Summary:

- UnitedHealth Group investors recently faced a rare bear market decline in UNH, which was hit by a series of unforeseen challenges.

- However, UnitedHealth management surprised the market by maintaining its 2024 adjusted EPS guidance.

- A robust post-earnings recovery suggests the market was too pessimistic heading into UnitedHealth’s first-quarter earnings release.

- With UNH valued below its long-term average, I explain why UNH’s long-term uptrend bias remains undefeated.

- UNH buyers looking to load up should capitalize on the recent reset and recovery before it resumes its recovery.

jetcityimage

UnitedHealth Group (NYSE:UNH) investors faced significant downside volatility in April. UNH was battered toward the $435 zone, representing more than a 20% decline from its November 2023 highs. As a result, UNH investors endured a momentary bear market decline in the stock of the leading integrated healthcare company. UNH investors have faced a series of disappointments since its Q4 release in January 2024. I upgraded UNH back then, assessing a more constructive risk/reward following the pullback from UNH’s 2023 highs.

The recent cyberattack on Change Healthcare worsened buying sentiments on UNH as investors assessed the impact on UnitedHealth’s EPS guidance. In addition, the disappointment from the early April CMS final Medicare Advantage rate notice sent the shares of health insurers sprawling, as the increase does not reflect “actual in-market medical trend,” potentially pressuring growth or profitability in 2025.

However, UnitedHealth’s first-quarter earnings release last week calmed investor nerves, as the healthcare leader maintained its full-year adjusted EPS guidance range. The market likely anticipated further downside adjustments as the company dealt with the costs emanating from the business disruption and direct response. However, UnitedHealth management indicated that its adjusted EPS guidance incorporates “estimated business disruption impacts for the affected Change Healthcare services.” Hence, it suggests UnitedHealth’s well-diversified business is positioned to navigate the potential one-off incident well. It also strengthened investor optimism that UnitedHealth has several growth levers to drive business recovery from 2025.

UnitedHealth management underscored its confidence that it has the necessary client engagement strategies to “regain customers who sought alternatives during the outage.” As a result, the company informed investors that UnitedHealth is sanguine in “regaining baseline performance by 2025.” UnitedHealth also gained goodwill with its affected customers by extending more than $6B in “advance funding and interest-free loans.” As a result, I believe it demonstrated UnitedHealth’s dedication to its customers to “ensure stability and continuity in healthcare services.”

Coupled with the robust growth momentum in the company’s Optum segment, I’m confident that Optum Health and Optum Rx should continue to drive solid double-digit growth, helping the company recover its long-term adjusted EPS growth range of between 13% and 16%.

UnitedHealth management’s 2024 guidance suggests a growth range of between 9% and 11% for its adjusted EPS. With the business disruption of Change Healthcare likely behind the company, it should lend credence to UnitedHealth’s execution through 2025, even as the MLR is still expected to be elevated. Despite that, UnitedHealth expects its MLR to align with Q1’s 84.3% metric in Q2, suggesting we are likely at cycle peak. Furthermore, with the market likely already priced in the effects of the MA final rate adjustment, it should clear the pathway for UNH to regain its buying momentum moving ahead.

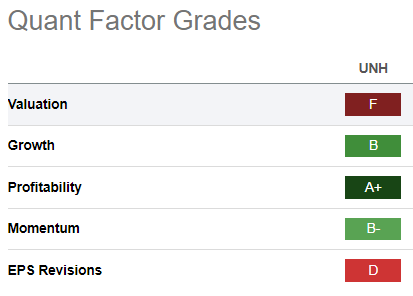

UNH Quant Grades (Seeking Alpha)

While UNH is still rated at a premium (“F” valuation grade) relative to its healthcare sector peers, it hasn’t affected its robust buying momentum (“B-” momentum grade). Consequently, I assessed the market has remained highly confident about UnitedHealth’s fundamentally strong growth thesis. Therefore, I believe last week’s dip-buying support demonstrated UNH remains a solid buy-on-steep-pullback proposition.

UNH is valued at a forward adjusted EPS multiple of 17.7x, below its 10Y average of 18.6x. Hence, it’s arguable that investors have already baked in execution risks related to the headwinds discussed earlier. With UnitedHealth’s 2024 guidance coming in below its anticipated long-term growth trend, I believe this year should mark somewhat of a transition year. Despite that, UnitedHealth’s ability to maintain its full-year adjusted EPS guidance is highly commendable, demonstrating its well-diversified growth drivers.

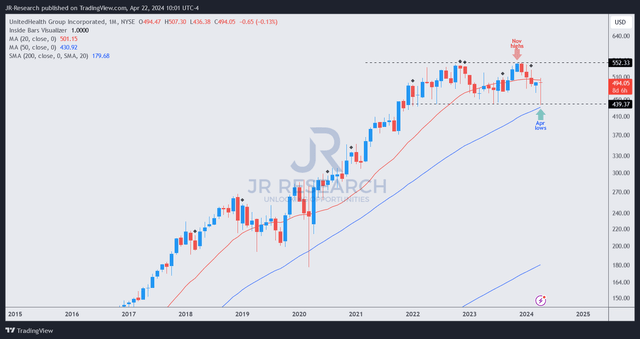

UNH price chart (monthly, long-term, adjusted for dividends) (TradingView)

UNH’s price action doesn’t lie. Its robust long-term uptrend suggests steep pullbacks have continued to attract long-term dip-buyers seeking potentially attractive entry levels.

Since its recent April selloff, robust buying sentiments have also been observed at the $435 level, a support zone that has been defended resolutely since June 2022. While the $550 level could see stiff selling resistance, I believe UNH remains in a consolidation pattern.

Bolstered by UNH’s relatively attractive valuation (compared to its 10Y average) and ability to maintain solid full-year guidance amid recent troubles, UNH is well-primed to resume its long-term uptrend continuation bias.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!