Summary:

- AT&T has been one of my favorite income stocks for decades.

- Nonetheless, over the past decade, T stock has been “dead money walking,” to say the least.

- What’s more, based on a looming recession and credit crunch, I do not see things changing for the better anytime soon.

- In the following piece, I give my thoughts on AT&T’s current prospects.

Brandon Bell

For those of you who have been following me for the past decade, you know I have been an AT&T (NYSE:T) bull for a vast majority of my time on Seeking Alpha. Even so, I have sold out at various points in time when the long-term growth story seemed threatened. I feel that way again at this time. On top of this, AT&T’s stock has been “Dead Money Walking” for the past decade, to say the least. Dead Money Walking is a play on the 1995 film titled “Dead Man Walking” starring Sean Penn. I highly recommend it.

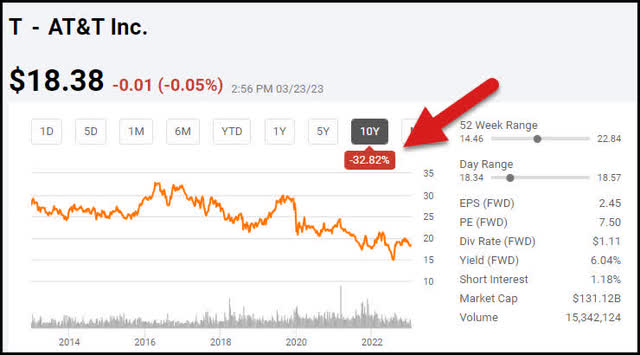

AT&T 10-Year Chart and Performance

AT&T’s stock is down approximately 33% over the past decade. Not exactly a great performance. It looks even worse when you consider the performance of the market as a whole during the same time frame.

SPY 10 Year performance

Seeking Alpha

While AT&T’s stock has fallen over 30%, the SPY (SPY) is up over 154% in the same timeframe. This is an extraordinary level of outperformance. The sad truth of it is, AT&T’s stock performance has begun to decelerate over the past few years at an alarming pace.

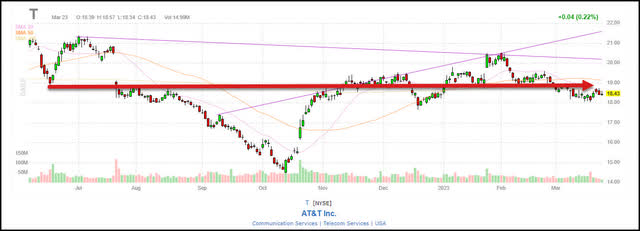

AT&T Long-term Chart

This has been primarily due to the AT&T/Time Warner merger debacle. AT&T had high hoped of leveraging their in-depth customer data to triple advertising revenues on Time Warner’s content. Sadly, this never came to fruition. With the suffocating debt load threatening to sink the entire ship, AT&T did the only thing they could. The company sold off the Time Warner assets and halved the dividend. This essentially saved the company from going bankrupt, yet wasn’t a magic bullet curing all the company’s woes. The stock has basically been dead money over the past year since the sale.

AT&T 1 Year Chart

As you can see by the chart, the stock has gone virtually nowhere over the past year. I bought into the stock when it hit the $15 level in October after the company reported free cash flow would take a $2 billion hit due to its client base being placed under stress. I sold out recently for an approximately 20% gain.

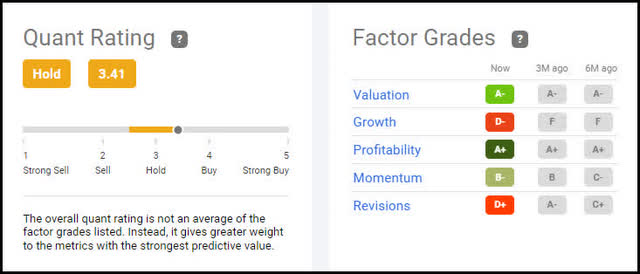

I see the same set up approaching with the economy more likely than not heading into a “hard landing” recession. The difference is, this time it won’t be inflation causing the issue, it will be a credit crunch and higher rates eating into AT&T customer’s disposable income. Nonetheless Wall Street analysts and Seeking Alpha authors still have a buy rating on the stock while the Seeking Alpha unbiased Quant rating stands at a hold.

Current Ratings Breakdown

Seeking Alpha

This happens more often than not actually. The reason for the disconnect is twofold. As far as the analysts go, they tend to always be late to the game. They usually don’t downgrade a company until after the fact. As far as Seeking Alpha authors go, most authors tend to focus on stocks they are bullish on and own rather than ones they don’t like. I can understand that. Now let’s dig a little deeper into why the SA Quant rating is currently a hold.

Seeking Alpha Quant Rating Overview

It’s kind of a mixed bag as far as the individual categories regarding the underlying quant metrics. Let’s look at the growth metric first since that’s the major point of the article.

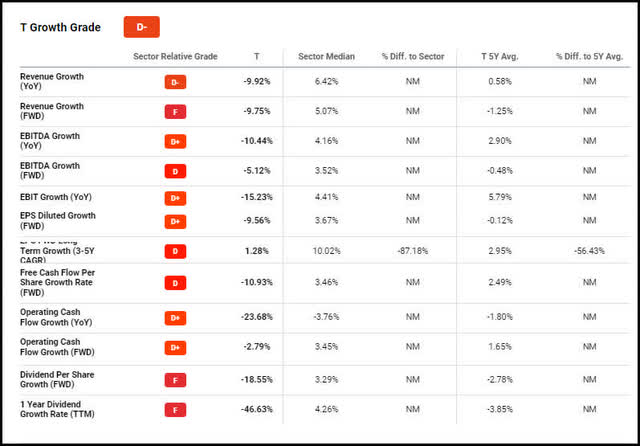

AT&T Quant Growth Grade D-

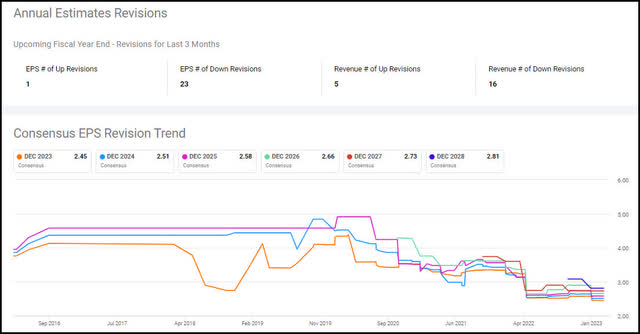

There are a multitude of negative growth attributes that justify a D- score. On nearly all growth sub categories AT&T is underperforming its peers and five-year averages. Keep in mind this is after they already took decisive action to correct the recent blunders of the past. Many believe things are not going to change for the company until current management is purged. I have argued against this in the past, yet the recent performance has me rethinking my position. The other area of weakness is the Consensus EPS and Revenue downward revisions.

AT&T Consensus EPS and Revenue Revisions

Over the past three months analyst have lowered their estimates drastically regarding AT&T’s prospective EPS and revenue growth. This is most likely due to the fact it’s becoming more and more apparent we are in for a recession of some magnitude. The Fed may have begun to lower inflation, yet it appears at the penance of the economy. Nonetheless, it’s not all bad. As many point out, AT&T is trading for a song presently, so to speak.

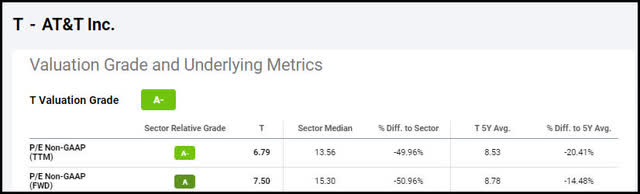

AT&T Quant Valuation Grade A-

Many point to AT&T’s low valuation as a reason to buy. The one point I’d like to make on this subject is the fact that sometimes stocks are cheap for a reason. I believe this is the case with AT&T presently. Management hasn’t worked their way into the market’s good graces just yet. They still have much to prove. Furthermore, with a recession looming, the company may be in for another rough stretch. Now let’s review the most important part of the equation, the dividend.

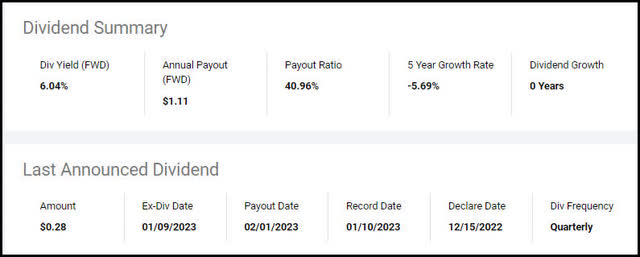

AT&T Dividend Review

After cutting the dividend in half when they sold off the Time Warner assets, the yield is currently 6%. Normally, I would be satisfied with a 6% yield. Nevertheless, with risk free money markets returning 5%, the risk/reward of a 6% yield in AT&T doesn’t really make sense at this point. I see 30% downside risk in the near term due to the impending recession. What’s more, the actual cash payout dividend ratio and the company’s total debt/equity statistics are suboptimal.

AT&T Dividend Safety Grade

I do not think AT&T will cut the dividend again. Although, no one ever knows. With the prospects of a substantial recession in the works, this set up doesn’t seem ideal. Now let’s wrap this piece up.

The Wrap Up

AT&T’s stock performance over the past 10 years definitely leaves something to be desired. When I began to pen this piece the title Sean Penn’s movie “Dead Man Walking” was the first thing that came to mind. With the overall market up 154% while AT&T’s stock was down 33%, I don’t think there’s any room for argument regarding this fact. Yet, when considering starting a new position, it’s more important to focus on about what lies ahead rather than what already happened. That’s why your car’s rear view mirror is much smaller than your windshield. Unfortunately, the future does not appear bright for AT&T presently. With a looming credit crunch and recession on the horizon, AT&T could get hit from both sides. Their cost of capital may increase substantially while simultaneously revenues may take a hit as a credit crunch and recession take hold. Let me finish by stating I’m not advising anyone to buy or sell AT&T. Everyone’s individual situation and suitability are different. I’m simply providing my latest thoughts on where I feel AT&T currently stands. Those are my thoughts on the matter. I look forward to reading yours. Do you think AT&T is a buy or sell presently?

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

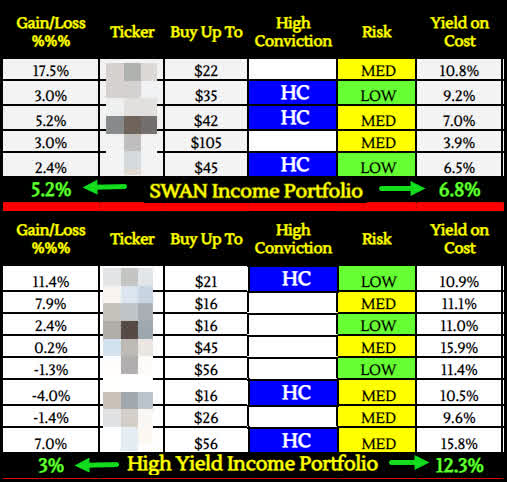

Join the #1 fastest growing new Income Investing Group! Our SWAN and High Yield Income Portfolios are substantially outperforming the market!

We have opened up an addition 50 Charter memberships at the legacy rate! Memberships are going fast with 30 new members already signed up! We have 17 FIVE STAR reviews in the first few months!

~ Quality High Yield Income – Current Yield – 12.3%

~ SWAN Quality Income – Current Yield – 6.8%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds is donated to the DAV (Disabled American Veterans).