Summary:

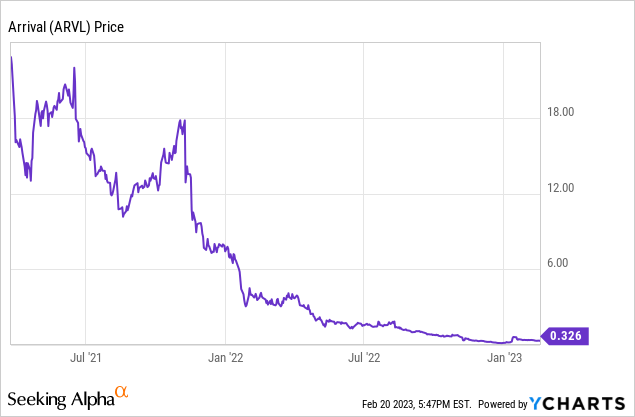

- Arrival went public through SPAC at the height of two manias – SPAC and EV.

- The timing couldn’t have been more right for investors looking to cash out.

- Two years later, I am hard-pressed to find a single promise that can be fulfilled by the company.

praetorianphoto/E+ via Getty Images

2020 and 2021 were a godsend depending on which group you belonged to. For SPAC promoters, it was the right time to sell their questionable mergers to prospective investors. If this SPAC merger was with an EV company, then it’s a double delight! One example is Arrival (NASDAQ:ARVL), an EV startup with no product to market and merged with CIIG Merger Corp. for a market valuation of $5.4B in 2021.

At the time when the merger was announced in 2020, the company’s promises included everything from promised revenues in 2021 to multiple vehicles in production in 2022, expectations to be cash positive in 2023, and $14.1B in revenue in 2024! In my review, I could not find a single promise that was fulfilled by the company. So let us pick some statements from their merger disclosures and see what can be learned from them.

“Those who cannot remember the past are condemned to repeat it.”

– George Santayana.

Disclosure #1

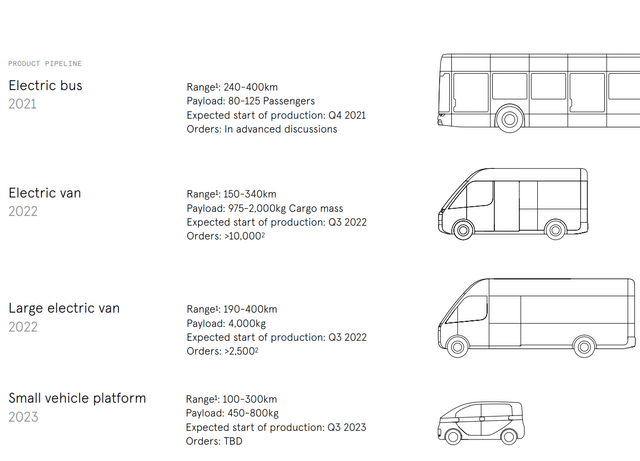

Four vehicle designs expected in market by 2023, with start of production for the first vehicle planned for Q4 2021

Product Pipeline (Arrival Investor Presentation for SPAC merger)

The company had plans for a bus, van, large van, and a small vehicle platform by 2023 but as of the latest news they have cut down their plans from four vehicles to having just one vehicle (van) in the market by 2023, and little plans past that. In Q2 2022, their initial target of 400 vans was cut down to just 20. By Q3, even this plan was completely scrapped.

For seasoned investors, a lot of this was to be expected. Auto manufacturing is a notoriously difficult business with a lot of moving parts. Getting a single vehicle to production is hard enough but the company promised new vehicle types in back-to-back years. But there was no room for skepticism during the EV hype of 2020.

Disclosure #2

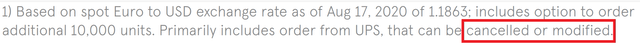

$1.2 Billion in orders

When there is any number with a “B” it is bound to get investors excited. But it is always good to see footnotes when numbers like this are thrown around. From their presentation, it mentions that these orders are non-binding. So none of the revenues are guaranteed. Also, orders don’t mean they can be fulfilled either. But it’s so easy to miss this when the environment is fully hyped around you.

Footnotes (Arrival Investor Presentation)

Disclosure #3

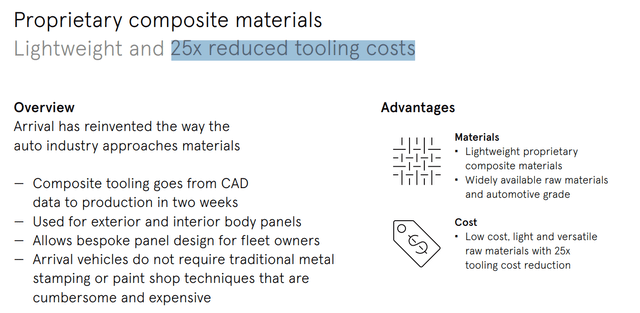

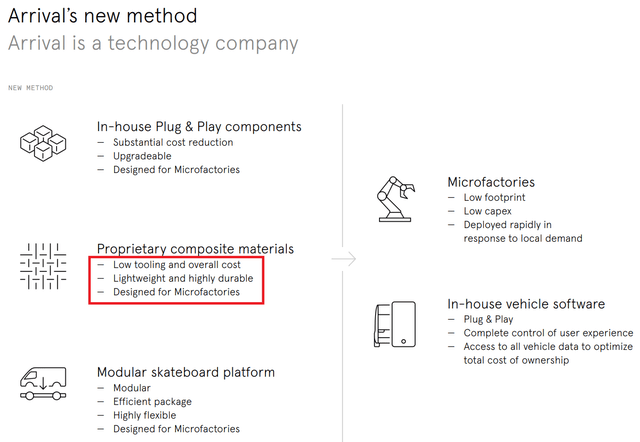

Low-cost model — Early projected profitability even at low volumes

At the time, company was touting its new approach to manufacturing and assembly as revolutionary and would significantly bring down costs to build factories. Its approach was cell-based micro-factories where the process uses ‘technology cells’ with vehicles moved between cells by autonomous mobile robots (There was a high reliance on robots to get cars out the door)

For some reason, lessons on excessive reliance on automation for cars are lost on auto manufacturers. In 2018, Tesla learned this the hard way after established auto manufacturers had learned this much earlier. Now I am not saying that technology doesn’t solve problems and new technology should be abhorred. Its approach to building cars through micro factories might be novel and revolutionary. But the high optimism and investors’ eagerness to hand cash, hand over fist needs a little skepticism.

Fast forward to now, there is already evidence of cost overruns and the company’s lack of funds threatens its survivability. Their approach to tooling needs a complete rework as their previous approach relied on soft tooling. Given the high cost of soft-tooled parts, they cannot meet their margin on soft tooling anymore. Precisely, tooling was one of the areas where the company boasted of increased cost savings.

Investor Presentation Arrival Investor Presentation

Is the latest development a canary in the coal mine for their micro-factory approach? Hard to say. But if it is, then it threatens their whole “novel” approach to building vehicles.

Disclosure #4

Transaction implies a fully diluted pro forma enterprise value of $5.39 billion, representing 0.4x based on 2024E revenue of $14.1 billion

It was quite unbelievable even back then that investors were willing to go on board for a valuation projected at 3 years into the future!

From the Q3 news I see now, it expects no revenue until 2024 (and I have a solid reason to believe it would not be $14.1B). There have also been multiple news from the company since its Q3 announcement. The CEO has stepped down and they have cut their global headcount by half. They have refocused their efforts on the U.S. which they believe to be a better target market. They are expected to end 2022 with $160 – $200M cash on hand and this to last into Q3 of 2023.

Currently, ARVL stock is trading at a market cap of $200M roughly at the amount of cash it has. This is a full indication of the current market that has arrived at reality; That there may be no pot of gold that was promised in 2020.

Why is it important to review all of this now? As we started the new year there is increasing evidence of a new hype in play. Everything AI. It only remains to be seen if investors have learned their lessons or rushing from one hype to the next. Evidence points to a bad picture.

Reassessing my rating

There are some catalysts that would make me consider reassessing my rating. Arrival is in possession of intellectual property that could be attractive to other companies. For established car companies it would take very little capital to get invested in the company. If their novel approach to manufacturing works it could present them with an asymmetric upside (Hyundai and Kia are already investors in the company and it remains to be seen if they will up their investment). In a best-case scenario, there could be an offer to outright acquire the company.

Upcoming earnings

From their last call, they refocused their strategy toward the U.S. as they saw a supply-demand imbalance for electric last-mile delivery vans that they could take advantage of. From their Q3 call –

At the same time, the introduction of the Inflation Reduction Act tax credits ranging from $7,500 up to $40,000 for commercial electric vehicles, the large market size, plus the anticipated higher margins for commercial vehicles, made the US our most attractive market

So one of the things I will be looking for in the upcoming earnings is the progress on their refocused efforts. If they have taken significant strides towards production it could be a big factor that can propel the business. They are scheduled to announce earnings on March 9. As of now, the bar is set quite low and subsequently, it could act as a crucial catalyst for them.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.