Summary:

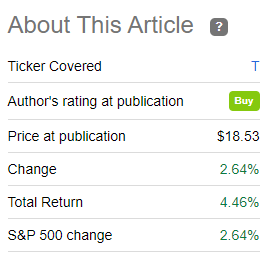

- We had previously assigned a fair value close to $22 for AT&T.

- AT&T delivered solid Q3-2022 results but kept free cash flow outlook static.

- We update our numbers and tell investors what they need to focus on for 2023.

ampueroleonardo

When we last covered AT&T Inc. (NYSE:T) we asked readers to curb their enthusiasm as the stock was unlikely to deliver big returns. We had just sold the November 2022 covered calls for $22 strikes and were happy to enjoy a 14.12% total annualized yield. Specifically we said,

That “enhanced” the yield and with the way things stand, we will capture the premium. With perfect hindsight, we should have gone a strike or two lower, but that will now be a consideration for the next set of calls. We remain bullish here for the intermediate term. Our last target on this was extremely conservative and we aimed for AT&T equity to be worth just 10X free cash flow. That 10X free cash flow now gets us to about $20/share.

Source: An Unusual Cut To Guidance

The stock has not fared poorly but the extra income from the covered calls was definitely helpful.

Seeking Alpha Returns Since Last Article

We examine the Q3-2022 and update our outlook.

Q3-2022

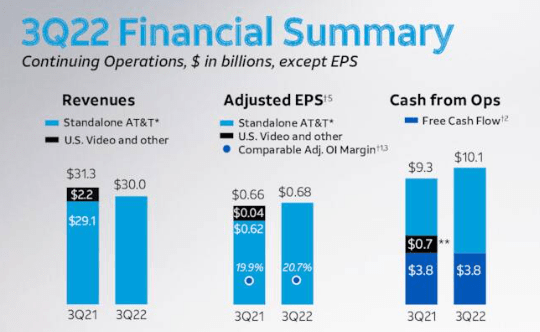

Q3-2022 was a strong quarter for AT&T. Revenue came about in line at $29.86 billion but the earnings per share of 68 cents shattered the ceiling vs estimates of 61 cents.

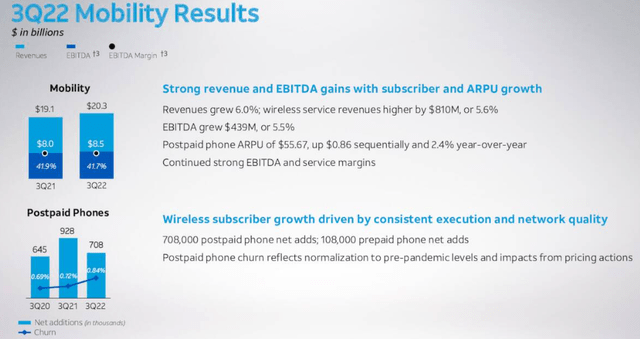

AT&T Q3-2022 Presentation

AT&T added 708,000 total postpaid phone subscribers during the period, bringing year to date numbers comfortably above 2.0 million. Wireless service revenue grew 5.6% over 2021 and this was one of the best gains we have seen in a long, long time.

While wireline revenues continued their steady descent (4.5% annual drop), the company made up for that on its fiber rollout, which had one of its best quarters. With the firm beat in place, annual EPS estimates were raised to about $2.50 per share but free cash flow guidance was kept at $14.0 billion.

Outlook

With about $14 billion in free cash flow, the stock is offering a solid 10% free cash flow yield. This is a better measurement of the stock’s potential versus earnings yield (13%). The annual dividend currently consumers close to $8 billion and there is substantial headroom on the dividend based on the more stringent measure of free cash flow. All eyes now turn to 2023 and AT&T has 3 issues to address.

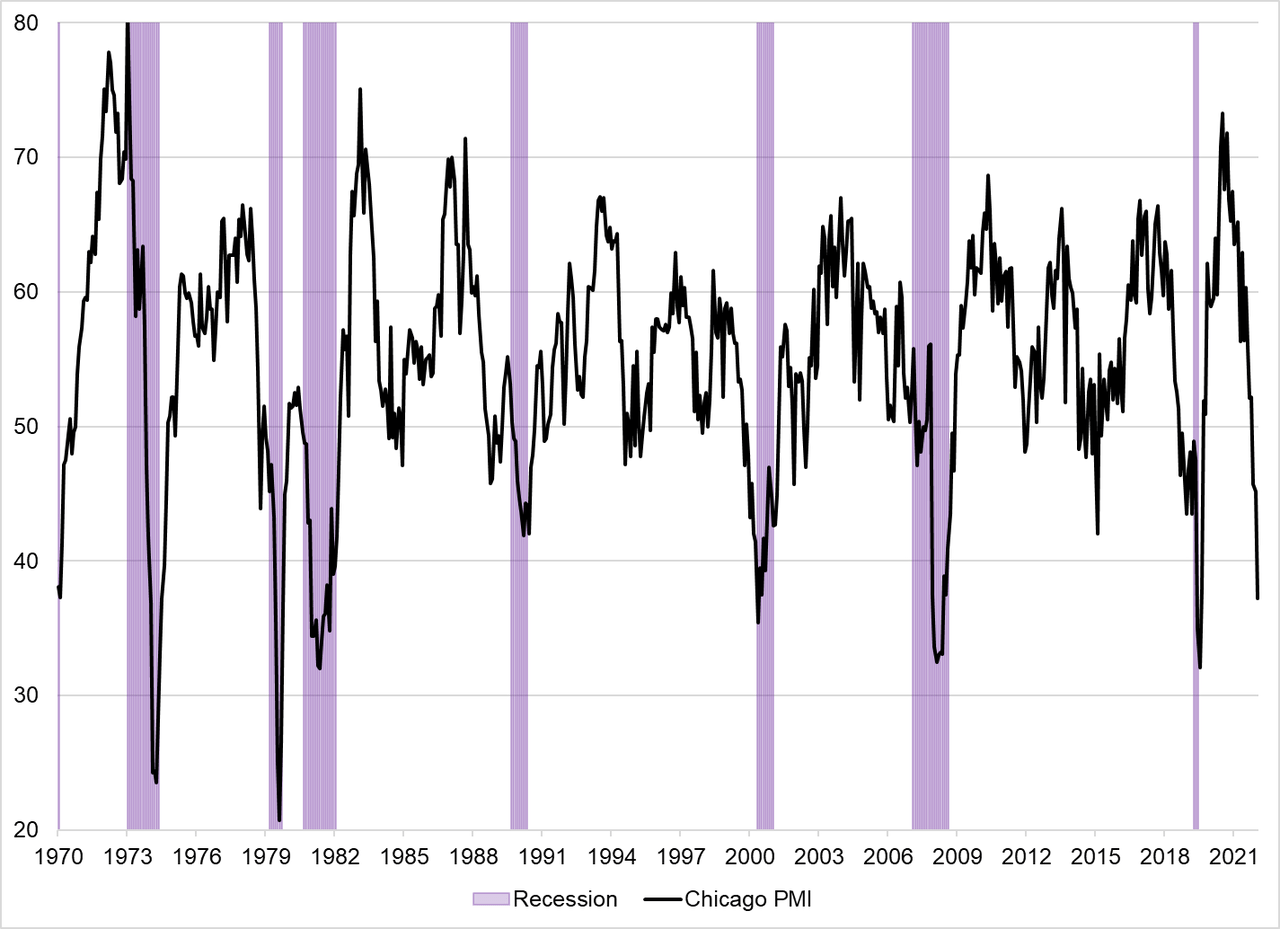

The first being whether they can weather a recession without losing too much ground. Stresses on margins will definitely show up, even for a company as recession resistant as AT&T. But if they can keep the damage to minimum, markets are likely to boost the multiple as we come out of it. Of course, a recession is not written in stone, but a lot of numbers suggest the very high likelihood of one. For example, Chicago PMI, which below 40, has called 8 out of the last 8 recessions is now at 38.

Twitter

So, we think we get one, although it remains to be seen whether the extremely strong labor market can be dented with even a recession.

The second thing that AT&T has to address is the free cash flow outlook in the face of what has been a scintillating run of inflation. Our thinking is that AT&T held the line on overall capex in 2022, but got less bang for its buck, thanks to inflation. That bill will come due in 2023 and if they can deliver in the $14 billion ballpark, we could see the stock move higher.

The final question comes on the dividend. The excess cash flow continues to move towards debt reduction for now and that is certainly the best use in a rapidly rising rate environment. But at some point, restoring a semblance of a divided growth story might be in the company’s best interest.

Verdict

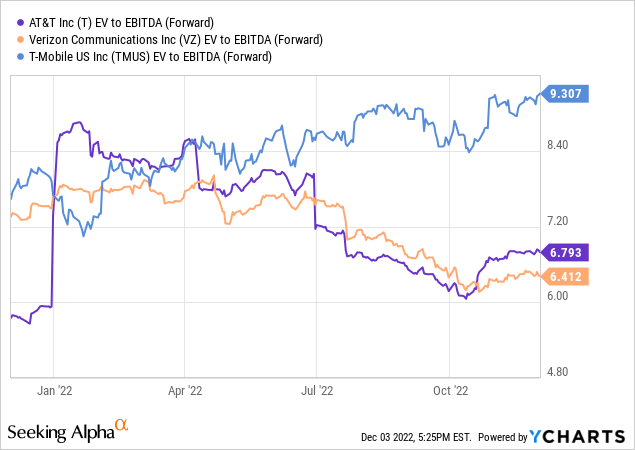

Our thinking is that AT&T will struggle to deliver on all three fronts, and we are most concerned about free cash flow outlook in 2023. Nonetheless the stock remains cheap, and it is trading at less than 7.0X on EV to EBITDA. Interestingly, Verizon Communications (VZ) trades even cheaper than AT&T today. This has been rare in the past.

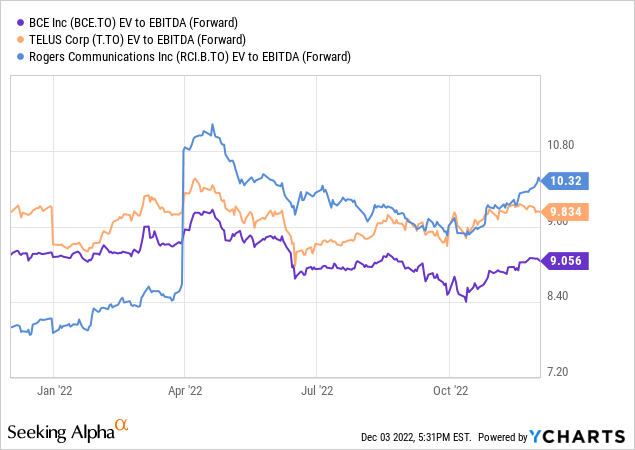

Looking further, the Canadian telecoms also trade quite expensive on a relative basis. We have highlighted just how silly the numbers looked for TELUS (TU) in our recent work. But BCE Inc. (BCE) and Rogers Communications Inc. (RCI) are also just as expensive.

Those are EV to EBITDA multiple differences and not P/E multiple differences. 3 multiples of EV to EBITDA is an enormous difference. So whatever issue AT&T has, it is hard to argue that the stock is not cheap at present. Whether that cheap state can be changed during 2023 is the question. We think it is unlikely to happen as the Q3-2022 results notwithstanding, execution has been mediocre. In order to maximize defensiveness, we sold the $20 strike calls for January 2024. We continue to rate the shares a “Buy” and think you can get modest upside alongside a big dividend.

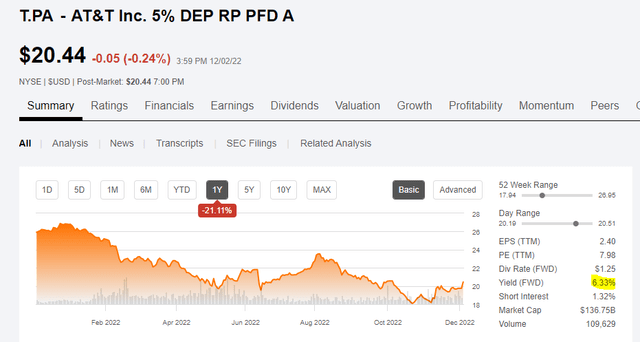

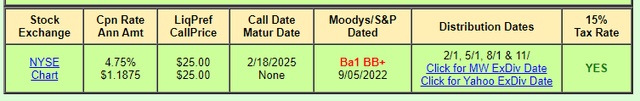

AT&T Inc. 4.7 DP SHS PFD C (NYSE:T.PC) & AT&T Inc. 5% DEP RP PFD A (NYSE:T.PA)

Both T.PC and T.PA are securities that risk-averse investors gravitate towards when they want the AT&T name, without the risks of common equity. At present both securities yield about 6.3%.

There is nothing wrong with that yield and certainly in a rate cutting cycle you could see some appreciation here too. But for their credit rating, we think the issues are a bit weak in the current market.

We think investors can do better if they want a safe bulletproof yield from preferred shares.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolio is designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.