Summary:

- AT&T’s Q4 earnings beat on revenue, but missed on EPS. The EPS miss was due to an actuarial charge on its pension plan.

- Investors sold T stock due to the earnings miss, but the pension liabilities that caused the earnings miss are shrinking long term.

- In 2023, AT&T showed positive growth in revenue, earnings, and free cash flow after years of decline.

- Factors such as positive revenue growth, the completion of the WarnerMedia divestment, and potential interest rate cuts could contribute to AT&T’s earnings improvement.

- In this article, I make the case that AT&T’s 2024 earnings will be better than its 2023 results, likely lifting the stock.

AT&T Stock Jumps On Strong Earnings Report Brandon Bell

AT&T (NYSE:T) just released its fiscal fourth quarter (Q4) earnings. The release showed 2.2% revenue growth and 4.9% growth in free cash flow. Diluted EPS of $0.54 was down 11.4%, however, much of it was a $0.18 actuarial loss on employee benefit plans. Such losses will reverse if AT&T’s pension fund makes gains.

AT&T’s post earnings selloff was extremely overdone. The reason for the EPS miss was an actuarial adjustment, not an increase in cash costs. Revenue, operating cash flows and free cash flow all increased. Full year free cash flow was $16.8 billion, meaning that the guidance for $17-$18B in 2024 free cash flow represents positive growth.

The EPS miss and actuarial adjustment are worth addressing. The $0.18 per share actuarial cost will someday turn into a cash cost if AT&T’s pension fund investments underperform, but simply assuming that will happen is not warranted. The fund’s status as a defined benefit (DB) plan does create certain risks. DB plans have to pay employees fixed amounts no matter how the investments perform. Such pensions generally aren’t good for investors, but with AT&T’s overall pension liabilities declining, the long term trend here is a good one.

Despite the risks, AT&T stock looks extremely cheap after earnings. At today’s prices, AT&T trades at just 7 times earnings, 1.01 times sales, and 1.2 times book value. That’s a pretty cheap valuation, and the company just recently did positive growth in revenue, earnings and free cash flow, after many years of all three metrics declining.

In general, I’ve been skeptical of AT&T for most of the time that it has been a ‘hot stock’ on Seeking Alpha. Although the company has always had optically low multiples, its revenue and earnings declined in the last five years. The decline in earnings was partially due to the buildout of 5G infrastructure, which caused a hit to the company’s cash flows. The decline in revenue was more ominous because that coincided with the sale of WarnerMedia. That business unit had some profitable properties in it, but AT&T had to sell it because the debt that came with it was excessive when considered alongside AT&T’s other liabilities.

So, AT&T had some financial problems that made it a bad investment over the last decade. Now, however, it is decisively turning things around. In the fourth quarter, AT&T delivered:

-

$32 billion in revenue, up 2.2% year over year.

- $0.30 in GAAP earnings per share, up from a $3.20 per share loss.

-

$0.54 in adjusted earnings per share (EPS), down 11.4%.

-

$11.4 billion in cash from operations, up 7%.

-

$6.4 billion in free cash flow, up 4.9%.

- A 20% free cash flow margin.

- Guidance for $17 billion to $18 billion in 2024 free cash flow, which will be between 1.2% and 7% growth if achieved.

It was a pretty impressive showing compared to the company’s last five years, which have mostly witnessed declines in revenue, earnings and free cash flow. Although the company missed EPS estimates, the cash flow metrics were strong, and much improved year-over-year. While it’s too early to call the Q4 results a trend, there are some encouraging signs.

First off, Q4 was the fourth of four consecutive quarters featuring positive revenue growth, beginning with the first quarter of this year, and continuing with the second and third.

Second, all the impacts of the WarnerMedia divestment are well into the past now, meaning that the associated costs will not be impacting net income or free cash flow in the coming quarters.

Third and finally, the Fed’s latest meeting signalled dovishness, indicating that perhaps we will see rates come down somewhat this year–in which case AT&T’s interest expenses may come down as well. For these reasons, I am now (slightly) bullish on AT&T, after being unconvinced previously.

When I last wrote about AT&T, I called the stock a ‘buy’ on the basis of valuation and moderate growth potential. I still maintain that rating, but it pays to take a closer look at the factors that I think will ramp up the company’s earnings growth, as we have entered a new quarter and the company’s Q4 earnings release showed significant growth in operating cash flow and free cash flow. In this article I explore all of the three reasons I just gave for believing that AT&T’s earnings will improve, in more detail. First, though, let’s take a look at T’s competitive position.

Competitive Position

AT&T has a strong competitive position, being the biggest telco in the United States by market cap and customer count. That alone is a competitive advantage of sorts, as it allows the company to spread its infrastructure across more customers. Another advantage AT&T has is a large 5G network, being one of the three largest 5G providers in the country. Many telecom customers want the fastest service possible, so AT&T’s 5G edge may be a differentiator. A final advantage AT&T has is its brand, which is quite recognizable and is worth $89 billion according to marketing experts cited in Statista. So AT&T has at least a few minor competitive advantages over its rivals. So far, these advantages have not stopped fierce price competition from impacting the company’s industry, but they are substantial enough to put AT&T in a better place than others.

The recently released fourth quarter earnings point to continuing strength in AT&T’s competitive position. In the quarter, the company added 526,000 phone net adds and 273,000 fiber net adds. For the full year, the numbers were 1.7 million for phones and 1.1 million for fiber. These adds show that AT&T is gaining customers at a rapid pace, an indicator of a good competitive position.

AT&T: Will The Earnings Trend Continue?

Since a big part of my mildly bullish opinion on AT&T relates to the company’s potential future earnings, I should take a minute or two to try and gauge whether, and how, they can increase. Here I will discuss the three factors I wrote about at the start of the article–the four-quarter trend, the WarnerMedia divestment and the Fed’s newfound dovishness–to make the case that AT&T’s earnings probably won’t decline indefinitely, and may rise in 2024.

First, the trend from the last four quarters. Most of AT&T’s income statement and cash flow metrics have been rising in this period, which is in contrast to most of the prior 10 years, in which they fell. In the table below you can see AT&T’s results in the first, second and third quarters, along with the full year results.

|

First quarter |

Second quarter |

Third quarter |

Full year |

|

|

Revenue |

$30.1 billion in revenue, up 1.4% |

$29.9 billion in revenue, up 0.9%. |

$30.4 billion, up 1%. |

$122.4 billion, up 1.2%. |

|

Operating income |

$7.6 billion, down 11.4%. |

$6.4 billion, up 29%. |

$6.5 billion, b |

$23.5 billion, up 5%. |

|

Free cash flow |

$1 billion in free cash flow, up 29.8%. |

$4.2 billion, up 214%. |

$5.2 billion, up 24%. |

$16.8 billion, up 19%. |

|

Diluted EPS |

$0.60, down 4.7% |

$0.61, up 3.3%. |

$0.68, down 6.3%. |

$2.41, down 5.1%. |

As you can see, most of these metrics are showing positive growth, both year-over-year and sequentially. In revenue, free cash flow and diluted EPS, the trends are unambiguously positive. The situation with operating income is more complex, but that metric did improve from Q2 to Q3. Overall, the short term trend in AT&T’s business appears to be one of positive growth. If the trend continues, then the company should deliver considerable growth in earnings and free cash flow in 2024.

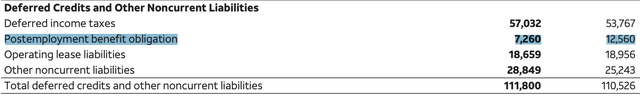

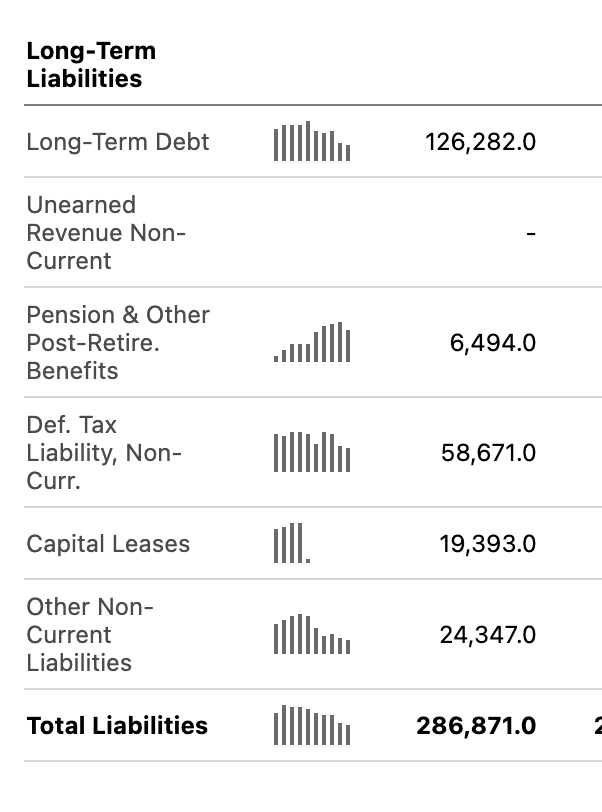

As for whether this positive earnings trend can continue, I’d wager that it can. One of the big things holding back T’s earnings in recent years has been the divestment of WarnerMedia. The divestment was announced two years ago, but was still having impacts on earnings as recently as Q2. With that deal having closed in April of 2022, its lingering charges and effects should stop affecting earnings by the second quarter of this year, resulting in a better earnings trajectory going forward. Likewise with the pension liabilities. The $0.18 fair value hit to earnings in Q4 was a big part of why the stock sold off today, but the pension liabilities that caused that fair value hit are trending down long term. Over the last 10 years, they have decreased from $34.4 billion to $6.4 billion! On a long term basis, AT&T’s pension situation is improving, not deteriorating.

AT&T’s pension liabilities declined in 2022 (AT&T) Even further declines in pension liabilities in 2023 (Seeking Alpha Quant)

Finally, there is the matter of the Federal Reserve’s monetary policy. AT&T is a highly indebted company, with $129 billion in net debt. The company’s interest expenses increased this year because the Fed raised interest rates in the year-ago period. That resulted in a negative earnings impact. Now, however, interest rates are expected to fall. Jerome Powell hinted at the last Fed meeting that the Fed might do 75bps worth of cuts in 2024, and have a 4.6% policy rate at the end of the year. That will have a positive impact on AT&T’s earnings if it materializes, as interest is a big portion of the company’s costs.

Valuation

Having looked at AT&T’s business and the operating and economic trends that impact it, we can proceed to a valuation. At today’s prices, T stock trades at:

-

7 times earnings.

-

1.01 times sales.

-

1.2 times book value.

-

3.3 times operating cash flow.

-

22 times free cash flow.

Apart from the free cash flow multiple, these are all very low, earning AT&T a ‘A-’ on valuation in Seeking Alpha’s quant rankings. The free cash flow multiple should improve eventually. That metric subtracts capital expenditures, which were very high for AT&T in the last few years, due to the buildout of the company’s 5G infrastructure. Now that those expenditures are mostly complete, the company’s FCF should grow, as it grew did throughout 2023.

The Bottom Line

The bottom line on AT&T is that it’s a beaten down stock whose day may finally have come. The company has gone to great lengths to spin off struggling business units, and now monetary policy looks like it will turn in its favor. To be sure, there are real risks here. For example, if interest rates go up instead of down, as I predict, then the company’s earnings will decline. Nevertheless, on balance, the company’s cheapness and newfound growth make it a mildly enticing buy following its Q4 earnings release.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.