Summary:

- AT&T shares have been climbing back from their lows, allowing us to write some covered calls.

- In doing that, our latest trade expired worthless, and we essentially doubled our ‘dividends’ in the last quarter.

- Shares are in an attractive position to continue writing covered calls ahead of their earnings.

Justin Sullivan

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on January 21st, 2023.

We have quite a bit of history with AT&T (NYSE:T), employing quite a few trades in both writing puts and covered calls. Due to the deterioration in the share price and 2022 being quite the volatile year for the telecommunication sector, this one took a while to continue the options wheel strategy we employ.

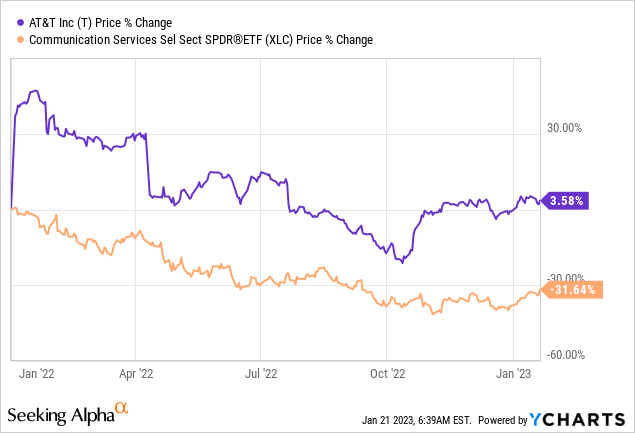

For AT&T, it wasn’t even particularly bad if we look at the returns from the first day of 2022 to today.

Ycharts

Now that shares have been clawing back, we are left in a better position with our shares that were assigned at $19 previously. That began with this latest trade where we could write calls on the January 20th, 2023, expiration at the $20 strike price. We netted $0.27 in options premium, working out to a potential annualized return [PAR] of 5.87%.

While not a staggering amount upon first blush, it actually meant we essentially collected another quarterly dividend in 84 days. That’s one of the comments I hear at times about writing options on T is that “you are collecting pennies.”

I’ll take my pennies when it essentially is the equivalent of collecting the dividend. Since we are long the shares and writing covered calls at this point, that means we are also collecting the dividend in combination. Since taking the assignment in August 2022, we’ve collected $0.555 from the two dividends. The next ex-dividend date has historically been in early April.

Said another way, if you are content with holding T for the dividend, this is just another way to generate the same or even more on occasion. If you don’t have an interest in that, then quite clearly, you just simply aren’t interested in investing in T.

Another clear bonus here would have been that we took an assignment of these shares originally at $19; having shares called away at $20 would have resulted in another $1 of capital gains.

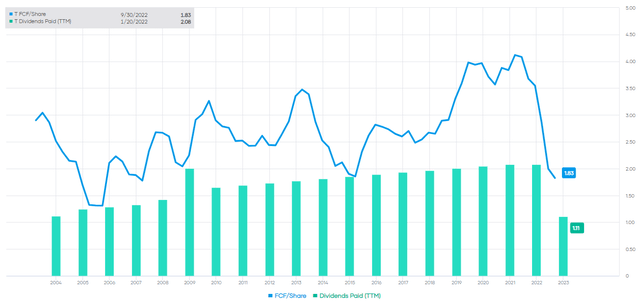

For me, I don’t mind holding T despite what might seem like massive shareholder destruction over the years. Surely they made many mistakes, and it all culminated in the dividend cut, but some of that was the adjustment for the Warner spin-off, too. That was a sizeable portion of their business, and we saw a big drop in FCF/share.

T FCF/Share Dividends Paid (Portfolio Insight)

The latest earnings they announced also showed us that things seemed to be heading in a better direction. Analysts are expecting that EPS will take a hit, adjusting for the spin-off, but some growth is to resume. Albeit, quite slow growth but growth nonetheless. They’ve also been on a string of beating analyst expectations for 8 quarters in a row going back to December 2020.

T Earnings Estimate (Seeking Alpha)

I had held AT&T shares for nearly a decade before selling them when hearing of the dividend cut. I didn’t anticipate that I’d really ever need to sell my position, but times change, and we need to change with it. It was mostly luck, but by selling immediately around $26 a share, some of the further declines were avoided.

What’s Next?

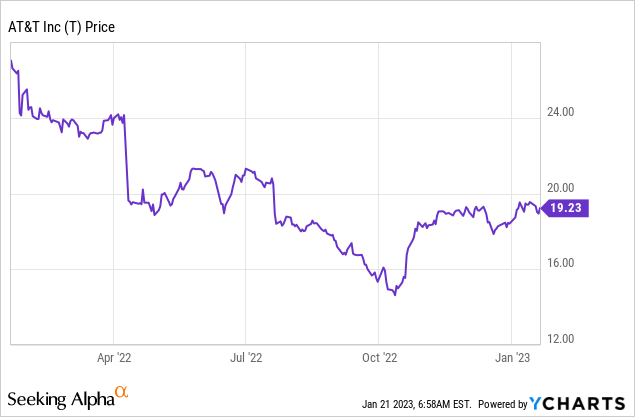

With retaining the shares of T after this options expiration, the next move would be once again to write more covered calls. Assuming the floor doesn’t fall out for shares heading into next week, we are in a really good position to write more covered calls with shares trading above our $19 assignment price.

Ycharts

Their next earnings report is expected to be on January 25th, so we will have a couple of days in the next week to get calls sold prior to this. I think that will ultimately be my plan because while earnings last time were good for the name, it adds another risk that shares could plunge lower. If that happens, we could end up writing more puts – so we can win either way.

I would rather make a move while we know we are in a good position than maybe not be in a great position. If shares rise too rapidly heading into the expiration, there is always the ability to roll the covered calls as well. With anticipated volatility due to earnings, we likely see premiums that are otherwise elevated, which is to our advantage too.

Another consideration here before looking at some specific trades is going back to the anticipated dividend. It hasn’t been declared yet, but as mentioned historically, it has an ex-dividend date in early April. I don’t mind holding onto the shares through another ex-div date, so I’m looking at longer-dated covered calls in this case.

With that, here are a couple of promising ideas, depending how the market treats us when it opens next week.

- April 21st, 2023, expiration 90 days out at the $20 strike could net us $0.56 for a PAR of 11.36%

- If we want to be a bit greedier, take the same expiration date but select the $21 strike to potentially net another $1 in appreciation, which could still give us a reasonable $0.26 in premium. Essentially, another dividend since it is 90 days out from the time of writing. This would work out to a PAR of 5% based on the $21 strike price – or 5.55% if you calculate it off our $19 assignment price.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: May write covered calls on T in the next 72 hours.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.