Summary:

- I love the classic comedy “Ghostbusters.’ The title of this article is a line from the movie.

- I have been one of the biggest AT&T Inc. bulls on Seeking Alpha and have written well over 100 articles on the name.

- Even so, contrary to popular belief, I have sold out at key inflection points in the past.

- For several reasons, I have recently liquidated my AT&T position once again. In the following piece, I explain why I sold out of AT&T.

Brandon Bell

Why I sold AT&T

For those of you who have been following me for years, you know I have been bullish on AT&T Inc. (NYSE:T) for a majority of the last decade. Despite what many in the comments section of my articles say, I have actually sold out at key points in time. For several reasons, I have decided to take profits on my AT&T position. In the following sections I lay them out. Let’s get started.

#1 Be fearful when other are greedy

I was born in Omaha, Nebraska, the home of the great Oracle of Omaha Warren Buffett. I can’t help being a huge Warren Buffett aficionado. Buffett’s most famous saying is, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

The interesting thing about this particular Buffett maxim is the fact that almost 100% of the time people only employ half of it in their investing methodology. I have read thousands of Seeking Alpha articles stating a stock is a “buy” due to the fact market participants have become unjustly fearful. Yet, I can’t think of one where the author says it is time to sell due to the fact investors have become too greedy.

Initial buy for Seeking Alpha Marketplace service

Seeking Alpha

Back in October, I wrote an article on AT&T. I felt the sentiment in the stock had become too bearish. the title was “AT&T Stock: Be Fearful When Others Are Fearful.” (A play on Buffett’s quote.) The bearish rhetoric had gotten so pronounced many were even predicting a dividend cut. This was just before AT&T was to report earnings. The stock is up 32.75% since that time. What’s more, with the tremendous amount of market participants piling in, the sentiment has turned from bearish to bullish very quickly. In short, investors have turned from fearful to greedy in just four-months’ time.

This is the primary reason why I have sold out. Buffett says to be fearful when others are greedy, not just greedy when others are fearful. I saw the opportunity to lock in a 20% gain in short order. This brings me to my second point. There is more than one way to create income from a stock portfolio. Let me explain.

Collecting dividends and taking profits can create income

Many consider dividends paid on stocks as the only way to create income. If this is all you count on, you are selling yourself short. here is a quote from one of the retirement investing greats Ken Fisher from his “Definitive Guide to Retirement Income” booklet. Fisher states:

“If your portfolio of $1,000,000 grew 10% last year, and you realized $100,000 in annual gains, this really isn’t any different than if your portfolio grew 5% last year and paid $50,000 in dividends. The total return (i.e., capital gains + dividends) is the same on a pre-tax basis; and, depending on your situation, selling a security and paying tax on the capital gains may be more tax-efficient than dividend income! Bottom line: When it comes to paying for your retirement, you should really only be concerned about the total return of your portfolio and after tax cash flow-not whether it comes from selling securities or collecting dividends.”

My father followed the same methodology and passed it along to me. He called it the “Diversified Cash Flow” method of retirement income investing. So when I saw the opportunity to lock in four years’ worth of income on AT&T in just four months, I had to pull the trigger.

Current AT&T Chart

The other factor in selling out at this point was that AT&T had reached my 12-month price target. When a stock rises this quickly over such a short amount of time, my decades of experience have taught me that there is little support underneath these gains. The odds of a significant pullback are high. Moreover, I have four years now to wait for a chance to buy back in at a lower price if I choose to. I actually used the funds to add an 11%-yielding stock to my High-Yield Quality Income portfolio. I essentially locked in a 20% gain and increased my dividend income payout by 100%. Not bad for a day’s work.

Now, moving on to my next reason for selling, I also own Verizon Communications Inc. (VZ) in my SWAN Income portfolio. I felt it was time to reduce my exposure to the Communications sector writ large. Here is why.

Communications sector competition intensifying

I have been a huge fan of AT&T and Verizon over the years. I consider their wireless businesses to be practically a utility at this point in time. I owned both in my SWAN Income Portfolio for my Seeking Alpha Marketplace Service SWAN Income Portfolio.

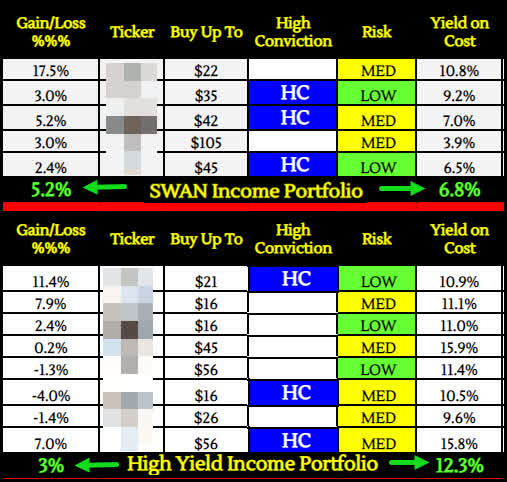

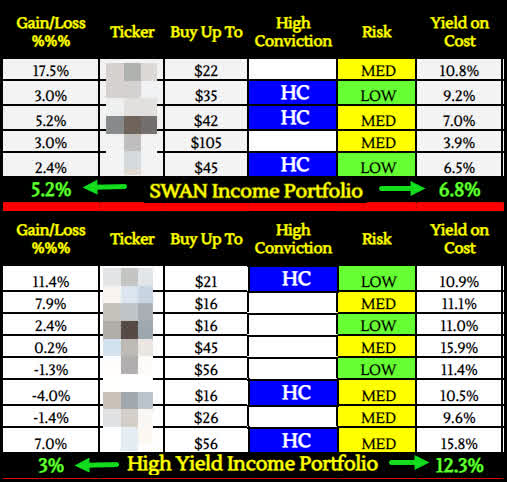

SWAN & Quality High-Yield Income Portfolios

WWI Core Portfolio

Nonetheless, some of the recent tailwinds driving AT&T’s stock higher are beginning to diminish. Over the past few quarters AT&T has been running specials and Verizon’s service was priced at a premium. Now, Verizon is running some substantial specials and outdoing AT&T. On top of this, a recent note out from MoffettNathanson titled “The Great Deceleration” states:

The Great Deceleration.” The firm sees a “growing mismatch” between industry growth rates and company expectations, not just for T-Mobile, but for all of the “Big Three” inclusive of Verizon (VZ) and AT&T (T) as well. Throughout 2022, as-reported growth was inflated by 3G network shutdowns as major 3G and legacy network decommissions “distorted industry metrics in every quarter of 2022,” but “subscriber growth IS slowing, and quite significantly so,” the firm contends. In 2023, the wireless market won’t have the network decommissioning tailwind while cable now capturing an even larger share of the net growth that’s left is “making matters worse,” the analyst tells investors. The firm has a Market Perform rating on Verizon and an Underperform on AT&T.”

The bottom line is the wireless pie is getting smaller and competition is heating up. What’s more, we could be heading into some semblance of a recession in the coming months as well. So I decided to take profits on my AT&T position. I had 44% exposure to the communications sector in my SWAN income portfolio and needed to reduce it. Now let’s wrap this piece up.

The Wrap-Up

AT&T Inc. remains one of my favorite companies. Yet, as an investor, you have to differentiate between the company and the stock. As far as AT&T stock goes, I believe it has run up too far too fast. The odds of a near-term pullback have increased. On top of this, Verizon offers a slightly better dividend yield at present as well. Verizon has a 6.46% yield versus AT&T’s at 5.77%.

As far as the company goes, I believe Verizon is now better positioned to capture new subscribers with the newly minted specials they are running. Moreover, with the cable companies entering the fray, the size of the wireless subscriber “pie” is shrinking, so to speak. I felt it was time to reduce my exposure to the sector.

The final nail in AT&T Inc.’s coffin for me was the fact I was able to lock in a substantial gain on the sale. Let me say this, everyone’s situation is different. I am not making a blanket sell call for everyone. I am simply explaining why I sold my AT&T Inc. shares so readers can draw any potential lessons learned. Those are my thoughts on the matter. I look forward to reading yours. Do you think AT&T is a buy or sell at present?

Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join the #1 fastest-growing new dividend income service! Our SWAN and High Yield Income Portfolios are substantially outperforming the market!

We have opened up an addition 50 Charter memberships at the legacy rate! Memberships are going fast with 30 new members already signed up! We have 10 FIVE STAR reviews in the first few months!

~ Quality High Yield Income – Current Yield – 12.3%

~ SWAN Quality Income – Current Yield – 6.8%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds is donated to the DAV (Disabled American Veterans).