Summary:

- We like the deleveraging story here and believe that investors need to ignore interest expense savings and instead focus on the freed up FCF in 2025 and beyond.

- In a few years, AT&T should be able to increase the dividend annually and buy back a considerable amount of shares each year.

- We believe that the dividend is safe and should economic headwinds arise, management would look to maintain the dividend while adjusting their target debt levels back a year or two.

Tim Boyle

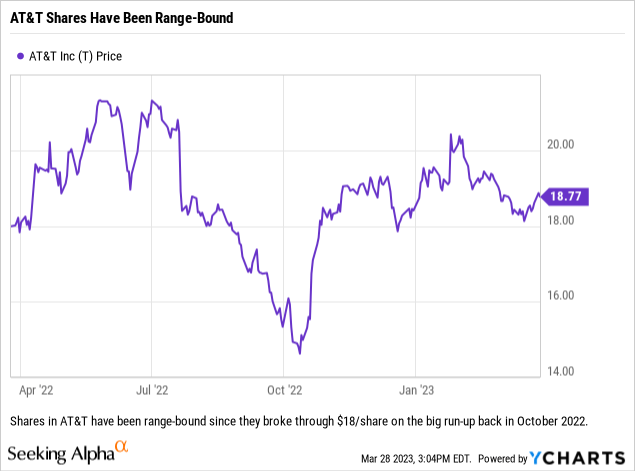

We have covered AT&T (NYSE:T) a few times over the last year, and wrote an article explaining our bullishness when sentiment was near its low (as well as the share price) for T stock. While there are some who want to discuss the company’s failings of the past, spin half truths about the large debt load or fear monger about dividend cuts, we prefer to look at the facts and invest accordingly.

This is what led us to create a cash cushion back in early March, when we went underweight financials in some of our portfolios. We exited names such as Bank of America (BAC) and Truist (TFC) which are strong financial names to be sure, but we just saw a less compelling story surrounding the industry as a whole if the Federal Reserve rate hikes were nearing a top and might not stay as high for as long. We were also seeing a lot of offerings for term deposits (that had been going on for over three months), mainly CDs, at rates that were pretty impressive – which in our mind would impact NII, or net interest income, by raising the cost of funding at the same time that it looked like the Fed might be nearing a top. In short, we thought that the margins might be coming down at the same time that borrowers were starting to feel the pinch of higher interest rates.

That was the logic behind the portfolio rebalancing, but the timing was purely luck. During the few days that we were sitting on cash and deciding where we would deploy it, the entire financial system began to take hits with a real fear of bank runs and some banks getting taken over by regulators. So until yesterday we had mostly sat on our cash positioning and just nibbled at certain names to allow us to build up to full positions. However, we still had the need to deploy a decent allocation and have been trying to decide where we wanted to seek shelter while this storm plays out.

So Why AT&T?

AT&T is not a financial, so wondering why we would use AT&T as one way to deploy funds as we reallocate is fair. While banks tend to do well in rising rate environments as net interest margins increase, we think that AT&T might be able to benefit by the inverse of that. Due to the fact that AT&T already is levered up, and that most of that debt is in fact fixed-rate (which we covered in this article discussing the company’s debts in detail), we think that the deleveraging story is somewhat equivalent to having financial exposure. Cash flows should increase as debt is paid down (marginally), and as we have discussed previously AT&T does have the ability (if they wanted) to simply pay off their maturing bonds in whole rather than rolling them. We doubt that happens as the company will probably want to stay in front of debt investors, but we suspect that they will issue shorter paper. Note: We have seen them in the commercial paper market issuing 300+ day paper in size, which seems to back up this thinking. Also, AT&T could look to repurchase bonds trading at a discount prior to maturity. So while not a financial, due to the financial engineering that the company can do, we do not mind adding this name to some of these client portfolios.

The financials we sold paid decent dividends, and while we were able to either collect the dividends, or qualify for the dividends, ahead of our sells, these portfolios do need to have that income replaced. So while we are giving up volatility by making this shift, we think that AT&T’s dividend and potential upside over the next year or two will be enough to keep performance on par with what we were previously estimating – even if financials make a full recovery. The key to this is AT&T not falling off of a cliff, as the sale (and lucky timing) of the financials has given us a big head start when comparing returns.

Looking Forward

Over the next two years investors will see AT&T pay off over $30 billion in debt if everything remains on track with management’s 2.5x leverage target for 2025. This will see the company significantly deleverage the balance sheet. If interest rates remain elevated, any debt that the company decides to not retire and roll will have a higher cost (although there are a couple of maturities with high coupons that could be rolled at what we estimate to be lower rates). The savings are not going to huge, as much of this debt is low coupon issuance, however the key is the free cash flow that will come available after this deleveraging period. If AT&T is deploying over $15 billion in free cash flow towards debt retirement/maturities each year, once they reach their desired debt levels they will then be able to utilize the free cash flow for more shareholder friendly items; such as share buybacks and increased dividends.

The Trades

We have purchased AT&T shares in income portfolios and some growth portfolios (those which have clients not needing to load up on risk) over the last two days. While the reasoning behind using AT&T in an income portfolio is pretty straight forward, the fact that we utilized funds in growth portfolios might strike some as odd. We allocated funds to AT&T in some of the growth portfolios as a way to de-risk part of our equity allocation while also keeping in mind that due to AT&T’s yield, it will enable us to open up the universe of growth stocks (to include those that do not pay a dividend) and focus on where the best value/bang for our buck is. Even if we decide to utilize a stock which does not pay a dividend, if given around the same allocation as AT&T in the portfolio, then the portfolios would still be yielding roughly the same after these trades as they were before the sale of the financials.

Final Thoughts

“Sometimes it is better to be lucky than good” is a quote that holds true in any market. While we had been looking at the financial exposure for some of our client portfolios for some time, we were lucky to have decided to finally pull the trigger on the sales when we did. It was not perfect timing, we did not get out at the top, but the fact that some major losses were averted is a huge win. Now, being able to reinvest those proceeds into a name which we think should not trade below $20/share and having 20-25% potential upside while collecting almost 6% on a dividend seems like another win. Sure, those financial names could come roaring back, but even if they get back to the levels where we were sellers, we are playing ahead as we received the dividends paid by those banks plus we are now positioned to collect AT&T’s dividend as well.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We own T in personal and client portfolios and continue to buy it in various portfolios as cash comes in.