Summary:

- UnitedHealth Group Incorporated is falling as inflation-proof defensive stocks are selling off.

- UnitedHealth’s valuation has gotten ahead of its growth prospects.

- Although a top dividend growth stock, a deflationary environment and/or recession could dampen UnitedHealth’s appeal.

- Multiple contraction is a risk as competitors with similar growth and dividend prospects close their valuation gap with UnitedHealth.

Jezperklauzen/iStock via Getty Images

In late August, Bashar Issa’s Seeking Alpha article, “UnitedHealth: This Defensive Trade Has Been Exhausted,” laid out a compelling case for why UnitedHealth Group Incorporated (NYSE:UNH) was likely to face selling pressure going forward. UnitedHealth Group has been a stellar performer over the past year but indeed looks like it may have reached the end of its run for the time being. In this article, I’d like to take another look at UNH in light of recent events and its latest earnings report to see if the stock’s outlook has changed since then and what our investing approach should be.

Filter Out The Noise

Without a doubt, the market is at a crossroads this week and seems like it could break big in either direction. After a massive spike last week, the big question on everyone’s minds is whether October’s surprisingly steep overall CPI and Core CPI declines were a one-off surprise or whether they’ll be confirmed with subsequent readouts.

The nice thing about UNH is that it is an all-weather SWAN (sleep well at night) stock. It sports the most impressive dividend growth history among health insurance stocks with a whopping 10-year dividend CAGR of 23.5% and has averaged 10% annual revenue growth and 20% annual EPS growth over the past 5 years. There is no question about its financial quality and stability (its business practices are another matter), only about its risks, valuation, and execution going forward.

What Goes Up…Must Stagnate?

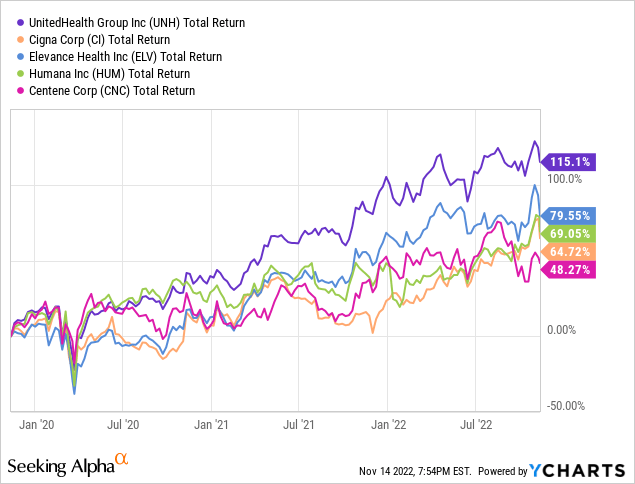

Looking at UNH’s price action, we can see that it has drastically outperformed its peers over the past 3 years:

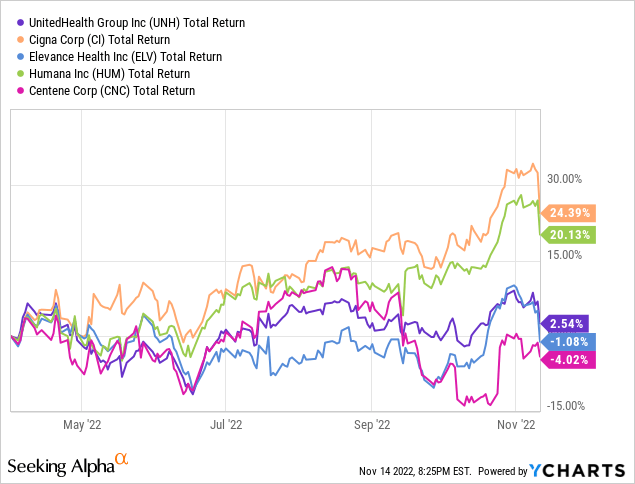

However, over the past year its performance has fallen to the middle of the pack, with Cigna (CI) and Humana (HUM) showing no signs of slowing down since their paths diverged from UNH in April:

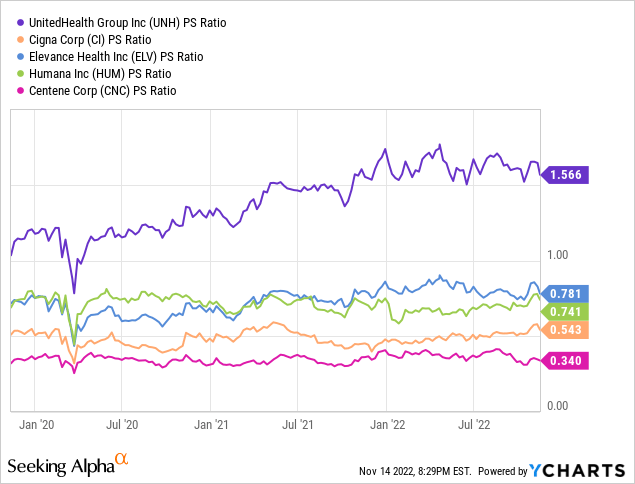

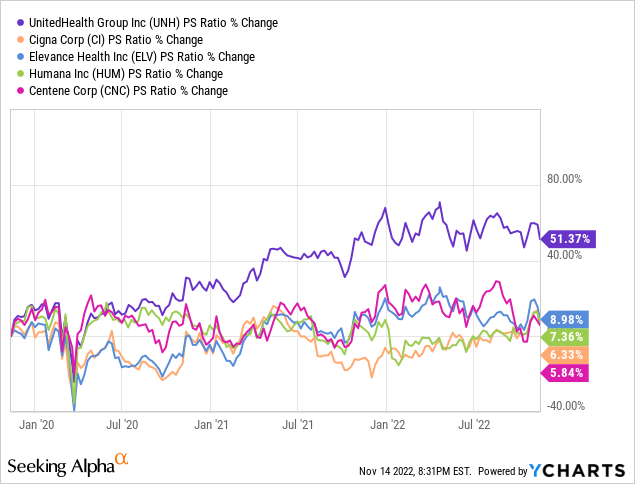

Focusing in on valuation, let’s look at how their P/S ratios changed over both of those time periods. While higher from the start, it becomes apparent that UNH’s valuation really starts to pull away, showing that it is being afforded a significant premium by the market.

In only 3 years, UNH’s P/S ratio has increased by 50% while its competitors’ have only risen between 5 to 9%:

Growth & Risk

Even with solid execution and consistent double-digit growth, we can see why UNH is starting to underperform some of its peers after a few years of outsized multiple expansion by looking at its competitors’ growth and dividend figures.

| Forward Metrics | UNH | CI | ELV | HUM | CNC |

| YoY Revenue Growth | 12.82% | 5.80% | 10.75% | 9.15% | 8.98% |

| EPS Growth | 13.91% | 10.56% | 13.29% | 14.33% | 8.27% |

| PS Ratio | 1.51 | 0.51 | 0.75 | 0.72 | 0.32 |

| PE Ratio | 24.8 | 15.2 | 19.2 | 22.9 | 24.9 |

| Dividend Yield | 1.26% | 1.47% | 1.04% | 0.60% | N/A |

| Past 3-year Dividend CAGR | 16.12% | 12.00%* | 16.42% | 12.52% | N/A |

*2021-2022 was CI’s first year of dividend growth

With insurers across the board performing so well this year and aggressively returning cash to shareholders – some primarily via buybacks like Humana, and some primarily via aggressive dividend hikes like Cigna – it seems hard to justify such a wide gulf in valuation. The top insurers all have great dividend metrics – ultra-low payout ratios, decent yields with the exception of HUM, high dividend growth, and long dividend histories with the exception of CI, which now seems determined to make up for it by supercharging their dividend growth.

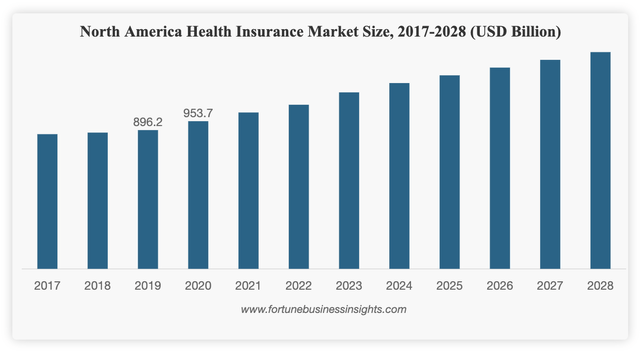

Health Insurance Market Growth Forecast (Fortune)

Another area for concern is long-term membership growth in Medicare Advantage and supplemental Medicare (Medigap) plans. So far, United has succeeded in management’s goal of 13% annual MA membership growth, but current forecasts from Fortune Business Insights predict just 5% annual growth in the overall health insurance market through 2028. This means that a lot of competing advertising dollars and insurance lobbying will go towards winning over retiring baby boomers in the next few years in order to hit the aggressive double-digit growth targets that insurers have set in place.

With high competition for new members in these profit-driving plans and increasing risks from politicians and providers pushing back on insurers’ claim denials and billing practices surrounding them, investors may finally be questioning whether or not UNH should be valued at literally twice as much as its nearest competitor going forward.

Conclusion

Business has been booming for health insurers this year, with no sign that inflation or recession risk has affected their earnings or revenue growth. However, wise investors know that when things can’t seem to get any better, it can also be the sign of a sector top and might be time to take some money off the table.

Time will tell, but I think it’s wise to be cautious with UnitedHealth at the moment given its comparatively extreme valuation difference with peers along with a macro environment that might put downward pressure on defensive inflation-hedging stocks like UNH in the coming months and years. UnitedHealth Group certainly deserves to trade at a premium based on its historical performance and dividend growth, but I don’t believe it deserves such a large one given how well its competitors are doing.

Looking at UNH’s long-term chart, it’s unlikely that the stock will see a major prolonged drawdown given its consistent double-digit earnings growth, low volatility, and economic resilience, especially now that odds for a soft landing in the U.S. are increasing. Still, I’m recommending a hold rating for UNH here until its valuation is more in line with its 5-year average.

A 15-20% drop from current prices would accomplish that and make it a strong buy for me. However, since UNH isn’t prone to large corrections, I think long-term investors could find enough margin of safety to add to their UnitedHealth Group positions at 10% below current prices, or around the $460/share mark. For those looking at immediate buys in the space, I recommend checking out my recent article on Humana, and I also think Cigna is trading at a compelling valuation and yield.

Disclosure: I/we have a beneficial long position in the shares of UNH, CI, HUM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.