Summary:

- AT&T is focusing on substantial shareholder returns through fiber and 5G expansion, aiming for 50 million fiber locations and significant market penetration by 2029.

- The company plans $22 billion annual capital investment, targeting 3%+ annual adjusted EBITDA growth and $18 billion+ FCF by 2027.

- AT&T’s shareholder return plan includes $20 billion in dividends and $20 billion in share repurchases, implying double-digit annualized returns.

- The company has dramatically improved its balance sheet, reduced net debt by $25 billion, and maintains a dividend yield of over 4.5%.

jetcityimage

AT&T (NYSE:T) is continuing its strong run, which we last talked about here, as the company continues to focus on overall shareholder returns. The company has had multiple “shareholder return” plans in the past, after a number of major and subsequently spun-off acquisitions such as TimeWarner and DirecTV. The company also had to invest in debt cleanup and 5G.

Despite all this, the company has cleaned up its position substantially, with an impressive asset portfolio. We see this shareholder plan as justifying substantial growth and investment in the company from its present size.

AT&T Largest Fiber Network

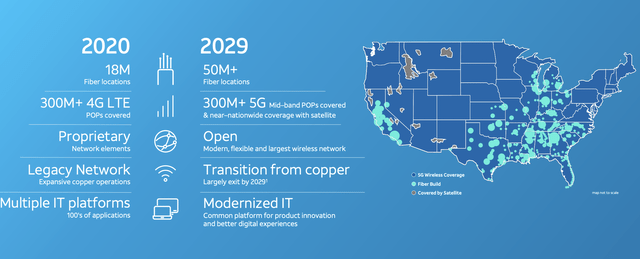

AT&T has rapid expansion planned over the next several years, especially versus where it was in 2020.

The company plans to move past 50 million fiber locations, with 300+ million people covered by 5G mid-band. The company will have an open-source modern wireless network and effectively completely exit the more expensive to maintain and dying copper network. The company’s modernization here will enable it to both grow revenue and reduce costs.

45 million of these fiber locations will be owned by the company, while 5 million will be through its joint venture with BlackRock. It’s a massive portfolio that will enable the company to hit additional economies of scale.

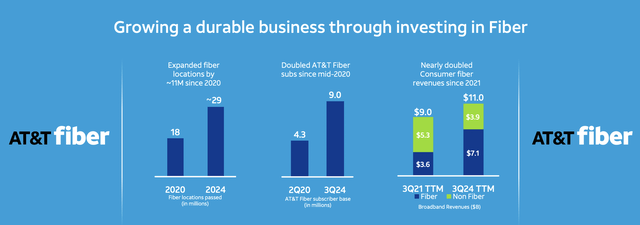

The above chart shows how the company’s growth is combining with increased market penetration to grow revenues. In 2020, the company had 18 million locations with a subscriber rate of just under 25%. Now the company has had 50% location growth but more than 100% subscriber growth as the company’s subscription rate has passed 30%.

That has enabled the business’ revenue to grow substantially despite a massive decline in non-fiber revenue. As fiber continues to grow, 50 million locations with increased market penetration could indicate another doubling of customers going into 2029, making the business’ TTM revenue more than $14 billion.

AT&T 5G

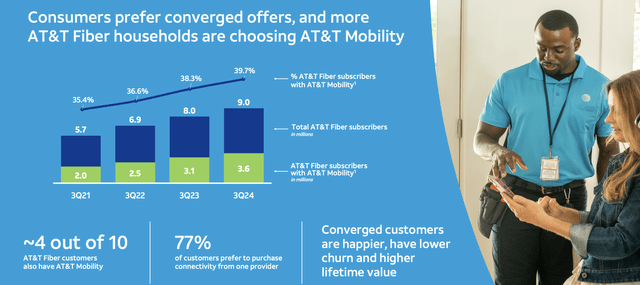

At the same time, the company is working to improve synergies between its business units.

The company has not only managed to grow fiber subscribers rapidly, as we discussed above, but fiber describers are much more likely to combine and use AT&T for cellular services. That % has grown from 35% to almost 40%, again a double-whammy that combined with fiber growth helps to grow the company’s subscribers even faster.

As we discussed above, with the company’s potential 2029 subscriber count approaching 20 million that could help the mobility business, especially if the company can keep growing that ratio towards 45-50%.

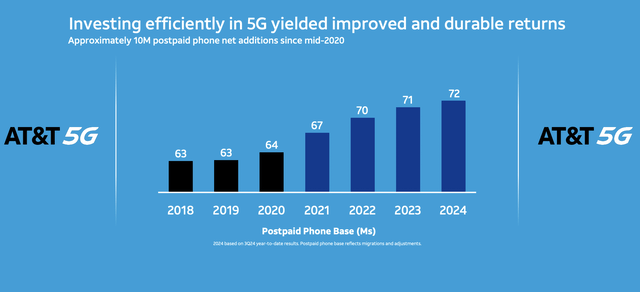

Overall, the company has continued to grow its cellular business as the company has rolled out 5G. With virtually no additions from 2018-2020, the company has grown more than 10% from 2020-2024, primarily due to big boosts in the 2020-2022 timeframe. Declining requirements for 5G growth along with continued growth help the company here.

AT&T 2025-2027 Growth Targets

Putting this all together, the company has ambitious targets for 2025-2027, while focusing on shareholder returns.

The company plans to spend $22 billion a year on capital investment, resulting in 3% or better annual adjusted EBITDA growth. The net result is the company expects $18 billion+ in annualized FCF by 2027, a double-digit FCF yield on its current share price, with continued growth past that level. The company is investing more than enough capital to continue its growth with strong returns.

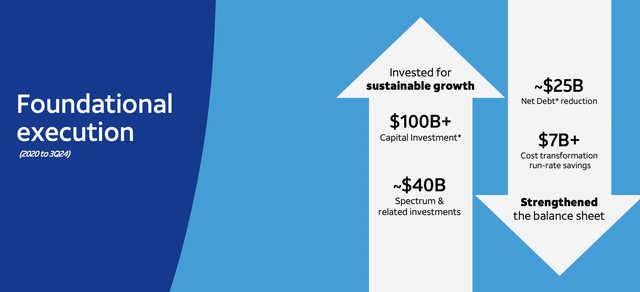

The company has an almost 5% dividend yield and from 2020 to 3Q 2024 invested ~$140 billion in its business. That massive investment resulted in lower shareholder returns directly, but enabled the company to position itself incredibly well. The company managed to reduce net debt by ~$25 billion and cut its expenses by more than $7 billion.

The company has positioned itself much better as a result, and it’s able to cut its capital expenditures going forward.

AT&T Shareholder Return Plan

Putting it all together, AT&T has the ability to drive substantial shareholder returns going forward.

The company’s base returns for the 3-year period will be $20+ billion in dividends. Its current dividend costs it ~$7.7 billion annually, ~$23 billion over the next 3 years. This implies minimal dividend growth, but at a dividend yield of more than 4.5%, the company does not need to increase dividends. The company also retains $10 billion in incremental flexibility.

That could enable it to grow further should it choose to. The company also plans $20 billion in share repurchases, a potential double-digit reduction in outstanding shares that could save it $1 billion in annualized dividends. That, combined with the dividends, implies double-digit annualized shareholder returns.

That’s impressive for a company that’s continuing to grow, highlighting how it’s a valuable investment.

Thesis Risk

The largest risk to our thesis is “shiny object syndrome”. The company has acquired and spun-off multiple companies, losing billions each time. The company needs to show an ability to stay true to a plan, repurchase shares, and drive real shareholder returns for years at a time, rather than getting carried away.

Conclusion

AT&T has an impressive portfolio of assets, and the company appears to be finally figuring out what’s working. The company is chasing a combined strategy of fiber plus mobility, with a number of stacked growth engines. Fiber locations are growing, fiber market penetration is growing, and mobility subscribers as a % of fiber customers are all growing.

The company has cleaned up its balance sheet dramatically and retains the capital flexibility to continue its large investments. The company is continuing its dividend yield of more than 4.5% and discussing bringing back share repurchases. We see this as having the potential to generate substantial profits and would like to see the company undergo them.

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.