Will Johnson & Johnson Remain A Top Dividend Aristocrat Stock Going Forward?

Summary:

- At the end of 2023, Johnson & Johnson will be spinning off its Consumer Health segment.

- Consumer Health has been the backbone of the company, but the Pharmaceutical and MedTech segments have provided the growth.

- Given the uncertainty surrounding the U.S. economy, healthcare is a defensive sector to invest.

skhoward/iStock Unreleased via Getty Images

Johnson and Johnson (NYSE:JNJ) has been in the news lately, largely for reasons they prefer not to have. For context, Johnson & Johnson has been served with thousands of potential lawsuits regarding talc issues within their once-popular Johnson’s Baby Powder. The lawsuits claimed that the powder had cause ovarian cancer, asbestos poisoning, and other illnesses for thousands of users.

In 2021, knowing about the growing number of litigation cases, JNJ created LTL Management, which was a separate subsidiary owned by Johnson & Johnson. This entity was created to house all the liabilities and settlement payments related to the lawsuits.

In October 2021, Johnson & Johnson announced that LTL Management had filed for Chapter 11 bankruptcy. The hope for JNJ was that all liabilities were captured under this entity. Fast forward to January 30th of this year and the U.S. Court of Appeals for the Third Circuit ruled that the company cannot use bankruptcy to shield itself from the talc lawsuits. LTL has since requested the Court of Appeals to reconsider its judgment.

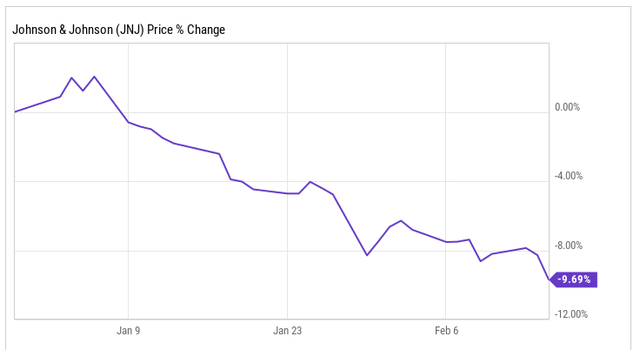

Shares fell over 3% on the original announcement on January 30th, as JNJ investors began to fret over the exposure the company has within these lawsuits.

On the year, shares of JNJ are down roughly 10%.

ycharts

With all that being said, Johnson & Johnson has long been a stalwart among dividend investors. In addition to its current legal issue, the company is also spinning off its consumer health segment at the end of the year, into a new separate company called Kenvue.

This is bound to bring a lot of change for Johnson & Johnson, as the consumer health segment has long been the backbone of the company. It is slow in terms of growth, but it is extremely consistent and reliable. The consumer health segment owns many well-known household brands, such as:

- Tylenol

- Motrin

- Zyrtec

- Listerine

- Aveeno

- Neutrogena

- Band-Aid.

The question that investors have most is whether or not Johnson and Johnson will be able to remain a consistent dividend payer moving forward.

A Consistent and Reliable Dividend

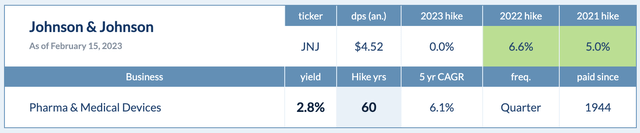

Johnson & Johnson is dividend royalty, having increased their dividend for 60 CONSECUTIVE year, making them not only a dividend aristocrat but a dividend king.

What is the difference between a Dividend Aristocrat and a Dividend King?

A Dividend Aristocrat is a stock within the S&P 500 (SP500) that has increased their dividend for 25+ CONSECUTIVE years. A Dividend King is any stock that has increased their dividend for 50+ consecutive years.

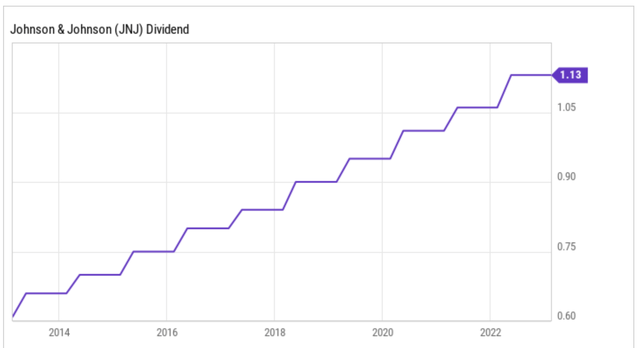

When you own shares of Johnson & Johnson, you currently earn $4.52 per share in dividends, which equates to a dividend yield of 2.8%. Looking at the chart below, you can see how consistently the quarterly dividend has grown over the past decade.

ycharts

Evaluating The Safety Of The Dividend

When evaluating the safety of a dividend, many investors refer to the payout ratio, which typically is referring the EPS payout ratio. JNJ’s EPS payout ratio is currently only 45%, which suggests the dividend is plenty safe and has room to continue growing.

However, I prefer to look further at the free cash flow (“FCD”) yield, as free cash flow is where the dividend is actually paid from. JNJ currently has a FCF payout ratio of 68%, which tells a drastically different story. Still, the dividend seems plenty safe, but if the lawsuit appeals do not go the way of JNJ, this could potentially put added pressure on the growing dividend.

Speaking of dividend growth, we have already seen that Johnson & Johnson has hiked the dividend for 60 consecutive years. Over the past five years, the company has an average dividend growth rate of 6.1%, a level they beat in 2022 when the dividend was hiked 6.6%. JNJ has paid a dividend every year since 1944.

Dividend Hike

What Happens To The Dividend After The Kenvue Spinoff?

As I mentioned earlier, JNJ will be spinning out its consumer health segment in Q4 2023. In terms of revenue, the consumer health segment generated $14.95 billion in sales, which accounted for 15.7% of the company’s total sales. This makes the consumer health segment actually the smallest of the three operating segments for the business.

Once the consumer health segment, Kenvue, spins off from Johnson & Johnson, the talc liabilities will remain, but the dividend does not look to be of concern at the moment. Kenvue plans to pay a quarterly dividend, but the amount is still undetermined.

The way I envision it playing out is very similar to how the AbbVie (ABBV) spinoff from Abbott Labs (ABT) took effect, meaning I expect the new JNJ to reignite its dividend growth. These two sectors grow at a much faster pace with strong margins, which should allow for more aggressive dividend hikes.

Valuation

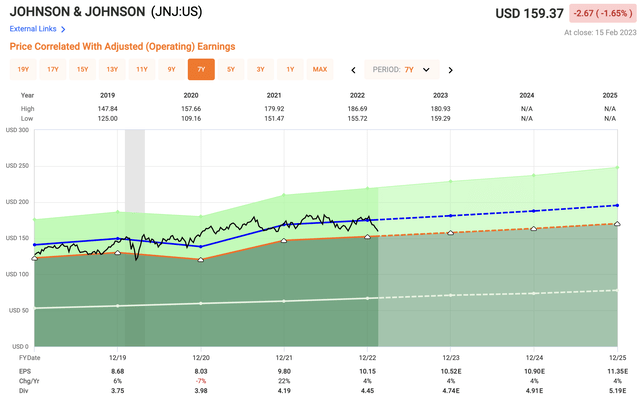

Given the pullback we have seen in shares of Johnson & Johnson, and given the uncertainty ahead for the U.S. economy, JNJ shares look rather appealing at current levels for a number of reasons.

First off, if the U.S. economy does fall into a recession, the healthcare sector tends to perform quite well and what better way to play healthcare than through JNJ, which has been steady sailing for decades.

Secondly, the company has maintained an average dividend yield of 2.6% over the past five years. For consistent dividend payers like JNJ, comparing the current yield to the five-year average can be a way of valuing a stock. As noted above, JNJ currently sports a dividend yield of 2.8%, which is on the higher side for them, indicating shares could be undervalued at current levels.

Next, analysts are looking for 2023 EPS of $10.52, suggest 4% growth from 2022. This would equate to a forward earnings multiple of 15.1x compared to their historical average of 17.2, again indicating shares of JNJ are undervalued.

Fast Graphs

Investor Takeaway

Johnson & Johnson is one of the great health care companies in the market today. The risks at the moment for the company lie with the company’s legal exposure to their talc lawsuits that the appeals court overturned. Another risk lies with the Kenvue spinoff at the end of the year and how successfully that goes.

However, Johnson & Johnson pays a consistent and growing dividend that seems well-covered at the moment in terms of safety. Johnson & Johnson’s free cash flow also indicates plenty of room for continued growth in the near future.

Disclosure: I/we have a beneficial long position in the shares of JNJ, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Historic Market Opportunity! Act Now!

The recent market crash has created exceptional opportunities. Many high-quality REITs are now offered at >10% sustainable dividend yields and have 100-200% upside potential in a recovery.

At High Yield Landlord, we are loading up on these discounted opportunities and share all our Top Ideas with our 1,500 members in real-time.

Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We have limited spots at a 20% discount. Get Started Today!