AT&T: A Classic Value Stock, Not A Trap

Summary:

- AT&T is trading at an extremely low valuation (6.5x EPS, 14% FCF yield) despite being on track to meet 2023 guidance.

- AT&T is guiding toward hitting its 2.5x leverage target by first half of 2025. After that, I believe they will begin repurchasing shares.

- I believe the constant heavy Wireless CapEx cycles may be coming to an end, as 5G proves to be fast enough for mobile devices.

- 0I believe the risk of AT&T’s resuming value-destructive M&A is very low.

- I think AT&T is a strong buy at these levels, and finishes 2024 above $20.

Brandon Bell

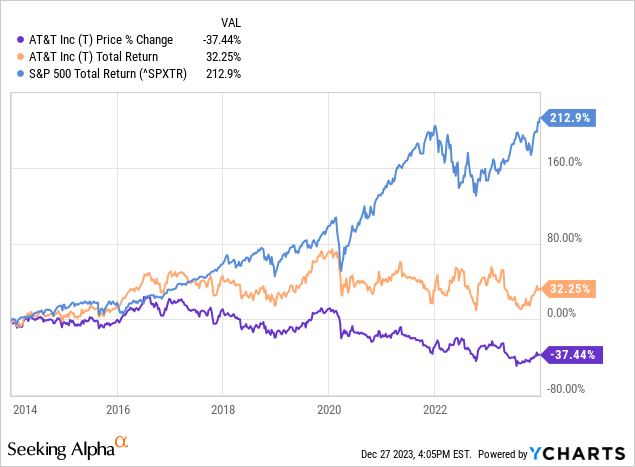

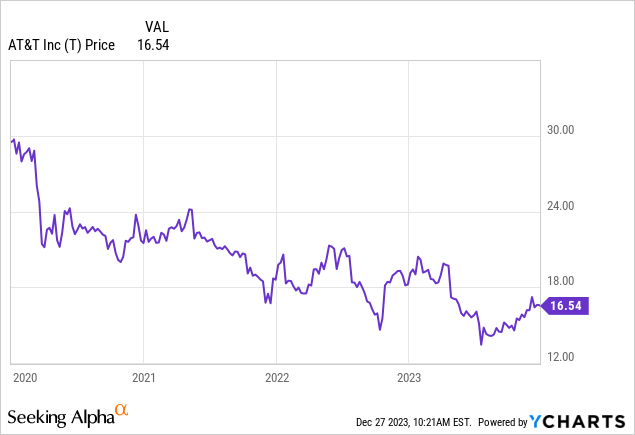

AT&T (NYSE:T) is a stock sworn off by many investors because of a decade long down trend. AT&T’s performance has been a disaster, especially compared to the S&P500.

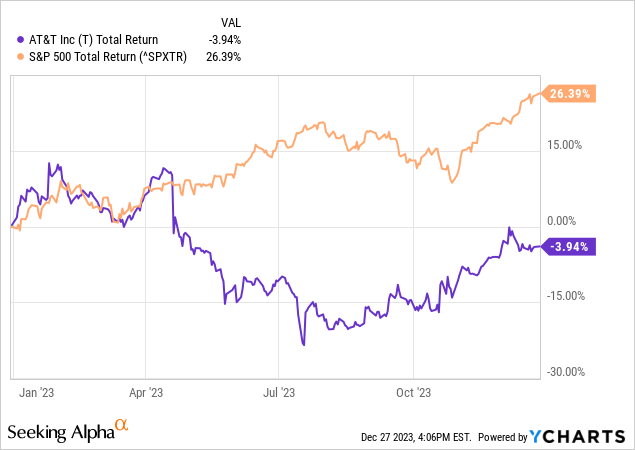

Despite being on track to hit their FY23 guidance, especially FCF, and further reducing debt, the stock has underperformed again this year by a massive amount.

I believe 2023 will mark the bottom for AT&T and that it is an exceptional buy here at $16.60. Free Cash Flow is about to inflect higher and I believe AT&T will double on a total return basis in the next 3 years.

A Value Trap? Or just a Great Value?

Recent critiques I’ve read of AT&T have centered around the following for why the stock is a poor investment:

- Poor revenue growth.

- Competition in the telecommunications industry, limiting pricing power.

- “Massive” debt load.

- High capital investment requirements.

- A history of value destructive M&A.

Except for the “Massive” debt load, which is really quite manageable and moderate at ~3x net debt to adjusted EBITDA, all of the above are certainly true.

They’ve also been true for most of the last decade when AT&T traded for double the P/E multiple it does today.

I’ll concede the low pricing power and slow revenue growth points to the bears; it’s absolutely true, especially as the business wireline segment will be a drag on revenue growth from Mobility and Fiber.

But I’m here to tell you it isn’t required to make AT&T a fantastic investment at these levels.

AT&T’s valuation has dropped so low that, absent any further ill-advised M&A, as long as the overall business remains stable or even erodes slowly (1-2%/year) shareholders should do well from these levels. See my work on H&R Block (HRB) for a great example of how well a stable, low growth business can do starting from a 6-7x P/E.

Business Performance

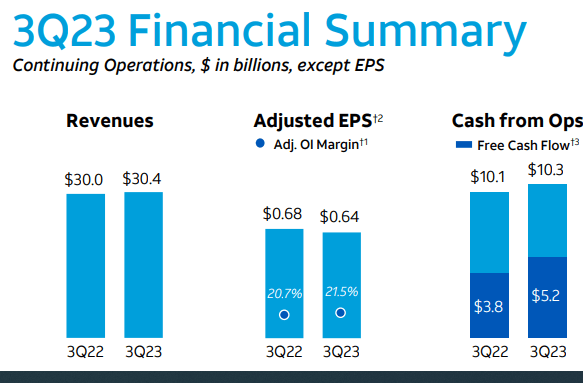

AT&T is down marginally over 2022 as strength in Mobility and Consumer Wireline was offset by declines in Business Wireline and higher costs from inflation as well as higher severance and restructuring charges. I expect EPS will start turning higher by mid-2024 on continued debt reduction and progress with AT&T’s plan to generate $2 billion+ of cost savings by 2026.

AT&T Q3 EPS and Revenue (AT&T Q3 Earnings Slides)

With a valuation this low, steady performance is all I’m looking for. Any EPS growth between now and mid-2025 is a bonus. After they hit their debt target in mid-2025, they will be able to drive EPS meaningfully higher with share repurchases.

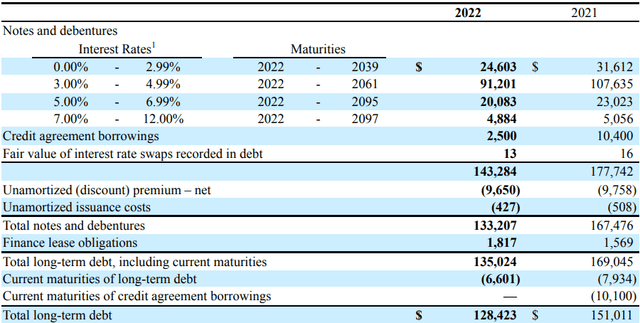

Debt Load

AT&T’s net debt load has decreased significantly from 2021 with the partial sale of DirecTV and the divestment of Warner. It has decreased another $2 billion in 2023 and should decrease further after Q4 (AT&T noted FCF would be backloaded in the 2nd half of 2023 based on CapEx timing.)

AT&T Debt (AT&T 2023 10-Q)

AT&T’s CFO recently reiterated the guidance on hitting this debt target by mid 2025, less than 18 months from now.

Pascal Desroches

We’re going to get to 2.5-time in the first half of 2025. Beyond that, I think what we do in terms of where we manage the company – a lot of it will depend upon what’s the interest rate environment. If interest rates are at current levels. I see – I’m pretty comfortable operating at this level of, at that leverage target.

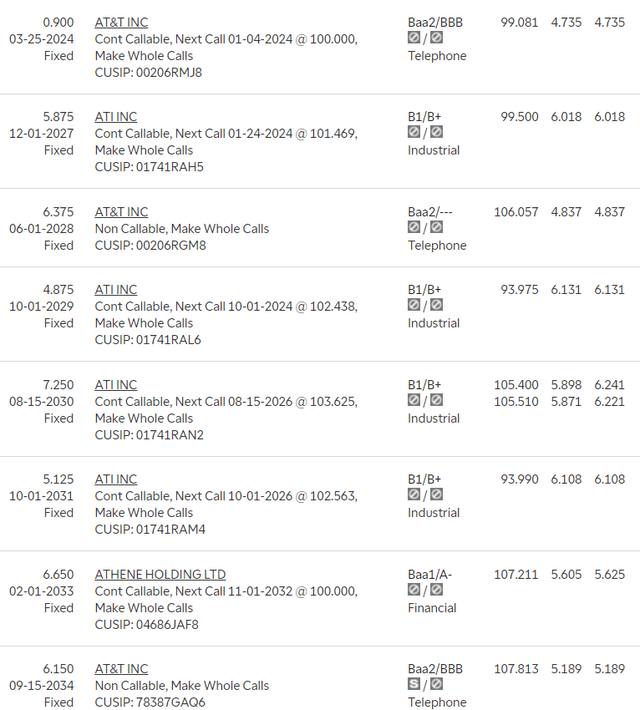

The 3.0x level is already reasonable low, debt maturities are well structured, and current quotes show almost no stress. There are even debt issues trading at premiums.

AT&T Debt (Ameritrade as of 12-26-23)

This business has leverage, but I believe it is at an appropriate level, and there are no major maturity walls to be concerned with.

Some investors get stuck on the high nominal debt number and miss that AT&T produced ~$38 billion in Operating Cash Flow in the past 12 months.

AT&T’s debt is not a big concern to me.

Heavy Wireless CapEx/Upgrade Cycles. What happens with 6G?

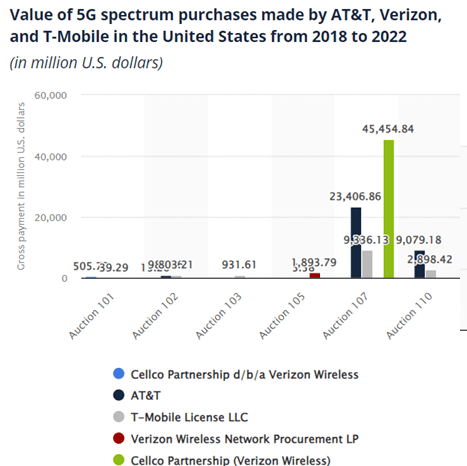

Another concern I often hear is the capital intensive nature of AT&T’s business. In particular, Wireless has been a never-ending upgrade cycle of spectrum purchases and equipment investment. In the past 5 years, both AT&T and Verizon (VZ) have spent a significant amount on 5G spectrum purchases and related hardware buildout.

5G Spectrum Purchases 2018-2022 (Statistica)

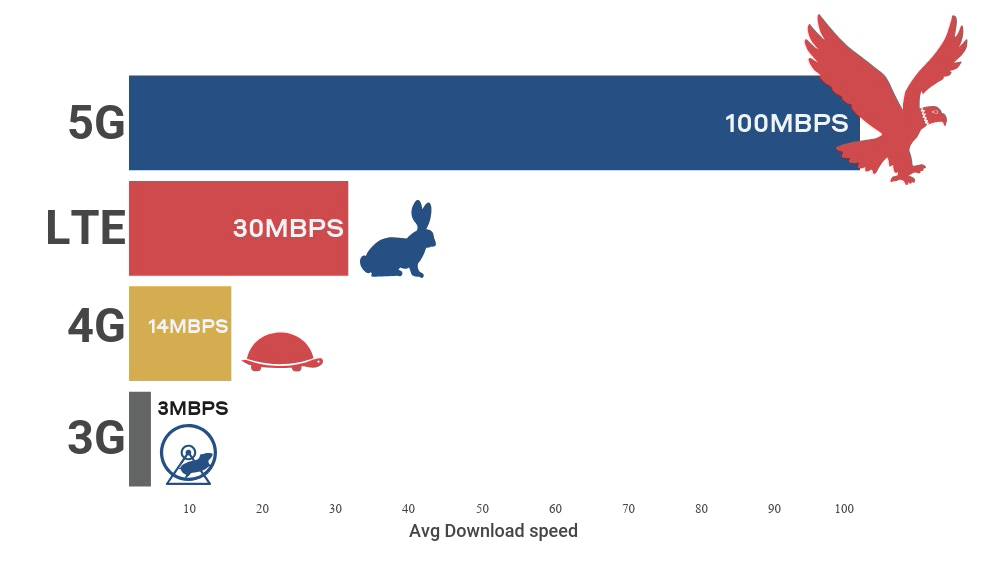

But I believe we are at an inflection point where the future looks better than the past, because I believe that 5G is good enough for nearly everything. As someone that has had cell phones for the past few decades, my experience has been that

2G to 3G was a huge deal. The original iPhone was only 2G and many consumers did not purchase it because of that. The 2G to 3G cycle drove many upgrades.

3G to 4G was also a big deal that drove upgrades. The bandwidth of 4G opened capabilities that worked poorly with 3G. With 3G, most users would switch to WiFi even if they had full signal strength on an unlimited plan just for performance.

Wireless Download Speeds (Bipartisan Policy Center report)

4G to 5G was, in my opinion, less of a big deal. There was a noticeable performance boost, but in my opinion it did not drive consumer interest and upgrades to the same degree as prior upgrade cycles.

Now we are at 5G and I think we’re done! I believe 5G is good enough for everything a mobile device needs. Video is seamless. Large files download very quickly. I don’t see any real capabilities that further increased bandwidth would provide.

I think 5G is the wireless equivalent to what Gigabit wired Ethernet is. For personal computers with wired Ethernet, there was a huge push to upgrade from 10Mbit to 100Mbit, and from 100Mbit to 1Gbit. Gigabit wired Ethernet because ubiquitous in the early 2000s, and then the upgrade cycles more or less stopped, because it was good enough and at those transfer speeds, generally something else in the computer or network became the bottleneck. 20 years since its introduction and most wired connections are still 1GB, and 10GB is primarily used for backend infrastructure connections.

I think we may see thing same that happened with wired Gigabit Ethernet happen with 5G. It’s fast enough and there’s little further consumer interest in higher bandwidth rates.

More Value Destructive M&A?

Besides the heavy CapEx cycles, the other fear of many investors is that AT&T will resume value destructive M&A when it has the opportunity to do so. I don’t believe this is the case, for 3 reasons

- The DirecTV and Warner failures were so large, and so public, I don’t think the AT&T executive management or BoD would even try it. I’m not sure CEO John Stankey or the BoD would keep their jobs if they tried.

- AT&T and many other companies sought acquisitions partially because the financing was so inexpensive. The debt markets are less forgiving today.

- With AT&T’s equity trading this low, I believe the opportunity cost in pursuing acquisitions over simply repurchasing shares is too high.

While the risk of this is never zero, I believe the odds of AT&T doing another large M&A deal in the near future is very low.

Valuation and My View of What Happens to AT&T Over the Next Few Years

It all starts with valuation. AT&T is trading like a business that’s a melting ice cube in deep distress. I see it as a company recovering from past mistakes.

AT&T Earnings Estimates as of 12-27-23 (SeekingAlpha)

AT&T currently trades at a 14% FCF yield (per their CFO) with plans to spend the next 18 months using excess FCF to pay debt down to their 2.5x leverage target. Longer term, they’ve guided to a mid-teens capital intensity which is significantly lower than current spend and implies that D&A will be higher than CapEx in the future, resulting in FCF that exceeds EPS.

Once AT&T hits it leverage target in mid-2025, I believe they will start share repurchases to go along with the fiber buildout.

Timothy Horan

Great point. Well, trading at a 14% free cash flow yield on your equity value, it would seem like the highest and best use would be to buy back stock, unless, of course, you can get 20% on the fiber builds, which you probably are. So, I know it’s a balancing act and – nice to do a little bit of everything?

Pascal Desroches

Indeed.

Another point to consider when thinking about AT&T’s CapEx spend. I believe the fiber buildout as true growth CapEx, whereas I believe the constant purchasing of spectrum and upgrading wireless capabilities is more maintenance CapEx. This could also help drive EPS in 2025 and beyond.

Conclusion

In a year or two, I think we’ll look about at buying AT&T at a 6.5x EPS multiple and 14% FCF yield as an absurd buying opportunity in the same way we look at buying Meta (META) under $100 was last year.

It’s incredible to me that even after the COVID drop, AT&T traded at $24 in April of 2020!

I think once the tax loss selling concludes, we’ll see AT&T back in the $18 range early in 2024, and closing the year above $20, with shares reclaiming mid $20’s in 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.