Summary:

- Upside Potential: AT&T’s financial review suggests a notable upside with a fair stock price of $25.15, showcasing resilience in the telecommunications company.

- Strategic Resilience: The company’s strategic strengths, including defense against industry newcomers and decent international operations, position it as a robust player in the competitive market.

- Prioritizing Profitability: Recognizing flaws, AT&T should prioritize profitability over shareholder rewards, ensuring a strategic focus on long-term sustainability.

- Adapting to Challenges: Facing challenges like the decline in legacy voice revenues and a saturated market, AT&T must continue efforts to boost efficiency and adapt to industry dynamics.

Brandon Bell

Thesis

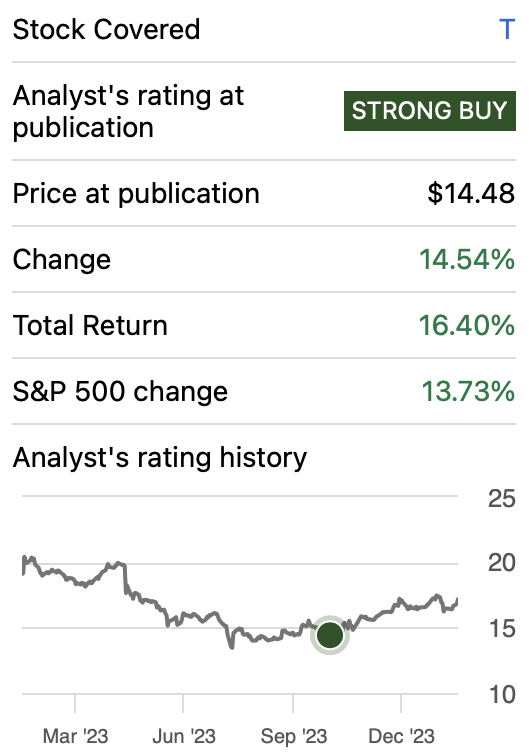

In my previous article on AT&T, Inc. (NYSE:T), I delved into various possibilities for the company. The mid-range projection indicated a fair price of $30.8, while the high-end projection suggested a fair price of $33.1. Since that article, the stock has surged by 14.54%.

In this piece, I will reassess AT&T based on the latest financial figures. As you will observe, AT&T still presents a substantial upside, with a fair stock price of $25.15. Although this figure is below the fair prices discussed in the previous article, I am reaffirming my strong buy rating on AT&T.

Seeking Alpha

Overview

In my previous article I explained that AT&T’s strengths lie in its strategic defense against new competitors in the communications sector, demonstrated by its effective response to Google Fiber. Operations in Mexico and Canada provide a significant catalysts because Canada is a wealthy country where AT&T isn’t the leader, and Mexico is an emerging economy where AT&T isn’t also the leader. This means that in both countries there is room for expansion. However, AT&T faces flaws, including its classification as a dividend stock prioritizing shareholder rewards over accumulating debt. The saturated market in which AT&T operates exposes it to potential price wars, necessitating a focus on efficiency.

Furthermore, I mentioned what already was known: revenue decline is attributed to the shift from Pay-TV to streaming services, prompting considerations to sell or merge its stake in DirectTV. Additionally, a decrease in legacy voice revenues results from the rise of Over-the-Top [OTT] voice services, impacting businesses and potentially linked to concerns about data breaches.

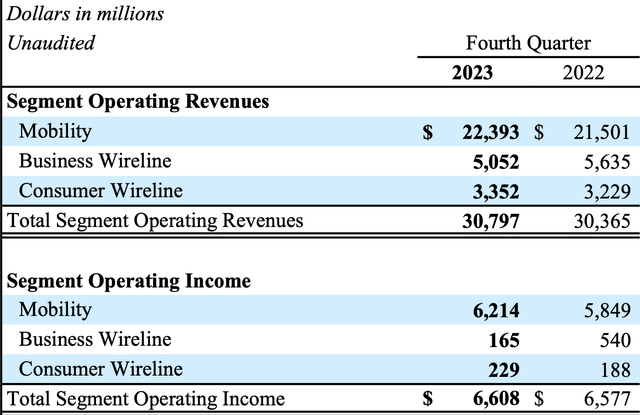

Segments

As observed, AT&T is segmented into three distinct categories. The first segment, mobility, provides wireless services and equipment. The second segment, business wireline, offers a range of services including fiber services, traditional voice, and data solutions. The final segment is consumer wireline, specializing in fiber connections and fixed telephony.

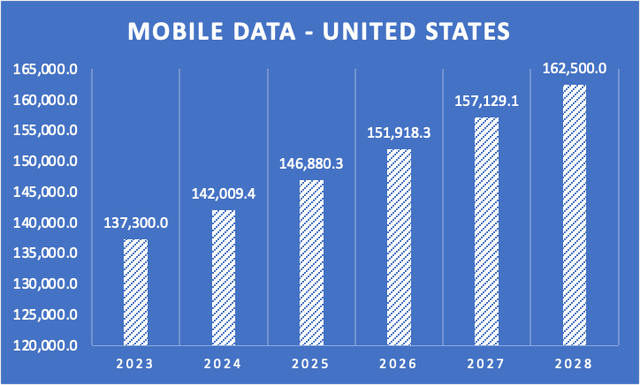

An examination of the Q4 2023 extract below reveals that mobile data and equipment (aka mobility) stand out as the primary contributors to AT&T’s revenue.

Market

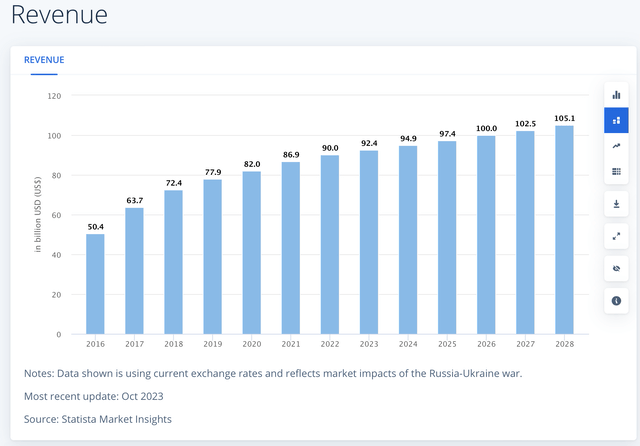

The domestic broadband market is projected to experience a growth rate of 2.61% from 2023 to 2028. Simultaneously, the mobile data segment is anticipated to grow at a rate of 3.43% over the same period.

Statista Author’s Calculations with base on Statista

Financials

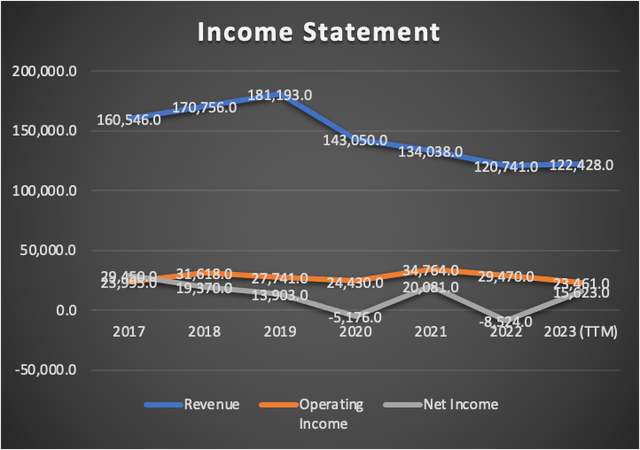

AT&T’s revenue has experienced a negative growth rate of -4% since 2017. The downturn began in 2020 during the pandemic, and despite expectations of an increase in revenue due to people staying at home, the decline persisted.

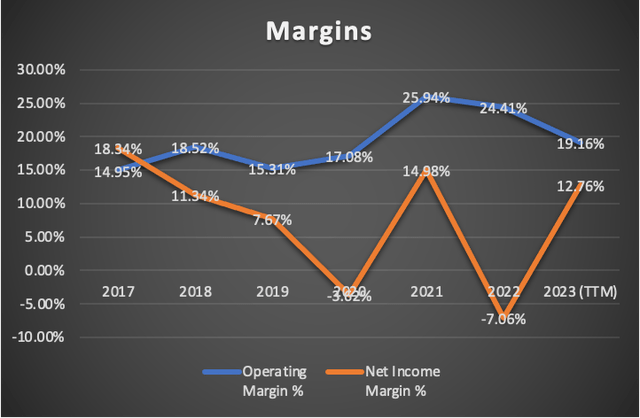

From Q2 2023 to Q4 2023, revenue showed a marginal change of 0.85%. Operating income witnessed an increase of 2.18%, while net income faced a more substantial increase of 79%.

Margins increased, with the net income margin increasing from -7.22% to 12.76%. Meanwhile, operating margin decreased from 23.02% in Q2 2023 to 19.16% in Q4 2023.

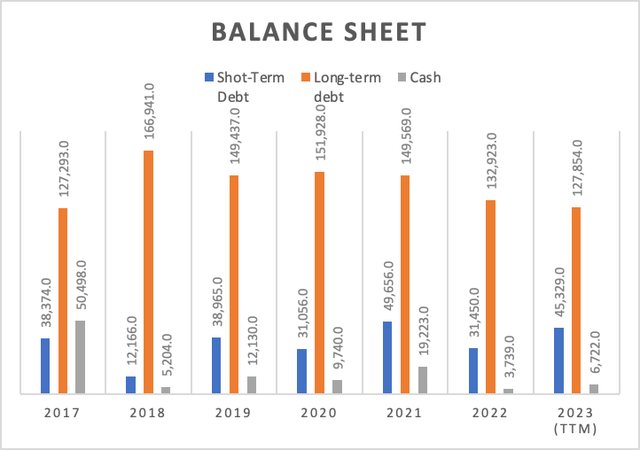

An analysis of the debt decrease since 2020 indicates an annual reduction of 5.2% in long-term debt, potentially leading to around $97-102 billion in long-term debt by 2028 if the pace is maintained.

Regarding the evolution of debt since my previous article, long-term debt has increased by 0.15% compared to Q2 2023, and short-term debt witnessing a significant 9.75% increase. However, cash reserves also increased by around 30.6%.

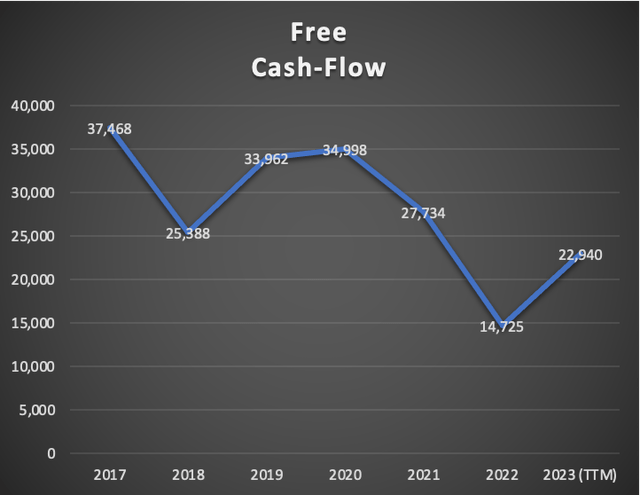

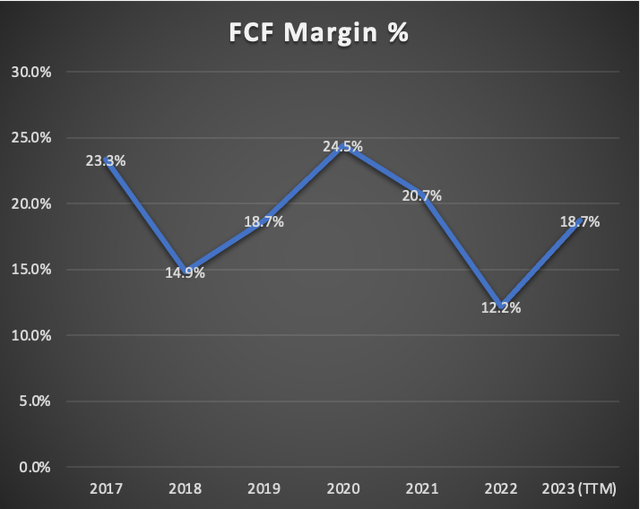

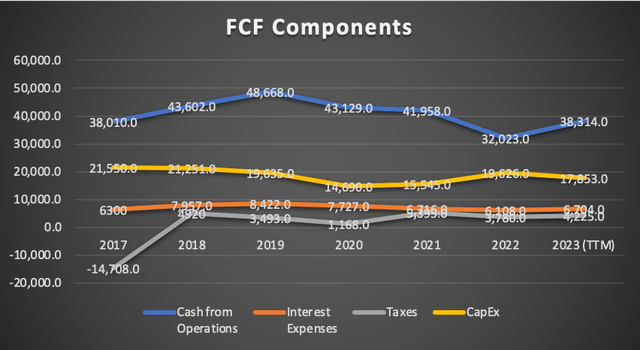

Despite challenges, free cash flow remains robust, with AT&T currently generating $22.9 billion on a trailing twelve-month basis. This reflects a commendable increase from Q2 2023 of approximately 9.5%. The free cash flow margin also stands at a respectable 18.7%, marking an improvement from Q2 2023’s 17.3%. Furthermore, the company is spending around $8.1 billion in dividend payments, if you subtract that, you will get that the company still has around $14.8 billion of cash flow available.

Author’s Calculations Author’s Calculations Author’s Calculations

Valuation

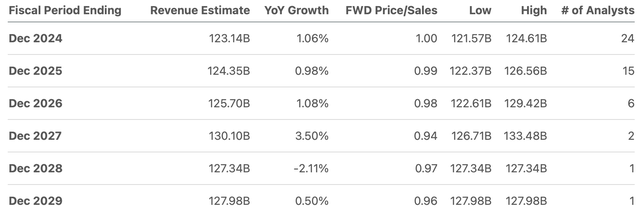

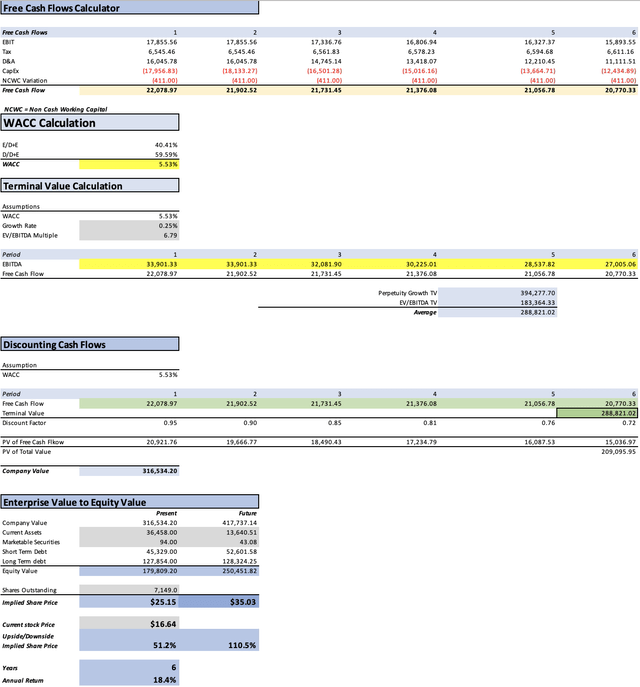

The financial projections for the company indicate a revenue of $123.14 billion for FY2024, with an expected increase to $124.35 billion for FY2025. The EPS forecasts are $2.47 for FY2024 and FY2025 (Yes, no change), resulting in net incomes of $17.6 billion and $17.65 billion, respectively. A forward revenue growth of -9% is estimated, as well as a 3 to 5-year long-term EPS growth rate of 0.25% (which will be used to calculate perpetuity growth), forming the basis for projecting net income in the model beyond FY2025.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2024 | $123,140.0 | $17,658.03 | $11,112.57 | $27,158.35 | $33,901.33 |

| 2025 | $124,350.0 | $17,658.03 | $11,112.57 | $27,158.35 | $33,901.33 |

| 2026 | $113,158.5 | $17,702.18 | $11,140.35 | $25,885.49 | $32,081.90 |

| 2027 | $102,974.2 | $17,746.43 | $11,168.20 | $24,586.27 | $30,225.01 |

| 2028 | $93,706.6 | $17,790.80 | $11,196.12 | $23,406.57 | $28,537.82 |

| 2029 | $85,273.0 | $17,835.27 | $11,224.11 | $22,335.62 | $27,005.06 |

| ^Final EBITA^ |

It’s important to clarify that these estimates are not optimistic whatsoever, since for 2029, analysts’ are expecting$127.98 billion which is way higher than the result I got of $85.27 billion. The same goes for EPS.

In the table provided below, you will find all the assumptions considered for the DCF analysis. D&A, Interest Expenses, and CapEx will be computed based on revenue-related margins. The rationale behind this approach is that, according to the logic, a company must invest in improved tools to enhance efficiency and generate higher earnings.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 117,442.00 |

| Debt Value | 173,183.00 |

| Cost of Debt | 3.87% |

| Tax Rate | -37.07% |

| 10y Treasury | 3.94% |

| Beta | 0.65 |

| Market Return | 10.50% |

| Cost of Equity | 8.20% |

| Assumptions Part 2 | |

| CapEx | 17,853.00 |

| Capex Margin | 14.58% |

| Net Income | 15,623.00 |

| Interest | 6,704.00 |

| Tax | 4,225.00 |

| D&A | 15,953.00 |

| Ebitda | 42,505.00 |

| D&A Margin | 13.03% |

| Interest Expense Margin | 5.48% |

| Revenue | 122,428.0 |

Moreover, to derive the perpetuity growth rate, one should divide the growth rate by the difference between the WACC and the growth rate. This calculation yields a perpetual growth rate of 1.04%. As demonstrated, I prefer to calculate it using a formula, as I find it more credible than making assumptions.

As you can see, AT&T could offer an upside of around 51.2% which would place its fair stock price at $25.15. The model suggests that for 2029, the stock should be priced at $35.03 if debt, current assets & marketable securities continue to grow at the same pace displayed during 2017-2023. This would mean annual returns of 18.4% throughout 2029.

Upon analyzing the financials and the valuation, I believe that AT&T does not have significant growth potential left. The current opportunity should be considered, as AT&T is on a clear path for a turnaround, as evidenced by the valuation process. It is actively reducing debt while maintaining operating income.

In the future, AT&T will become a slimmer company, but it will continue to be an established player in the industry. Only well-capitalized players will have the capacity to challenge the market share of the US telecom giants, albeit with substantial losses along the way.

Additionally, it’s important to acknowledge that my previous target was $30.80, therefore, the new fair price of $25.15 represents a reduction in value of around 18%. The main reason for this is that as financials evolve, these will have influence on the valuation’s result.

Why I am bullish on AT&T?

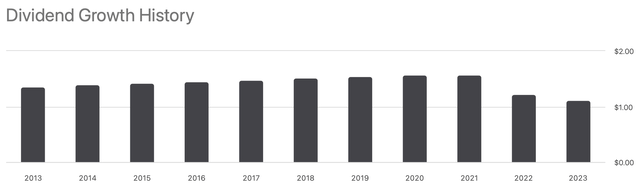

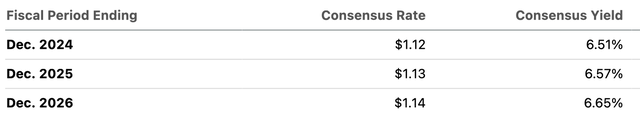

To summarize why I am bullish on AT&T, it’s because they have shown a positive behavior in what concerns reducing debt, cutting costs, and reducing its dividend. Observing the dividend estimates, you will notice that it’s not expected to increase exponentially, which is good, this can help AT&T build up cash reserves and continue to pay down debt. Nevertheless, observing the “consensus yield” we can imply that the stock is expected to stay somewhat flat. Nevertheless at the worst of cases we end with a flat dividend payer. What I truly want is AT&T to completely cut its dividend because it can unlock a lot of money for AT&T. This is possible because they have recently cut their dividend, therefore doing the same again is not unthinkable.

Risks to Thesis

The primary risk associated with the thesis lies in the potential for AT&T to revert to destructive practices that affect their financials negatively. This risk could materialize through actions such as increasing dividends or repurchasing shares to artificially boost share prices, ultimately exacerbating challenges for AT&T. Therefore it’s important that AT&T continues its current strategies, focusing on enhancing profitability through sustained cost-cutting measures. The chances of success, are in my opinion pretty high, because when a family acquires an internet pack or a mobile data pack, they must stay with AT&T for around 24-36 months, this ensures that AT&T has a constant cash stream while they do their changes.

The second risk is market-related, given AT&T’s reputation as a dividend play. The removal of dividends entirely could lead to a temporary decline in the stock price. However, this downturn should be perceived as a buying opportunity, emphasizing that dividend payments are justified only when the funds cannot be strategically reinvested into the company for greater long-term gains.

The final risk pertains to the saturated telecoms market, where potential price wars could prove costly. Despite this, it’s essential to note that major competitors like Verizon Communications, Inc. (VZ) and T-Mobile US, Inc. (TMUS) face their own financial challenges. Verizon holds approximately $174 billion in debt, while T-Mobile, though smaller in net income and revenue, still grapples with around $113 billion in debt and roughly $5 billion in cash. Consequently, engaging in a price war could lead to mutual-assured destruction, presenting a precarious scenario for all players in the industry.

What stands out about AT&T is the manifestation of constructive behaviors, such as debt reduction and a meticulous approach to acquisitions. Nevertheless, the potential for greater gains could materialize if the company opts to suppress its dividends. This strategic move could unlock approximately $8 billion, which could be strategically utilized mainly for debt reduction and bolstering cash reserves.

Conclusion

In conclusion, AT&T’s financial outlook reveals both strengths and challenges as it navigates a rapidly evolving telecommunications landscape. Despite a slight dip in fair stock price projections from the previous article, AT&T’s current fair price of $25.15 indicates a significant upside potential. The company’s strategic strengths, including its adept defense against industry newcomers and successful operations in Mexico and Canada, position it for resilience in a competitive market. However, inherent flaws, such as its classification as a dividend stock, underscore the importance of addressing priorities, particularly focusing on profitability enhancement over shareholder rewards. The ongoing decline in legacy voice revenues and challenges in the saturated telecoms market present hurdles that demand continuous efforts to boost efficiency. Despite recent financial setbacks, AT&T’s commitment to debt reduction and strong free cash flow signal resilience. The valuation model suggests a notable upside, provided the company remains disciplined in its strategic decisions. Acknowledging potential risks, including a return to destructive practices and market-related concerns, calls for a vigilant approach. In essence, AT&T’s future success hinges on a balanced strategy that leverages strengths, mitigates risks, and adapts to the dynamic telecommunication

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in T over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.