Summary:

- AT&T’s joint venture with BlackRock, GigaPower, LLC, provides the company with a way to grow outside of its core geographical area in a cost-effective manner.

- The JV benefits both, but should help AT&T keep deleveraging its balance sheet while gaining new customers as roughly $1.5 billion in network buildout is completed by GigaPower, LLC.

- Regulators should bless the deal, as it has the potential to bring fiber to underserved areas and could also open those same areas up to competition.

Tim Boyle

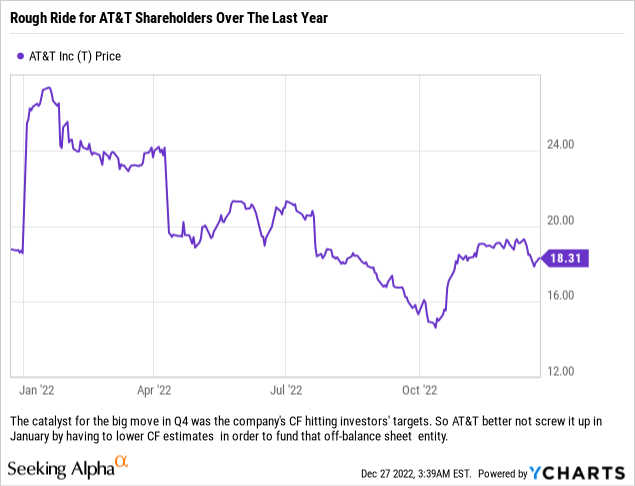

We have made no secret of our bullishness for AT&T (NYSE:T) shares in recent months, having written two articles about the company. Our overall investment thesis rests on the debt and dividend, which we covered in depth in ‘AT&T: The Real Story Behind The Debt And Dividend’. Our other article focused on trading out of a winner in an income portfolio and reinvesting the proceeds into AT&T.

When it comes to AT&T, one constant theme that both retail and institutional investors discuss is the company’s abysmal track record as it pertains to deals. Over the last 20-30 years, one can look back at a number of deals that led to serious losses for shareholders. Making matters worse, in some cases management pulled the plug too quickly and sold assets to others who actually profited handsomely. So in short, historically AT&T has done a poor job of investing shareholders’ money and basically everyone in the market knows, or is at least aware, of this.

With that said, we were pleased to see the press release that AT&T and BlackRock put out on Friday December 23, 2022. While the timing was a bit odd, it being the Friday before a holiday when most everyone was out of the office, maybe it was a bit of an early Christmas present for shareholders.

So What Was Announced?

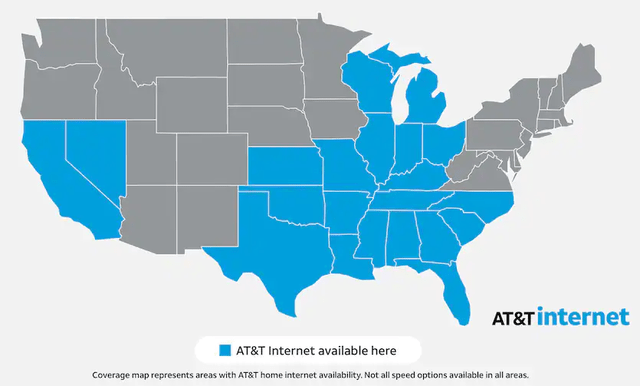

AT&T and BlackRock’s BlackRock Alternatives, via the Diversified Infrastructure business, have agreed to form a joint venture to build a best-in-class fiber network. This joint venture will be called Gigapower, LLC and will focus on territories outside of AT&T’s traditional wireline service footprint (which is in 21 states in the Southeast, Midwest and West Coast). The joint venture will be structured so that it is jointly owned and governed by AT&T and BlackRock and the network will serve as a commercial operator, with AT&T as its first customer.

The goal is to have 1.5 million customer locations across the nation by what appears to be 2025. This will be incremental to AT&T’s current target for 30 million+ fiber locations by 2025.

Importantly, it was not announced what the cash flow implications for AT&T would be, or how the joint venture would be set up (such as who is contributing what to the partnership).

Why This Makes Sense

AT&T and its peers have a desire to have higher margins. Laying fiber is expensive, so if AT&T can essentially lease a network and pay for its usage, they could create solid margins in areas which ordinarily have not so great economics. This joint venture makes a lot of sense on a few levels. First, BlackRock’s infrastructure funds are always looking for interesting deals with solid cash flows. While this is not a sale-leaseback transaction, we think that it might have some similarities because you have one group with money and another needing an asset to operate. If BlackRock provides the bulk of the capital, and AT&T is the initial customer, then the transaction looks a lot like BlackRock is buying a stream of cash flows while AT&T is selling a stream of cash flows for something upfront (like an equity stake in Gigapower, LLC by putting in less money upfront).

The move will also enable AT&T to potentially offer current business customers more services in areas not currently serviced by fiber at all of their locations. For instance, a business with locations in Wisconsin, Illinois and Iowa might use AT&T at their Wisconsin and Illinois locations, but a competitor at the Iowa locations. If Gigapower happens to build part of its network in Iowa and it passes those locations, AT&T is then able to easily sell a current client on simplifying their fiber needs across the business and getting a larger portion of that customer’s spend. We suspect the majority of the network will be built in low-density areas, so competition from incumbents will be low and their networks might already be outdated. Letting Gigapower focus on blue sky or greenfield expansion build will allow AT&T to continue to deleverage the balance sheet, expand in a responsible manner and create a business with respectable margins in parts of the country which historically have lower margins.

Having AT&T as a customer will help Gigapower early on, but so too will funds from the government to build out this network. Based on the description in the press release, we suspect that a large portion of the network will be located in areas qualifying for government subsidies for the buildout.

There are many attractive areas outside of AT&T’s core 21-state market – especially in the Midwest and Northeast areas. (AT&T)

Why Regulatory Issues Might Not Be An Issue

As we said before, Gigapower’s network is going to be a state-of-the-art commercial network, and while AT&T will be the first customer, the idea is for the network to be open to other ISPs to sell fiber services. We think that regulators will look at this deal as a net benefit to consumers as Gigapower will be providing underserved markets with two key items:

- fiber access via their fiber network

- potentially numerous competitors offering various price point entries via competition and some players being able to operate on lower margins

Getting fiber/broadband access to areas of the country without service is one key area of focus for the current Administration, but the cherry on top with this deal is the network enables not only AT&T to enter a market, but numerous other competitors too (if they chose to enter the market and utilize the network). Gigapower leases to everyone, so the government should not have a problem with AT&T teaming up with BlackRock on this deployment – especially if it enables broader high speed internet deployment and possibly further 5G deployment in less populated areas.

Why This Could Be A Winner For AT&T

First off, AT&T is not going to be consolidating Gigapower’s results on its own balance sheet. So essentially AT&T gets to have a 1.5 million location buildout occur without having to fully pay for it or show additional debt on its balance sheet. Assuming that Gigapower was able to deploy its entire initial 1.5 million location buildout across multiple states and keep the cost down to $1,000 per location, then the total network cost is going to come in around $1.5 billion. Certainly not a figure that AT&T shareholders would like to be added to the debt stack, but certainly a number that is theoretically possible for the joint venture to finance with an infrastructure fund partner kicking in cash and a large operator signing a first lease.

Depending on where these networks are built, AT&T might be able to grab additional wallet-share of current clients via the new territory, or could grab new customers altogether who have operations in these new territories as well as locations in AT&T’s historical footprint.

Bottom line: AT&T essentially gets to build the network for pennies on the dollar upfront, pays for use of the network moving forward (while keeping some of those fees due to its ownership), gets to depreciate the fiber assets (on Gigapower’s balance sheet) and benefits from other ISPs paying fees to utilize the network. All while avoiding adding at least $1.5 billion in debt.

AT&T is looking at this as a pretty cost effective way to open up new territories while BlackRock sees the opportunity to line up their first customer for a deal that is significantly de-risked because they have a big tenant for their network and will be creating value on day one for their investors.

Our Thoughts

Based on what was announced, our first reaction is that we like this deal. We actually like it from both sides as this is an infrastructure play which makes sense for both AT&T and BlackRock. We suspect that AT&T will provide further details when they announce Q4 results in early 2023, and it is probably at that time that we will see the impact, or maybe even impacts depending on the deal’s structure, to AT&T’s previous guidance on cash flow. That is what truly matters to investors, and with our back of the envelope calculations we suspect that investors will like the economics of this deal when management does a deep dive on expected annual outflows and initial investment requirements.

This deal will not move the needle for the company in any meaningful way over the next few years, but more importantly will enable the company another avenue for responsible growth with potential dividends to be paid down the road after that responsible growth is achieved.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We own T in personal portfolios and Client portfolios. Could trade shares in the company at any time over the next 0-84 hours.