Summary:

- Despite ongoing revenue growth, investors shouldn’t overlook Apple as a dividend-growth stock.

- In this report, we share data on over 100 top dividend-growth stocks, as compared to Apple.

- We also dig into the details on Apple’s business, competitive advantages, growth trajectory, cash flows, dividend, share repurchases, valuation, and risks.

- We conclude with our strong opinion on investing in Apple, especially in the current dividend-growth-stock environment.

Blue Harbinger Research – 100 Dividend-Growth Stocks SOPA Images/LightRocket via Getty Images

A lot of investors think of Apple (NASDAQ:AAPL) as a pure-growth stock. And while the company does have impressive growth opportunities ahead, it’s also a stable value stock—with a powerful trajectory of dividend growth. In this report, we share comparative data on over 100 top dividend growth stocks, with a special focus on Apple, including a discussion of its business, competitive advantages, growth trajectory, cash flows, dividend, share repurchases, valuation and risks. We conclude with our strong opinion on Apple and the current market opportunity for select dividend growth stocks.

Apple: The Dividend Growth Stock

As you are probably well aware, Apple designs, manufactures and markets smartphones (iPhones), personal computers (Macs), tablets (iPads), wearables (e.g. Beats, Apple Watches, AirPods), and sells a variety of related services. It also has a lot of compelling growth opportunities in the years ahead (as we will discuss later in this report).

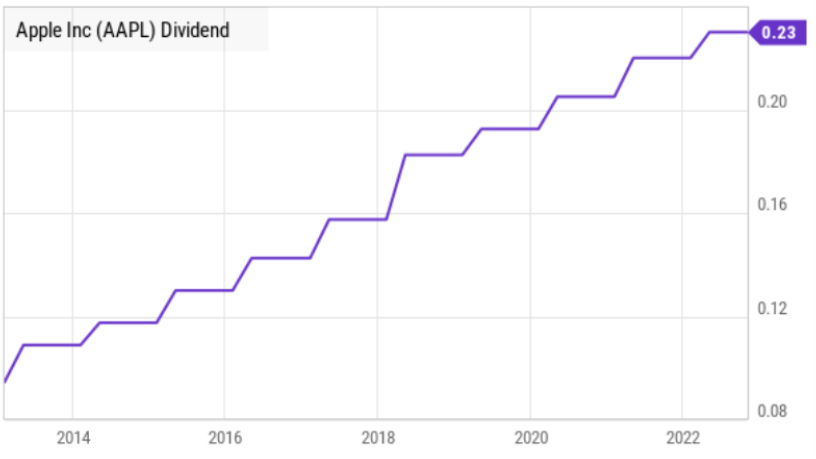

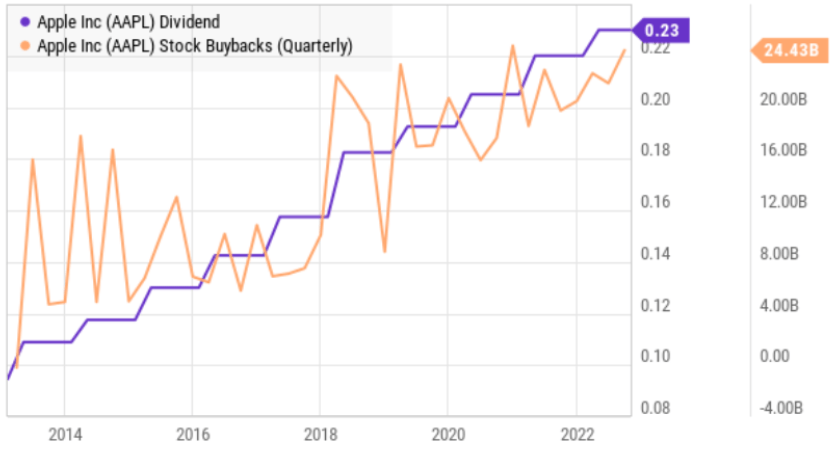

But what many people do NOT realize is that Apple is also an impressive dividend growth stock. For example, here is a look at Apple’s powerful dividend growth over the last 10 years.

YCharts

Yield on Cost: Apple Is Impressive

Many income-focused investors are turned off by Apple’s paltry 0.7% current dividend yield. Instead, they prefer to own stocks with much higher current yields. But what many of them don’t realize is that dividend-growth stocks (such as Apple) often end up paying much more income over the long-term than does chasing after the highest current yields—which are often just dangerous yield traps. For example, we warned investors of the dangers of chasing after AT&T’s (T) very high dividend yield years ago (prior to its relatively recent massive dividend cut).

“Yield on Cost” is the current dividend per share divided by the price you paid for the share (however long ago you bought it). For instance, Apple’s 5-year and 10-year yield on cost is 2.2% and 5.7%, respectively. That’s a very healthy amount of income for the price you pay. And Apple is on track to keep growing the dividend in the future (as we will explain later in this report).

What’s more, when you factor in total returns (i.e. share price appreciation, plus dividends reinvested), dividend growth stocks quickly become even more impressive. We share data on over 100 top dividend-growth stocks (including Apple) in the next section, and you can see how impressive Apple’s total return has been over the last 10 years.

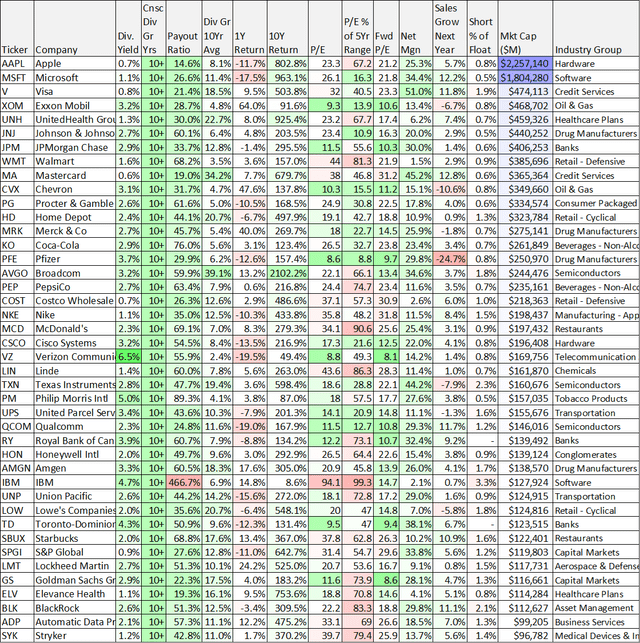

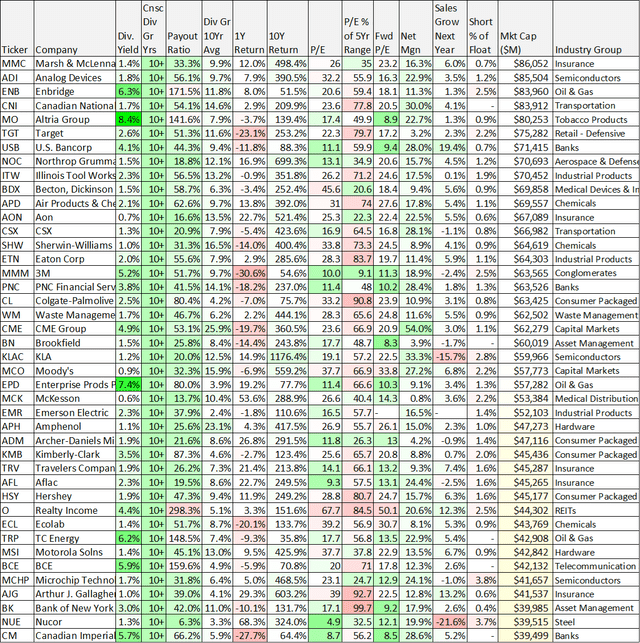

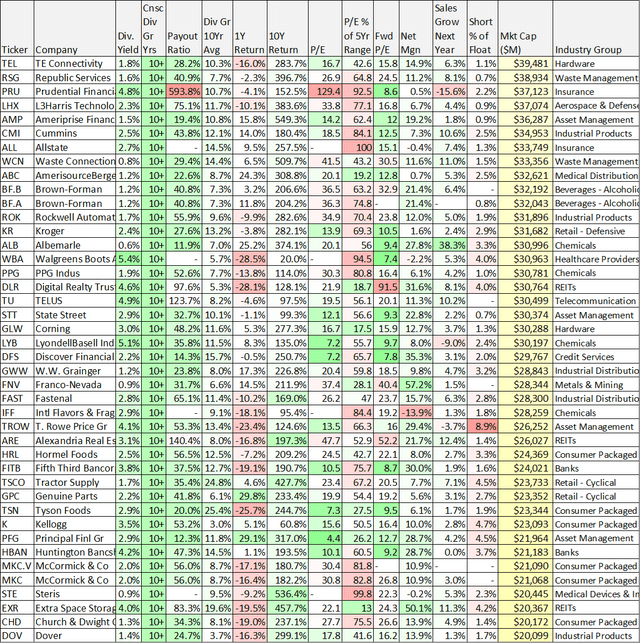

100 Top Dividend Growth Stocks, Compared

To be included in this table, we required at least 10 consecutive years of dividend growth and a market capitalization of at least $20 billion. The table also includes a lot of other metrics that we consider important when considering dividend growth stocks. The table is sorted by market cap (Apple is at the top).

data as of Tues, Jan 24th (StockRover)

(MSFT) (V) (XOM) (UNH) (JNJ) (JPM) (WMT) (MA) (CVX) (PG) (HD) (MRK)

data as of Tues, Jan 24th (StockRover) data as of Tues, Jan 24th (StockRover)

A downloadable (and sortable) spreadsheet of this data is available to members here.

A few of Apple’s most impressive metrics from the table above include its 10-year total return (price appreciation, plus dividends reinvested), its 10-year dividend growth rate, its extremely strong margins, and its very impressive forward growth trajectory.

This table also reveals something important about “yield chasing” (i.e. chasing after stocks with the highest current yields—which often turn out to be dangerous yield traps). For example, stocks like IBM, Verizon and others have fairly consistently offered higher dividend yields than Apple (and many income-focused investors are constantly drawn to them). However, these high current yield investments have much lower dividend growth rates (as you can see in the table) and much lower total returns. Also, the table doesn’t include the stocks that used to have big dividend yields (and 10+ years of dividend growth) because they ended up being yield traps that cut their dividends (such as AT&T from our earlier example).

Essentially, chasing after a stock just because it offers a big current yield is often a bad idea in the long-term. Rather, investing in healthy dividend-growth stocks often proves to be the much better choice in the long run.

Why Dividend Growth Stocks Now?

The pandemic “pure-growth” stock bubble has been bursting hard, and there are reasons to believe the pain is not over (we will explain). Conversely, “dividend-growth” stocks are particularly compelling in the current macroeconomic environment.

For example, pure-growth stocks soared to incredible heights as the Fed set interest rates near 0.0% during the pandemic thereby making its easy to borrow money (at low rates) to fund growth. But now as the Fed keeps hiking rates (to fight inflation), many of the young growth companies that relied on essentially free money to support their businesses are in big trouble. On the other hand, healthy dividend-growth stocks (such as Apple) have the mature businesses and steady cash flows to easily support their businesses regardless of the Fed’s interest rate hikes.

We don’t expect interest rates to go back to 0.0% anytime soon, and it’s going to be extremely difficult for many young pure-growth companies to achieve their previous sky-high stock prices anytime soon (or ever). This is one of the big reasons we like dividend-growth stocks now (i.e. they can continue to thrive in a higher interest rate environment). Another reason we like dividend-growth stocks now is because many of them have inappropriately gotten caught up in the recent indiscriminate market sell off, thereby creating select attractive long-term contrarian buying opportunities (such as Apple).

Apple: Business Overview

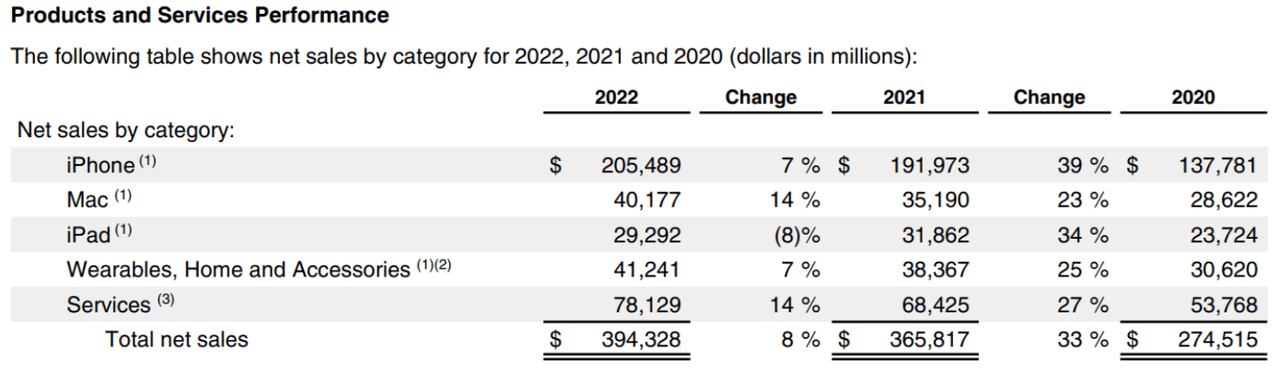

As mentioned, Apple sells iPhones, Macs, iPads, and wearables (and provides related services) primarily to consumers, small and mid-sized businesses, education, enterprises and government markets. You can get an idea of the breakdown in the table below.

Apple Q4 Earnings Release

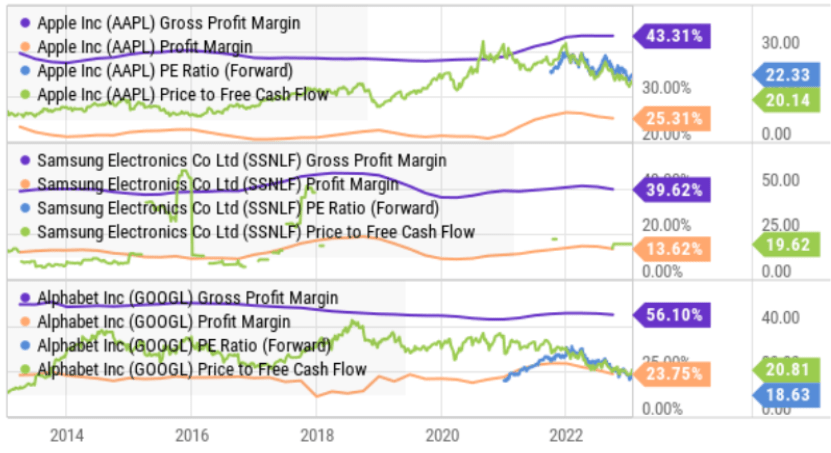

Furthermore, Apple is unique versus competitors because it designs and develops nearly all of its solutions, including the hardware, operating system and software. Competitors, lead in hardware (such as Samsung mobile devices (OTCPK:SSNLF)) or Software (such as Google’s Android (GOOGL) operating system), but not both.

Apple Q4 Earnings Release

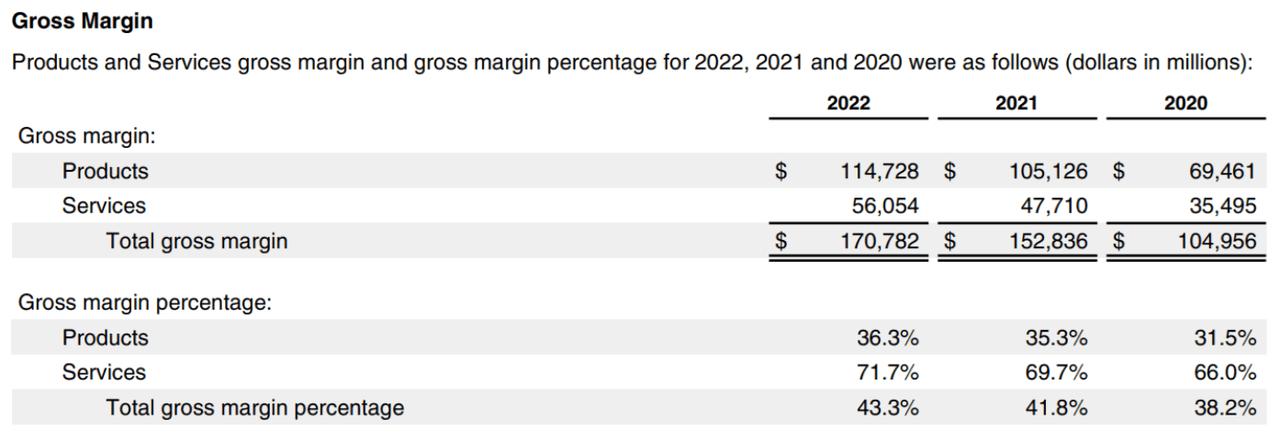

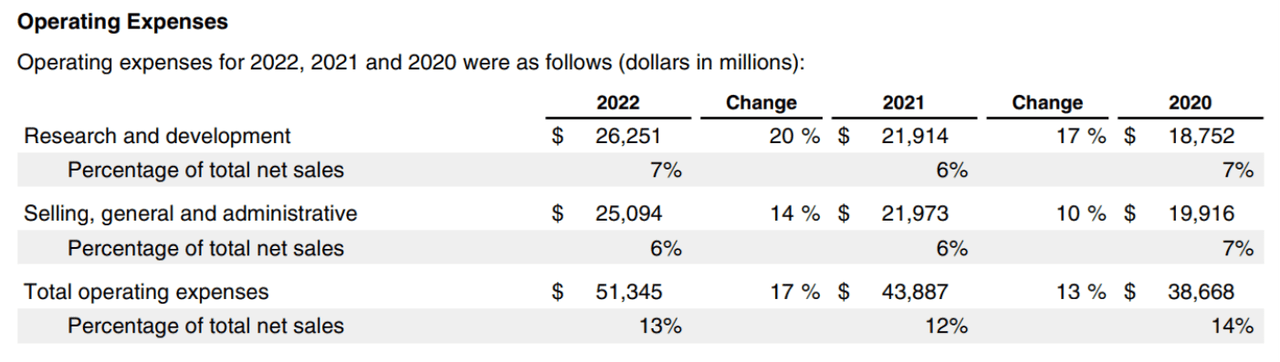

What’s more, Apple offers premium products (see high margins above), whereas many of its competitors seek to compete primarily through aggressive pricing and very low cost structures. Markets for Apple’s products and services are highly competitive (resulting in downward pressure on margins) and characterized by frequent new product and service introductions, short product life cycles and rapid adoption of technological advancements. Like other large peers, Apple benefits from economies of scale, thereby keeping its R&D, SG&A and total operating expenses relatively low as a percent of its total sales (see below).

Apple Q4 Earnings Release

Competitive Advantage: Brand, Pricing Power

Apple’s premium brand allows for its products to be sold at a higher price point than competitor products. We believe this premium brand provides a sustainable competitive advantage. Apple customer satisfaction is extremely high, and the ecosystem of products makes it harder for customers to switch to a new brand. We believe this is a sustainable competitive advantage that will benefit Apple for years, thereby allowing it to maintain its high margins (described earlier).

Revenue Growth:

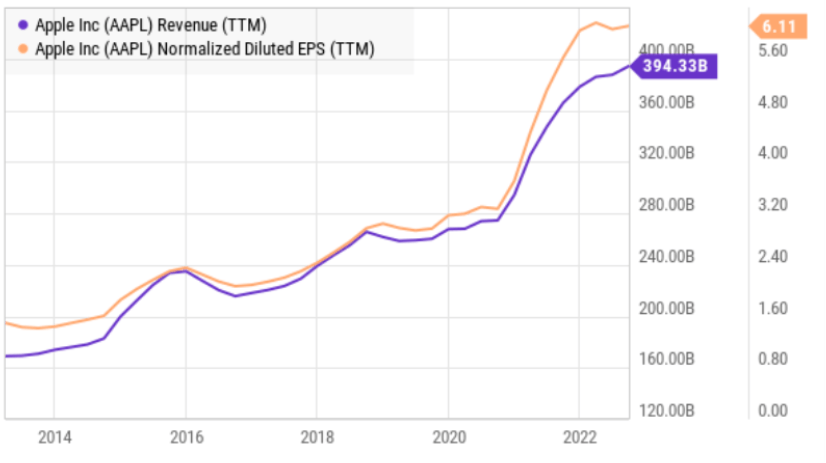

Apple has achieved impressive revenue growth over the years (most recently thanks to the success of the iPhone franchise, as well as constant innovation and features), however current 2023 estimates are lackluster (coming in–in the single digits).

YCharts

In our view, Apple will face challenges in the near-term stemming from slower macroeconomic growth (i.e. recession looming). However, it is somewhat encouraging (from a contrarian standpoint) to see street estimates have already been lowered, thereby keeping expectations relatively tame. For example, over the last three months, earnings revisions have been largely negative (34 down revisions, versus only three upward revisions from Wall Street analysts).

However, over the long-term, we believe the strength of the franchise, combined with plenty of cash flow to easily support R&D, will allow innovation and growth to persist.

Cash, Dividends and Share Repurchases:

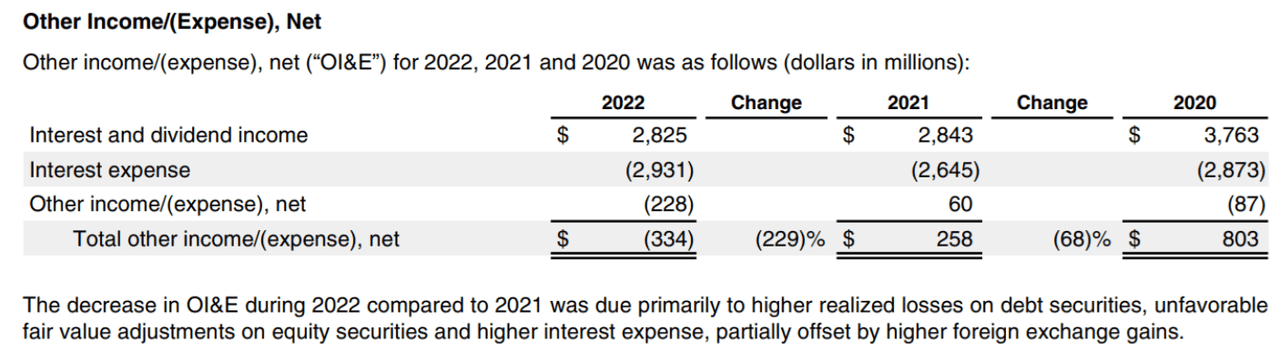

Apple currently has significant cash and liquidity on its balance sheet, including $156.4 billion of cash, cash equivalents and unrestricted marketable securities at the end of fiscal Q4 (versus around $154 billion of current liabilities). Further, the company’s interest expense is largely offset by the interest and dividend income the company receives.

Apple Q4 Earnings Release

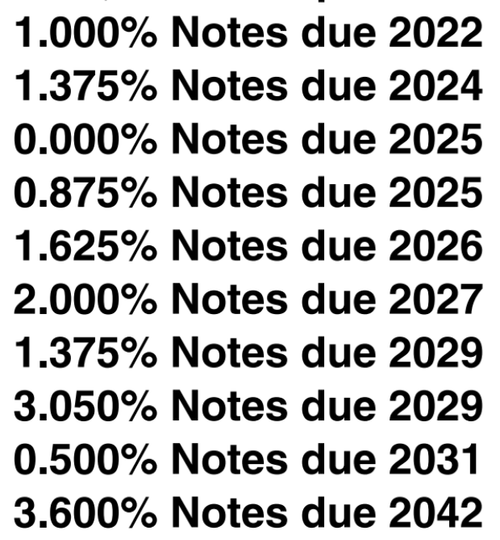

Not to mention, Apple’s AA+ credit rating (from S&P Global) has allowed the company to borrow at very low interest rates (see below).

Apple 10-K

Apple is positioned much better than many technology sector companies in the current macroeconomic environment (e.g. higher interest rates), particularly better than those with more debt and lower credit ratings (especially considering Apple’s strong cash flows and cash position). Whereas others may struggle with liquidity and higher borrowing costs, Apple is in great shape to thrive.

And perhaps one of Apple’s most underappreciated qualities is its powerful dividend growth. Not only has the dividend been increased every year over the last decade, but the actual payout has steadily doubled. The current yield is mathematically low because the share price has also grown rapidly as compared to the growing dividend payout.

Further still, Apple returns more cash to shareholders by buying back shares.

YCharts

Valuation:

Apple is currently the largest publicly-traded company with a market cap of over $2 trillion. The shares currently trade at 22.3x forward earnings estimates, which is reasonable in the technology sector, especially considering the company’s sustainable competitive advantages (brand, ecosystem and economies of scale).

YCharts

For some perspective, of the 45 Wall Street analysts covering the shares, 26 rate Apple a “strong buy,” seven rate it a “buy” and 10 more rate it a “hold.” And according to a January 20th note from Morningstar Strategist Abhinav Davuluri (Abhinav has a buy rating on the shares):

“Our fair value estimate is $150 per share. Our estimate implies a forward GAAP price/earnings ratio of 24 times. In fiscal 2023, we expect total revenue to be up 3% thanks to strength in iPhone, wearables, and services sales, partially offset by weaker Mac and iPad revenue following multiple strong years associated with work- and learning-from-home trends due to COVID-19.”

Also worth mentioning, Apple continues to generate very strong returns on equity, assets and invested capital.

Risk Factors:

Of course Apple does face risk factors, as we have described below.

-

Competition: While Apple customers tend to be very loyal and report extremely high satisfaction rates, Apple may still be only a few bad releases away from losing market share to competitors, as customers constantly seek new technological innovation and features. We don’t expect this, but it remains a possibility considering fierce industry competition.

-

Supply Chain Risks: Essential components for Apple products are generally available from multiple sources, but some are available from a limited or single source. Additionally, commoditized components can be subject to significant market price volatility and swings. Supply chain disruptions would negatively impact the company and remain a risk factor.

-

International Manufacturing: Substantially all of Apple’s hardware products are manufactured by outsourcing partners that are located primarily in Asia, with some Mac computers manufactured in the U.S. and Ireland. Recent news indicates that Apple wants to move as much as 25% of its iPhone manufacturing to India, to reduce the manufacturing concentration risks.

-

Recession Risks: Furthermore, Apple faces recessionary risks. As the Fed keeps hiking rates to slow inflation, they’re driving the economy closer to recession and that may certainly prevent some people from purchasing a new iPhone, for example. However, Graham Smith argues in this article (titled “Is Apple recession-proof?”) that “we ought to consider Apple to be more of a defensive growth stock as opposed to the out-and-out growth stock it once was.”

Conclusion:

In the short-term, Apple may face continued headwinds based on the looming recessionary environment (the company is scheduled to announce earnings on Thursday, February 2nd). But over the long term, we expect the shares are going much higher and the dividend is likely to keep growing significantly too. As long-term shareholders, we’d consider adding to our position on any significant share price weakness. In fact, we like Apple enough to rank it #8 in our new report: Top 10 Dividend Growth Stocks, Down Big. We expect disciplined, goal-focused, long-term investing to continue to be a winning strategy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

*Note: If you are interested in more investment ideas, consider a subscription to Big Dividends PLUS, where you’ll get access to the holdings in our 30-stock members-only portfolio, plus a lot more. We’re currently offering 32% Off all new annual subscriptions.