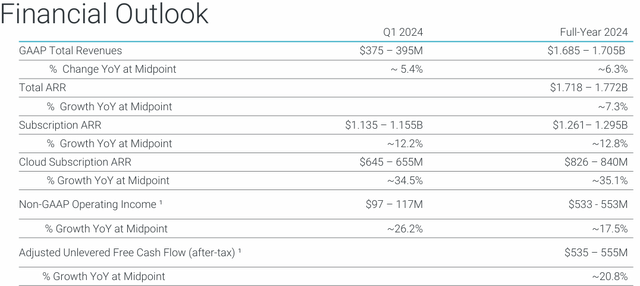

But what do we find below the top line and its mix? Let’s look at the company’s 2024 guidance.

INFA Q4 2024 Earnings Presentation

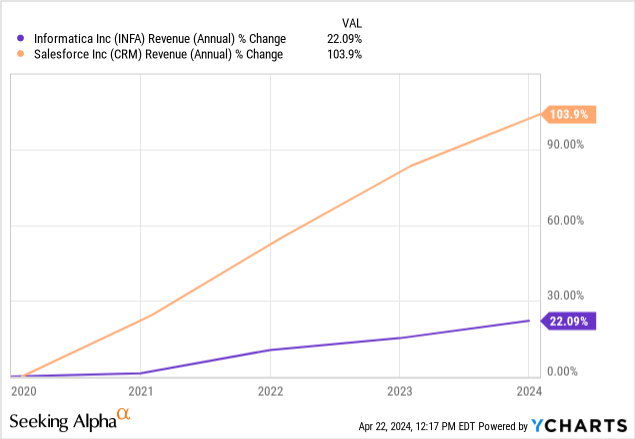

Informatica grows its top line more or less at a mid-single-digit pace. Compared to Salesforce’s growth rate, there is no match.

For this fiscal year, Salesforce guided for 9% revenue growth, which is still faster than Informatica. So, the deal would not have been motivated by the need for faster revenue growth.

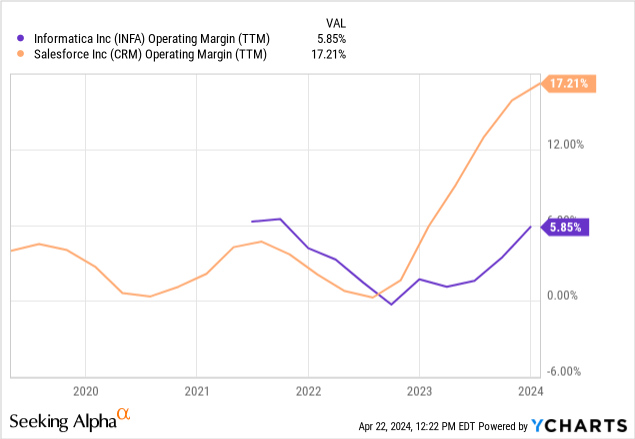

Informatica’s margins are not exceptional, either, considering we are before an asset-light business. They hover around 6%, while Salesforce, once it switched gears, is headed towards 20+% margins.

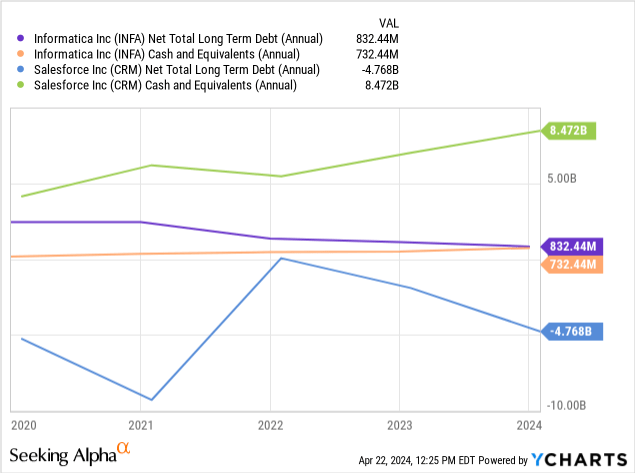

Informatica’s balance sheet is also neither poor nor great. It currently carries a net LT debt of $832 million, considering $732 million in cash. Salesforce, on the other hand, has an incredible balance sheet with a negative net debt position of almost $5 billion thanks to its $8.5 billion in cash and equivalents. This means Salesforce could acquire Informatica, raising probably no debt if a stock component would be considered in the potential deal. Salesforce would pay around a 6 sales multiple, which is a lot cheaper than the 24 sales multiple it paid for Slack.

Yet, acquiring Informatica would mean for Salesforce to take on the endeavor to complete Informatica’s turnaround and make it margin accretive, rather than margin decreasing.

From a financial standpoint, the acquisition is no great deal. This proves once again that Salesforce is after the product rather than the high-quality company. This makes sense because Salesforce is proving to be extremely profitable, and it can be confident enough can digest similar acquisitions, integrating them into a well-oiled system where high profits seem ahead.

However, Salesforce must also listen to what many shareholders have asked the company for a long time: internal operating efficiency and focus on cash flows. The feeling many have is that Salesforce is far from done under this perspective, as this past fiscal year proves. If these outstanding profitability metrics were achieved as soon as Salesforce pivoted, why shouldn’t investors expect the company to post, sooner or later, numbers similar to Microsoft’s?

For example, Salesforce’s gross profit margin is 75.50% vs. Microsoft’s 69.81%. Yet, Salesforce’s net income margin is only 11.87% vs. Microsoft’s 36.27%. Even if we compare Salesforce to SAP, we see a gross profit margin of 72.43%, but a net income margin of 19.67%. Obviously, Salesforce can still extract value from its revenue dollars. Let’s quickly compare the three companies’ income statements (in the parenthesis, I put the % on revenues):

|

in USD billions; last TTM |

CRM | SAP | MSFT |

| Revenues | 34.86 | 34.45 | 227.58 |

| Gross Profit | 26.32 (75.5%) | 24.95 (72.4%) | 158.89 (69.8%) |

| SG&A | 15.41 (44.2%) | 10.78 (31.3%) | 29.88 (13.1%) |

| R&D | 4.91 (14.1%) | 6.97 (20.2%) | 27.5 (12.1%) |

| Operating Income | 6.00 (17.21%) | 7.18 (20.8%) | 101.49 (44.6%) |

| Interest Expense | 0.03 (0.01%) | 0.71 (2%) | 2.46 (1%) |

| Income Tax | 0.81 (2%) | 1.92 (5.6%) | 18.67 (8.2%) |

| Net income | 4.14 (11.9%) | 6.78 (19.7%) | 72.36 (31.8%) |

From this comparison, we can easily spot where Salesforce loses profits: SG&A. As we can see, both CRM stock and SAP perform worse than Microsoft because they both have higher selling expenses. After all, they are not as mature as the largest company by market cap in the world. But even compared to SAP, Salesforce is lagging. If we consider that the company can cut several percentage points on revenues of this item, we can expect Salesforce’s profits to go up even further in the future.

As a result, Salesforce valuation multiples may create something similar to an optical illusion. After all, a 44.4 fwd GAAP PE is not cheap. But Salesforce can still improve its profitability, and I would not be surprised to see the company end this new fiscal year with a net income margin close to 20%. Considering Salesforce guided for around $38 billion in revenue, we could see the company’s net income come close to $7.6 billion. If the shares outstanding were to stay flat, this would translate into EPS of $7.83, which equals a 34.9 PE. But if the company is going to purchase $10 billion worth of its stock, it is going to decrease its share count by more than 36 million and EPS should come around $8.13. The result is a fwd PE of 33.6.

So, Salesforce forward-looking multiples may differ significantly from what we are seeing today. This is because there is still ample room for the company to improve its efficiency.

This is why I welcomed the news that the deal won’t probably go through.

At the same time, I think this turmoil opened up a buying opportunity in a stock that I see as one of the most rewarding ones for the next decade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.