Visa: Resilient Business At A Good Price

Summary:

- Visa is capitalizing on the global shift towards card-based and electronic payments, with a robust business model and consistent revenue streams.

- The company experienced a slight deceleration in revenue and payment volume growth in Q1 2024, mainly driven by trends in consumer spending in the US.

- Visa has opportunities for growth in Europe and emerging markets, as well as in the digitalization of consumer payments and the conversion of cash and checks to digital transactions.

Abdullah Durmaz

Investment Thesis

Visa Inc. (NYSE:V) is capitalizing on the ongoing global shift towards card-based and electronic payments. I believe the company’s business model is robust, underpinned by its consistent revenue streams, solid margins, and substantial cash flow. The migration of shopping to online from physical stores is a key driver for electronic payments that has rapidly accelerated due to COVID-19, and the company’s revenue and earnings have continued to grow after a temporary setback during the pandemic in 2020. I see V as a good defensive stock to have in the portfolio, and I assign a buy rating to the stock.

Post Q1 Earnings Outlook: Resilient Consumer Amid Weak Macro

In the first quarter of its 2024 fiscal year, Visa reported a slight deceleration in revenue and payment volume growth. Visa’s payments volume increased by 8.4% year-on-year, a small step down from the 8.8% reported in the prior quarter, mainly driven by a further deceleration in the US. Although this appears mainly linked to the recent trends in consumer spending and inflation, the growth opportunities in US card payments are gradually narrowing. The US Federal Reserve introduced new rules for processing debit card transactions in the summer of 2023, giving merchants the option to process debit transactions over at least one additional network not affiliated with either Visa or Mastercard. This is intended to increase competition in the US debit card market, but Visa’s management highlighted that it has, so far, not seen any meaningful shift in volumes being routed away from its network. However, there is still substantial room for growth in Europe, where cash use remains quite high. Moreover, the firm has launched a plethora of initiatives to capitalize on the digitalization of payments in emerging markets and to capture payment flows other than traditional consumer-to-merchant card transactions.

Visa’s expansion into new areas is partly reflected in fast-rising personnel expenses, which have more than doubled since 2018 and have outpaced revenue growth. This, however, is not translating into margin pressure because of the combination of the firm’s scale and the low marginal non-personnel costs of processing payments. In the quarter, the operating margin increased by 70 bps to 69.1%. As the business model also has very modest capital expenditure requirements, the firm continues to generate significant free cash flows. These are largely used for share buybacks and dividends, as well as frequent bolt-on acquisitions, such as Pismo and Prosa. Visa appears positioned for a healthy fiscal 2024, fueled by momentum in new flows monetization and services revenue growth. Top-line gains could see a slower start to the year and then accelerate, with a potential 6-8% expansion in nominal terms in 2Q.

Traditional Consumer Payments Have Room to Grow

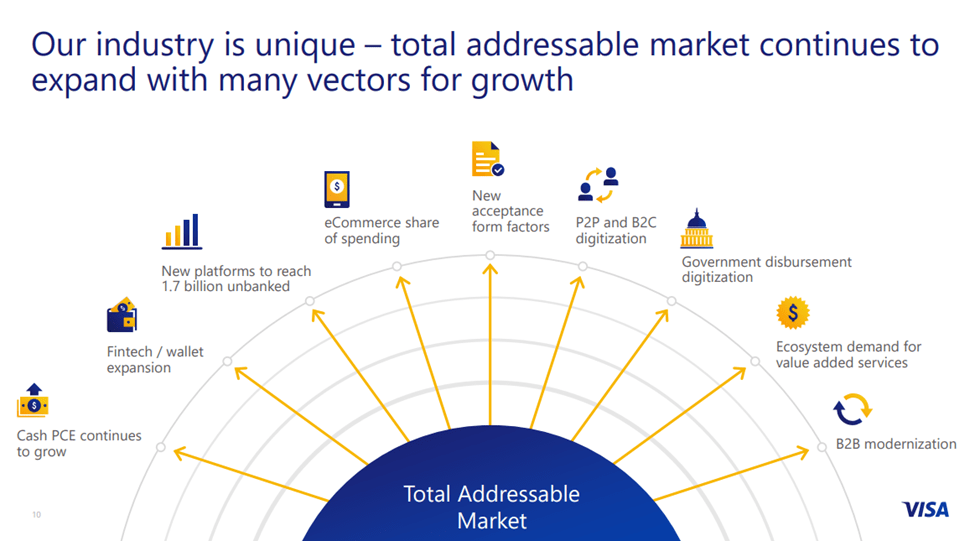

Visa’s primary focus is on the digitalization of consumer payments, which remains a substantial and expanding market. Visa has several competitive advantages in this space, including the increase in digital spending compared to physical retail, where Visa can earn 43 cents for every $1 spent, as opposed to 15 cents for physical transactions. Additionally, the rise of next-generation financial institutions like neobanks and fintech companies, cost-effective alternatives to traditional payment terminals for digital transactions, and global government initiatives to promote digital payments all contribute to Visa’s edge.

The value of payments still transacted with cash and checks represents a big opportunity for Visa, and it’s converting that in three ways: expanding Visa credentials (cards and tokens), adding acceptance points (quadrupled seller base in the last decade to 100 million sellers) and improving engagement (increasing usage via tap- and click-to-pay).

I believe Visa is poised to achieve high-single-digit growth in its core consumer payments segment in the near future, despite facing increasing competition from UnionPay, which holds a dominant position in global card network volumes with an approximate 75% market share in Asia. This segment, which accounts for about two-thirds of Visa’s revenue, benefits from several positive trends, including cross-border spending, the ongoing shift from cash to digital payments, the digitization of business-to-business transactions, and the growing adoption of e-commerce.

Company Presentation

Financial Outlook & Valuation

The dollar volume of payments made with cards and other digital methods is the main driver of Visa’s growth, and it relies on the secular shift from cash and checks and more cyclical consumer spending. I believe the total payment volume could expand at a high-single-digit rate through 2024. Going forward, growth should taper from the abnormal levels of 2022 yet hold up against a weakening economy, as Visa targets new flows and the post-pandemic travel recovery extends, especially in Asia.

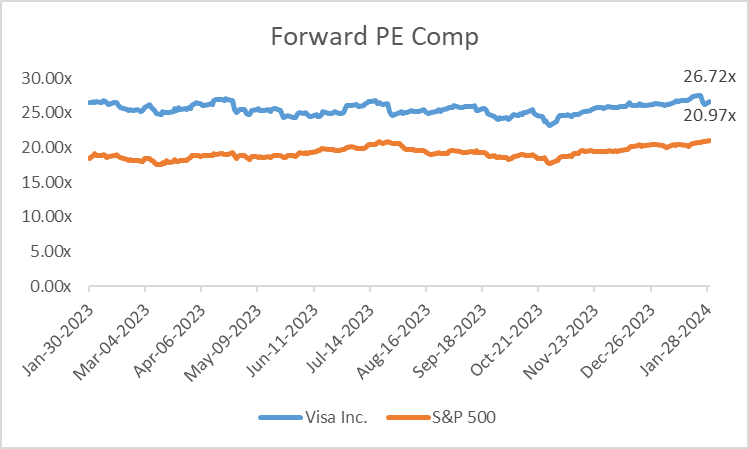

Despite the recent stock outperformance, I view Visa’s valuation as reasonable both on an absolute basis and relative to the S&P. V trades at a 27% premium to the S&P on NTM earnings, below where it was trading before Covid. I believe that the fundamentals continue to be healthy, and spending growth has stabilized after slowing down earlier in 2023. Global travel continues to recover, including inbound to the US and outbound from China, though I expect less catch-up going forward. In an economic slowdown or recession, I view V as a good defensive stock and would expect it to outperform. I am optimistic about the company and assign a buy rating to the stock.

Capital IQ

Risks to Rating

There are several risks associated with investing in Visa including adverse impacts from the implementation of interchange and/or network routing regulation, including market share loss and increased pricing pressure. Additionally, unexpected regulatory changes in payment processing, particularly in international markets, could create unforeseen challenges for Visa. Moreover, the rise of alternative payment processing methods or local domestic schemes, enforced by local regulatory authorities, could intensify competition in the industry which may lead to market share loss and a downside in Visa’s stock price.

Conclusion

I believe Visa’s exposure to both cross-border travel and the expanding e-commerce sector may help mitigate the adverse impact of inflation on consumer spending. The company’s significant debit card portfolio, with market-share gains in new flows, including business and value-added services, can help fend off risks from a challenging economy. The company’s business model is robust, and I am optimistic about the company’s long-term growth potential, driven by both double-digit revenue growth facilitated by increased penetration of personal consumption expenditures and the expansion of value-added services thanks to the company’s scale. I assign a buy rating to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.