Summary:

- Asana shot up more than 43% since reporting Q3 earnings and productivity wins with AI Studio. We think this name should be on investors’ radar for next year.

- AI Studio’s stickiness and ease of adoption will drive top line growth in FY26 and show up on management’s FY guide next quarter, in our opinion.

- We think the more favorable rate cut environment next year should also help Asana to capture a wider scale of mid-market customers alongside momentum with large customer adoption.

- Profitability remains a risk and, with the stock run-up, Asana will be under heavy investor scrutiny for any slip-ups. Management expects to see positive cash flow in Q4.

- We’re initiating Asana with a buy to add on a pullback in the near term as we think at current levels too many of the positives have been priced in.

JamesBrey/E+ via Getty Images

We’re initiating our coverage on Asana, Inc. (NYSE:ASAN) with a Buy after its recent 3QFY25 earnings triggered the stock to close 43% higher the day after, on Friday, with Wall Street taking notice of Asana’s new AI Studio and 89% gross profit margin. Asana, a cloud-based task management solution mainly for workplaces, has more than a couple of green shoots causing all this excitement. While we don’t think current entry points after the post-Q3 rally are attractive, we do think this is a name that will trade higher in FY26 and recommend investors put it on their radar to add on any pullback.

For starters, the company reported revenue of almost $184M, surpassing its guidance for $180M-$181M and Wall Street’s by $3.24M and non-GAAP EPS of -$0.02, beating estimates for -$0.08. For Q4, the company is guiding for a 10% jump in revenue to $187.5M-$188.5M and FY25 revenue of $723.0M-$724M, for 11% Y/Y growth, outpacing street estimates for $720.17M. Management noted their expectations for revenue to be generated by AI Studio, which brings us to the next green shoot: New AI Studio and productivity wins.

The company launched its AI Studio toward the end of October, and excitement is building up with what management called remarkable momentum within Top 100 customers. CEO Dustin Moskovitz, who is also an internet entrepreneur who co-founded Facebook back in the day with Mark Zuckerberg, describes AI Studio as an:

AI-powered workflow builder that empowers teams to design any workflow, embed AI agents without code and deploy these workflows where their teams are already working.

There are two selling points for AI Studio as far as we’re concerned. The first is that it’s not a chatbot-style kind of AI. In other words, you don’t speak to it. Instead, AI Studio is made up of “workflows with AI agents embedded within them that are automatically initiated in reaction to things people are doing, like filling out forms or changing task statuses.” We think this opens new AI use cases that don’t necessarily replicate ChatGPT and are also easily adaptable. Management noted on the call that:

It also doesn’t require the end user to adopt a new behavior with some new AI tool. The AI capabilities are automatically initiated based on the smart workflow that the program manager created.

The second selling point is the appeal to small IT teams and the significant new value AI Studio can generate independently on seat count. Moskovitz noted an example of the productivity wins on the call: “Customers are saving one hour of work for every $0.01 to $0.05 in cost, including our margin on top of the LLM cost.”

Now, adoption, stickiness, and competitive edge matter for shareholders when they can be monetized. Where price is concerned, Asana is doing a couple of things to boost top-line growth that, we think, will pay off, literally.

There’s a recurring platform fee, which can be scaled with more credit tranches, and then there’s the consumption-based model, where there’s massive revenue potential in a shift away from traditional seat-based licensing. The company is focusing on making AI Studio “an essential part of customers’ operations” and is already noticing many large customers enabling AI Studio and demand strength among mid-market customers. We think AI Studio’s unique stickiness, already showcasing productivity wins, could see even more adoption in a friendly interest rate environment, in which large or even mid-market customers could see less stringent budgets.

Also worth keeping in mind is that Asana management is essentially rebranding itself as a multi-product company, allowing it to expand its growth into multiple verticals using AI. This quarter, non-tech verticals were up 15% Y/Y, growing faster than overall growth and accounting for two-thirds of total business. Management mentioned on the Q2 earnings call that “diversification outside of tech is one of our main focus areas,” and they executed that this quarter. For the quarter, the core custom base grew 11%, and $100K and over customers grew 18%.

Will anything pull the rug?

We think this is Asana’s turnaround moment, and we agree with management that “AI Studio has the potential to eclipse… current revenue scale over time.” Having said that, we do believe a lot of the positives have been priced into the stock after the 40%-plus run on Friday and another 10% surge on Monday trading so far. This makes jumping in at current levels risky because high growth expectations deflate as quickly as they’re built up. All eyes will be on Asana to show better profitability, with the company reporting a negative free cash flow of $10M through 1Q-3QFY25, and analysts didn’t hesitate to poke around it in the Q&A section. Now, the company is guiding for positive free cash flow in Q4 under new CFO Sonalee Parekh, spearheading a cost rationalization plan. It will be an uphill battle, and the market is already pricing in its success. With all this in mind, we do think that management will execute well into FY26. We expect the stock will outperform in 1HFY25 but don’t see attractive entry points at current levels.

Valuation and Word on Wall Street

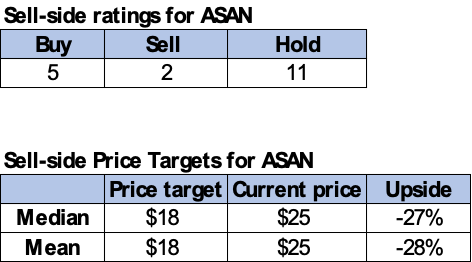

In our opinion, Asana is fairly valued. The stock trades at an EV/sales of 6.90x C2024, significantly lower than rivals monday.com Ltd. (MNDY) at 14.91x and Atlassian Corporation (TEAM), respectively. Wall Street turned more positive on the stock after the Q3 earnings call, but the outlook is pretty mixed. Of the 18 analysts covering the stock, five are buy-rated, 11 are hold-rated, and the remaining two are sell-rated. The sell-side price targets don’t tell us much either, with the post-earnings rally pushing the stock price way past the median and mean price targets of $18 per share by around 27% to 28%. Sell-side price targets, however, have been revised upwards since their Work Innovation Summit in New York in October. They just weren’t revised fast enough. The following chart outlines Asana’s sell-side ratings and price targets.

Techstockpros

What to do with the stock?

Our recommendation is to avoid giving in to FOMO (fear of missing out) and put this name on your watchlist to add to a pullback. If you own the stock, don’t add after so much of the positives have been priced in, and if you don’t own, then add it to your radar to add on a pullback or when Wall Street growth expectations get ahead of themselves. We think the combo of a consumption-based model and easy adoption makes a good setup for a higher-than-anticipated FY26 guide next quarter.

We think Asana will see top-line acceleration in FY26 based on the fact that it’s a software-as-a-service platform working in the team collaboration and work management market that has an easy-to-use AI tool that’s already showing productivity boosts. We think there’s more upside here but believe the stock price is too high at current levels and should deflate a bit intra-quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.