Summary:

- AT&T’s stock has appreciated by 13% since our last coverage, outperforming the S&P 500’s negative 6% return.

- The underlying ratios of AT&T’s business paint a better picture than bears would have investors believe.

- With CapEx expected to decline in the near term, we think the overall prospects for the company are positive.

Brandon Bell

Background

AT&T (NYSE:T) may not be a traditional battleground stock, but on Seeking Alpha there are no shortage of strong opinions about the company. Some say buy, others say sell, and investors are left to sort out what makes the most sense to them.

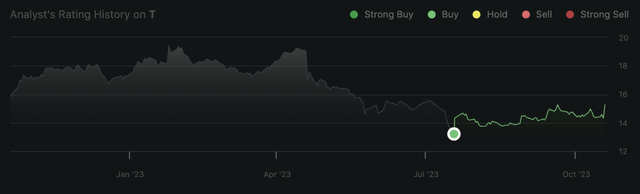

For us, we remain bullish on the stock. We last covered AT&T in July (you can read that article here), and since then the stock has appreciated by 13% since then on a price basis (15% on a total return basis), compared with the S&P 500’s negative 6% return in the same time frame.

AT&T reported it’s Q3 earnings yesterday, and they didn’t disappoint: revenues were up 1% to $30.4 billion, and cash from operations came in $10.3 billion, up 2.4% year over year. Management also raised free cash flow guidance by $500 million, from $16 billion to $16.5 billion.

The focus of this article, however, will not focus on the recent earnings print (for an overview on that, check out this article from Cavenagh Research) but on the outlook for the company and an attempt to make our case that the dividend is not in the danger that many suppose, and that the current valuation makes for an attractive opportunity.

Valuation & Estimates

Let’s start with what everyone already knows–AT&T stock is cheap. Like, historically cheap.

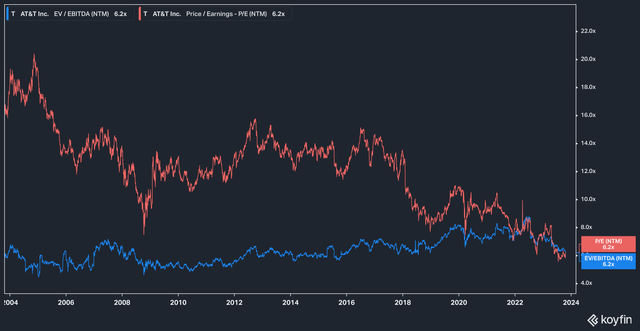

T Forward EV/EBITDA & P/E (Koyfin)

Looking back over the last 20 years reveals a declining slope In forward P/E estimates. The stock is currently plumbing its 20-year lows at 6.2x forward earnings estimates.

EV/EBITDA is also comparably low at 6.2x. However, the added factor of debt (a long-running topic of conversation around AT&T) has contributed to the relative stability of this multiple.

The Health Of The Business

Of course, we can’t think about valuation multiples in a vacuum–after all, a lot of business trade at low multiples, and justifiably so. Is AT&T in that boat?

We think not.

First, not enough time has passed since investors were burned with the infamous Time Warner deal. While the spinoff of that asset in the form of Warner Bros. Discovery (WBD) has freed the company to focus on its core business, investors have understandably been cautious and taken a ‘wait-and-see’ approach.

This is, of course, understandable.

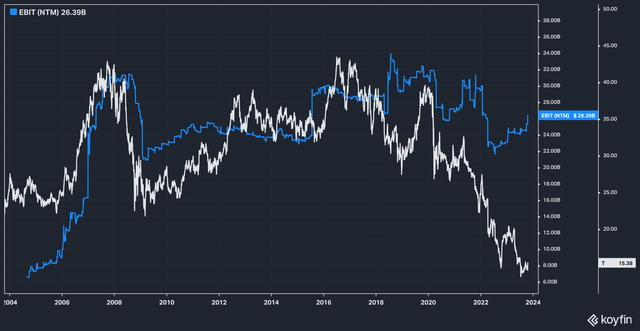

However, we think that this hesitancy on the part of investors has created an opportunity. Consider this chart laying out AT&T stock price against the company’s operating income (or EBIT):

T Stock Price vs EBIT Estimates (Koyfin)

Again, looking back 20 years, we see an interesting divergence has formed between the company’s stock price and forward EBIT estimates. The divergence began in 2018, and then picked up a full head of steam in 2022 and 2023.

This, we think, is the result of fear, and an overreaction.

Many readers will beg to differ, of course, so let’s go through the bear case, which can be summed up as: AT&T has onboarded too much debt to service without creating reasonable doubt that the dividend is sustainable. Since the stock is largely owned by dividend seeking retail investors, this uncertainty creates doubt about the long-term profitability and dividend sustainability at the company.

But is this true?

Clearly, as the chart above shows, AT&Ts operating income has remained healthy, with estimates improving throughout 2022. Further, while the company’s leverage has gone up over time, its leverage ratios have actually improved as well.

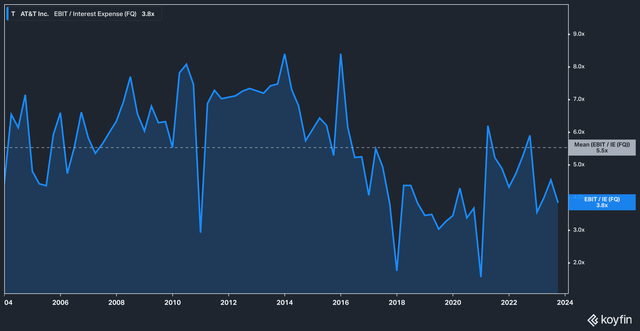

T EBIT/Interest Expense (Koyfin)

AT&T has averaged 5.5x EBIT/Interest Expense [IE] over the last 20 years. Today, that figure sits at 3.8x. Net debt/EBITDA for the latest quarter came in a 3x, versus the 5 and 20 year historical average of 3.4x and 5.1x, respectively.

Additionally, the company generated a 5.68% return on capital in the latest quarter–a good showing after spending most of 2019-2020 in the 4% range and improving gradually since then.

We also think the company’s capital expenditures are likely to continue to moderate. Over the last 10 years, the company has averaged roughly $5 billion per quarter in CapEx.

On the latest conference call, CFO Pascal Desroches had this to say on the matter:

Our cost takeout efforts the last couple of years have shown that we are committed to creating a really efficient cost structure. So all those things will help drive EBITDA growth and you couple that with a step-down in CapEx from the elevated levels we’ve been at in ‘22 and ‘23. Those are going to be the big growth drivers to drive both free cash flow growth next year.

The Bottom Line

Long-suffering AT&T investors have good reason to be cautious, skeptical, or even downright hostile after the ride they’ve endured. The company’s stock price has suffered a long-term free fall, and they’ve had to hang on for the ride. However, with the Time Warner fiasco behind the company, we think that enough people have counted AT&T for dead that the stock presents a compelling opportunity.

If we target an 7.5x earnings multiple on current FY 2025 EPS estimates of $2.53 per share, we arrive at a target price of about $19, roughly 19% above today’s levels.

Risks to our thesis include an faster than anticipated deceleration in the company’s DIRECTV business, as well as higher than anticipated CapEx needs for the continued rollout of 5G.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified the author is under no obligation to do so. Author Is also under to obligation to update changes of view. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.