Summary:

- AT&T Inc. may not seem like much of a growth prospect when you first look at its numbers, but the numbers can be deceptive.

- Digging deeper, you see that there are parts of the company that are growing at a nice clip for a firm this size and in a market this mature.

- As older operations shrink, this should become more apparent and investors are likely to benefit.

Brandon Bell

Those who follow my writing closely know that one of the few companies I actually hold shares in is telecommunications conglomerate AT&T Inc. (NYSE:T). Compared to the market more broadly, the company has done quite well over the past year or so.

Having said that, I still maintain that AT&T Inc. stock is significantly undervalued. Much of my argument in the past has revolved around the leverage the company has, as well as just how cheap shares look from a cash flow perspective. But there’s also another reason why I like the business. And that relates to the fact that there are certain portions of the enterprise that are growing at a rather rapid pace for a company so large and in an industry that is so mature. But to really see this growth in action, you need to wade through the data, since there are some parts of the company that are winding down. As these trouble areas continue to shrink, I believe that investors will start to recognize the attractive growth the company is generating and will reward investors accordingly.

Focus on the good… and the bad

The purpose of this article is not to provide a valuation of AT&T. I have done that in the past. The most recent occurrence of this was in an article published in late January of this year. Since then, the stock has dropped by 9.7% while the market has seen downside of 4.5%. Given that no new fundamental data has come out since then, I think it would be more appropriate to point you to that article if you are interested in a discussion of why the stock is undervalued.

No, the purpose of this article is to talk about some of the growth areas of the business that make it more appealing than what it looks at first glance. Because of certain structural changes management has made, such as a number of asset sales, I will keep this analysis to just the past three fiscal years. But that will be enough to show management’s magic at work. The true growth engine of the company over this time frame has been the Mobility operations under its Communications segment. This is the portion of the company that provides nationwide wireless services to its customers, as well as the equipment needed for those services to exist.

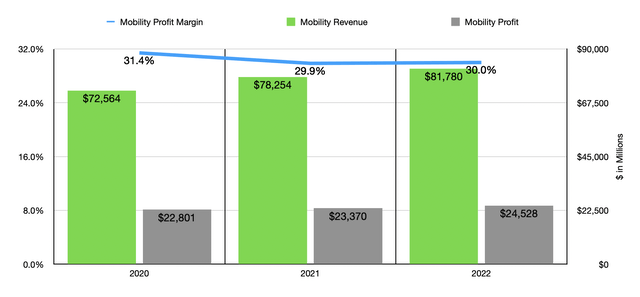

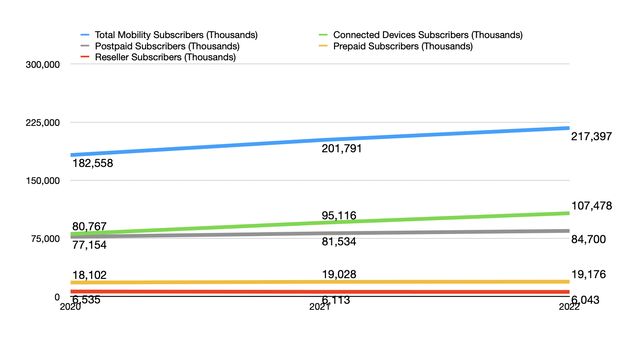

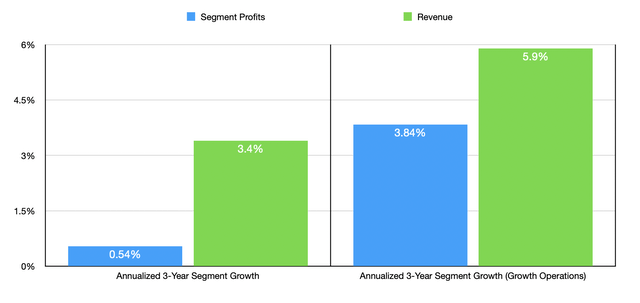

When you look at the company as a whole, you see that over the past three years, revenue has grown from $112.5 billion to $120.2 billion. That translates to an annualized rate of about 3.4%. But the Mobility unit of the company has seen growth that has been nearly double that. From 2020 to 2022, sales expanded from $72.6 billion to $81.8 billion. This increase has been driven in large part by a surge in the number of subscribers under it. This number ultimately rose by 19.1% from 182.6 million to 217.4 million. We can dig even deeper than that. One of the fastest-growing portions of the business has been the Connected Devices category. This is essentially the IoT (Internet of Things) arm of the business, and it focuses on the sale of devices that help to connect everyday things, such as vehicles, to Internet and phone services.

Back in 2020, the company had 80.8 million subscribers under this umbrella. Over the ensuing two years, that number spiked 33.1% to 107.5 million. This is not to say that other portions of the Mobility unit weakened. Yes, it is true that reseller subscribers declined during this time from 6.5 million down to 6 million. But the number of post-paid subscribers grew 9.8% from 77.2 million to 84.7 million, while prepaid subscribers expanded 5.9% from 18.1 million to 19.2 million. What’s also fascinating is that the total subscriber base under the Mobility business grew so much even after the company lost almost 10.2 million subscribers because of its decision to no longer support 3G devices. 8.3 million of these losses came from Connected Devices.

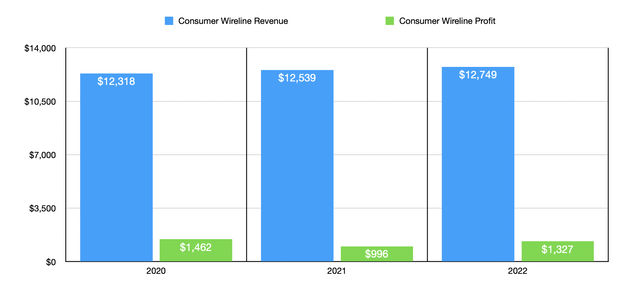

With the rise in revenue also came a surge in profitability. Operating income for the Mobility portion of the business expanded from $22.8 billion to $24.5 billion. Admittedly, the operating margin declined a little bit, dropping from 31.4% down to 30%. But if you were to look at the data over a five-year window, that’s still within the typical range. This is not the only portion of the company that is demonstrating growth. The Consumer Wireline unit, which focuses on providing broadband services, including fiber connections, to residential customers, and which also operates under the Communications segment, has demonstrated relatively attractive growth. Over the past three years, revenue has grown from $12.3 billion to $12.7 billion.

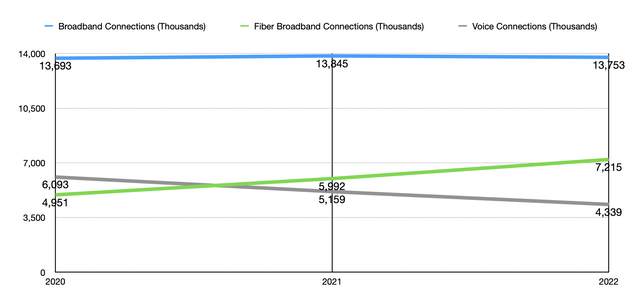

Growth would have been even more impressive had it not been for some pain points. For instance, over this window of time, legacy voice and data services revenue declined from $2.2 billion to $1.7 billion. This decline was driven by a plunge in the number of voice connections that the company had from 6.1 million down to 4.3 million. Over the same window of time, the “other service and equipment” portion of the business fell from $1.6 billion to $1.3 billion. If we focus only on the broadband side of the equation, we would have seen sales rise from $8.5 billion to nearly $9.7 billion. That works out to an annualized growth rate of 6.4%. This growth, it’s worth mentioning, can be attributed to continued growth in the number of connections the company has. Total broadband and DSL connections for the business fell from 14.1 million down to 14 million. But just broadband connections on their own expanded from 13.7 million to nearly 13.8 million.

The real winner under this category, however, was the fiber broadband space. Connections here skyrocketed from just under 5 million to roughly 7.2 million. What’s really exciting is that management continues to lay the groundwork for continued growth here. Although it only has 7.2 million connections, the number of fiber locations it can reach ended at 22 million last year. The company’s goal is to hit at least 30 million by the end of 2025, and that excludes other deals that it has with other companies to continue expanding. If the same ratio of locations to connections are held, this could translate to roughly 9.8 million connections by the end of 2025. Unfortunately, profits have been a bit lumpy on this side of the business. After generating almost $1.5 billion in operating income in 2020, profits dropped to just under $1 billion in 2021 before rebounding some to $1.3 billion in 2022.

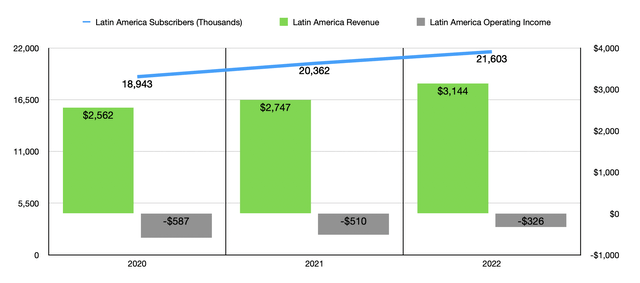

We also have one other part of the company that’s growing at a nice clip. This is the entire Latin America segment. From 2020 to 2022, sales jumped from $2.6 billion to $3.1 billion. This was driven by a rise in the number of subscribers from 18.9 million to 21.6 million. Critics of the company will point out that the firm continues to generate a loss on these operations. That is absolutely true. However, that loss is narrowing year after year. The company went from generating a loss of $587 million in 2020 to generating a loss of $326 million in 2022. It’s not unthinkable that, in another couple of years, the segment could break even or even start generating a profit.

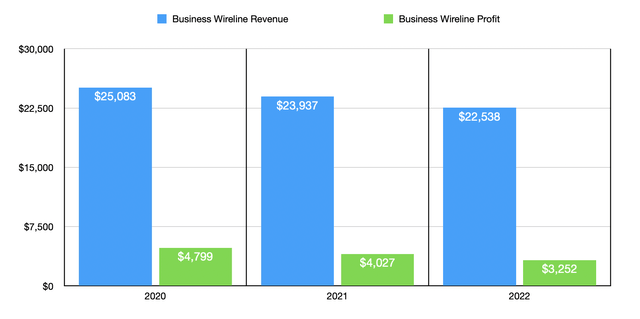

Holding the company down are some of its legacy operations. The major one that comes to mind is the Business Wireline unit. Through this, the company provides advanced Ethernet-based fiber services, as well as IP Voice and managed professional services, and other offerings, to its business customers. Over the years, management has overseen revenue dropped from $25.1 billion to $22.5 billion. Profits, meanwhile, plunged from $4.8 billion to $3.3 billion. Management has attributed this decline to a couple of factors. At one point, they blamed the trouble on the COVID-19 pandemic. But in general, this portion of the company has been declining for years even prior to that time.

This is not to say that the company is just straight-up losing business. Some of this decline is certainly attributable to a transition to other revenue-generating parts of the business. For instance, the company said in its latest annual report that as it expands its fiber reach, it will be orienting its business portfolio by moving customers who are under the Business Wireline unit onto fiber. Management believes that this would be particularly appealing for the customers that are small and medium-sized businesses. Making this move also should bring on additional revenue and profits for the company as opposed to just cannibalizing an old business. Recently, the COO of the firm, Jeff McElfresh, mentioned that the firm is seeing strong average revenues per user on fiber that are about $10 higher than what they see with their non-fiber broadband customers.

Earlier in this article, I talked about the growth differences for the company when it comes to revenue. Removing the problem areas results in stronger revenue growth. The same also applies to the bottom line. Unfortunately, some parts of the company cannot be separated from a profitability perspective. But stripping out the problem areas that we can would result in segment profits expanding from $23.7 billion in 2020 to $25.5 billion in 2022. That’s an annualized growth rate of over 3.8%. By comparison, actual segment profits for the business grew a more modest 0.5% over the same window of time.

When and where this really pays off is when the problem portions of the business reach a point where their declines are not as statistically significant as the growth we are currently seeing. Although management has not provided any guidance on that continued downturn, they have said that wireless service revenues for the company should grow by about 4% or more in 2023, while broadband revenues should expand by 5% or more. Profitability for the company as measured by EBITDA will grow a more modest 3%. But this makes sense when you consider the drag being experienced by the problem areas. But as these trouble areas die down, that growth could be expected to pick up also. By how much would depend on how management handles the process. But given how attractive the margins are for some of the growth areas of the business, combined with how rapidly those parts of the firm are expanding, it’s likely that bottom line performance will only improve in the years to come from here. This is especially true when you consider that, Over the past year or so, the company has succeeded in capturing around $6 billion worth of cost savings on a run-rate basis. Part of that has been through its decision to cut about 30,000 jobs in its communications business, with roughly 7,000 of those job cuts in the final quarter of 2022 alone.

Takeaway

Operationally speaking, AT&T Inc. is a fantastic company. Although the firm made plenty of mistakes in the past, it has learned from those and it has taken time to carefully divest itself of non-core operations. Today, the firm is far healthier than it has been in a long time. But this is not to say that it’s perfect. There are some older lines of business that are approving to be a drag on the rest of the firm. Eventually, those parts of the company will die down as well. As this occurs, it’s likely that growth for the company will accelerate on the whole. This should be true of both the top line and bottom line. When coupled with my prior analysis on the company wherein I calculated how cheap the stock was, I do believe that AT&T Inc. still warrants a ‘strong buy’ rating.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!