AT&T: Dividend Cut Is Unlikely – This Is Why

Summary:

- T recently highlighted its position “among the best dividend-yielding stocks in the United States and in the Fortune 500.”

- Combined with its potential FY2023 FCF generation of $16B or more, it appears that the company may deliver on its existing commitments with no issues.

- Even so, investors need to closely monitor T’s forward execution and macro risks, due to the potential impact to its top and bottom lines.

- Particularly, its elevated long-term debts of $129.19B continue to weigh on its forward execution, attributed to the $6.1B of annual interest expenses.

takasuu

T’s Dividend Investment Strategy Still Looks Safe

After Intel (INTC) cut its dividends after 8 years of continuous growth, we think it is a good time for us to examine if AT&T’s (NYSE:T) dividend is safe, due to their similar situation of high capital expenditure and elevated debts.

As similarly discussed in our previous INTC article, we believe that, like INTC, it is unlikely that T will completely suspend its dividends moving forward, and we see the worst case scenario as a minimal cut. In this case, we are cautiously more optimistic due to the promising signs thus far.

The telecom company had more than enough cash flow to sustain its annual dividends of $8.05B, due to the robust cash from operations of $32.02B and Free Cash Flow [FCF] generation of $12.39B in FY2022. Particularly, the company also provided an optimistic FCF guidance of $16B or more (+29.1% YoY), suggesting its ability to “more than cover its existing commitments.”

T is reportedly looking to divest even more non-core assets as well, namely its cybersecurity unit previously valued at $600M, on top of those discussed in our previous article. It is apparent that the company seems determined in reducing its net debts to $100B by 2025. The number suggests an excellent moderation from its peak net debts of $161.74B in FQ4’18 and the $129.19B (-11.1% YoY) reported in FQ4’22.

The next important question is probably: will T increase its dividend payout by a large percentage in FQ1’23? We note the zero dividend growth since FQ2’22 levels of $0.2775 and pre-spin off levels of $0.52.

We reckon that it is unlikely, since the macroeconomic outlook remains uncertain, with the company’s guided capital expenditure remaining high at ~$24B (inline YoY) in FY2023. Due to the inherent importance of 5G and fiber investments to the core telecom business, we concur with the company’s sustained commitment indeed.

On one hand, most of T’s long-term debts of $129.19B are well staggered through 2097, with a reasonable weighted average interest rate of 4.1% as of December 2022. On the other hand, the company is also looking at $7.46B of debts maturing in 2023, with a total of $14.89B due within the next three years.

Therefore, we posit that investors might see a minimal $0.01 hike in FY2023 to annual dividends of $1.12, as it has historically done pre-pandemic. Even so, investors need to closely monitor T’s forward execution and macro risks, due to the potential impact to its top and bottom lines.

Particularly, INTC had no choice but to cut its dividends due to the drastic -20.2% YoY impact on the top line and -59.6% YoY on the bottom line in FY2022, largely from the ongoing PC demand destruction.

However, it appeared that the pessimism might have been priced in, with the INTC stock minimally declining by -4.8% in the days after the announcement of the steep -65.8% dividend cut on February 22, 2023.

We must also remind investors that one does not usually invest in T for high growth or high returns, due to its historical 5Y revenue CAGR of -8.3% and 5Y Total Price Returns of -30.9%. If investors were looking for high growth telecom stocks, they probably would have chosen T-Mobile (TMUS) instead, which notably does not pay a dividend.

If investors were looking for higher return trades which naturally came with higher risks, they would have turned to cyclical stocks, such as oil/ gas/ commodity/ shipping companies, which usually paid variable dividends. For example, Chevron (CVX) offered TTM dividends of $5.77/ yields of 3.55%, ZIM Integrated Shipping Services (ZIM) – TTM dividends of $27.55/ 125.31%, or Broadcom (AVGO) – TTM dividends of $16.9/ 2.93%.

This leads us to surmise that T may continue playing its role as a long-term hold dividend income stock, with the company highlighting its position “among the best dividend-yielding stocks in the United States and in the Fortune 500.”

Therefore, no matter how elevated its debt situation is, we reckon that T may continue delivering steady passive income to dividend seeking investors, significantly aided by the $6B in cost savings in 2023 and renewed focus on its core telecom business for the foreseeable future.

So, Are T Stock A Buy, Sell, or Hold?

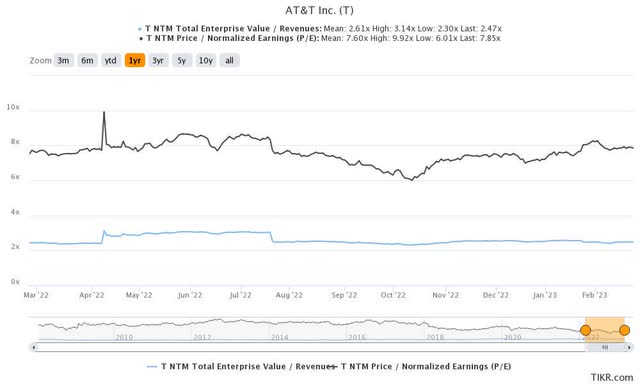

T 1Y EV/Revenue and P/E Valuations

T is currently trading at an EV/NTM Revenue of 2.47x and NTM P/E of 7.85x, higher than its 3Y pre-pandemic EV/Revenue mean of 2.24x though lower against its P/E mean of 10.76x. Otherwise, it is trading somewhat inline with its 1Y P/E mean of 7.60x.

Based on its projected FY2024 EPS of $2.51, we are looking at a moderate price target of $19.70, suggesting minimal upside potential from current levels.

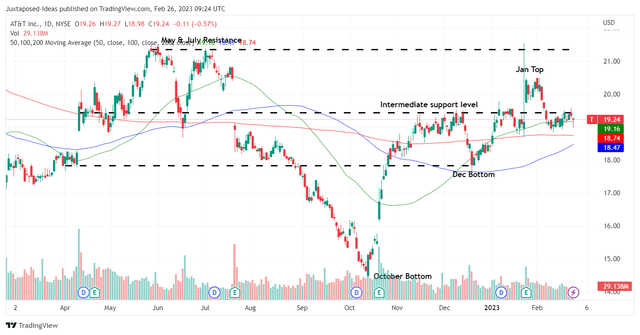

T 1Y Stock Price

This is unsurprising, due to the dramatic 33% recovery from the October bottom of $14.46 to $19.24 at the time of writing. Notably, we may see T trade sideways from here since the stock is near its intermediate support level.

Due to the potential underperformance, we prefer to rate T as a Hold here. Investors may be well advised to wait for another dip to the October bottom in the $15s or December bottom in the $17s before adding, for an improved margin of safety to our price target.

Those levels would also provide an improved forward dividend yield of 7.46% or 6.58%, against its 4Y average of 6.95% and sector median of 3.26%. Patience may be more prudent here, in our view.

Disclosure: I/we have a beneficial long position in the shares of TMUS, AVGO, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.