Summary:

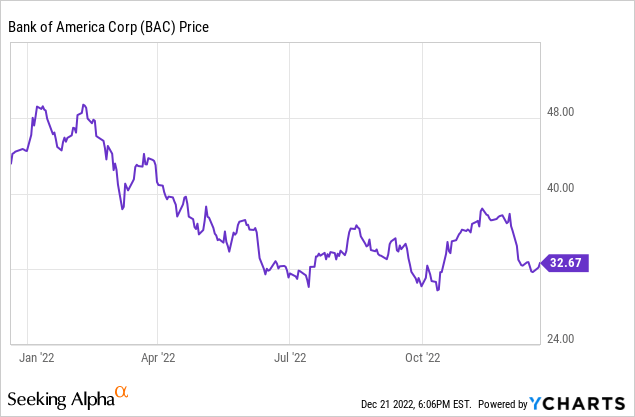

- Bank of America is one of the United States’ largest financial institutions.

- The preferred shares offer a dividend yield of approximately 6%.

- The prefs with a low preferred dividend are trading at a steep discount to the principal value, making them interesting securities to bet on lower interest rates.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

Bank of America (NYSE:BAC) doesn’t need any introduction. A household name in the US financial sector, virtually every investor in the USA and abroad will have heard of this bank. Rather than discussing the merits of owning the common shares (there are plenty of articles here on Seeking Alpha doing exactly that), I wanted to look at the P-Series of the preferred shares as these have a low preferred dividend yield resulting in the stock trading approximately 30% below par. While the yield on purchase is not necessarily better than most other preferred shares issued by Bank of America, some investors might be interested after all.

Bank of America’s financial results so far were satisfying

I will keep the review of Bank of America’s financial results pretty short as I mainly want to focus on the preferred shares.

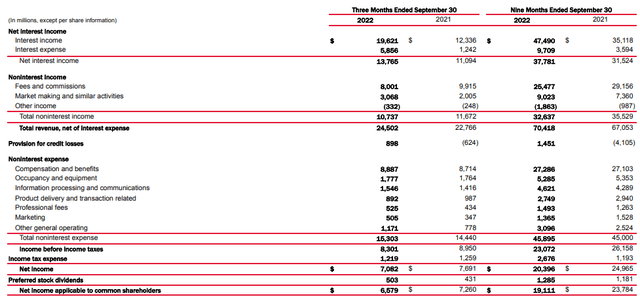

During the third quarter of this year, BAC saw its net interest income increase by approximately 25% as it jumped from $11.1B to $13.8B on the back of a 50% increase in the interest income. While the total amount of interest expenses increased at a faster pace (expressed in a percentage), the absolute increase of $4.6B was lower than the $7.3B increase in the interest income.

Bank of America Investor Relations

The bank reported a total revenue of $24.5B including about $10.7B in non-interest income and after deducting the $15.3B in non-interest expenses and $896M in loan loss provisions, Bank of America reported a pre-tax income of $8.3B. The total tax bill was $1.22B resulting in a net income of $7.06B. Of that amount, about $500M had to be spent on the preferred dividends which means there was about $6.58B in net income attributable to the common shareholders, resulting in an EPS of $0.81.

This already is an important element to determine how ‘safe’ the preferred dividends are: during the third quarter, BAC only needed about 7% of its net income to cover the preferred dividends (after taking almost $900M in loan loss provisions into account). Looking at the 9M 2022 results, the bank needed about 6.3% of its net income to cover the preferred dividends.

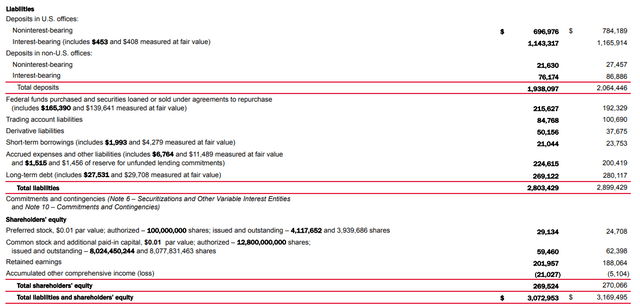

A second element I focus on when I look at preferred shares is the asset coverage ratio. As you can see below, the total equity on the balance sheet equals about $269B of which just over $29B is related to preferred equity. Which means there’s about $240B in equity ranked junior to the preferred shares.

Bank of America Investor Relations

Singling out the PP-Series of the preferred shares

There’s plenty of preferred shares out there that were issued by Bank of America, but I wanted to single out the PP-series, trading as (NYSE:BAC.PP) as this specific series has a low preferred dividend which also results in the lowest share price among all of Bank of America’s preferred shares. The PP-Series pay 4.125% preferred dividend which means the annual dividend is $1.03125, payable in four equal quarterly tranches of $0.2578125 per share. These securities are non-cumulative and can be called from February 2 nd 2026 on.

While I understand most investors would like to invest in higher yielding preferred shares on the off-chance they may get called as Bank of America refines its capital structure, this 4.125% yielding preferred at a huge discount to its principal value could be appealing to a specific set of investors: those who think the Fed overstepped its boundaries with the rate hikes and expect the interest rates to decrease.

Right now, Bank of America is paying approximately 6% on its preferred stock as pretty much every single issue of preferred stock issued by BAC is trading within a few percent of that 6% range. But that also means that if interest rates go back down and the market only requires a 5.5% yield for BAC’s preferred capital, these 4.125% yielding securities will trade at $1.03125 / 0.055 = $18.75 for an immediate capital gain of 8.4%. Meanwhile, the securities with a higher yield like the 6% yielding (BAC.PB) will likely not exceed the par value by too much as those 6% yielding shares can be called from May 2023 on and a decrease in interest rates makes a call likely.

Investment thesis

I’m still looking for ‘December deals’ for my income portfolio as over the past few months a bunch of my existing preferred shares and bonds have been called and matured. While the 6% yield offered by Bank of America’s preferred shares is definitely not the highest on the market, it is rather attractive for a preferred stock you don’t need to invest too much time in other than following Bank of America’s quarterly reporting and the market interest rates. I don’t have a position in BAC.PP but I am keeping an eye on these preferred shares.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.