Summary:

- AT&T has shown strong growth in customer lifetime value and impressive free cash flow performance.

- Q4 2023 earnings for AT&T saw growth in revenues and cash from operations, despite a slight decline in adjusted EPS.

- AT&T is trading at an attractive value compared to T-Mobile US and could see further upside if revenue growth continues.

Brandon Bell

Investment Thesis: I take a bullish view on AT&T given strong LTV growth and impressive free cash flow performance.

In a previous article back in November 2023, I made the argument that AT&T Inc. (NYSE:T) has the capacity to see further upside from here, based on growth in customer lifetime value, a strong customer base, and a reduction in long-term debt.

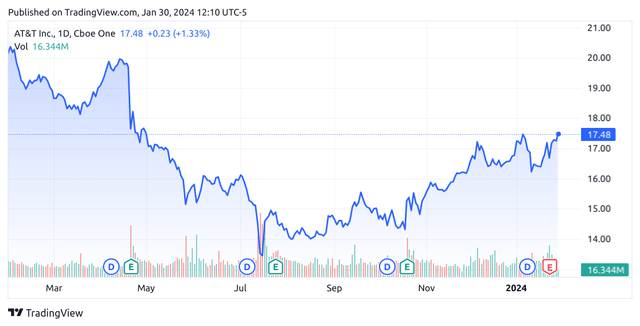

Since then, the stock has ascended to a price of $17.48 at the time of writing:

The purpose of this article is to assess whether AT&T has the ability to see continued growth from here taking recent performance into consideration.

Performance

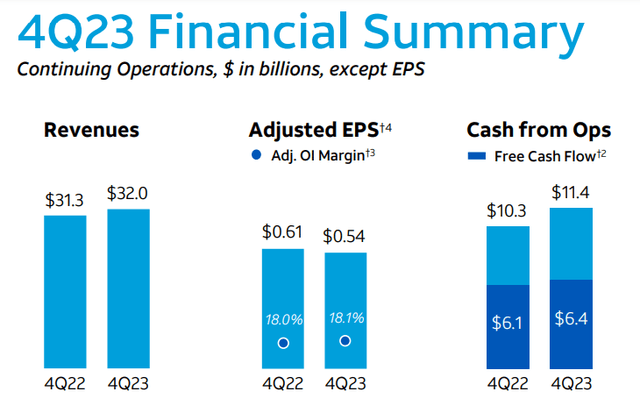

When looking at Q4 2023 earnings results for AT&T as released recently on January 24, we can see that while adjusted EPS saw a slight decline from that of the prior year quarter, that of revenues and cash from operations continued to see growth.

AT&T Investor Update January 24, 2024: 2023 4th Quarter Earnings

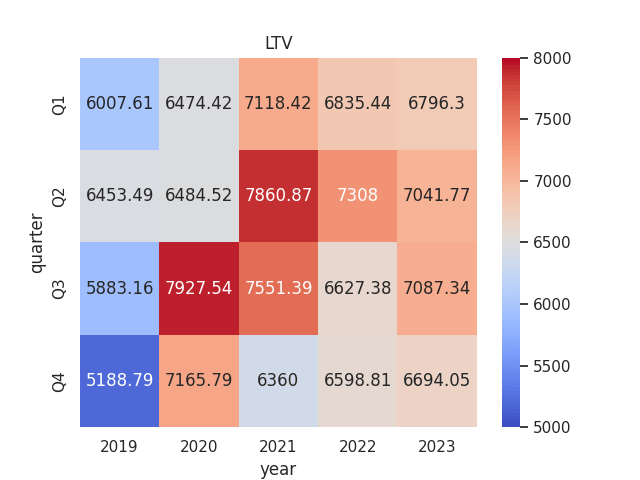

I had previously made the argument that growth in customer lifetime value had been encouraging. When looking at LTV (calculated as ARPU/churn rate), we can see that growth has continued from that of the prior year quarter:

Calculations and heatmap generated by author.

For this quarter, churn remained constant compared to Q4 2022 at 0.84%, while ARPU increased from $55.43 to $56.23 over the same period.

From a balance sheet standpoint, we can see that the long-term debt to total assets ratio of AT&T remains near the same level as that of last year – but long-term debt has seen a slight decline over this period.

| Dec 2020 | Dec 2021 | Dec 2022 | Dec 2023 | |

| Long-term debt | 153775 | 151011 | 128423 | 127854 |

| Total assets | 525761 | 551622 | 402853 | 407060 |

| Long-term debt to total assets ratio | 29.25% | 27.38% | 31.88% | 31.41% |

Source: Long-term debt and total assets figures (in millions of dollars) sourced from historical AT&T quarterly reports. Long-term debt to total assets ratio calculated by author.

My Perspective and Looking Forward

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, the fact that customer lifetime value has continued to see an increase over the past two quarters as compared to that of the prior year is encouraging.

I had previously cited competition from T-Mobile US, Inc. (TMUS) as being a potential impediment to AT&T’s growth, given the risk that AT&T could see increasing churn rates as a result of the former’s continued expansion of its customer base. However, it is notable that T-Mobile’s postpaid phone churn of 0.96% for Q4 2023 is actually higher than that of 0.84% for AT&T across the same quarter.

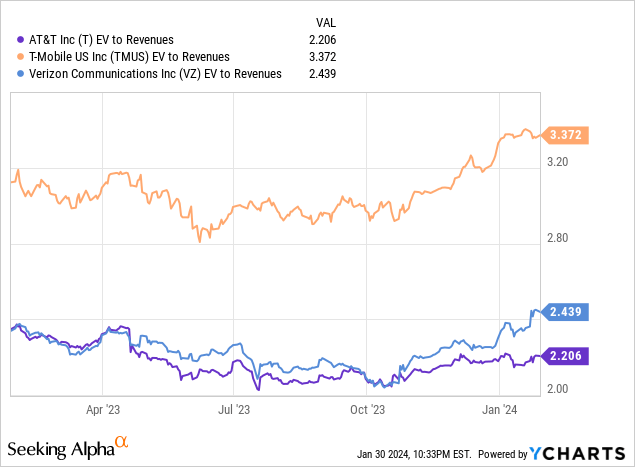

Additionally, when we look at enterprise value to revenues – we see that T-Mobile US has a substantially higher ratio to AT&T and Verizon Communications Inc. (VZ). In this regard, AT&T seems to be trading at attractive value on this metric relative to T-Mobile US – and from this standpoint, the stock could see substantial growth going forward if we continue to see revenue growth from here.

ycharts.com

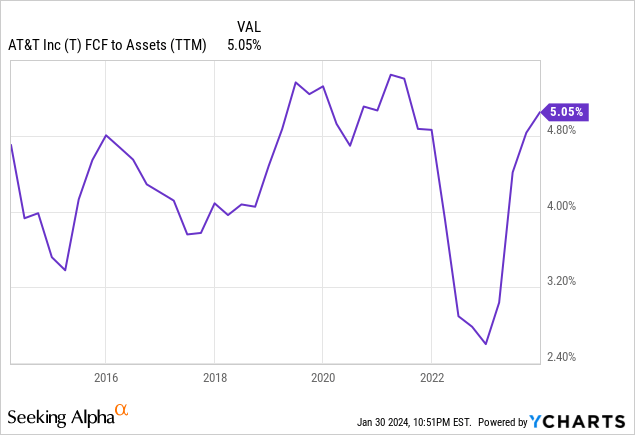

From a free cash flow standpoint, the company has seen significant growth – with full-year free cash flow up to $16.8 billion, which is an increase of $2.6 billion as compared to the prior year. Free cash flow has primarily been driven by growth in 5G and Fiber. In addition, we can see that while there was a dip within the last two-year period, the FCF to Assets ratio is now back up towards prior levels.

ycharts.com

Given both a shift in customers to higher-priced plans as well as having achieved a cost-cutting goal of $6 billion ahead of schedule with plans to cut another $2 billion in costs – I take the view that this puts AT&T in a good position to service its net debt and maintain its dividend – the company has already managed to reduce its net debt to EBITDA ratio from 3.19x to 2.97x.

Risks

In terms of the potential risks to AT&T at this time, prior downside in the stock over lead cable issues remains a concern, with the US Environmental Protection Agency having stepped up scrutiny of both AT&T and competitor Verizon over reports that the company’s older, lead-covered cables had led to contamination of waterways and soil across certain parts of the United States.

Should scrutiny of this issue resurface significantly – then we could see a drop in investor confidence which may undo the gains that we have recently been seeing in AT&T stock.

Conclusion

To conclude, AT&T has seen encouraging revenue growth and has shown its ability to compete effectively against T-Mobile US. While concerns over lead cable contamination remains a concern, I take the view that AT&T is ultimately in a good position to sustain growth going forward. I continue to take a bullish view of AT&T.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written on an "as is" basis and without warranty, with no guarantee of accuracy or completeness. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.