Summary:

- AT&T. is an American classic. But much like many Americans, AT&T too has fallen on hard times.

- After years of questionable M&A activity, AT&T has finally reset its core focus back to connectivity.

- Though the Warner Bros divestment was a move in the right direction and helped AT&T remove a large chunk of debt it still remains a heavily indebted company.

- Rising interests have increased the value of cash flow today and devalued speculative future growth.

elenaleonova/E+ via Getty Images

Introduction

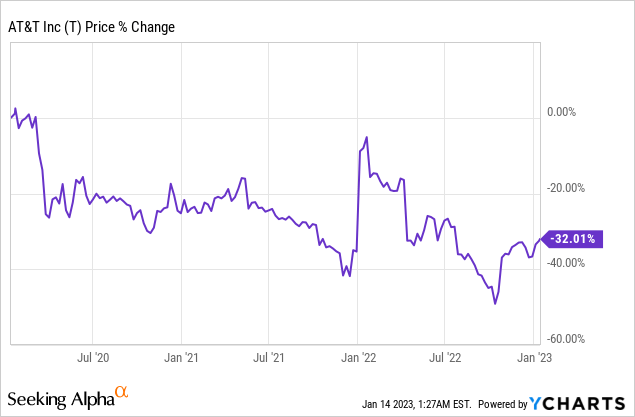

AT&T (NYSE:T)… an American classic. But much like many Americans, AT&T too has fallen on hard times. Over the course of the last 3 years, AT&T’s share price has dropped over 30%!

After years of arguably questionable M&A activity, AT&T has reset its core focus back to connectivity. Through its divestment of DirecTV and Warner Bros. (WBD) AT&T is left with a much slimmer company.

Well… Slimmer in terms of focus.

In terms of its debt levels AT&T perhaps ‘obese‘ is a more fitting word choice.

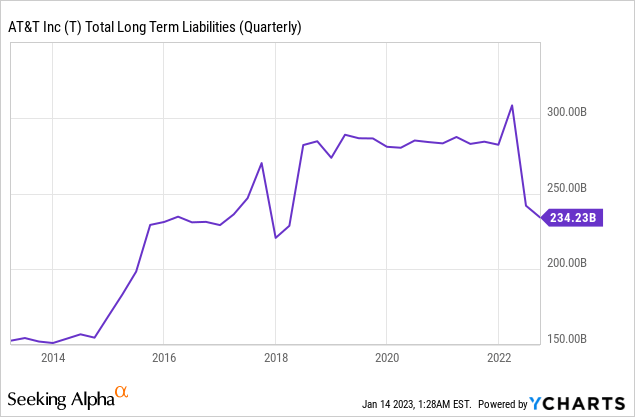

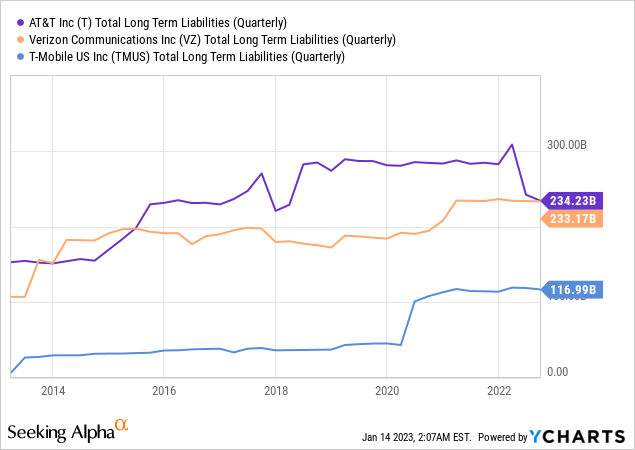

The Warner Bros. divestment was, in my opinion, a move in the right direction as it helped AT&T shift a large pile of debt off its balance sheet, but it still remains heavily indebted with $234B in long term liabilities. So sure, AT&T is slimmer, but it has merely gone from morbid obesity to “plain-vanilla” obesity.

Despite its “debt-diet” or “debt-liposuction” if you will, this company still has a lot of work to do before it’ll “be back in shape” and suitable as an investment.

Within this article I’ll explain:

- Why I believe AT&T’s business model is fundamentally flawed

- How that has impacted and will continue to impact its financial performance

- What a fair price is for AT&T’s stock

Flawed Business Model

We all know the history of AT&T, the standard phone company that branched out too far, overpaying for businesses in an attempt to buy growth. It’s a story as old as time, a company buying growth to give itself a face-lift and breathe some new life into the business.

But at the end of the day, I believe that AT&T’s business model is simply flawed. Sure they have some irreplaceable infrastructure, there’s no denying that. But most of their revenues are derived from selling a commodity service that is also offered by two or three other companies in any given area.

This level of competition puts a permanent cap on pricing power as consumers could simply switch to the lower-priced competitor.

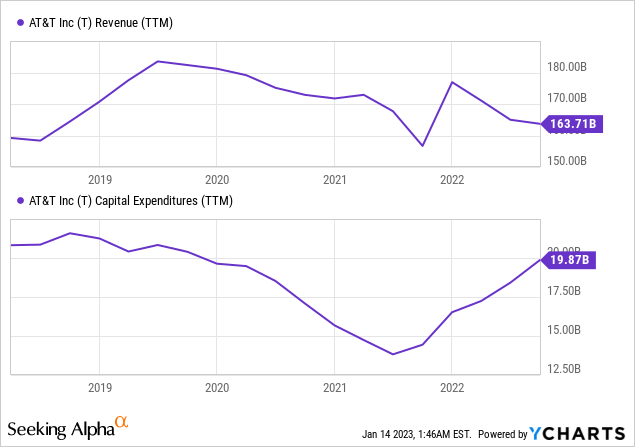

Also, to sustain the customers that they do have, they must continually invest in spectrum during auctions and work on improving the infrastructure they already have in place.

My View:

AT&T = Low Revenue Growth + High Capital Investment Requirements = Poor Returns for Shareholders

The financials confirm this…

This is troublesome.

Let me paint you a picture, imagine you are a landlord in a 3-unit condo, there are two other landlords, and each of you owns one unit. You each offer month-long leases and are required to constantly invest capital into the building to attract the one renter that lives in town.

Would you expect those landlords to run a profitable business?

That is quite similar to the position that AT&T finds itself in.

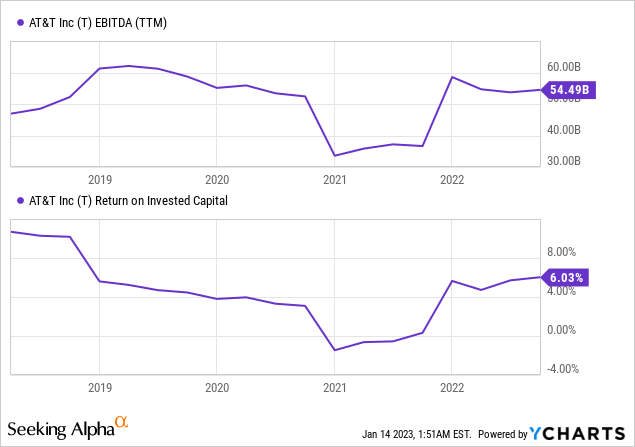

EBITDA and ROIC

It’s no wonder why its returns on invested capital have been so poor and earnings growth so slow. At the end of the day, these are just fundamental qualities of the industry AT&T operates in.

While all of that sounds quite dim (because it is) there are some plusses to be had. Notably, the recurring nature of AT&T’s revenues, and its mobile phone and internet contracts which provide a relatively reliable source of recurring revenue.

Competition keeps a lid on any revenue growth but the revenue that is there is relatively steady.

Finance 101: Recurring revenue, no growth, a long-dated bond! That’s why in my last article I suggested the company could be thought of as a junk bond proxy.

AT&T vs Peers

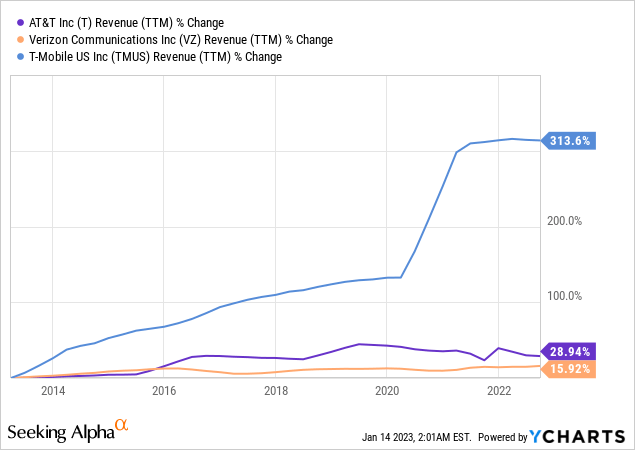

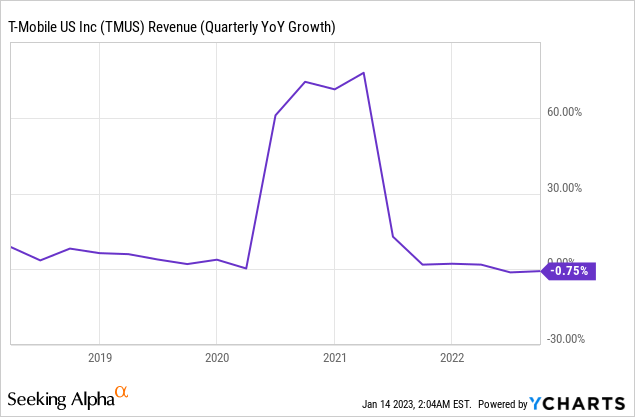

In fairness to AT&T they are not alone in their struggles. So too has Verizon’s (VZ) and T-Mobile’s (TMUS) revenue growth stalled out. Over the last 10 years, Verizon grew its revenues by a mere 16%! While T-Mobile appears to be different, much of that growth is simply due to its merger with Sprint as evidenced in the following chart.

Alongside revenue growth challenges these companies also share ballooning debt loads, the interest expense of which starves investors of cash flow. When all, or most of your earnings must go towards servicing your debt it leaves little for the shareholders of the company. The ballooning debt load can be seen below.

Valuation

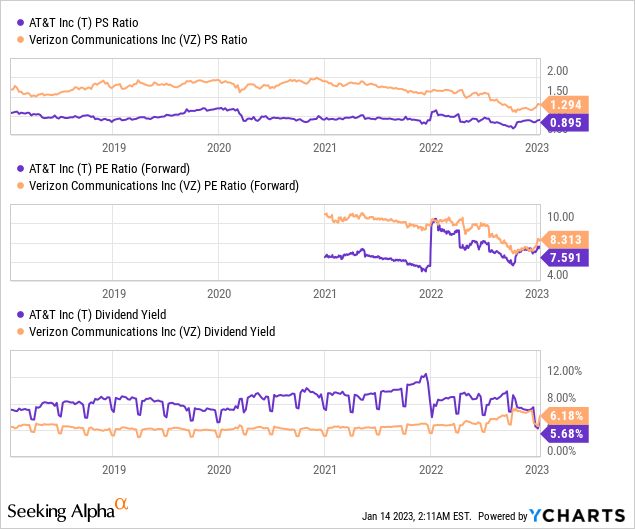

Simply comparing AT&T to Verizon one could make an argument that AT&T is actually undervalued. After all, AT&T boasts a price to sales of just .9x compared to Verizon’s 1.3x and it trades at a forward PE of just 7.6x compared to Verizon’s 8.3x.

But just because one company is priced cheaper than its peer doesn’t make a company a buy on that merit alone.

Discounted Cash Flow

In my last article, I arrived at an $18 price target on AT&T. Shares more than crossed that threshold late last year and have rallied back to the ~$20 level. Updating my DCF model using the latest analyst expectations for 2023 and my new expectations yielded the following result.

| 2023 | 2024 | 2025 | 2026 | 2027 | |

| Revenue | $121k | $121,880 | $121,880 | $121,880 | $121,880 |

| Cash Flow | $18k | $18k | $18k | $18k | $18k |

As you can clearly see, I am assuming flat revenue and cash flow growth for the next 7 years followed by a terminal growth rate of negative -3%. Applying a 10% discount rate brings me to an intrinsic value of ~$21 a share. A slight bit higher than where shares trade for at the time of writing (around $20).

Conclusion

I am less bearish on AT&T now than I was last year.

The company continues to make good progress in paying down its substantial debt load and trades cheaper than its close peer Verizon despite having similar growth prospects.

Rising interests have increased the value of cash flow today and devalued speculative future growth. While this may create issues as AT&T refinances maturing debt, it increases the value of the cash flow it generates and should help to lift the share price.

I’m moving to a Hold on AT&T and I’m upping my 1-year price target to $21.

Thank you, Reader!

If you made it to the end of this article, thank you! I value all of my readers deeply, if there are any questions you have for me please let me know in the comments and I will get back to you with a response as soon as possible.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.