Art Of Merger Arbitrage: Activision-Microsoft Deal

Summary:

- Merger arbitrage investing can be highly lucrative in a volatile environment.

- The Activision-Microsoft deal is more likely to go through than not.

- Risk-reward points to a buy.

Rich Polk

Whenever the markets have been volatile, and investors are looking for safety in trades, arbitrage is a classic strategy that investors may use to shore up their portfolio. Arbitrage is a well-known strategy among institutional investors many of whom see it as a way of safety. Arbitrage usually involves taking up leverage, with a probabilistic bet that a takeover or a merger will go through. Collectively known as risk-arbitrage, a successful bet can be very lucrative for a portfolio, with a limited downside if options are used correctly.

Activision Blizzards shareholders overwhelmingly voted for the takeover of the company, at $95 a share. Since then the deal has largely been approved, only for the FTC to come in the middle with a complaint against Activision Blizzard, that the deal has implications that deal could eventually fall through.

Beyond the FTC complaint, there are currently implications for regulators in the EU and in the UK, as well.

The current complaint revolves around antitrust issues surrounding Call of Duty, and whether or not Microsoft will have a dominant position in the video games market if the deal goes through. Call of Duty remains one of the, if not the foremost games. The antitrust regulators have increasingly cited that the company may exploit its ownership of an ‘independent’ game design studio in order to capitalize and further strengthen its own position within the gaming industry, presumably through X-Box.

Antitrust definition according to the FTC:

Market Power

Courts do not require a literal monopoly before applying rules for single firm conduct; that term is used as shorthand for a firm with significant and durable market power — that is, the long-term ability to raise prices or exclude competitors. That is how that term is used here: a “monopolist” is a firm with significant and durable market power. Courts look at the firm’s market share but typically do not find monopoly power if the firm (or a group of firms acting in concert) has less than 50 percent of the sales of a particular product or service within a certain geographic area. Some courts have required much higher percentages. In addition, that leading position must be sustainable over time: if competitive forces or the entry of new firms could discipline the conduct of the leading firm, courts are unlikely to find that the firm has lasting market power.

Exclusionary Conduct

Judging the conduct of an alleged monopolist requires an in-depth analysis of the market and the means used to achieve or maintain the monopoly. Obtaining a monopoly by superior products, innovation, or business acumen is legal; however, the same result achieved by exclusionary or predatory acts may raise antitrust concerns.

Exclusionary or predatory acts may include such things as exclusive supply or purchase agreements; tying; predatory pricing; or refusal to deal. These topics are discussed in separate Fact Sheets for Single Firm Conduct.

Furthermore, the FTC believes:

“With control over Activision’s blockbuster franchises, Microsoft would have both the means and motive to harm competition by manipulating Activision’s pricing, degrading Activision’s game quality or player experience on rival consoles and gaming services, changing the terms and timing of access to Activision’s content, or withholding content from competitors entirely, resulting in harm to consumers,” – FTC Commission

The European Commission has stated similarly

“may significantly reduce competition on the markets for the distribution of console and PC video games, including multi-game subscription services and/or cloud game streaming services, and for PC operating systems.” (Source)

Therefore, the case comes down to whether there is enough of a belief that Microsoft can gain significant market power, and exclusionary privilege from the Call of Duty franchise, and whether Microsoft will be able to use its platforms to significantly exclude competitors.

Both these claims are not likely to hold up in court, and the probability of the deal going through is certainly on the side of ATVI and Microsoft than not. Currently, the market share of Call of Duty within the gaming market, while high, does not justify economic claims that have monopolistic factors. Activision’s total revenue in 2022 was $2.7 billion and the total size of the gaming market expected to around $384 billion in 2023, therefore, exclusionary conduct, if it limits the Call of Duty franchise is unlikely. Furthermore, 60% of the gaming market is now on mobile, making it harder for Microsoft to try and stifle availability of the franchise

Therefore, the argument is likely to come down Microsoft’s ability to limit CoD and achieve pricing power. Neither of these things are likely. CoD is highly reliant on the PC cloud, and the PlayStation. And that will remain the crux of the argument i.e., it makes no financial sense to limit CoD, and so neither the European/UK Courts nor the ones in the U.S. will probably take heed of regulators arguments, that such limitations will take place.

Furthermore, defining that Call of Duty has a 50% market share would be very hard, and highly unlikely meaning there is little belief that it has the market power for it to be called into question. This leaves the question whether the company’s ownership of both the X-Box and the CoD franchise provides enough of a case to meet these standards? In my opinion it is unlikely.

Basic probability and risk-reward

Merger arbitrage investing is an art, especially since it often involves taking up leverage and figuring out the probabilistic odds of whether or not something is likely. This means in Activision’s case, investors have to figure out whether the takeover will go through. Usually, in this case, historical cases attributed to antitrust cases, especially those involving both technology companies, and gaming companies would help in figuring out how strong of a case Microsoft has. In turn that allows for figuring out the probability and thereby allows one to figure out the upside-downside case.

Since the current stock trades at around $75, the maximum total upside currently is $95, which means that the total profitability if everything goes smoothly would be around 26-27% from these levels. This would then be combined with Bayesian probability to figure out the likelihood of whether or not there is enough of a probability of the takeover going through. The probability is similar to that of poker, in that for example if you have a 1/10 chance of winning, then on the other side you have a payout that is 9:1. The current payout therefore for Activision is 25%, or 1.25x investment needs at least an 85% chance or probability of going through for it to be considered a viable investment.

According to Mckinsey: “in any given year, about 10 percent of all large mergers and acquisitions are canceled—a significant number when you consider that about 450 such deals are announced each year.” Source

Furthermore, antitrust legislation usually remains a long shot, and with historical figures, and the current status of Call of Duty, it is likely that the current deal between Microsoft and Activision eventually goes through.

Safest way to bet on the deal? – Options

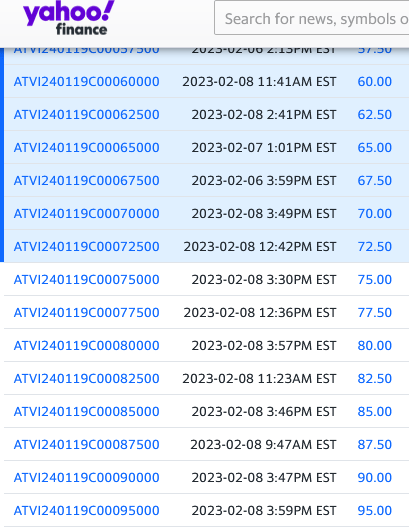

Currently buying long dates call options remain the best bet. The current options chain for ATVI as of 02/09/2023 is the following:

Options Chain (Yahoo Finance)

Therefore, looking at the options chain investors are probably the safest when buying in-the-money options, with limited downside at this point, with most risks already factored in, and limited losses due to options.

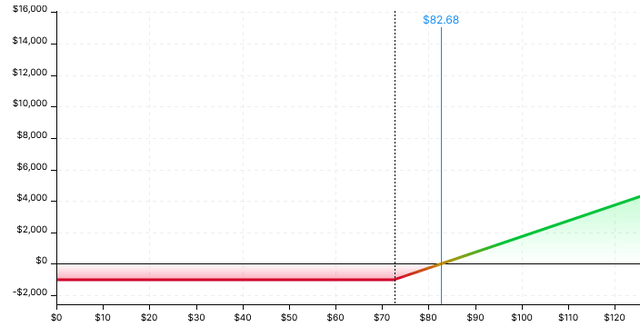

Options Calculator (Options Strat)

Current estimates put the upside, (should the deal go through at expiration) at around 30%, and that’s if the deal goes through.

Investors can consider investing in ATVI, with limited downside, and reasonable upside, using options. The current likelihood of the deal going through is relatively reasonable, and long-dated bets remain the best option.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.