Salesforce: On Track To Deliver Solid Revenue Growth

Summary:

- Salesforce has been outperforming the broader U.S. stock market since my initial bullish thesis went live.

- I am optimistic about the company’s FY 2025 prospects as I see several bullish signs which are likely to convert into financial success.

- My valuation analysis suggests that the stock is dirt cheap.

JasonDoiy/iStock Unreleased via Getty Images

Investment thesis

My initial bullish thesis about Salesforce (NYSE:CRM), which I shared in April 2023, aged well. The stock delivered a 37% total return, compared to a 20% increase in the S&P 500 index over the same period. A lot of developments happened over the last twelve months and today I want to update my thesis. I see several strength signs for the company’s top-line prospects in FY2025. Another big positive sign is the management’s firm commitment to continue driving operating leverage further. Solid revenue growth potential together with cost discipline appears to be a robust blend to drive more value for shareholders. Moreover, my valuation analysis suggests that the stock is extremely undervalued. All in all, I reiterate my “Strong Buy” rating for CRM.

Recent developments

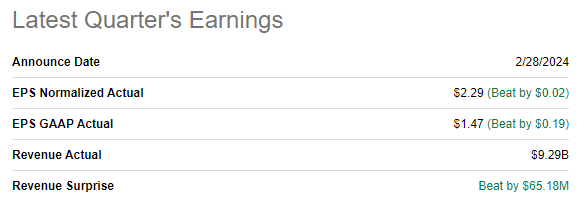

The latest quarterly earnings of CRM were released on February 28, when the company surpassed consensus estimates. Revenue grew by 10.8% on a YoY basis, and the adjusted EPS expanded from $1.68 to $2.29.

Seeking Alpha

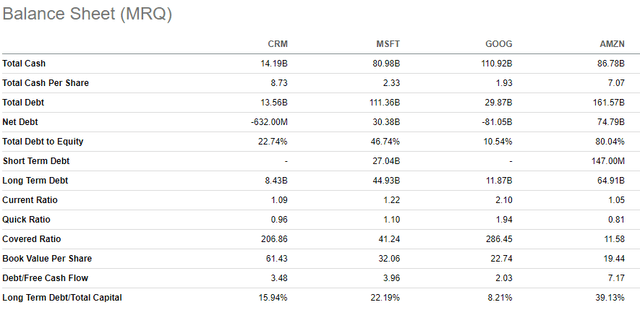

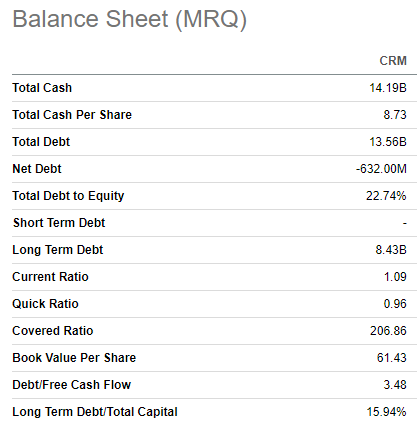

The EPS improvement was of high quality since it was achieved by the expansion of the operating margin from 14.1% to 19.3% YoY. Strong Q4 performance enabled CRM to further improve its financial position. The company had $14 billion in cash as of the latest reporting date, and its financial leverage is low. Having a sound balance sheet is crucial because it provides the company with a substantial financial flexibility, which can be exercised to invest in new growth opportunities. Past performance is not a guarantee of future victories, but CRM’s historically high profitability adds optimism regarding the company’s ability to reinvest successfully.

Seeking Alpha

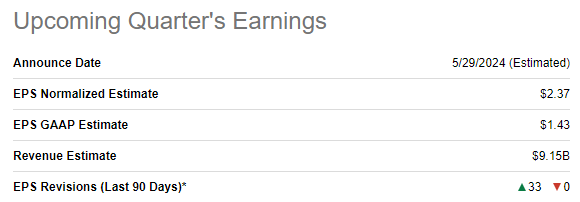

The upcoming earnings release is scheduled for May 29. Quarterly revenue is forecasted by consensus at $9.15, which indicates a 10.9% YoY growth. The adjusted EPS is expected to expand further, from $1.69 to $2.37. As we see below, there were 33 upward EPS revisions over the last 90 days, which signals that the optimism around the upcoming earnings release is substantial.

Seeking Alpha

The first reason why I am optimistic is CRM’s flawless earnings surprise history over the last 16 consecutive quarters. This underscores the stability and predictability of CRM’s financial results and the management’s ability to set realistic financial goals.

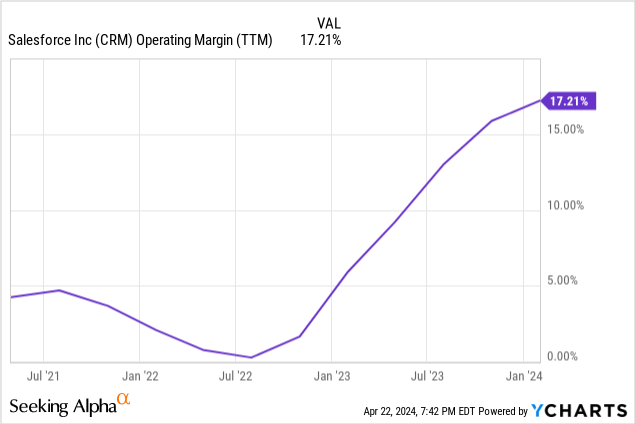

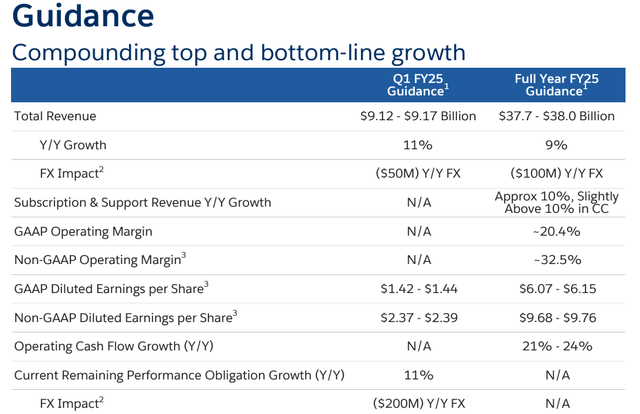

Secondly, CRM has demonstrated a massive strength in recovering its operating profitability in FY2024, which is another bullish sign. Since the adjusted EPS is expected by consensus to expand again, I think that this will be achieved with the improved operating leverage. The management is committed to drive higher operating margin, which was highlighted during the latest earnings call. According to Amy Weaver, the CFO, the management targets to deliver a 32.5% in non-GAAP operating margin in FY 2025. This means that the management aims to expand this metric by two percentage points.

CRM’s latest earnings presentation

According to the latest 10-K report, the company’s current remaining performance obligation (cRPO) grew by 12% in Q4 FY 2024. This underscores strong demand for CRM’s products and services and helps investors gain visibility into the company’s near-term future performance. This stability and predictability are crucial amid the current uncertain environment and is another positive sign for potential CRM investors. The fact that CRM generates 93% of its revenue from subscriptions also provides greater visibility for investors.

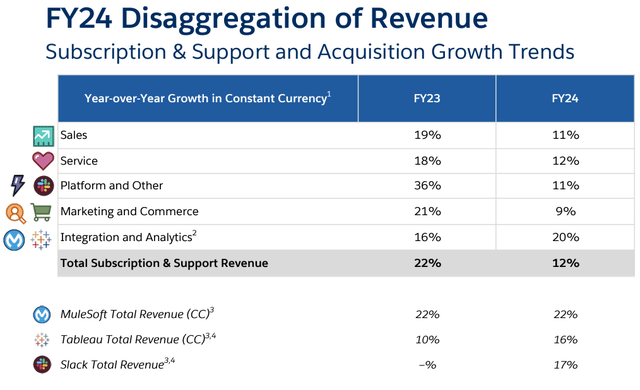

CRM is still firmly positioned because it provides a multi-cloud offering to its customers, which helps to connect all data across sales, service, marketing, and commerce. All these are leveraged with AI and advanced analytical tools. AI-powered tools like Tableau (visual analytics) and MuleSoft (automation of routine tasks) demonstrate solid revenue growth momentum, which helps CRM to smooth out the effect of soft macro environment on its legacy offerings.

CRM’s latest earnings presentation

To summarize, I think that CRM is firmly positioned to continue delivering value to shareholders. The company’s solid backlog and its diversified offering with relatively new AI-powered tools give optimism about the top-line potential to expand. From the costs perspective, I like the management’s commitment to improve the operating margin further in FY2025.

Valuation update

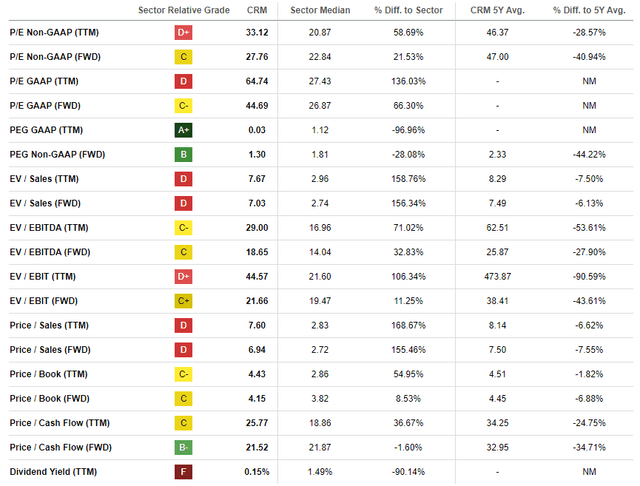

The stock rallied by 37% over the last 12 months, significantly outperforming the broader U.S. market. This year, CRM demonstrates a modest performance with a 3% share price increase YTD. Current valuation ratios are lower than the company’s historical averages, which likely indicates that the stock is undervalued.

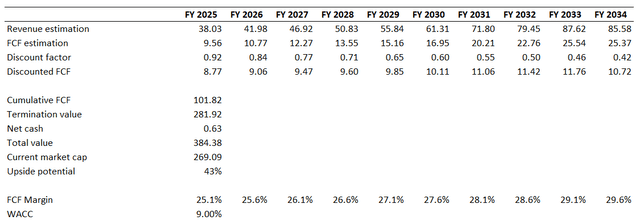

I am using a 9% WACC, which aligns with the range recommended by valueinvesting.io. Consensus revenue estimates for FY 2025-2034 project a 9% CAGR, which I incorporate since the level is quite conservative. For the base year, I use a TTM 25.1% FCF ex-SBC margin and expect a 50 basis points yearly expansion. I ignore the net cash position for CRM since it is insignificant compared to the company’s scale.

According to my DCF template, the business’s fair value is slightly around $384 billion, which means there is a massive 43% upside potential. Such a big discount for the undisputed leader in its niche looks like a gift to me.

Risks update

Despite declaring its first-ever dividend in February 2024, CRM is still a growth stock. Discount rates have a significant influence on the valuations of growth stocks, since a company’s future free cash flows are discounted. The higher the discount rate, the lower is the present value of future cash flows. That said, the current stance of risk-free rates (Federal funds rates) is a headwind for all growth stocks, including CRM. And there is an extreme degree of uncertainty regarding the Fed’s future steps in its monetary policy. Despite the Fed announcement in late 2023 that there likely will be three rate cuts in 2024, I see a few big reasons why the Fed is unlikely to soften the monetary policy. Since CRM’s leverage is low, I do not expect high-interest rates to significantly weigh on the company’s financial performance. However, higher rates for longer mean that the valuation will remain under pressure for longer.

It is also crucial to recall that CRM operates in a highly competitive environment where it competes with giants like Amazon (AMZN), Microsoft (MSFT), Google (GOOG), Oracle (ORCL). Moreover, the technological landscape is evolving rapidly and every year new startups emerge that can potentially bring more threats to CRM. The company has been quite successful in dealing with the intense competition, but past success is not a guarantee of future wins. CRM’s financial power is much lower compared to companies with trillions in market caps. It is important to understand that CRM does not only compete directly with these giants but also competes for the best talent and potential new acquisitions.

Potential investors should also be aware that the stock lost 11% over the last month, mainly due to rumors regarding the potential acquisition of Informatica (INFA). Informatica’s market cap is around $10 billion, meaning that it could potentially be a significant investment relative to CRM’s scale. Since any major acquisition usually means increased leverage to finance the deal and substantial integration risks, the market reacted negatively to this information. Recent news suggests that the parties could not agree on terms, which added slight optimism to CRM investors in recent days. However, if CRM’s management has already expressed interest in the deal, it is probable that parties might enter into new negotiations, which could potentially harm CRM’s share price.

Bottom line

To conclude, CRM is a “Strong Buy”. The company’s fundamentals keep improving, and I expect FY2025 to be even more successful than FY2024. There are several robust indications that the topline is poised to deliver solid growth further and the management is committed to deliver more operating efficiencies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.