Summary:

- AT&T’s sale of its 70% stake in DIRECTV is a strategic move to reduce debt and focus on core strengths, benefiting shareholders.

- This transaction will lower AT&T’s net leverage and EV to EBITDA multiple, making it a net positive for the company.

- The sale, valued at $7.6 billion, marks the end of a challenging era and allows AT&T to streamline its operations.

- Investors should watch for AT&T’s Q3 2024 results on October 23rd, focusing on guidance, revenue, and earnings metrics.

Anne Czichos

September 30th was a really interesting day for shareholders of telecommunications conglomerate AT&T (NYSE:T). This is because the company entered into an agreement to sell off the 70% ownership stake it still controls in DIRECTV in a multibillion-dollar transaction. This marks the end of what has been a very challenging ownership of the business by AT&T. Ultimately, it’s clear that this was a major mistake by management years ago. Truly, it has been a big source of concern amongst investors. But now, this gives the company the opportunity to focus on what it’s really good at while simultaneously reducing debt even further.

The ultimate impact of this transaction is something that investors will have to wait for management for. After all, only they will be able to provide a truly comprehensive look at AT&T without DIRECTV. Having said that, I believe that this transaction is for the better of investors. Based on my own analysis, this will reduce the company’s net leverage. It will also cause the firm to trade at a slightly lower EV to EBITDA multiple compared to what it would trade at without this transaction. When you add these things together, I struggle to see how this is not a net positive for the business.

On a personal level, I also have to say that I feel relieved. After all, I do own a decent amount of stock in the business. As of this writing, it accounts for roughly 9.5% of my total portfolio. And in recent months, things have gone quite well. Since I last reaffirmed my ‘strong buy’ rating on the stock in late July of this year, shares are up by 14.6% compared to the 6.7% increase seen by the S&P 500 over the same window of time. And over the past year, the stock is up 50%. This doesn’t mean that the picture can’t change for the worse. As new data comes in, investors should adjust their holdings accordingly. It just so happens that, before the market opens on October 23rd, management is expected to announce financial results covering the third quarter of the company’s 2024 fiscal year. Leading up to that point, investors should know what to keep an eye out for when data does come out. But absent something significantly negative coming out of the woodwork, I think that keeping the company rated a ‘strong buy’ is logical.

A big move to end an era

It was less than a decade ago that the management team at AT&T ended up acquiring DIRECTV in a transaction valued at $48.5 billion. If we include net debt in the picture, the valuation swells to $67 billion. The hope by management was that they would be able to turn the company into a thriving enterprise. But unfortunately, that failed to materialize. Changes in industry conditions, combined with a management team that was overwhelmed by a bulky and inefficient conglomerate, ended up resulting in millions of users lost. Over the past few years, management has been working to reinvent the business. This has included selling off significant assets such as WarnerMedia to create Warner Bros. Discovery (WBD), as well as smaller assets such as anime streaming service Crunchyroll and Playdemic Ltd.

Over the past few years that this has been going on, I have followed the company very closely. I have not done a full tally of all the companies that I have written about. But AT&T seems to be the company that I have written the most about if we ignore the industrial conglomerate once known as General Electric that has since been broken up in a similar fashion. Given all of the changes that AT&T has made over the years, I don’t know how many more substantive assets the company could possibly sell off. But honestly, that’s a good thing. This is because, as I have detailed in prior articles like here and here, the company is making interesting moves, and it has quality assets that should create increasing shareholder value in the long run.

Regarding the most recent development, it is worth noting that, back in 2021, management formed a new company called DIRECTV with TPG as its partner in that endeavor. In exchange for contributing its US video operations to that new venture, the firm received $7.60 billion worth of cash. It was also able to transfer $195 million worth of debt into that new business. There were other aspects to the deal as well. But the important thing to remember is that the transaction valued the new enterprise known as DIRECTV at $16.25 billion. It also resulted in AT&T retaining a 70% ownership interest over the firm.

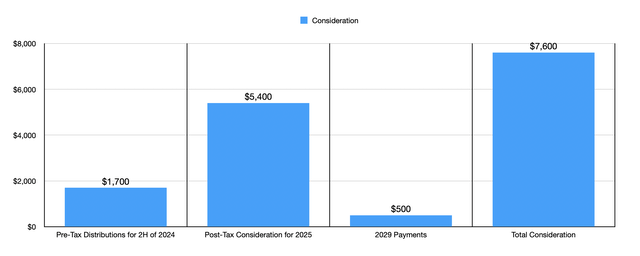

When that transaction occurred, it was agreed upon that AT&T would not sell its ownership stake in the business for three years. It just so happens that this three-year window ended on July 31st of this year. Taking that into consideration, I don’t find the timing of this arrangement to be terribly surprising. In exchange for selling the 70% ownership in DIRECTV to TPG, AT&T will receive total cash payments of $7.60 billion. The base purchase price for the 70% in question is $2 billion. However, the rest of the amount is in the form of cash distributions.

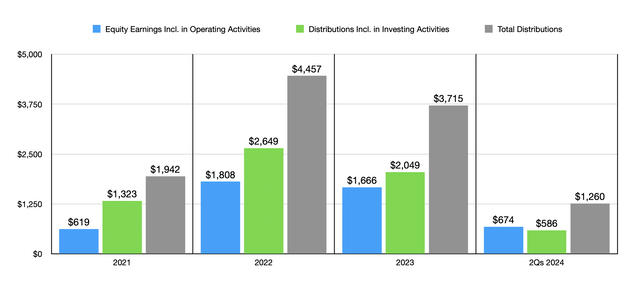

While this might seem like a disappointing end considering the value assigned to DIRECTV just a few years ago, it is important to point out that, since the initial closing of its transaction with TPG, AT&T has received approximately $19 billion, or $18.97 billion according to my math, in cash from this arrangement. This includes the aforementioned cash amount paid back in 2021. However, it also includes $4.78 billion of distributions that were attributable to the company because of earnings included in equity in net income from the arrangement. In addition to this, the conglomerate also received $6.61 billion worth of distributions that were in excess of this that fell under its investing activities a portion of its cash flow statement.

For this particular transaction in question, the $7.6 billion will be broken up into a few different categories. First, it will include $1.7 billion, on a pre-tax basis, of quarterly distributions covering the second half of this year. Another $5.4 billion, which will include other guaranteed distribute and the base purchase price that TPG is paying for the 70% ownership stake, will be paid throughout 2025. The final installment of $0.5 billion, meanwhile, will be broken up into four equal quarterly installments that will be paid to AT&T in 2029. In the event that either party backs out of the deal, there are certain circumstances where they individually could be responsible for up to $2 billion worth of damages that the other party incurs. But hopefully, that won’t come to pass.

The full impact that this transaction will have on AT&T is currently unknown. Based on my own assessment of the picture, however, the transaction should boost EBITDA by approximately $500 million on an annualized basis. This is based on $250 million of retained costs that AT&T incurred in the first half of this year. In calculating the impact to operating cash flow, the situation is more complicated. We do know that, for the first half of this year, the conglomerate saw $674 million in distributions classified as operating activities from its ownership of DIRECTV. If we annualize this, and factor in the tax rate that the company saw during the first half of this year, we should see a reduction in operating cash flow of about $1.04 billion. Assuming that management uses the cash proceeds to pay down debt that mirrors the 4.2% annualized rate that the firm’s current the book of debt has, that will add back about $247 million in interest expense. Management’s the current guidance calls for operating cash flow, at the midpoint this year, of about $39 billion. When you run all of these numbers, you end up with about $38.2 billion on a pro forma basis.

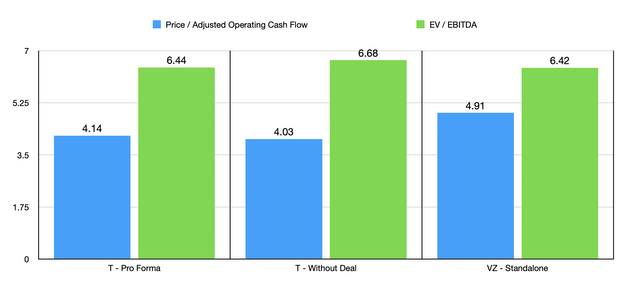

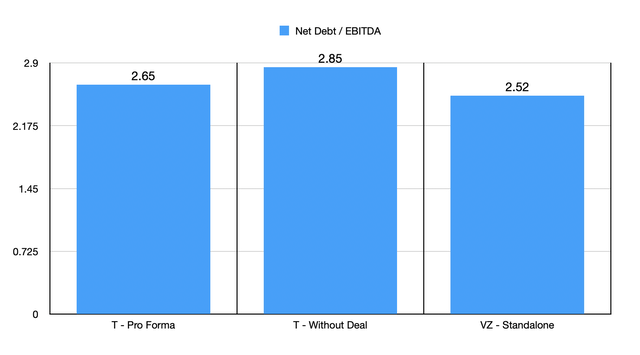

Using these estimates, we can see in the chart above how shares of AT&T are valued on a pro forma basis. We can also see how the company is valued without this transaction occurring. The chart also illustrates what rival Verizon Communications (VZ) is currently valued on a standalone basis, which excludes any potential changes coming from its recently announced acquisition of Frontier Communications Parent (FYBR). As you can see, the companies are priced very similar now. However, on a price to operating cash flow basis, AT&T is still cheaper.

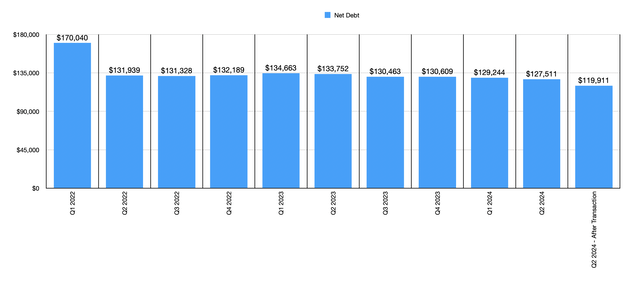

Another benefit to this transaction is that AT&T should experience a reduction in its overall leverage profile. In the chart above, you can see the net debt of the company for the past several quarters, including what I estimate on a pro forma basis for this transaction. This does not factor in any cash flows the company might have generated for the third quarter that we are at the tail end of. And it does factor in the $500 million that the business will receive from this transaction in 2029. Ultimately, we should see a reduction in its net leverage ratio from 2.85 to 2.65. That’s within striking distance of the 2.52 that Verizon Communications currently has. To put this in perspective, in order for the two companies to have a net leverage ratio that’s the same as one another, AT&T would need to reduce its overall net debt by only $6 billion.

A look at upcoming results

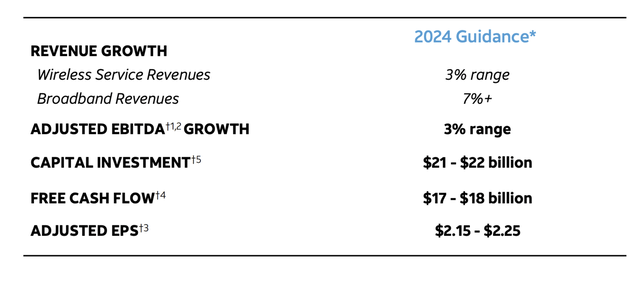

Based on the data provided, I would make the case that this transaction is ultimately a positive one for AT&T and its investors. Obviously, since I own stock in the company, I still remain very bullish. But of course, investors would be wise to train their eye on the future. The fact of the matter is that management is just about to come out with new data covering the third quarter of the 2024 fiscal year. That is expected to occur before the market opens on October 23rd. The first thing that investors should be paying careful attention to is guidance. Big changes often necessitate changes in guidance. At present, though, as you can tell from the image below, management is forecasting operating cash flow for this year, at the midpoint, of about $39 billion. They also expect EBITDA for 2024 to be about 3% higher than it was last year. That would be approximately $44.70 billion.

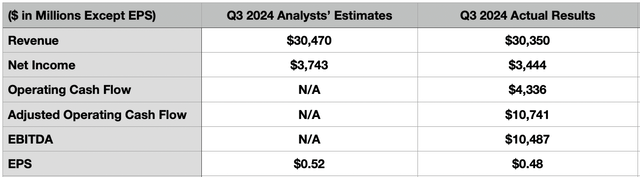

Outside of these guidance figures, investors should also be looking at what management reports for key metrics like revenue and earnings. At present, analysts expect revenue of $30.47 billion. If this comes to fruition, it would be slightly above the $30.35 billion the company reported the same time last year. Earnings per share, meanwhile, are expected to climb from $0.48 last year to $0.52 this year. This would imply an increase in net income from $3.44 billion to $3.74 billion. There are other important profitability metrics that investors should pay attention to. Analysts do not provide estimates for those. But in the table below, you can see what they were for the third quarter of 2023.

Takeaway

Fundamentally speaking, I think that AT&T is most certainly on the right track. The company has done incredibly well as of late, and this latest maneuver only empowers it to focus more on its core assets. Of course, we should be looking at new data that does come out in the coming days. But given how cheap the stock is and the impact this should have on leverage, it’s difficult to be anything other than bullish in my book.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!