Summary:

- AT&T Inc.’s stock is consolidating on a high level.

- Free cash flow forecast was better-than-expected.

- The dividend is now well-covered.

Brandon Bell

AT&T Inc. (NYSE:T) fell to a one-decade low in October amid concerns about a possible dividend cut, but the stock has recently recovered.

AT&T’s recent gains have been bolstered by better-than-expected fourth-quarter earnings, which included a strong forecast for free cash flow in 2023.

Even though there is a risk of a T stock pullback following a strong run-up, I believe AT&T’s dividend is protected by sufficient free cash flow, which is probably the best news passive income investors have received in a year. As a result, a dividend cut appears to be a long-term risk for AT&T.

AT&T Proves The Market Wrong

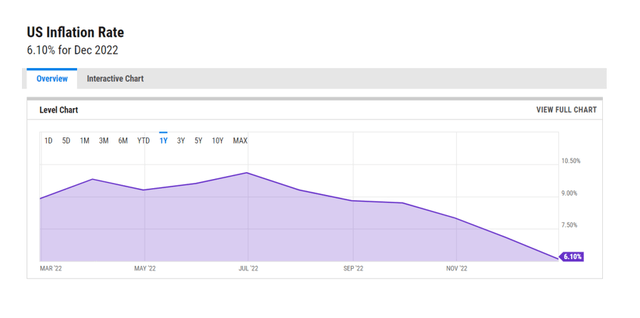

A potential dividend cut, which weighed on AT&T’s stock price in 2022, was a major source of uncertainty. Fears were exacerbated by AT&T’s second-quarter earnings release, in which the company warned of risks to its free cash flow due to sky-high inflation rates, which were delaying AT&T’s customers’ timely payment of bills. The earnings release also included a reduction in free cash flow guidance from $16 billion to $14 billion, which exacerbated the situation for AT&T’s stock.

As it turns out, AT&T’s free cash flow did not deteriorate, despite my expectations that it would, given that inflation reached 40-year highs in 2022. However, inflation slowed towards the end of the year, relieving pressure on AT&T’s customer base.

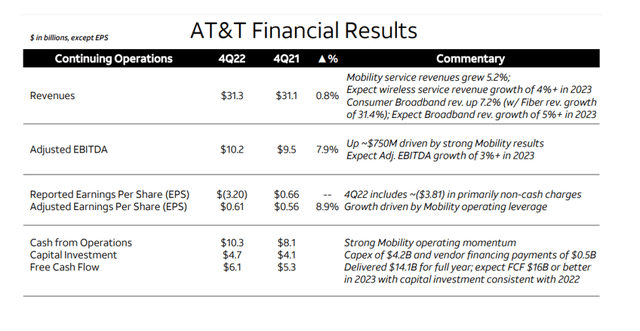

AT&T’s free cash flow did fall within the expected range at the end of the year. The telecommunications company earned $14.1 billion in free cash flow, with the fourth quarter contributing $6.1 billion.

Overall, AT&T’s results were slightly better-than-expected, thanks to strong Fiber Broadband subscriber growth.

AT&T Expects To Add $2 Billion To Its Free Cash Flow In 2023

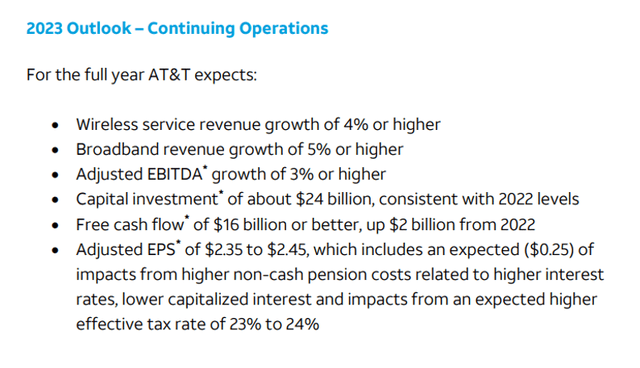

The outlook for AT&T’s continuing operations shows that the company expects $24 billion in capital investments and 16 billion in free cash flow in 2023, implying a $2 billion increase in free cash flow. Obviously, this has far-reaching implications for investors and dividend payouts.

The implied coverage ratio is 50%, implying that dividend investors do not need to worry about the dividend in 2023. Considering AT&T’s significant leverage (AT&T had $132.2 billion in net debt at the end of the December quarter), AT&T has bought itself some breathing room and would be wise to reduce its net debt and maintain the dividend at its current level.

Full Gap Close Imminent

AT&T’s stock dropped 8% following the release of Q2 2022 earnings and the disclosure of delayed bill payments due to skyrocketing inflation, setting the stage for a months-long decline.

Having said that, the stock has almost fully recovered and is about to close a gap. A full gap close would be good news from a technical standpoint, as investors frequently view the closing of a gap as a bullish signal that opens the door for more upside.

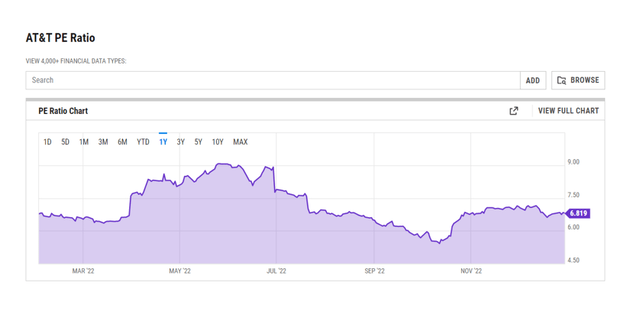

AT&T’s P/E-Ratio Reflects A High Margin Of Safety

AT&T’s forward earnings multiple is currently less than 7.0x. Passive income investors who want to lock in AT&T’s 5.5% dividend yield must pay 6.8x this year’s estimated profits, a multiple that, from where I sit, reflects a very high margin of safety.

When you consider that AT&T expects to increase its free cash flow in 2023, I believe the multiple is especially appealing for passive income investors.

Why AT&T Could See A Lower/Higher Valuation

Inflation is a major concern for telecommunications companies, but it may not be as serious as I thought. AT&T reported lower free cash flow in the second quarter due to delayed bill payments, fueling concerns that the company may not be able to cover its dividend.

Fortunately, AT&T’s 4Q-22 earnings release allayed these concerns, and the threat of a dividend cut is no longer a drag on the stock.

My Conclusion

The market was incorrect in pricing in a dividend cut. With a free cash flow estimate of $16 billion, I believe it is highly unlikely that the telecommunications company will have to reduce its dividend this year.

The dividend is well covered by free cash flow, and T stock is trading at a high margin of safety. There is also the possibility of a short-term gap closure, which would be a bullish indicator for investors who pay attention to technical as well as fundamental factors like dividend coverage or cash flow. A complete gap-closure would indicate additional upside for AT&T’s stock.

Taking into account AT&T’s large net debt and capital needs, investors should, however, not expect the dividend to grow in 2023.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.