Cisco Stock: 11 Reasons To Question The Bull Case

Summary:

- In August, I published one of the few bear articles written on Cisco stock during the past 18 months.

- I was curious why investors have been so bullish on Cisco even though the stock has performed poorly and the business has performed mediocre over this time.

- In this article, I examine and respond to 11 general reasons bulls have given for rating CSCO stock buy over the past 3 months, and why I don’t find them compelling.

- I also share a brief revaluation of the Cisco stock, and slightly move my rating for the stock from “Sell” to “Neutral”.

jejim

Introduction

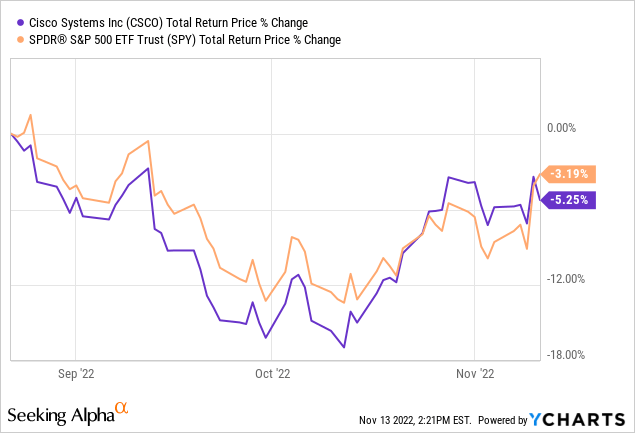

About 3 months ago, on August 22nd, I published my first Cisco (NASDAQ:CSCO) article titled “3 Reasons I Continue To Avoid Cisco Stock“. In that article, I rated Cisco stock a “Sell” for three reasons: The 3-year revenue trend was negative, the valuation was too high based on earnings and earnings growth, and their capital allocation put too much of an emphasis on stock buybacks for such a slow-growing business. Here is how the stock has performed since that article:

After falling about -15% in two months, it has rallied back to about -5% down. For most of this period, Cisco stock has underperformed the S&P 500 (SPY) and it was negative the entire period. This is just a short time period, of course, but I always like to review any previous coverage I’ve had with a stock at the beginning of my articles so readers can see how things have gone.

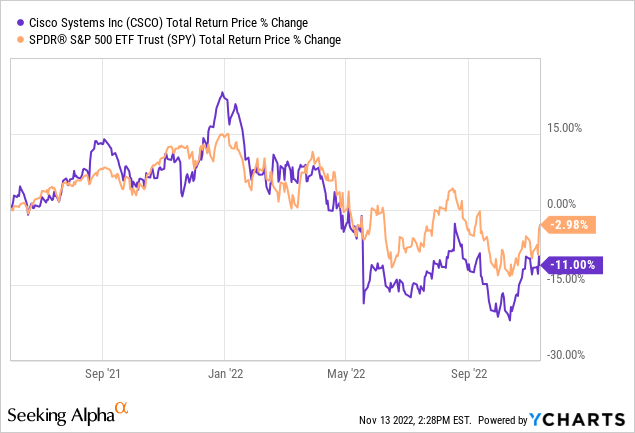

As I went back to review my August article, I noticed that my article was the only article with a “Sell” rating on Cisco stock since June, and only the 3rd “Sell” article in the past 18 months. This genuinely made me curious about what so many investors found attractive about the stock. It’s not like Cisco stock has performed well in the past 18 months:

Since June 1st of 2021, Cisco stock has produced a total return of -11%, more than 3X worse than the -3% return for the S&P 500 over the same time period.

So, I went and read all the bull articles published since my last article to see if there was something I was missing, or, to at least understand the other side of the argument. Without singling out any particular case (most of them made logical sense, given the premises they started from) in this article, I’m going to summarize many of the overall bullish themes that I read and explain why I personally don’t find them compelling.

Often when I write “Sell” articles, it is because I think there is significant short-term or medium-term danger to the stock price, and I want to warn investors of those high risks. Cisco is a little different than that, and I think the logic behind my Cisco critique can be applied to many, many dividend stocks in the market right now. So, while my inspiration for this article came directly from Cisco bulls, the principles are widely applicable to other stocks with a similar profile. I will also share my “buy price” for Cisco at the end of the article for those that do find the business attractive.

Next, let’s examine some of the bull arguments for buying Cisco stock.

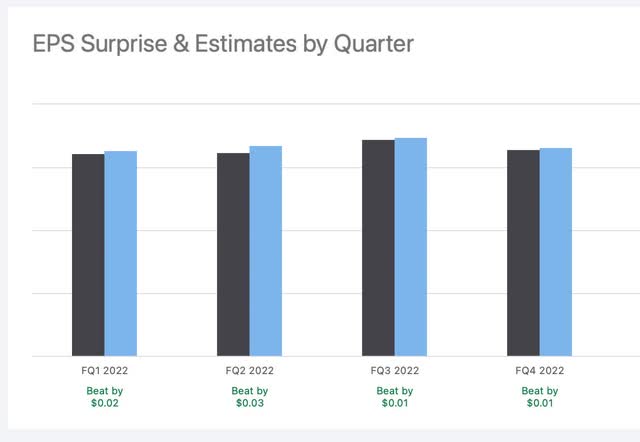

#1 Beating Earnings Expectations

Cisco has beaten earnings expectations during the past 4 quarters:

One argument I read was that Cisco had beaten earnings expectations when some other tech stocks had disappointed. First, we really need to judge whether Cisco stock is good on its own merits rather than its relative merits. For example, if I compared my stock picks to, say, ARK Innovation ETF (ARKK), then I’m going to look pretty good as long as I wasn’t down -90%. That doesn’t mean I made any money. Next, beating earnings expectations doesn’t really mean anything in and of itself because expectations can be low or even bad. For example, if analysts expect EPS to drop by -50%, and they only drop by -40%, that does not mean the stock is a good medium or long-term investment. And earnings trends only really matter over the medium or long term. They aren’t predictive of price over the short term. Stocks can beat earnings and go down, and they can miss earnings and go up. So, short term, earnings beats or misses aren’t particularly useful for investors. Cisco beat earnings 4 quarters in a row, yet the stock price is down -21% over those 4 quarters.

#2 The Company Is Boosting Spending

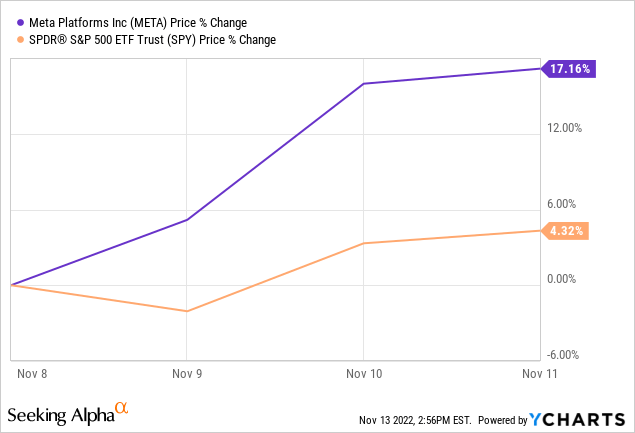

A company boosting spending in one area or another is basically a neutral event without having specific knowledge of whether that spending will translate into future earnings. And often, at least over the short term, it’s stocks that cut spending that tend to rally. For example, Meta (META) announced they were cutting 11,000 jobs, and here is what the stock price did afterward:

The stock rallied 17% in 3 days, 4x more than the S&P 500. I’m not saying that cuts are always good, especially if they hurt the long-term prospects of a company (like, say, Twitter), what I’m saying is that spending or cutting alone isn’t usually a good reason to get bullish or bearish on the stock without much more deep work into the ultimate long-term effects of the spending. Typically, the company’s history of such actions is a pretty good guide to the future, though, and that history will be reflected in their earnings history about 80% of the time. That means, historical earnings are a good guide to whether spending and investing will pay off in the future and we are usually just speculating when we think the historical trend will change in the future.

#3 Stock Buybacks

I hold a little bit of a contrarian, or at least nuanced, view when it comes to stock buybacks. There are basically 6 ways a business can allocate earnings. They can reinvest those earnings into an internal project that the company has; they can acquire assets and businesses outside of the company; they can distribute them as dividends; they can buy back stock with them; they can pay down debt, or they can hold them as cash.

Cisco generates plenty of cash and earnings, so they have to decide what to do with that money. The best use is usually to use earnings to grow their own business, but those opportunities may no longer be available. Most other businesses have been way too expensive to buy over the past several years, so there aren’t many options there. Cisco doesn’t have a high amount of debt compared to its market cap. Cisco’s business is pretty stable, so they really don’t need to hold a lot of cash. This leaves two options, dividends and buybacks.

The way I choose my preference between these two is to look at how fast earnings are growing. If earnings are growing at a decent rate, I’m fine with buybacks. But Cisco’s earnings growth rate, once buybacks are excluded from the EPS growth, is between 3% and 4%. If I am a Cisco shareholder, I would much rather have the money distributed to me as a dividend so I can go buy the stocks of businesses that are growing earnings faster. Cisco’s revenue growth over the past three years is about 0%.

Even though I’m not a “dividend” investor, I very much prefer dividends with slow-growth businesses because very often slow-growth businesses become no-growth businesses and no-growth businesses become negative growth businesses, and the stock price almost always falls a lot when that happens. A large enough dividend (which Cisco is certainly capable of producing) is money that I view as an insurance policy on my original investment. If I get an 8% starting dividend yield, even if it doesn’t grow much, I will earn an amount equal to my original investment back in 9 years. If the business slowly dies during that time, at least I won’t have lost money. For example, if you had purchased IBM (IBM) stock 9 years ago in 2013, the stock price would be down -22% since then, but if it had an 8% yield at the time (which it did not), you would have been up more like 50% even if you couldn’t find a place to reinvest the money. Buybacks didn’t do much to help your returns. Even if a company like IBM went bankrupt, under these conditions of collecting an 8% yield, you would have lost nothing because IBM would have paid you back your initial investment and you could have invested it elsewhere in a faster-growing business. Those still wouldn’t have been great returns, but if the dividends would have been buybacks instead of dividends, a person would lose their entire investment under those conditions.

So, for me, I don’t want to see slow or no-growth businesses buying back stock. Give me the money in dividends instead.

#4 Long-term Industry Estimates

This is the argument that some business segments or the wider industry itself is likely to grow in the future. If a person really knew what they were doing and had an accurate pulse on a certain industry, they could certainly make money betting on it this way. But it’s pretty rare with a business the size of Cisco to develop something really new that has a significant impact on their business, and there is never any guarantee that they will be better than their competition at acquiring their share of growth in a particular industry. It’s just really difficult to predict these sorts of impacts far into the future.

The biggest error I typically see from investors in this regard is often the new “growth” part of the business is extremely small compared to the bigger, slow-growing (or shrinking) part of the business. So, the story sounds good, but the actual impact on the bottom line of the business is often limited.

#5 Current Dividend Yield of 3-4% (Getting paid to wait)

The very long-term inflation rate in the USA has roughly been about 3% per year. Sure there are some years when inflation is higher than that, like now, but they are balanced out by years where inflation is sub-2%. So, when a stock with effectively no revenue growth and 3-4% earnings growth has a dividend yield between 3% and 4%, I simply don’t understand why that is considered an attractive investment. It’s basically just treading water with inflation. (More on this later.)

#6 Low Return Goals

This is somewhat similar to me not quite understanding investors who think a 3-4% dividend yield is a reasonable return for a no-growth stock. But in the same vein, if a person runs their analysis and comes away with an estimate that Cisco stock will return 6% per year over the medium term, I just don’t understand why that would be enticing enough to buy unless they also make the case that the S&P 500 Index is likely to return significantly less than that over the same time period. Why buy an individual stock when the return expectations are so low?

#7 A Wide Moat

Here is the way I think about wide moats. A wide moat means that your future earnings projections for the business have a high likelihood of not being undermined by some competitive threat, and therefore might give you more clarity over those potential returns over the next decade. But the catch with moats is that they are less valuable to investors the slower the business is growing and the worse the valuation is. Moats only really matter if the valuation is attractive.

For example, if you run your valuation analysis and accurately predict that because of Cisco’s wide moat, their business will return 5% per year and that is almost guaranteed because of their moat. Well, so what? If you’re right, you earn 5%. Moats really matter when you expect 15%+ earnings growth and that growth is in danger of potentially being disrupted. Or you find a stock with a very good valuation and the moat gives you confidence that your valuation won’t be wrong because of competition from other businesses over time.

Government bond yields have a big “moat” as well, but getting 3% for 10 years “risk-free” is still, ultimately 3% per year. It’s the same with stocks; being confident you will get low returns due to a moat, still will produce low returns if the valuation isn’t good.

#8 Good Credit Rating

Like most of the issues I’ve brought up already, it’s not that credit ratings are never useful. They can be. I often watch for a low credit rating for stocks that I find attractive because there could be things about the general workings of the business or the company’s debt, if they have some, that makes lenders nervous. And if lenders are nervous, that probably means I should be extra careful as an equity investor.

But a good credit rating just means the business is a decent risk for lenders. It does not mean there aren’t risks to stock investors. So I view a good credit rating as neutral. A stock doesn’t get any extra bonus points from me for that. But a bad credit rating might cause me to be more cautious. In either case, the credit rating doesn’t really contribute to the bull case of a stock for me, even if it might contribute to the bear case if it’s bad.

#9 Brand Name With A Long History, AKA (SWAN)

One pattern I’ve noticed for many years now is that investors are willing to pay more for the earnings of businesses whose brands they are familiar with that have relatively predictable earnings growth. Often these types of stocks are labeled “sleep well at night”, or “SWAN”, investments.

This is a mistake.

That doesn’t mean I am advocating for the stocks of brand-new businesses that haven’t been tested by a full business cycle and have business models that are difficult to understand. I’m not. In fact, I usually recommend avoiding all new IPOs for at least 3 years, and most of the time, I require a business has gone through at least one full business cycle before I am willing to buy the stock. But that doesn’t mean earnings need to be stable and I need to recognize the brand. During the March 2020 crash, I bought the stock of lots of businesses I had never even heard of before. They had long histories of good earnings, but not always stable earnings, they simply weren’t well-known public businesses. I made a 100% return within two years on the vast majority of these lesser-known businesses, while more well-known brands vastly underperformed.

The bottom line is that significant underperformance from a SWAN stock, even if it’s ultimately positive performance, isn’t a good investment. Sleeping well while performing worse than average shouldn’t be anyone’s goal if they are buying individual stocks. Volatility is not the same as risk, and having earnings that fluctuate some isn’t such a bad thing as long as one’s valuation techniques account for those fluctuations.

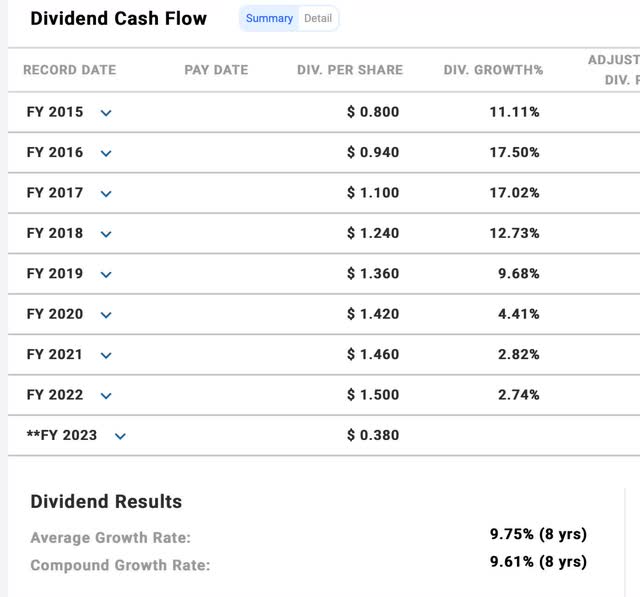

#10 Fast Dividend Growth Rate

Some investors like to focus on the dividend growth rate more than other factors. The time frame I chose to use to analyze Cisco was from 2015 to the present. The dividend growth over this time period according to FAST Graphs is 9.75%.

There are some investors who think that a +9.75% dividend growth rate is quite good because it is at least keeping up with inflation. But the dividend growth rate (just like the earnings growth rate for the earnings analysis I use) is not useful in isolation. The reason for that is the base from which the dividend is growing significantly impacts the ultimate amount an investor will receive from the dividends.

I actually developed what I call the “Dividend Time Until Payback” analysis, which I use in my marketplace service, The Cyclical Investor’s Club, that takes both the starting yield and the expected dividend growth, and works out how long it would take to earn one’s initial investment back in the form of dividend alone. In other words, if you buy a stock for $100, it estimates how long it will take to earn $100 worth of dividends. The way I do this for stocks that have a payout ratio less than 50% is that I average the dividend growth and earnings growth together in order to get a long-term dividend growth expectation (because dividend growth will be ultimately bound by earnings growth since dividends come out of earnings). Cisco’s earnings growth has been 3.64% and the dividend growth rate has been 9.75%, so that makes my long-term dividend growth rate estimate about 6.70%. The current dividend yield based on 2023’s expectations is 3.43%. So that 6.7% growth will be applied to that 3.43% base.

The way I like to think about this is if I bought Cisco stock for $100, it would pay me $3.43 the first year in dividends, and that amount would grow at 6.7% each year afterward. What I want to know is how long it would take to collect $100 via only the dividend. And what I get when I do the math is that it would take about 17 years. The threshold I use for this strategy that would get me to buy a stock based on the dividend and dividend growth is 10 years, so Cisco stock is nowhere close to being a “Buy” based on dividends and dividend growth. However, it’s worth noting that a 60/40 ETF, which is what I use as a relative benchmark for dividend growth stocks, would currently take about 20 years to earn one’s initial investment back via only the dividends. So, on a relative basis compared to a 60/40, Cisco is currently more attractive as an income investment.

The main point I want to make here, though, is that dividend growth cannot be viewed in isolation. Even a very high dividend growth stock can be a poor dividend investment if the base the growth is working from is too low, or if earnings growth isn’t also sufficiently high to support the dividend growth over the long term.

#11 Assuming Mean Reversion Instead Of Rerating

This is going to be a more nuanced critique and warning about assuming mean reversion will occur in the future. For the record, in the analysis I shared in my last Cisco article, a portion of the Cisco stock’s expected returns came from P/E mean reversion. I’ll share those numbers in the next section again. But what I want to share here are the dangers and limits of mean reversion assumptions.

The typical lifecycle of business’ earnings is that they start off unprofitable, but they grow revenues quickly. Then they become profitable and grow earnings quickly. Usually, fast-growing earnings correspond to a high P/E ratio, and if the earnings growth is fast enough and lasts long enough, then it might not be unreasonable to pay a 40, or 50, or even a higher P/E for a stock. But usually, the really fast earnings growth only lasts so long, and once it slows, the 50 P/E ratio falls down to the 20s or 30s. What is important in this instance is even if the company averaged a 50 P/E for many years, it is unwise for investors to assume the P/E will ever revert to the previous 50 mean ever again. And if an investor buys with that assumption of mean reversion, they will probably be very disappointed at the returns they get. Instead of mean reversion, what a stock does is “rerate”. That means the market now values the business at a much lower (or higher) P/E than it has in the past. This pattern of the rerating of fast-growth stocks is very common, and I call it a “multiple compression cycle” because the P/E multiple shrinks to a permanently lower level.

But fast growth stocks are not the only types of stocks that can rerate a lot. There are also stocks that go from growing earnings each year to shrinking earnings each year. They can rerate, too. But instead of rerating from, say, 50 to 25 P/E, they can rerate from 15 to 7.5 P/E, which is the same degree of error if you buy the stock at a 12 P/E, expecting it to rerate to a 15 P/E. So, we need to be careful.

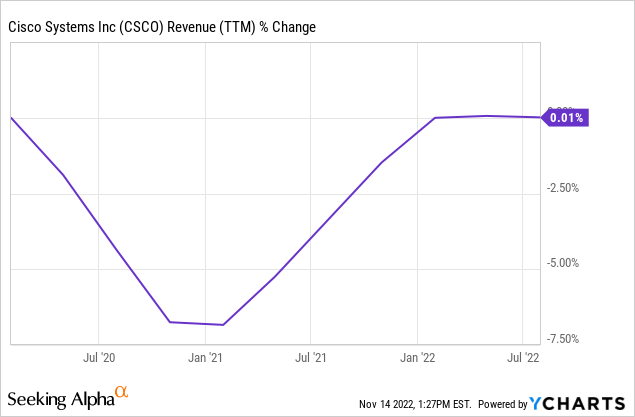

The main way I protect myself from making this second rerating mistake is to watch the 3-year revenue trend. Assuming we aren’t in a recession or something like that, if a steady-earning business like Cisco’s revenues this year are lower than they were 3 years ago, that is a leading indicator that this second type of rerating is likely. So, when I see this metric negative, I avoid the stock entirely (and I wrote about this in my last Cisco article).

Three months ago, this metric was negative. But it has improved so that it is essentially flat now. Additionally, it looks like it will probably turn a little more positive at the beginning of the year. So, while not good or impressive by any means, Cisco has improved since my last article.

In terms of mean reversion, I think as long as we avoid placing too much weight on any mean reversion assumptions we make, we should at least be okay using it for the time being.

A Return Expectation Update

Since Cisco now (barely) meets my revenue requirements, it’s okay to calculate what a reasonable buy price for the stock might be. I’m going to refer readers once again to my previous Cisco article if they are curious about my basic valuation process and just share the updated results in this article. I expect Cisco to earn $3.53 per share this year and for that to grow at 3.64%. That would produce a CAGR from the business over ten years of about +6.92% based solely on earnings and earnings growth. The average P/E ratio from 2015 to the present was 14.37, and the current P/E ratio is 12.86. If the P/E ratio reverts to the mean over the course of 10 years, it will produce a 1.12% CAGR. If we put the 1.12% and 6.92% CAGRs together, we get an expected 10-year CAGR of +8.04%.

My buy/sell/hold parameters for this strategy below a 4% CAGR is a “sell”, above a 12% CAGR is a “buy”, and in between 4% and 12% is a “hold”. Cisco stock is exactly in the middle of my hold range, so it is probably pretty close to fairly valued at today’s price. In order for the stock to cross the 12% CAGR threshold and become a “buy”, the price would need to fall to $35.32, and the rest of the earnings metrics would still need to be the same.

Conclusion

Hopefully, readers found this article thought-provoking and useful, even to stocks besides Cisco. Some of the reasoning I shared is part of my personal bias, the types of stocks I prefer to own, and my return expectations for the stocks I buy. But part of it also identifies what I believe are clear mistakes in reasoning.

When it comes to Cisco right now, in order for me to become a buyer, the stock price would have to come down and buybacks would need to shift to dividends so that I could get a 7% to 8% dividend yield. Those still aren’t my favorite types of stocks to buy, but at least there is the prospect of a decent return over the medium-term at that point, and also some margin of safety.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $30/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.