Summary:

- Supported by a favorable interest rate environment, BofA closed FY 2022 accumulating $30.7 billion of pre-tax earnings.

- In 2022, BofA’s net interest yield jumped to 2.22%, an increase of 55 bps as compared to Q4 2021, adding $3.3 billion of incremental NII.

- The full effects of the 2022 rate increases are likely to materialize only in late 2023/ early 2024, and as rates are likely to rise further in 2023.

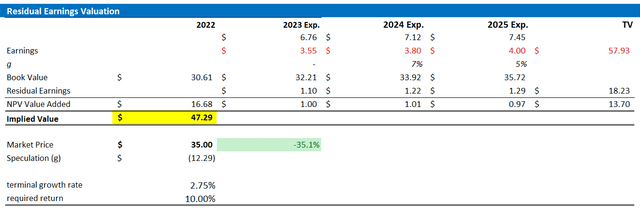

- Anchored on analyst EPS estimates through 2025, I value BAC stock with a residual earnings model and calculate a fair implied share price of approximately $47.

artran

Thesis

Bank of America (NYSE:BAC) delivered a strong Q4 2022, beating analyst estimates with regards to both revenue and earnings. But although BAC continues to perform — and the macroeconomic backdrop remains favorable given a strong interest rate environment — the financial giant is likely trading at a discount to the bank’s intrinsic worth. Anchored on analyst EPS estimates through 2025, I value BAC stock with a residual earnings model and calculate a fair implied share price of approximately $47. Bank of America shares are a ‘Buy’.

For reference, BAC stock is down approximately 21.5% for the past twelve months, as compared to a loss of about 7.5% for the S&P 500 (SPY).

Strong Q4 Results

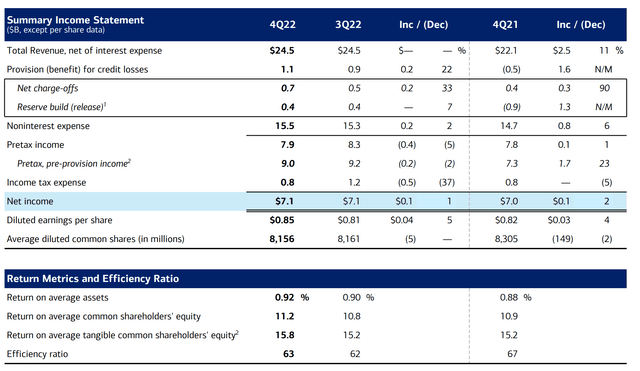

Bank of America closed FY 2022 reporting solid Q4 results. During the period from September to end of December, the US bank generated total revenues net of interest expenses equal to $24.5 billion, as compared to $22.1 billion for the same period one year prior (11% year over year growth) and as compared to about $24.2 billion as estimated by analyst consensus ($300 million beat). With that frame of reference, the bank’s net interest income jumped 29% year over year, to $14.7 billion and non interest income ‘only’ contracted by about 8% YoY, to $9.9 billion, despite material weakness in investment banking and asset management.

With regards to profitability, BofA’s non interest expenses only increased slightly, by 2% YoY, to $15.5 billion. But given a jump in provision for credit losses, increasing to $1.1 billion for the December quarter, BofA’s pretax income remained in line with Q4 2021 results — but about $200 million ahead of analyst estimates.

For the full year 2022, Bank of America’s revenues came in at $92.4 billion and profitability before tax was $30.7 billion.

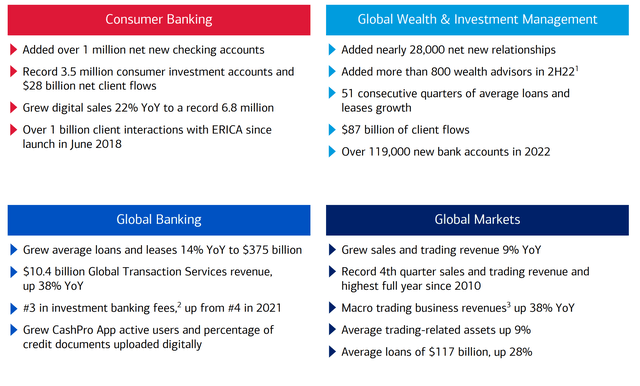

Q4 2022, and FY 2022 in general, highlighted why it is so important for banks to offer a diversified portfolio of financial services. For example, consider the recent past: In an environment of near-zero interest rates and steady markets, BofA’s investment banking and wealth management franchise performed well. Now, in a somewhat stressed market, global markets/ trading accumulated bumper earnings. And rising interest rates supported higher income from retail banking.

Below are a few selected highlights from BofA’s key business units.

Strong Interest Rate Tailwind Going Into 2023

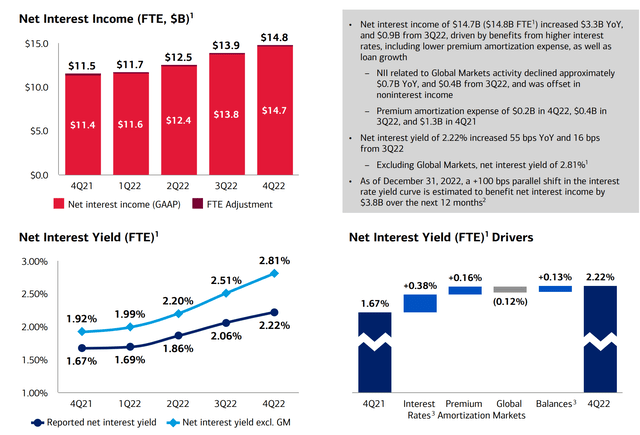

BofA’s strong performance in 2022 was supported by a favorable net interest margin expansion as compared to the previous year[s] In fact, in 2022, BofA’s net interest yield jumped to 2.22%, an increase of 55 basis points as compared to Q4 2021, adding $3.3 billion of incremental net interest income. Excluding Global Markets, the bank’s NII would have been 2.81%, according to company disclosures.

However, I believe that the full benefits of the advantageous interest rate environment are expected to materialize only in late 2023 or early 2024. The argument for it is simple: A considerable share of a bank’s loan portfolio needs to mature before it can be repriced.

Moreover, investors should take into account that many central banks, including the FED, are still in the process of raising interest rates. Some market participants have argued that the fed funds rate could jump to a level as high as 6% (some even see the fed funds rate at 8%). With that frame of reference, BofA’s interest income is poised to expand further (anchored on a favorable NII sensitivity analysis):

As of December 31, 2022, a +100 bps parallel shift in the interest rate yield curve is estimated to benefit net interest income by $3.8B over the next 12 months

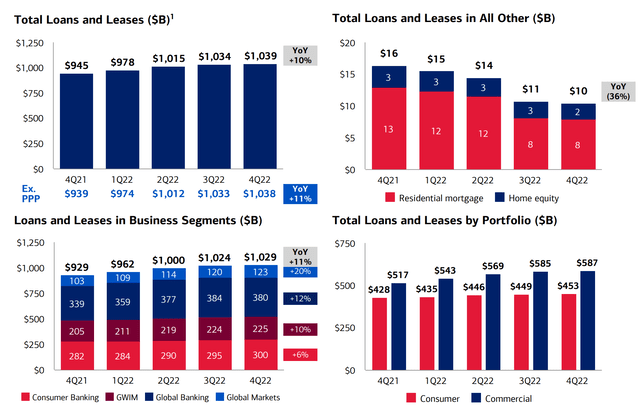

Loan growth is another favorable driver for BofA’s profitability. With capital markets and ‘innovative’ funding sources frozen, solid banking institutions with strong brand names, such as BofA, are poised to attract more business (and at attractive rates, as argued). For reference, as compared to Q4 2021, BofA’s total loan and lease portfolio has increased by 10% YoY, growing to $1.04 trillion as of December 31st 2022.

Residual Earnings Valuation

In my opinion, banks are prime candidates to be valued with a residual earnings valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework – especially for banks.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of January 31, 2023. My calculation indicates a fair required return of approximately 10%.

- For the terminal growth rate, I apply 2.75% percentage points, which I view as in line with estimated nominal GDP growth in the US.

Based on the above assumptions, my calculation returns a base-case target price for BofA of 47.29/share, implying material upside of close to 35%.

Analyst Consensus Estimates; Author’s Calculation

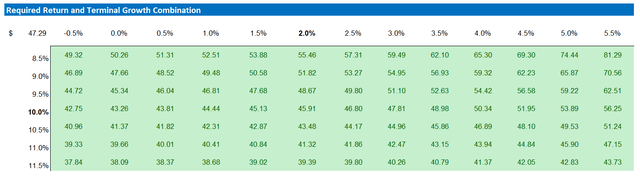

I understand that investors might have different assumptions with regards to BofA’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus Estimates; Author’s Calculation

Risks

I think bank investments are safer than market suggests, but there is still elevated tail-risk that could, in very extreme cases of financial distress, bring BofA close to bankruptcy. Banking is a risky business, as many big financial institutions have not yet recovered pre-financial crisis levels. Moreover, investors should consider that BofA’s 11.25% CET1 ratio is slightly below major competitors, especially European peers.

Conclusion

Supported by a favorable interest rate environment, BofA closed FY 2022 accumulating $30.7 billion of pre-tax earnings. But as the full effects of the 2022 rate increases are likely to materialize only in late 2023/ early 2024, and as rates are likely to rise further in 2023, there is more upside to BofA’s earnings power. That said, I anchor my BAC valuation on analyst EPS estimates through 2025, and calculate a fair implied share price of approximately $47.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: this writing is not financial advise, but expresses the opinions of the author only.