Summary:

- AT&T’s shares have been a disappointing investment, but recent upgrades and the company’s strong free cash flow suggest undervaluation.

- Investor sentiment and competition pose risks, but AT&T’s debt situation is improving and its core business is growing.

- AT&T’s debt load is manageable, and the company’s strong cash flow and solid 2023 fiscal year performance make it a bullish investment.

PM Images

AT&T (NYSE:T) is one of the most frustrating companies in which I have ever invested. While AT&T has climbed 32.76% since reaching its 52-week low of $13.43, it’s still down -12.08% over the past year. Despite the strong level of profitability, shares of AT&T have been a destroyer of shareholder capital, declining -20.26% over the past 5-years, and leaving investors down -26.90% over the past decade prior to accounting for dividends. There are many reasons why AT&T has been a lackluster investment, from failed acquisitions to being saddled with an enormous amount of debt. AT&T was just upgraded by JPMorgan Chase (JPM) to overweight as they increased their price target from $18 to $21. While AT&T can be looked at as dead money, I think more investment firms are going to realize that the debt situation isn’t as bad as it once seemed, their free cash flow (FCF) levels are strong, and the underlying business is growing. I still believe shares of AT&T are undervalued, and as painful as it is to see shares under $20, I think there is significant value to be unlocked, and investors can continue to get paid a 6.23% yield while AT&T’s transformation continues.

Seeking Alpha

Following up on my last article about AT&T

I remained bullish on AT&T despite shares falling below the $15 level. Despite how bearish the market got, I stuck with AT&T because I saw value in their shares. In my previous article (can be read here), I discussed Q3 earnings, and my thesis on why shares were undervalued. I am following up with an article to discuss their full-year earnings, and why I feel the market is incorrect in its current valuation on shares of AT&T. I still believe things will turn around, and shares of AT&T represent tremendous value for investors who have time on their side and can tune out the noise.

Seeking Alpha

Risks to my investment thesis on AT&T

No matter how bullish I am on AT&T or any other company, there are always risks to investing. Investor sentiment has been negative on AT&T, and due to other investment trends, the opportunity cost for not allocating capital toward big tech could prohibit investors from buying shares of AT&T under $20. Competition is also a real threat to AT&T, and while it is basically a triopoly in communications, we have no idea how Starlink from SpaceX will disrupt the communications sector in the future. Management from AT&T has promised to stay focused on the core business of communications, but there is always the risk of them stepping out of their comfort zone once again and trying to extend their reach into other areas. Past acquisitions have gone poorly for AT&T, and the market could perceive any questions outside of enhancing their communication product mix as negative. AT&T also has innovation risk as there aren’t adjacent verticals their business can expand into to create a growth cycle, and that’s not necessarily what investors are looking for. The largest risk in my opinion, is that AT&T won’t shed the negative stigma around its company and just be considered a boring telecommunication company rather than being looked at as the cash flow machine they are.

2023 has come to an end, and AT&T’s debt load isn’t the red flag it once was

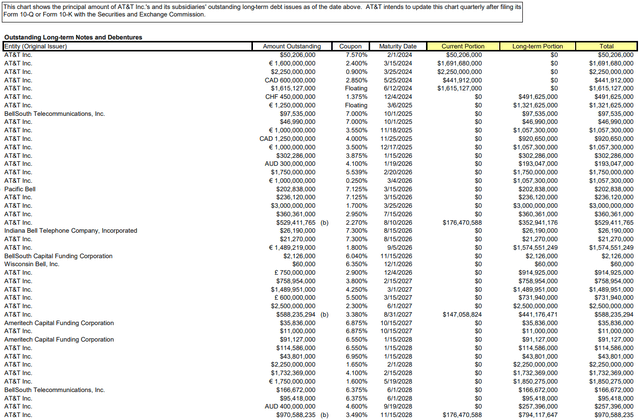

Debt doesn’t destroy companies; the inability to repay and service debt destroys companies. There is a misconception about debt that needs to be cleared up. There are 3 ways a company can fund its future growth. They can reinvest their profits, issue debt, or dilute shareholders by issuing more shares. AT&T is running a capital-intensive business, and they have needed to continuously tap the debt markets just like many other companies. The major difference is that AT&T has the ability to repay and service its debt obligations. Back in 2018, AT&T closed the year with $166.94 billion in long-term debt, and since then, AT&T has spun off WarnerMedia and reduced its long-term debt position by -23.41% (-$39.09 billion) to $127.85 billion. After the WarnerMedia transaction, AT&T finished 2022 with $132.92 billion in long-term debt, and paid down an additional $5.07 billion in 2023. I believe the debt position continues to be misunderstood, and I will explain why the bear thesis around debt is misleading.

AT&T

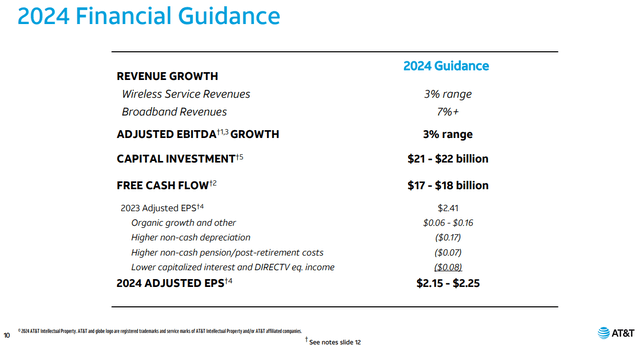

The current portion of AT&T’s debt which is due in 2024, is $7.04 billion. In 2025, there is $4.5 billion, and in 2026, there is $9.99 billion of long-term debt maturing. Many look at the total long-term debt of $127.85 billion and the upcoming maturities and regurgitate the bear case regarding debt. AT&T finished 2023 with $6.72 billion of cash on hand and produced $20.46 billion in FCF. In addition to the debt obligations, AT&T is paying a dividend of $1.11 per share, which is an annual obligation of $7.94 billion based on the 7.15 billion shares outstanding. AT&T is guiding for $17-$18 billion in FCF to be generated in 2024. If AT&T takes a logical approach to financial discipline, there is more than enough room to manage these obligations.

I will assume that AT&T generates $17 billion on an annual basis for its FCF over the next 3 years in this example to stick with the low end of its guidance. In 2024, AT&T has $7.04 billion in debt obligations maturing and another $7.94 billion in dividend payments to make. In total, their outgoing obligations are $14.98 billion between debt maturities and dividends. If AT&T generates $17 billion in FCF for the 2024 fiscal year, they will have $2.02 billion remaining in FCF after these obligations. In 2025, AT&T will have $4.5 billion in debt maturities and $7.94 billion in dividend payments to make, assuming that the dividend payment stays flat. If AT&T generates $17 billion in FCF, then they would produce an additional $4.56 billion of FCF, which is more than what is needed to retire the 2025 maturing debt and pay its dividends.

Going into 2026, AT&T would still have $6.72 billion of cash on hand and an additional of $6.59 billion in excess FCF remaining from 2024 and 2025. In 2026, there is $9.99 billion of debt maturing, which brings its total payments for dividends and maturing debt to $17.93 billion. If AT&T produced $17 billion in FCF, it would put them at a -930.52 million deficit in 2026 before factoring in their cash on hand and excess FCF. Hypothetically, if the retained FCF from 2024 and 2025 was stored as cash on the balance sheet, they would have $13.31 billion in cash on hand, and after paying the remaining -930.52 million, AT&T would go into 2027 with $12.38 billion in cash on hand having retired $21.54 billion in debt maturities from 2024-2025 and producing tens of billions in FCF. I still believe the bear case regarding debt is a nothing burger, and I think that after AT&T retires enough debt to get under $100 billion of debt obligations, its balance sheet will act as a catalyst as the optics should drastically change.

AT&T

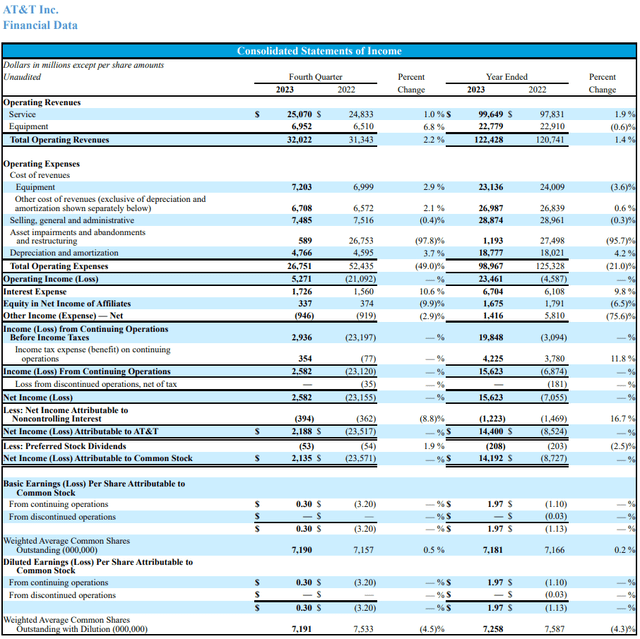

AT&T recorded a strong 2023 fiscal year and I am very bullish going forward

I want to own businesses that have strong cash flow and the ability to continue producing strong cash flow. AT&T reported a solid 2023, but their increased spending wasn’t received well initially as shares slid more than -4% on the news. On a YoY basis, AT&T increased its postpaid phone subscribers by 2 million and its fiber subscribers by 1.1 million in Q4 2023. Revenue from mobility increased by $600 million, while fiber revenue jumped $300 million. Overall, AT&T generated $32 billion in revenue, $11.4 million in cash from operations, and $6.4 billion in FCF during Q4 2023. This is not a company that has a problem producing billions in profitability.

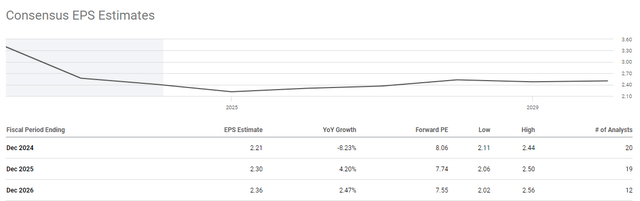

When I go through the income statement, I see a lot of reasons to be bullish over the next several years. I think investors may be looking at the lower 2024 EPS on a short-term basis rather than the bigger picture. In 2024, AT&T estimates that they will incur $0.24 of non-cash headwinds, including $0.17 higher depreciation and $0.07 in pension and postretirement benefit costs. Before getting to the bottom-line EPS numbers, AT&T had $6.7 billion in interest expenses in 2023. Over the next several years, the amount of interest that AT&T pays on their debt should decline due to the combination of eliminating maturing debt, and paying the non-cash impairments. AT&T is expecting to grow its mobility and fiber businesses in 2024 and benefit from roughly 3% in Adjusted EBITDA growth.

AT&T

Over the next 3 years, AT&T isn’t expected to have explosive growth in EPS, but EPS growth does return in 2025 and 2026. The consensus EPS estimates for 2024 come in at $2.21, making AT&T trade at 8.06 times 2024 earnings. AT&T is projected to generate $2.30 of earnings in 2025, which means AT&T is trading at 7.74 in 2025 earnings. At some point, how much you pay for a company’s earnings matters. Today, you are able to pay less than 10 times earnings for AT&T, and you are getting a 6% dividend in addition to its earnings power. AT&T trading at $25 or $30 per share may not happen for quite some time, but its entirely possible if management plays their cards right.

The recipe for success is financial discipline and return of capital to shareholders. As AT&T retires debt, their interest expenses will decline. As the Fed cuts rates, AT&T should be able to refinance some of its higher coupon debt at lower rates. The Fed expects rates to be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026. AT&T has billions in debt with coupons that exceed 6.5%. Eliminating and refinancing higher debt will allow additional earnings to flow to the bottom line. I am not concerned with dividend increases yet, as I would like to see a buyback program of at least $1-$2 billion per year authorized from their retained FCF. Over the next 5-years, AT&T could easily repurchase $5-$10 billion of its shares, which would decrease the float by 250 – 500 million shares and artificially boost the amount of EPS it produces. If AT&T does these things, there would be limited reasons for a bear case to exist, and while the company may not be as exciting as Nvidia (NVDA), the earnings power and valuation should be too much to ignore.

Seeking Alpha

Conclusion

I think the bear thesis for AT&T continues to come undone as the current debt levels are not a threat to AT&T’s solvency. AT&T has more than enough room in its FCF to repay its upcoming debt maturities rather than refinancing, and management has many levers it can pull. For my investment thesis to play out for AT&T, a combination of time and a hardline approach to financial discipline will need to occur. If AT&T can get out of their own way, retire the annual debt maturities, and buy back shares with a portion of the retained FCF, we could see shares trade between $25 – $30 in 2025 or 2026, maybe higher. AT&T is interesting from a value standpoint because you are paying less than 10 times earnings, debt can easily be repaid, and you are collecting a 6.23% dividend. AT&T has been a battleground, but I am sticking with them and believe that management will ultimately prove the bears wrong.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.