Summary:

- AT&T Inc. is expected to report Q4 earnings with a decline in EPS and minimal revenue growth.

- The company has a history of beating EPS estimates but mixed results with revenue.

- Key things to monitor include the company’s Free Cash Flow, debt levels, and updates on its lead cable situation.

jetcityimage

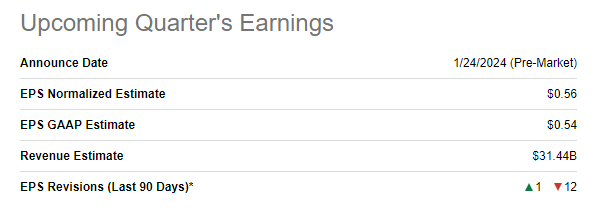

AT&T Inc. (NYSE:T) is expected to report its Q4 earnings pre-market on Wednesday, January 24th, 2024. Analysts expect the company to report 56 cents/share on the back of $31.44 billion revenue. Should AT&T meet these expectations, it’d represent a YoY EPS decline of 8.20% and a YoY revenue growth of about 0.3%. That doesn’t look good for longs right off the bat but AT&T’s earnings these days are all about one number as we will see below.

ATT Q4 Preview (Seeking Alpha)

My most recent coverage on AT&T was ahead of the company’s Q3 earnings report when I rated the stock a “Buy”. Since then, the stock has handily outperformed the market as it is up nearly 14% compared to the market’s near 10% return. Have things turned around for AT&T and its investors?

Let us now preview AT&T’s Q4 with an eye on recent EPS revision trend, the company’s recent earnings history, key items to track in Q4, valuation, and technical strengths as we head into the report.

Declining Expectations

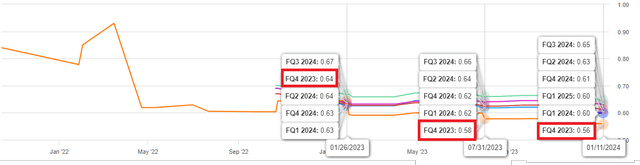

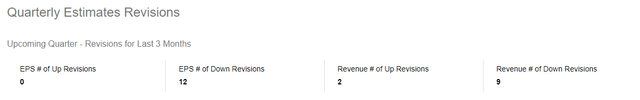

It is safe to say AT&T is going into earnings with muted expectations, to put it mildly, from the analyst community. 12/12 EPS revisions and 9/11 revenue revisions have been to the downside. I don’t recall any recent instance in which a big name I covered went into earnings with a clean slate, full of downward EPS revisions.

ATT Q4 Revisions Count (Seeking Alpha)

Overall, over the last year, FY 2023 Q4’s EPS expectation has trended down from 64 cents/share to 56 cents/share or about 12%. It may not be a bad thing for a company like AT&T with its doubters (most of them, rightly so) to head into the earnings report with lowered expectations.

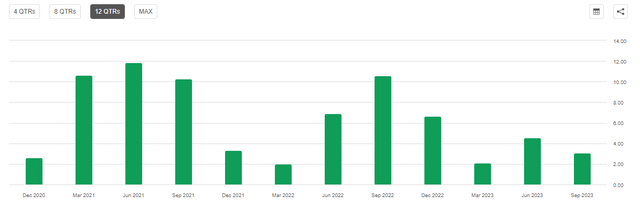

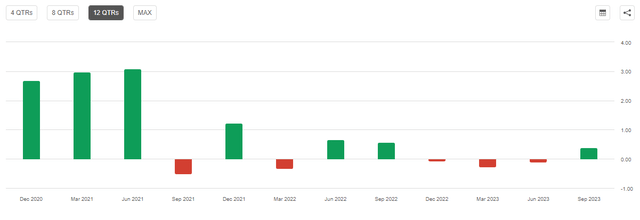

Beat or Miss? History Suggests EPS Beat

AT&T has beaten EPS estimates in the last 12 consecutive quarters with the beats ranging from 2% to 12%. The average beat in the last 3 December (Q4) quarters has been by 4.2%. Revenue has been more of a mixed bag with just 5 quarters beating out of the last 12. More worryingly, 3 out of the last 4 quarters have seen AT&T miss revenue estimates, although by small margins.

Despite that, I expect the new AT&T to have operated with its new-found discipline and beat EPS expectations. For the record, I am predicting an inline revenue.

ATT EPS Surprise (Seeking Alpha) ATT Revenue Surprise (Seeking Alpha)

Things To Monitor

- When reporting Q3 results, AT&T guided up its Free Cash Flow [FCF] estimate for FY 2023 to $16.5 billion. In the first three quarters of the year, AT&T totaled $10.2 billion in FCF and that means the company expects to record at least $6.3 billion in Q4 FCF, which would easily be the highest FCF since the Warner Bros. Discovery (WBD) spin-off in 2022. Should AT&T meet $16.5 billion in FCF for FY 2023, then its payout ratio based on FCF will be at an impressive 48%. I arrived at this based on the fact that the company has 7.15 billion shares outstanding and pays $1.11/share in annual dividend. That means AT&T needs just $7.93 billion in annual FCF to cover its dividend.

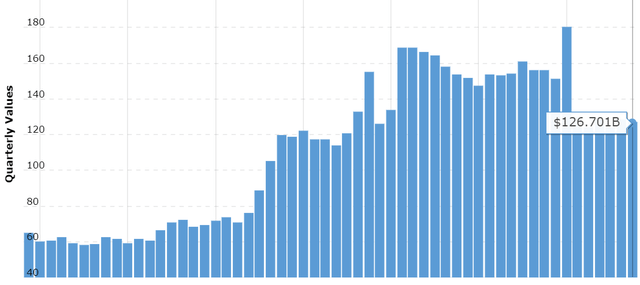

- AT&T’s Achilles heel (its own doing) has been its debt. I’ve written in past articles that $150 billion was the line in the sand for me, at which stage I’d seriously reconsider my investment with AT&T. However, to the company’s credit, AT&T’s long-term debt has now come down to about $127 billion. This is confirmed by Seeking Alpha’s data as well. I will be keeping an eye on the debt level and the interest expense, which has been trending up as a result of the high-interest rate environment, despite lower debt burden.

- The lead-cable situation seemed to have gone under the radar over the last couple of months. However, just as AT&T is about to release its Q4 numbers, the lead-cable situation has flared up with the EPA seeking a meeting with AT&T on this subject. AT&T’s stock fell 4% after that news broke out on January 11th, although the stock recovered a bit the next day. It will be interesting to see if the company or the analysts have something to say about this recent development.

Valuation

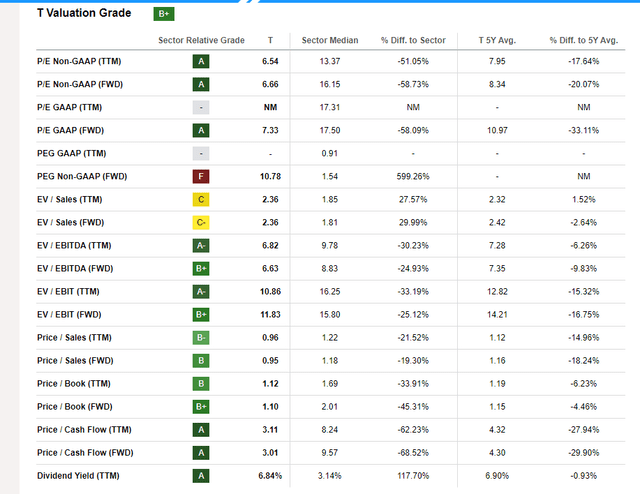

- The biggest thing AT&T stock has in its favor, at least on paper, is its dirt-cheap valuation as it is trading at a forward multiple of 6.77. This gets cheaper when you factor in the near 7% yield. But we all know about this company’s self-inflicted wounds including but not limited to its debt and bad acquisitions. The key question is, has the new AT&T changed and moved on from those mistakes?

- Verizon Communications Inc. (VZ), the closest peer possible, is still trading at a premium, at 8.22 times forward earnings. Applying the same to AT&T’s current FY 2024 EPS estimate of 2.46 cents, we arrive at an attractive price target of $20.22.

- Finally, as undervalued as the above two points make AT&T stock seem to be when you factor in the expected earnings growth rate (I am using those words loosely), AT&T’s stock has a Price to Earnings/Growth [PEG] of well over 10. Seeking Alpha’s quant ratings once again nail it as AT&T’s valuation looks good generally but when you factor in the growth rate (or lack of it), the stock’s low valuation seems justified.

Technical Indicators

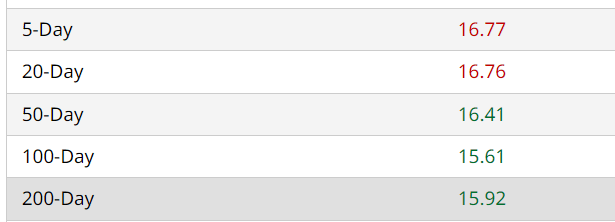

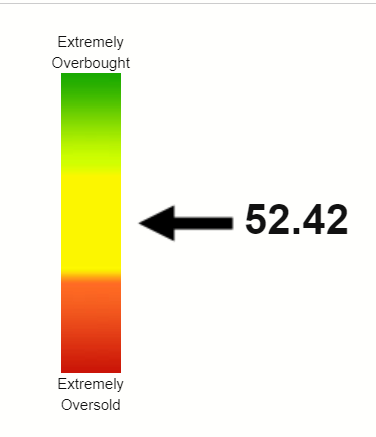

AT&T’s stock is heading into Q4 report with a decent technical setup. The stock is trading above both the 100- and 200-day moving averages but not by much. That means long-term support is nearby to act as a cushion in case Q4 numbers or FY 2024 guidance disappoint. In addition, the stock’s Relative Strength Index [RSI] is in the 50s, indicating that the stock is looking for direction and Q4 report is likely to influence the direction.

ATT Moving Avgs (Barchart) ATT RSI (Stock RSI)

Conclusion

AT&T’s stock may not have turned the corner just yet but the stock is definitely building some momentum of late. As has been the case for at least the last 2 to 3 years, FCF and debt will remain the two hottest topics when AT&T reports its Q4 results. I continue reinvesting my dividends into AT&T stock to accumulate additional shares when the yield is north of 6% and will continue doing so as long as the yield remains attractive and the company does not return to its old habit of using debt and poor acquisitions as its two core strategies.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.