Summary:

- An exodus of funds from smaller banks is possible.

- It is likely that some of these outflows will find a home at Bank of America.

- Further bank failures will hurt BAC badly.

dimitris_k/iStock Editorial via Getty Images

Preamble

Anyone that follows the banking industry is by now familiar with the reasons behind the collapse of Silicon Valley Bank (SIVB). However, for those who are not, in a nutshell, corporate customers began to shift their money out of the bank to put their funds into bigger banks. This meant that the losses on long term bonds had to be realised to cover the outflow of funds. For those who would like more background on the topic, I suggest they read an article I wrote in February (Banking Sector: Storm Clouds Are Gathering), in which I outlined the risks in the banking sector.

Recent research has suggested that there are around 190 other banks that may follow SVB into oblivion, and for similar reasons. Therefore, in advance of a collapse, customers are likely to consider making for the exit in advance of this situation. Prior to moving their money out of these other banks, clients are likely to consider several factors. Firstly, if runs on these banks continues, the FDIC’s deposit insurance fund will be depleted to such an extent that customer’s losses cannot be covered. Next, we have Janet Yellen’s statements concerning future bank failures; “not all uninsured deposits will be protected.”

Also, large institutions tend to exercise risk management and have insurance in the shape of derivative instruments to cover their paper notes, whereas smaller banks are probably amongst the circa 1% that have uninsured leverage. For customers of smaller banks, there is no way of knowing whether the bank has adequate insurance to cover outflows.

Finally, and I suspect most importantly for many customers, there are the relatively new “bail-in” laws, which I suspect is the reason why the Treasury Secretary doesn’t feel the need to protect uninsured deposits. In short, it is now perfectly legal for banks to use the cash and deposits from uninsured depositors above the FDIC threshold to bail themselves out, rather than use the money of taxpayers. In the new world, depositors are classified as an “unsecured creditor,” that is to say, when you deposit money in a bank, that money belongs to the bank, and not you. So, naturally, many customers may wish to get their money out before banks are “rescued” using their money.

Now, as an investor in Bank of America (NYSE:BAC) you may well be thinking that these outflows from smaller banks will be just perfect for BAC, after all it should mean extra accounts and deposits; right? In fact, this is extremely bad news for BAC.

Overview

As I mention in my preamble, the majority of banks will have hedged some or all of their illiquid exposure through derivative instruments such as interest rate derivative, thus passing the issue of unrealised losses on bonds due to increasing interest rates to entities that are in a position to offer such insurance. Now, we all know, SVB was amongst the small number of banks who failed to exercise adequate risk management and opted not to obtain this type of safeguard.

Once SVB began to realise the losses on their assets to cover outflows, there was a collapse in the share price as the bank became insolvent. Had the bank exercised a modicum of risk management and taken out insurance, well then, I imagine that there would have been a fall in the share price of the issuer of the insurance. Since, clearly, the issuers of insurance would have borne the losses emanating from the fall in value of bonds held by SVB; right?

So, the question arises; which institutions are offering this type of insurance to banks? An important question for investors in light of a potential avalanche of claims if, as suggested, approximately 190 banks follow SVB into memory. One of the biggest names offering interest rate derivative instruments to cover losses on bonds is BAC.

Bank of America

Typically, investors are delighted to see companies in which they are invested get some award or other type of recognition. And, of course, that is typically a positive for the stock. However, in 2022 BAC received awards from the Global Capita Derivatives Awards. It would appear that the bank “topped polls across six categories,” including; “Americas Interest Rates Derivatives House of the Year.” In addition to these awards, it was reported that BAC had increased its market share of these interest rate instruments to a considerable degree. In fact, even in 2021, the bank had estimated share of around 30% at the illiquid 20-year bonds. So, one must assume that BAC have an even greater market share at this point.

If the above does not give pause for thought, consider the implications of offering such insurance in Europe, where there is no shortage of banks facing problems; Credit Suisse and Deutsche bank to name but two. Over the years, BAC has spared no effort in expanding operations in Europe in order to increase their footprint. To this end, there is a large trading floor in Paris with over 400 employees busily flogging their services and derivatives.

Since 2019, the bank has gained primary dealer roles for government bond issuances in Europe, including Italy, Germany, France, Portugal, the Netherlands and the UK. Furthermore, BAC has been involved in the role out of European Union issuances. This involvement has surely assisted the bank in convincing prospective clients across the region of their ability in providing suitable financial instruments.

Balance sheet

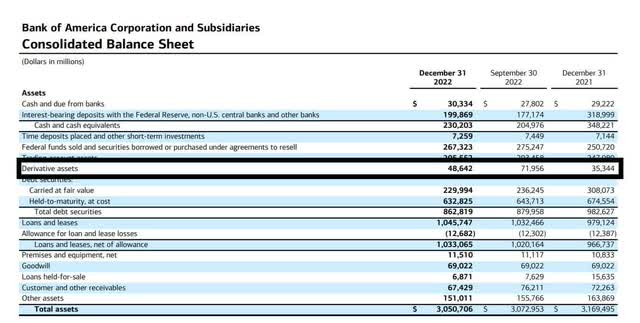

From the latest balance sheet, we can see that the bank has $48,642 million in derivative assets, a proportion of which is insurance protection on bond assets for financial institutions. Unfortunately, BAC does not publish details on the proportion of its derivative portfolio comprising interest rate derivatives, and so investors cannot determine the level of risk involved. However, according to a derivatives report, 72.8 percent of all derivatives cover these types of risk. This high percentage is easy to understand since the bond market is massive. Given that BAC is a key player in this market, it’s safe to assume that the level of BAC’s interest rate derivative assets is significant.

BAC balance sheet (www.d1io3yog0oux5.cloudfront.net/_a295293d032aa4603f2939bd6eff5ec0/bankofamerica/db/806/9782/supplemental_information/The+Supplemental+Information_4Q22.pdf)

In basic terms, monies received for these derivative products represents a premium for insurance given. And these derivatives remain on the balance sheet as an asset, however, if a claim is made, the fair value doesn’t simply go down, it will turn negative. As regards the potential exposure, we need to find the data at The Federal Deposit Insurance Corporation (FDIC).

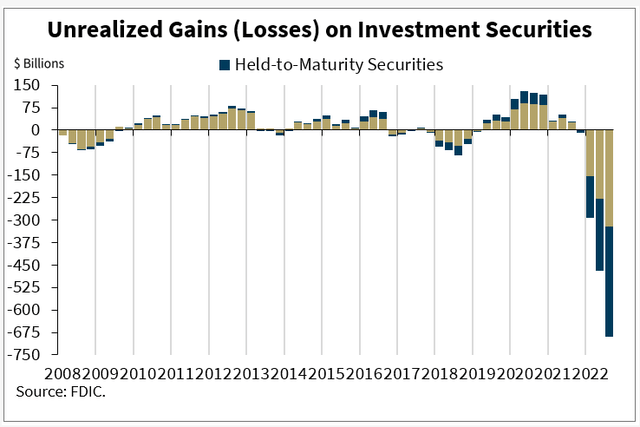

To establish the size of the risk facing organisations offering insurance against the loss of value of bonds, the latest data provided by FDIC can be reviewed. According to this report, in 2022 banks were down by around $690 billion in unrealised losses. So, given that BAC has such a high market share of interest rate instruments, we can assume that their exposure to these potential losses is considerable. And bearing in mind, this is just the US and doesn’t include Europe.

Chart 7 FDIC (www.fdic.gov/analysis/quarterly-banking-profile/index.html)

At this point, some BAC investors may be wondering whether customers may have to bail out BAC should this implied catastrophic scenario unfold. Well, according to the FDIC, in excess of $9.2 trillion of US bank deposits were uninsured at the end of last year. This sum accounts for more than 40% of all deposits, including deposits at BAC.

On the other hand

Of course, the above hints at a doomsday scenario, which may or may not come to pass. Prior to the collapse of SVB and Signature Bank (SBNY), insuring financial assets of banks were great business, since a bank collapse was completely unforeseen. And we may have seen the last of bank runs amongst significant players in the sector, who knows? As for me, there are echoes of the catastrophic impact the 2008 crisis had on AIG.

There is also the big question regarding the direction of interest rates. Given that the banking sector is under extreme pressure, it is entirely possible that the Fed may reverse direction to alleviate these stresses on bonds. Should the Fed indicate that interest rates will move down, that will of course cause bonds to move up in value, and therefore reduce the problems described for BAC.

Summary

Should there be further bank runs in the financial sector, either in the US or Europe, BAC may be on the hook to make good losses on financial assets. In this scenario, one can well understand that these losses will be many multiples of any premium that may have been received. Under these circumstances, without a doubt, the impact on the company’s stock price will be huge.

Caution

Please note that the above represents my own opinions. Furthermore, I recently held a short position on BAC, which I have now exited. Right now, I have a strong conviction that the Fed will signal move in interest rates to the downside, and so I plan to initiate a long position on BAC. As always, the above does not constitute advice and investors should conduct their own due diligence.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.