Summary:

- AT&T continues to deliver healthy subscriber growth and improving margins, resulting in high-single digit non-GAAP earnings growth.

- The company met the free cash flow forecast of $14 billion for 2022 and expects $16 billion in 2023. FCF will grow further as AT&T passes peak capex.

- Debt is being reduced. This will speed up with less spectrum license costs compared to 2021-22.

- AT&T is pursuing responsible growth with its fiber JV with BlackRock.

- The stock is around fair value and competitive with bonds that yield 5-6% but with potential for dividend growth in 2024 and beyond.

SOPA Images/LightRocket via Getty Images

Healthy Growth In A Mature Industry

No one buys AT&T (NYSE:T) stock expecting rapid growth in earnings and share price. Investors generally purchase it for income comparable to a corporate bond but with the potential to grow the dividend gradually over time. In the years leading up to early 2022, however, the company damaged its capability to deliver high income by overpaying for acquisitions like DirecTV and TimeWarner. New management finally took steps to undo these moves and focus AT&T on mobile and fiber-based communications, but still ended up cutting the dividend 47% in 2022.

As I mentioned in a prior article, the turnaround became clearer in the second half of 2022 as AT&T delivered strong subscriber growth in mobile and broadband fiber, but also began showing margin improvements as a result of cost cutting efforts. The company also managed to hold on to customers despite a shaky economy due to the essential nature of its services and simple pricing plans where “everyone gets the best deal”.

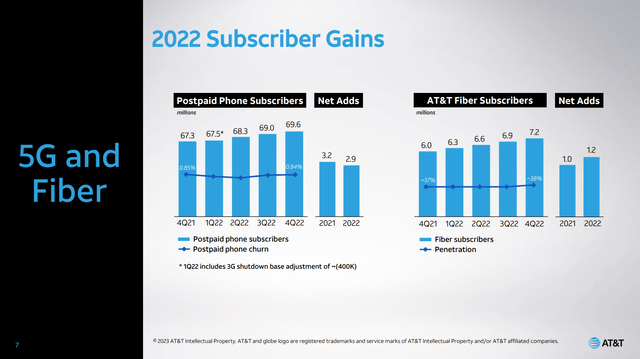

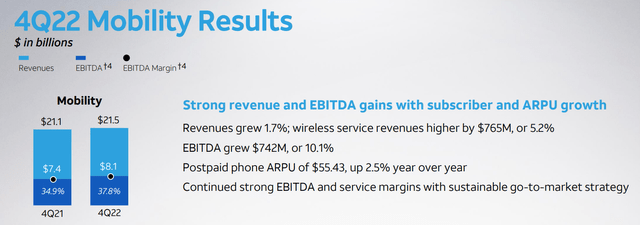

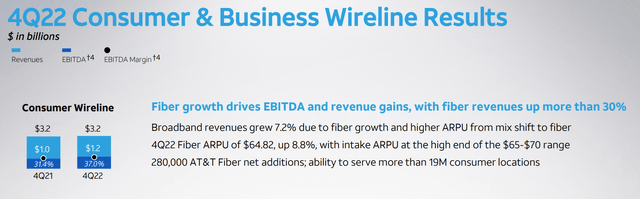

These improvements continued as shown by the 4Q 2022 results recently released. The company added 656,000 net postpaid phone customers in the quarter, bringing the full year total to 2.9 million. This beats the 2.6 million added by Verizon (VZ) in 2022. AT&T is once again growing revenue per user, with phone ARPU improving to $55.43 as international roaming is improving as travel recovers. In broadband, while the overall number of customers is staying about flat, higher paying fiber subscribers are offsetting losses in slower legacy technologies. Fiber ARPU is now $64.82 with new subscribers paying close to $70 per month.

In addition to the subscriber growth, AT&T is growing its margins, especially in mobility and consumer wireline despite the effects of inflation on costs.

Looking forward, for 2023, AT&T expects revenue growth of 4% in wireless services and 5% in broadband. The company appears to be a little more conservative on cost reductions as they are forecasting EBITDA growth of 3% for the year. Investors looking for growth can certainly find more attractive opportunities but those looking for safe income can expect a well-covered dividend with the possibility of increases, probably in 2024 and beyond.

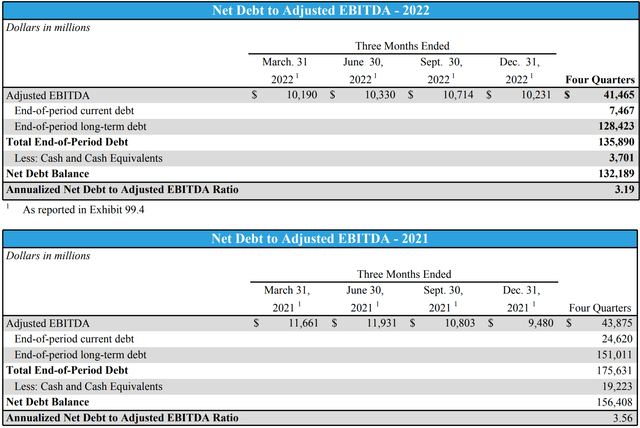

Cash Generation To Increase, Debt To Decrease

AT&T produced $14.1 billion of free cash flow for the full year in 2022. This easily covered dividends paid of $9.9 billion in the year, including the 1Q 2022 dividend which was almost twice the size of the current dividend. During the year, the company reduced net debt by $24.2 billion, from $156.4 billion to $132.2 billion. In addition to the excess free cash flow after dividends, the company also received cash in the WarnerMedia spinoff that created Warner Bros. Discovery (WBD). AT&T also had another use of cash, spending $10.2 billion on wireless spectrum, which is recorded in acquisitions and not capex, and therefore not subtracted when reporting free cash flow.

For 2023, AT&T expects $16 billion “or better” of free cash flow. The company has one more year of high capital spending on its 5G and fiber build out before it tapers down in 2024 and later years. Capex will be around $24 billion in 2023, similar to 2022. Operating cash flow will therefore improve to around $40 billion from the $35.8 billion recorded in 2022. About $1.2 billion of this would be from the 3% higher EBITDA with the balance due to working capital improvements as inflation slows down.

On the earnings call, management mentioned that this higher free cash flow would “improve the credit quality of the dividend” which suggests to me that they probably will not increase the dividend in 2023 but will keep it at $1.11 per share for the year. This would result in dividend payout of around $8 million or a ratio of 50% based on FCF. In later years as capex comes down and earnings grow gradually, I expect AT&T to resume dividend raises. For now, the stock yields about 5.5% following the pop in the share price after earnings.

On the debt front, AT&T has reduced leverage (net debt/EBITDA) to 3.19, down from 3.56 at the end of 2021. When calculated on an apples-to-apples basis, AT&T now has an almost identical leverage ratio to Verizon. (VZ reports net unsecured debt in the numerator but if I use total secured and unsecured debt, the ratio is similar to T.)

The company mentioned on the earnings call that their target leverage is 2.5 which they expect to hit by the beginning of 2025. While this debt reduction has proceeded slower than many would like to see, it has been impacted over the last two years by the cost of wireless spectrum on which AT&T spent $25.5 billion in 2021 and $10.2 billion in 2022. While the company does not subtract this spending from reported free cash flow, it is of course a real and substantial use of cash. Looking forward, I expect these costs to be lower in the next few years with the 5G build out well underway. AT&T will be able to apply more of the free cash flow after dividends toward debt reduction.

More Disciplined Growth Strategy

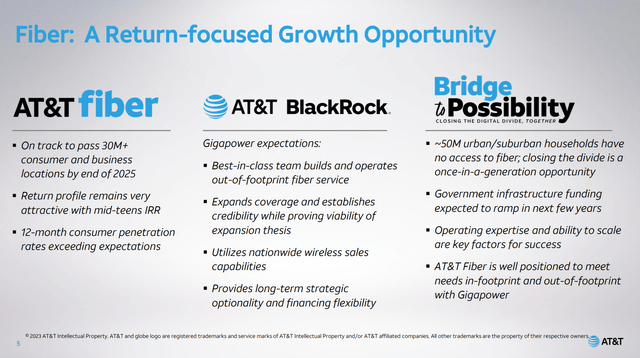

Increasing the fiber service area continues to be a major component of AT&T’s growth strategy. As I have noted in earlier articles, the company considers fiber a more efficient data delivery method at higher data usage rates than the fixed wireless strategy now being pursued by competitors like T-Mobile (TMUS). At the end of 2022, the company had more fiber customers than non-fiber. The company can now reach 22 million locations (19 consumer and 3 business) and 38% of these locations are paying customers. In addition to increasing this penetration in the existing footprint, AT&T also plans to reach a total of 30 million locations by the end of 2025, or about another 2.5 million new locations each year for the next 3 years. Beyond this organic growth, AT&T is pursuing a partnership to expand its customer base without committing a lot of capital up front.

On the earnings call, AT&T provided a few more details about its partnership with BlackRock (BLK) to further increase fiber broadband sales. Known as Gigapower, the JV will provide fiber connectivity to around 1.5 million customers outside of AT&T’s physical footprint by 2025. (This is over and above the 30 million locations reachable within AT&T’s footprint targeted by that date.)

This allows AT&T to grow its customer base without committing a huge amount of capital up front. If the JV does not go well, the company loses some of its initial contribution, but if it does go well, AT&T could offer to buy out its partner for an instant growth opportunity. This is in contrast to the major all-in investments such as DirecTV and TimeWarner that AT&T has undertaken in the past with negative results. This more conservative bet on growth is encouraging and safer for a company that relies on steady cash flow to meet dividend commitments to investors.

Valuation

AT&T shares have returned over 20% since my last writeup following 3Q 2022 earnings. The market appears to like the 4Q results as well, with the stock trading at $20.35 at the time of writing, up 6.2% so far on the day of the earnings release. That leaves T valued at 8.5 times estimated 2023 EPS of $2.40. By comparison, VZ at $40.17 is valued at 8.5 times estimated 2023 EPS of $4.70. After many years of looking “cheap”, the valuation gap with its nearest competitor has now closed completely.

In terms of dividend yield, if AT&T does not raise the dividend this year, T stock yields 5.5%. Verizon, with its total annual dividends of $2.61, has a higher yield at 6.5%. Payout ratio is slightly lower for AT&T however, at 46.3% of EPS vs. 55.5% for Verizon. While Verizon looks like the better dividend play in the short term, AT&T has more potential for dividend growth after this year as spending on capital investment and wireless spectrum declines.

Conclusion

AT&T now has a couple of quarters under its belt of demonstrated customer growth and margin improvement. The more focused strategy after spinning off its media divisions is paying off. The market has recognized this already, with the valuation gap vs. Verizon having closed. As a modestly growing mature business, AT&T stock has to compete for a place in investors’ portfolios with corporate bonds and higher yielding peer stocks like Verizon. As a result, there could be a lot of sideways action in T share price this year especially given the recent run-up. However, the stock should begin moving again when bond yields start to decline and a dividend hike looks more likely. Since I expect those to happen by the end of 2023, I still rate T a Buy to be in ahead of these events.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.