Summary:

- Asana is no longer a growth stock, with minimal increase in guidance for the remainder of fiscal 2025.

- Asana’s stock valuation is at 4x forward sales, indicating compressed growth rates and unprofitability for another year.

- The bottom line is that Asana is a sell, as investors will have to wait at least two more years for profitability.

Talaj/iStock via Getty Images

Investment Thesis

Asana (NYSE:ASAN) was once a high-flying work management platform. But its latest results remind investors that this fallen angel is not a business that is about to regain its footing any time soon.

To complicate matters further, the business is not expected to reach breakeven profitability on its non-GAAP operating profits for yet another year.

All in all, the stock may look cheap at 4x forward sales, but I believe that investors will look back in time to $13 per share as a high point to aspire towards.

This stock is best avoided.

Rapid Recap

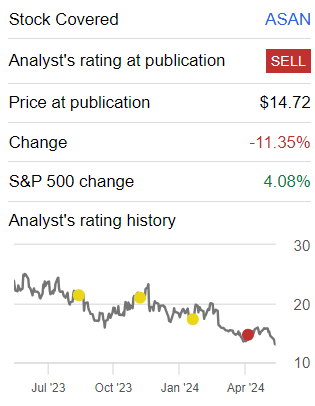

In my previous bearish analysis, titled Don’t Buy This Dip, I said,

[ASAN] today appears to be cheaply valued at 3x forward sales. In fact, paying less than $14 per share for Asana seems like such a bargain opportunity.

However, I argue that Asana is not a stock worth investing in. In fact, I declare that this stock is a sell, given that investors will have to hold on for at least a further two years before this business reaches breakeven on its profitability.

Author’s work on ASAN

At the time, it was a tough call to make, to downwards revise my rating of ASAN from a hold to a sell rating. But given this latest earnings report, I’m reassured that Asana’s stock is a sell. Here’s why.

Asana’s Near-Term Prospects

Asana is a work management platform that helps teams organize, track, and manage their tasks and projects more efficiently. Similar to Atlassian’s Trello (TEAM), Asana allows users to collaborate on tasks, set deadlines, and monitor progress in a centralized location, making it easier for teams to stay on top of their work and achieve their goals.

Next, we’ll discuss the bullish aspects, before turning our attention towards the bearish aspects facing the stock.

Asana’s near-term prospects appear fair, underpinned by its strategic focus on enterprise growth and AI integration. The company reported a 13% y/y revenue increase, with significant contributions from its largest customers, indicating continued trust from major enterprises.

Also, there was an improvement in non-GAAP operating margins by 5 percentage points y/y which further underscores Asana’s drive to reach profitability.

Another positive aspect is Asana’s enterprise go-to-market strategy to enhance sales productivity is yielding positive results, positioning the company for the potential for sustained growth.

That being said, Asana faces near-term challenges, particularly in fostering trust in AI within the enterprise environment and differentiating itself in a crowded market. As noted in the earnings call, a key concern highlighted by the Work Innovation Lab is that 53% of executives worry about the reliability of decisions made using generative AI, a sentiment fueled by experiences with inaccurate or distorting AI outputs.

Furthermore, Asana’s ability to highlight its unique value proposition and differentiate its work management solutions from Trello’s or Smartsheet (SMAR) is struggling to gain traction, a topic that we delve into more detail next.

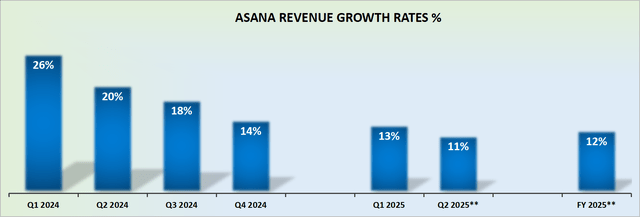

Asana is No Longer a Growth Stock

Another set of quarterly results and the facts are in. Asana is no longer a growth company. It may have a Founder with deep pockets capable of buying up a lot of stock in the company, but this doesn’t change the underlying reality, that Asana is no longer a growth stock.

To support this contention, consider that, as we look out towards the remainder of fiscal 2025, Asana has barely increased its guidance for the full fiscal year.

Therefore, to reiterate what I previously remarked about Asana, what you see here in terms of its growth rates, is all there is. Given this context, let’s now discuss its valuation.

ASAN Stock Valuation — 4x Forward Sales

In my previous analysis, I said,

When it comes to investing in high-growth stocks, investors demand high growth. Because if the growth rates are not satisfactory, the multiple that investors will be willing to pay for the stock will continue to compress with time, and no matter how cheap the stock gets, it will always seemingly get cheaper still.

Here’s the thing. Asana’s underlying profitability is still pointing towards another full fiscal year as an unprofitable company. Yes, the business will reach positive free cash flow this year, but that’s being driven by squeezes to its working capital, since even on a non-GAAP basis, Asana is guided to be unprofitable.

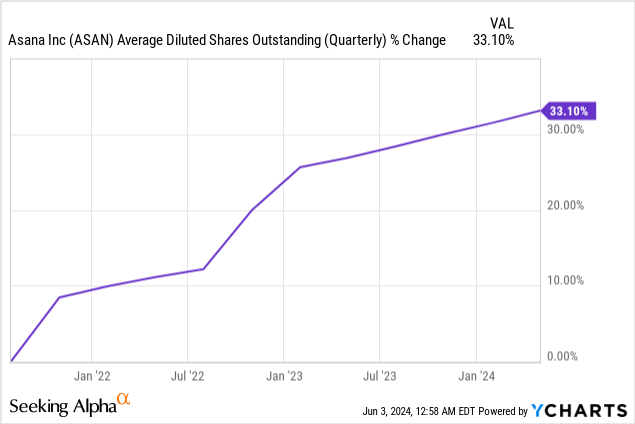

Meanwhile, consider the following chart.

Above, we see Asana’s total share count increasing with time. A good business is one that can keep its share count stable, while it increases its market share.

While a poor business is one that sees its growth rates fizzle out, while its share count continues to increase. Hence, I reiterate my sell rating on this stock.

The Bottom Line

Despite Asana’s strategic focus on enterprise growth and AI integration showing some promise with a 13% y/y revenue increase and improved non-GAAP operating margins, the company’s financial outlook remains challenging.

Asana is expected to remain unprofitable on a non-GAAP basis for at least another year, and its share count continues to increase, diluting shareholder value.

Although Asana’s current valuation at 4x forward sales might seem attractive, the company’s struggle to regain its growth momentum poses a problem. Therefore, the stock is best avoided.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.