Summary:

- Arrival turned from a promising start-up to a disaster. I’m glad that my subscribers anticipated it many months ago.

- Although the company’s current outlook still looks awful, I hoped that the sale of its assets could have been beneficial for shareholders.

- Unfortunately, our analysis shows that the odds aren’t in the bulls’ favour.

alphaspirit/iStock via Getty Images

An old friend of ours – Arrival (NASDAQ:ARVL) – is running around like a dog stung by a bee. After a devastating Q3 report, the stock plummeted by 30% before taking off again over the following days. Some of you are probably wondering what is happening with the stock right now. If questions like — should I invest in Arrival? Am I missing something that the big guys know? — are coming to mind, then this article is for you. If you’re already an Arrival bear, though, I’m sure you will still enjoy reading.

There is likely no other author on Seeking Alpha who follows Arrival’s stock as enthusiastically as I do. If only you knew how much I loved the idea of producing a cheap ecological vehicle in microfactories all over the world. It could have revolutionized the entire car industry, after all! Arrival became the hero of my first article on Seeking Alpha. But by that time, I was starting to become sceptical about the stock, as “minor” production delays seemed concerning to me.

It may be that I also feel personally attached to Arrival because its CEO is a Russian trying to build his company in Europe from scratch— just like me. But we Russians aren’t all the same. While some are pitching non-functional electric vehicle ideas and some are busy ardently supporting the war, others still are working day and night to come out with the newest and best analysis possible. My followers know that, and I really appreciate their views, comments, likes, and criticism. Thank you for your support and I hope my articles help you profit.

Turning back to our old friend, those who have been following my blog since the very beginning know that the company’s stock was dangerous. Despite all my emotional links, I continuously warned you to stay away from the stock. Recently, it became clear to the market that Arrival was turning into a zombie company that had a lot of know-how, but no sufficient funds for expansion and any promising track record. The most obvious answer in such a situation is to put the company’s goals on the shelf of dead ideas. But I decided to give it a second look and tried to approach the stock with an asset-based valuation. I thought that if Arrival found a strategic partner, then its stock could profit a lot. Unfortunately, we can’t bring you any positive news, even though we’d be eager to do it.

Pushing the panic button

In the spring article, “Avoid Buying Shares of Arrival Now,” we doubted Arrival’s chances to succeed and warned our followers to keep their fingers away from the stock.

At that time, the stock price was already about $2— significantly below the initial price of $23. Despite some difficulties, the stock was still loved by investors. Otherwise, it would not have had the $1.5 billion valuation. Its relatively low multiple compared to the peer group gave hope to investors for nice future gains. In contrast to the Street, we didn’t like the company’s continued underperformance. The plans were constantly changed, the roll-out was delayed, and Management didn’t deliver on its plans. The necessity for funding became more and more obvious. We wrote:

So far, management hasn’t shown any meaningful track record and has made significant overstatements during the SPAC roadshow. Without $1 billion in external funding in late 2022, Arrival will lack cash in early 2023.

Over the summer, the situation deteriorated, and we rushed to update our readers. In the article, “Avoid Arrival: It Is Just Getting Darker,” we questioned why management was eager to raise capital before the first vehicle launch. After all, it would have been much more rational to raise capital after a successful roll-out enjoying the strong stock momentum. It brought us to the idea that the management hadn’t expected to produce the vehicles soon. We wrote:

Arrival’s inability to produce vehicles this year, amplified by the strapped cash, would mean a bankruptcy scenario for Arrival.

A couple of days ago at the Q3 earnings call report, Arrival announced new plans that confirmed our doubts. The company announced huge losses amounting to $310.3 million, and claimed that it was changing its focus to the US market segment due to a more beneficial regulatory environment. The most surprising thing for the market was that Arrival would not make any revenue in 2023. And that it will produce vans only 12-18 months after the equity is raised. The management admitted that it was challenging to issue equity at the current market, but it hoped to do so over the next 6 months.

Doing simple math, we see that if the vans are produced, then it will happen in 18-24 months from now in late 2024. The statement, “No revenue in 2023” starts sounding optimistic in this case.

As it is said, when it rains, it pours. So, troubles didn’t end for Arrival. In fact, the situation only worsened as the media wrote about the fire that happened with the recently produced van.

I’ll be frank with you, I have lukewarm feelings. It’s really a pity that Arrival didn’t manage to bring its idea to reality. But I am utterly proud that my team was able to go against the market and turn out to be right. Could we have expected that the first van would be caught in fire? Definitely not. Even in our wildest dreams we couldn’t have imagined it. But we can be very attentive to details. We can read across the lines. And we managed to save our money and the savings of our followers.

All-or-nothing game

It seems like it can’t get any worse for Arrival. But Arrivals’ CEO, Denis Sverdlov, must be a very smart person if he managed to achieve such a tremendous valuation at the listing. Plus, the CEO of Automotive, Mike Ableson, used to work for General Motors and must be well connected in the industry. So is there any hope that Arrival will strike beneficial partnerships?

It is possible, but not very likely. Arrival has definitely invested a lot in its portfolio of software and hardware patents that could be interesting for a large auto producer. This would potentially work if a recession wasn’t knocking on the door, as automakers are among the first to suffer during a recession. As we wrote once to subscribers:

It is relatively easy for a consumer to postpone the decision to buy a car. Automakers sell roughly 15-17 million vehicles annually in the USA. Considering 127 million households in the USA, an average family buys a car every 7.5 years. Hence, if the decision is postponed only by one year, the car market decreases to 15 million cars (12% decline).

In the case of a recession, car makers count every penny and always think twice before acquiring anything. Let alone a start-up with flaming vans. But if one of them decides to support or buy Arrival, it would be a strong catalyst for the stock. Should I invest hoping for a potential acquisition, keeping in mind that the company will face bankruptcy if there is no buyer?

You should certainly do your own analysis, but in our team we’re asking ourselves: how much will we lose if the company doesn’t meet the angel in the recession hell? If loss is too high, then it is simply not worth the risk.

Potential loss calculation or asset-based valuation

There are three ways to value any company: discounted cash flow model (“DCF”), multiples valuation, and asset-based approach. Usually, analysts expect the company to operate forever and rely either on the DCF and multiples. With the DCF method, you determine the present value of the future cash flows and compare it to the current stock price. With the multiples method, you benchmark the stock vs competitors to see how the market treats the company when compared with the others. All these methods can be very helpful if you assume that the company exists forever. But what if the company is going bankrupt soon? Then another popular approach comes in handy: the asset-based method. It allows us to compare the company’s asset value with the stock’s value. In other words, how much will you get if the company declares bankruptcy?

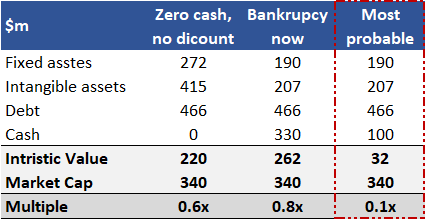

Unfortunately, the Q3 balance sheet hasn’t been published yet. But if we take around $300 million property & equipment and add $400 million intangible assets from the Q2 report, then we will get about $700 million in assets that can be sold. I doubt that Arrival will be able to sell its assets at the balance value given that the company hasn’t managed to produce proper vehicles. Therefore, I’d assume a 30% and 50% discount for fixed and intangible assets respectively. In case of bankruptcy, creditors will be the first in line to get compensated. Therefore, I need to deduct about $470 million in debt liabilities. If the company stopped its operations today, then the cash could be also distributed to shareholders. Since the management hopes to find investors, it would initiate the bankruptcy procedure when cash is very low.

My calculations below show that, in the most likely scenario, shareholders could rely only on $30 million. This is much less than the current market capitalisation. If no investor is found, then the shareholder will receive around 10% of the current market capitalisation.

Put differently, there is enormous upside potential at the risk of 90% loss. It would be a wiser choice to spend the weekend in Las Vegas— at least then you get free cocktails.

Author’s Work. Arrival’ statements, Seeking Alpha

Bulls say

Bulls would say that Arrival has produced a fantastic innovative vehicle concept— one that needs just a bit more money to start production and benefit from its capital-light business model. Thanks to a well-connected management team, the company has a good chance to strike a partnership with a leading carmaker that will help Arrival survive 2023.

Conclusion

If you don’t like Arrival, don’t invest in it. It’s that simple.

If you do like Arrival as we do, don’t invest in it either. It is difficult, I know. But from what we have been seeing, a white knight in shining armor is unlikely to save the company. Investment is about risks and reward— not love and hate. And our analysis shows that the downside risks are just too high.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.