Summary:

- Lucid’s abysmal performance in 2022 continues as the EV startup is forecasting 2023 production of just 10k to 14k units, 40% below its initial target from 2022.

- Essentially, Lucid is forecasting average quarterly production of ~3,500 vehicles at the top end of the range, about in line with Q4’s total, or equaling no growth.

- Lucid also has poor delivery rates relative to production, delivering just 60% of its production volume for the year, relative to ~90% averages for peers.

- Lucid’s limited production outlook suggests it is unlikely to make a margin on any vehicle for at least six quarters, threatening its balance sheet later this year.

David Becker

Lucid Group’s (NASDAQ:LCID) recent run of abysmal performance in 2022 continues, after the EV startup offered a bleak production outlook for 2023 — Lucid is targeting production volumes around 40% below 2022’s initial target for this year. Aside from falling significantly behind schedule in scaling up production, Lucid faces other major obstacles this year — its logistics network looks very challenged, with a delivery ratio 20 to 30 percentage points below peers, while decreasing ASPs are set to exhibit downward pressure on revenues for six or more quarters. Comments about liquidity are concerning, given the fact that an outlook for minimal growth above Q4’s 3,493 unit production points to an inability to make margin on vehicles this year.

Horrid 2023 Outlook

There’s not much to describe Lucid’s 2023 outlook other than horrid — the company is projecting production of just 10,000 to 14,000 vehicles, in line with its first production cut from last year and down 75% from 2023’s initial guidance from its SPAC merger. Essentially, Lucid is forecasting practically no growth in production sequentially from Q4’s 3,493 tally.

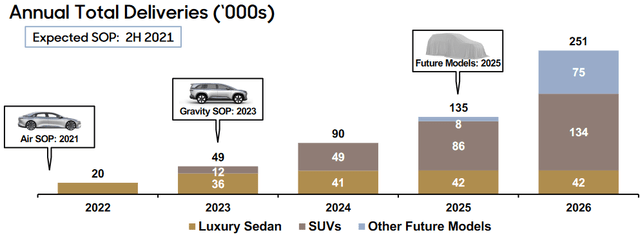

Let’s put 2023’s outlook in perspective: here’s Lucid’s original production outlook taken from its SPAC merger — these are the numbers Lucid expected and believed it could reach in order to garner a $24B valuation at its $15 PIPE price. Investors bought the story that Lucid would be able to quickly scale production and revenue shortly after product launches (i.e. Gravity growing 4x in 2024 relative to ’23), and to date, have been fleeced badly as Lucid is struggling to reach its 2022 volume targets six quarters or more behind schedule.

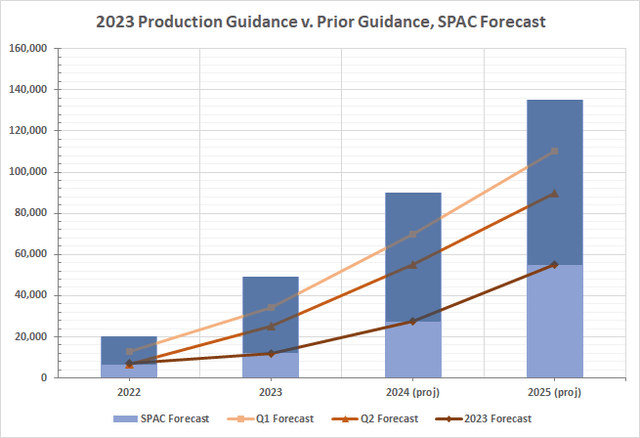

In the graph below, the dark blue column shows the massive production volume lost in 2022 and 2023 relative to SPAC guidance — initial projections for 2024 and 2025 again show massive lost volume. Now, let’s compare Lucid’s original production guidance to its revised targets. In 2022, Lucid cut that 20,000 vehicle volume target twice — first by ~35% to 12,000 to 14,000 vehicles in Q4 ’21, then a further 50% cut to 6,000 to 7,000 vehicles after Q2 ’22.

For 2023, Lucid offered a preliminary outlook of 10,000 to 14,000 vehicles, representing about +39% to +95% y/y growth to the low and high end of the range, respectively. Relative to Q4’s 3,498 unit production, Lucid is essentially forecasting zero growth through 2023: at the high-end of its range at 14,000 units, Lucid would be averaging production of just 3,500 vehicles per quarter. There’s three ways this could pan out:

- production volumes show little to no sequential growth through 2023 and remain steady around 3,500 units

- production dips significantly q/q in Q1 (i.e. 1,500 units) before showing growth through the year

- production dips significantly in the back half of the year

Lucid effectively is back to square one with its 2023 guidance — one year later, and Lucid is just now attempting to reach that 35% cut target topping out at 14,000 vehicles. That’s about 75% lower than that initial 49,000 unit guide from the SPAC merger.

Putting that in context — Lucid is now likely six quarters out from reaching 2022’s original guidance — 20,000 units on a TTM basis does not look to be in the picture until Q2 2024 at the earliest.

These major delays threaten Lucid’s ability to scale in the next two to three years — the company says production is not the issue, but rather customer awareness. But the guidance means a good portion of the 28,000 reserved customers will be waiting six quarters or more for vehicles, suggesting Lucid has limited confidence in customers not canceling reservations as it waits for parts constraints to ease.

Erosion of supplier confidence in Lucid is likely the major reason behind the continual cuts to production — the company had stated earlier in 2022 that chips are not the main constraint, but rather components such as glass, carpets, etc. While sourcing critical components at a small scale technically shouldn’t be too challenging, some auto suppliers [such as ON Semiconductor (ON)] are completely booked in long-term contracts, leaving less available supply, while others might be unwilling to enter into contractual agreements due to the high uncertainty that Lucid can scale production and exceed targets given its performance history.

Other Major Issues At Hand

Aside from perpetually weak production guidance so far, Lucid faces significantly worse delivery fulfillment rates relative to peers, suggesting major logistics utilization issues, along with an inability to make margin on vehicles through 2023. Gravity SoP has been delayed until 2024, another nail in the coffin to scaling volumes, while commentary on liquidity suggests Lucid is massively overspending to sell each vehicle.

Order Fulfillment Rates Very Low

Here’s a quick breakdown of Lucid’s production to delivery fulfillment ratios for each quarter of 2022 (deliveries divided by production volume):

- Q1: 51.4%

- Q2: 96.3%

- Q3: 61.3%

- Q4: 55.3%

- FY22: 60.8%

On average for FY22, Lucid delivered 6 of every 10 vehicles it produced during that same quarter. This rate is far below standard levels — Tesla (TSLA) noted an increased amount of vehicles in transit, but still delivered over 92.2% of produced vehicles in Q4, Toyota (TM) delivered 90% of its production volume in November, even after a large drop from October. Rival startup Rivian (RIVN) also managed to deliver 80.4% of its production volume in Q4, down from 89.4% in the prior quarter.

Lucid desperately needs to improve its vehicle logistics, which could increase logistics expenses even as truckload rates slump, to facilitate delivery growth as production scales. The company is averaging delivery fulfillment rates 20 to 30 percentage points below peers, suggesting that it does not have a suitable outbound logistics network to facilitate timely delivery.

For example, should Lucid maintain a ~61% fulfillment rate per its production volume, at 12k units for 2023, the company would be delivering just 7,320 vehicles. That level of deliveries is nowhere near high enough to drive meaningful revenue growth as ASPs continue to fall.

Inability To Make Margin

With 2023’s initial guidance forecasting quarterly production averages in line with Q4 levels, it’s likely that Lucid will struggle to make margin on vehicles through 2023, given its cost profile.

For Q4, Lucid delivered 1,932 vehicles, generating revenues of $257.7 million (an ASP of ~$133.4k), while incurring a gross profit of ($357.6 million). Lucid is operating at a (138.8%) gross margin — again, with vehicle production outlook not signaling much growth, if any, through 2023, Lucid is expected to continue operating far in the red.

To frame this better, it’s costing Lucid $318.5k to produce and sell a vehicle for $133.4k — that’s unsustainable. There’s no other way to put it. Moving through 2023, if Lucid continues at this rate of delivering approximately 2,000 vehicles per quarter on production of 3,500, it’ll be posting a gross profit of ($1.4 billion) on revenues near $1 billion. With R&D and SG&A included (and assuming a boost to marketing to improve customer awareness, as Lucid puts it), the company could be look at losses of $3 billion to $3.2 billion in 2023 alone.

ASPs are also exhibiting downward pressure on revenues — Q4’s ASP of $133.4k is 4.8% below Q3’s ASP of $139.8k, which are a distance off Q2’s ASP of $141.5k and Q1’s $160.3k. Lucid’s current reservation backlog points to an average ASP of $96k, a slight improvement from prior levels, but still at a level that will exhibit substantial downward pressure on revenues for the next six quarters.

Liquidity Update Concerning

Management’s commentary on liquidity was quite concerning — Lucid is entering 2023 with “approximately $4.9 billion in total liquidity,” which it believes “provides sufficient capital at least into the first quarter of 2024.”

While Lucid is planning about $1.5 billion to $1.75 billion in capex for the year, it’s still overspending to produce a limited amount of vehicles. For 2022, Lucid spent $733k ($376.8k cost of revenues, $356.2k R&D/SG&A) to sell each vehicle for $139.3k on average — that’s not expected to decrease by much in 2023.

Given the comments about the $4.9 billion in liquidity lasting four to five quarters, that’s about $1.1 billion to $1.2 billion in cash burn per quarter — losing about $800m per quarter on average, slightly above Q4’s level, combined with the planned capex would equate to about five quarters of runway. Thus, the bleak production guidance and minimal growth above a 3,500 vehicle per quarter rate in 2023 is likely to place increasing pressure on the balance sheet as 2023 comes to a close.

Outlook

Lucid looks to be circling the drain — the startup is struggling to scale production anywhere close to targets it had confidence in reaching when securing a $24B valuation, forecasting average quarterly production of 3,500 vehicles at the high-end of its range. With minimal growth above Q4’s production tally, combined with sub-par outbound logistics and decreasing ASPs, Lucid’s top-line is increasingly threatened, while the bottom line looks set to struggle as Lucid faces challenges to making margin on vehicles for six quarters or more. The takeaway here — don’t be greedy on Lucid as the company faces extreme levels of execution risk to meet already questionably low production guidance.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.