Summary:

- AT&T Inc. had a strong Q4 from a free cash flow perspective, the single number that matters for the company’s business.

- The company is continuing to invest heavily within its business and has a number of exciting developments, including its fiber business.

- The company’s largest variable is whether it can continue to generate FCF and improve its balance sheet without shiny-object management getting overexcited.

Brandon Bell

AT&T Inc. (NYSE:T) has recovered almost 40% from its 52-week lows. However, the company continues to have a market capitalization of barely $150 billion, with a substantial debt load and investor concerns over its almost 6% dividend yield. As we’ll see throughout this article, AT&T’s earnings show a continued ability to generate shareholder returns.

AT&T Business Accomplishments

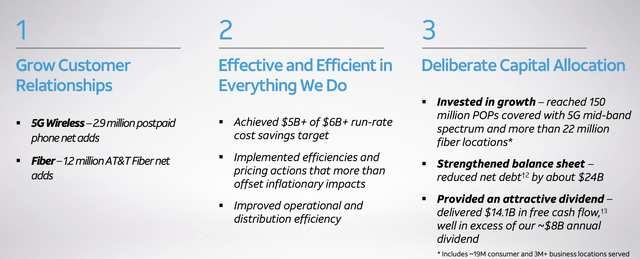

AT&T has continued to drive some substantial accomplishments across its business portfolio with its revamped goals.

The company managed to add 2.9 million postpaid phone customers, a strong improvement in a relatively stagnating business. More importantly, the company managed to add 1.2 million AT&T Fiber net customers, enabling the company to add roughly billions to its annualized revenue. These additions are continuing to support the company’s long-term businesses.

AT&T Inc. is continuing to achieve its cost savings targets while looking to improve efficiency across its business. The company’s 5G mid-band spectrum now reaches 150 million people along with 22 million fiber locations. The company is spending billions if not $10s of billions trying to build out this capacity. It’s also managed to reduce its net debt by $24 billion.

The single most important number for the company is $14 billion in FCF and a $8 billion in dividends, generating an almost 6% yield.

AT&T Fiber

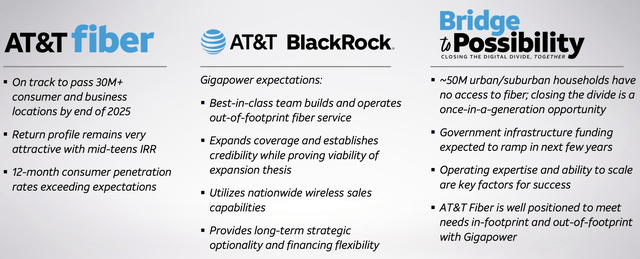

AT&T has a once-in-a-generation opportunity to build out a massive new business for the long term.

AT&T Inc. is rapidly building out its fiber network, but it’s a slow and expensive project. However, the company is doing well here. It’s growing its market share in established businesses and is still on track to pass 30+ million locations by YE 2025. The company is correct in highlighting that ~50 million households don’t have a connection and it’s a unique opportunity.

We expect that the company’s substantial and focused investments here will enable it to capture large portions of this market, building up a substantial base of long-term revenue.

AT&T 4Q 2022 Results

The company generated strong results through the 4Q 2022, highlighting the company’s ability to continue performing despite concerns from analysts.

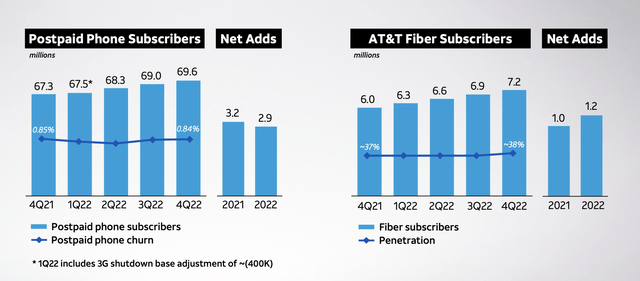

The company added 2.9 million prepaid phone subscribers through the year, although with a 400k loss from shutting down 3G. That gave the company slight YoY growth, which is exciting to see. The company’s ability to maintain a strong business here in the face of growing competition and a changing economy reaffirms our belief that the company will see strong baseline earnings for the long run from this division.

The company’s fiber division, of course, is much more impressive. As we’ve discussed before, top line subscriber numbers are of course important, but what’s more important is the company’s penetration statistics. There’s no point in building a fiber business that no one wants to sign up for, especially if you’re focusing on lower cost mediocre locations.

Here, despite rapidly ramping up location counts, the company’s penetration number has ticked up slightly YoY to 38%. The company added more than 1.2 million customers, for more than $1 billion in new annual revenue, with total fiber locations crossing 15 million. The company remains on track to double this in the next 3 years.

We expect penetration will allow total customers to grow faster than locations, adding $10 billion in additional annual revenue.

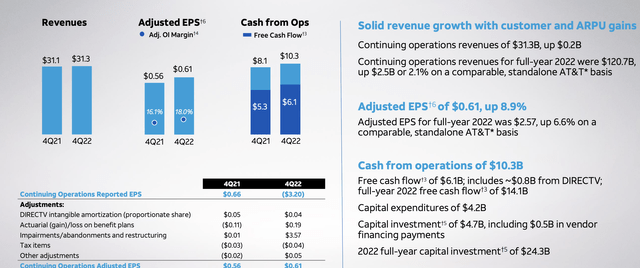

Financially, the company had a strong quarter. It earned $31.3 billion in revenue with $0.61 in adjusted EPS. Margins remained strong at 18%. The company earned $10.3 billion in CFFO and a very strong $6.1 billion in free cash flow (“FCF”). The company’s FY FCF was $14.1 billion, enough to cover its dividend comfortably and leave additional FCF.

The company’s business investments remain strong at $4.2 billion in quarterly capital expenditures and $24.3 billion in annual FY capital expenditures. Those investments will continue to support strong business growth.

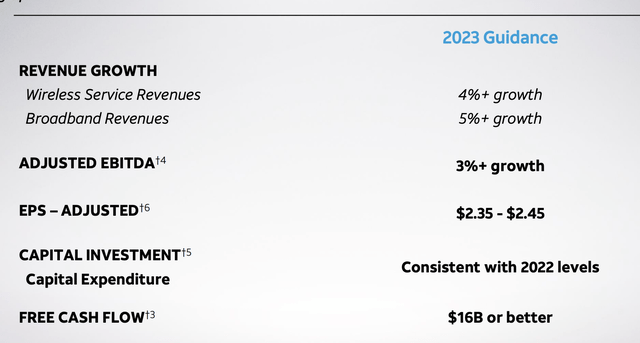

AT&T 2023 Financial Guidance

The company’s guidance for 2023 represents a continued ability to drive shareholder returns.

The company expects roughly 4-5% top-line growth translating to 3% adjusted EBITDA growth. The company’s $2.4 EPS will give the company a P/E of about 8. The company’s net debt still sits at a hair just over $130 billion. The company expects FCF of $16+ billion above 2022 levels, and leaving the company with roughly $8 billion to spare after debt.

Keen graduates of elementary school math will be able to observe one of the company’s key problems. The dividend yield of almost 6% might be secure, but even if all remaining FCF goes to the debt, that’s a decline 6% / year, meaning a 16-year payoff. Fortunately, that’s post interest, but it still goes to show the company’s massive debt load.

Before we were okay with the company avoiding paying off its debt for dividends and share buybacks. Now, however, the writing is on the wall. Investors clearly aren’t going to be re-rating the company until it solves its debt load drastically, and in a rising interest rate environment that debt is potentially $10 billion / year in interest.

The company needs to be patient and spend, frankly, the rest of the decade, paying off that debt. The numbers are promising. The company, assuming the only FCF growth is interest savings, could pay off $76 billion in debt over the next 8 years, taking its net debt load down to just over $50 billion. Its FCF will be at $20 billion from interest savings alone.

It’s worth noting that’s pessimistic, we expect the company’s almost $200 billion in capital spending by the end of the year to help here.

Thesis Risk

The largest risk to our thesis is that AT&T Inc. has remained a volatile company, uncertain about what its next steps are. It’s acquired companies and spun them off. It’s built up its debt load and then focused on canceling it. It’s announced and then cancelled share buybacks. The company’s success depends on staying to the true and narrow for the next 5-10 years.

Conclusion

AT&T Inc.’s 4Q 2022 earnings highlight that the company’s thesis isn’t over. The company has a unique portfolio of assets and it’s continuing to generate strong FCF. The company can afford its almost 6% dividend yield, and we expect it to be able to continue paying that dividend. We do expect that to make the base of the company’s shareholder returns.

The determination of whether the company is a good investment, especially in the current high interest environment, is whether it can continue to aggressively pay down its debt. We see this as something AT&T Inc. can comfortably afford, but its management has a poor history of staying true to a goal.

Let us know what you think in the comments below.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.