Summary:

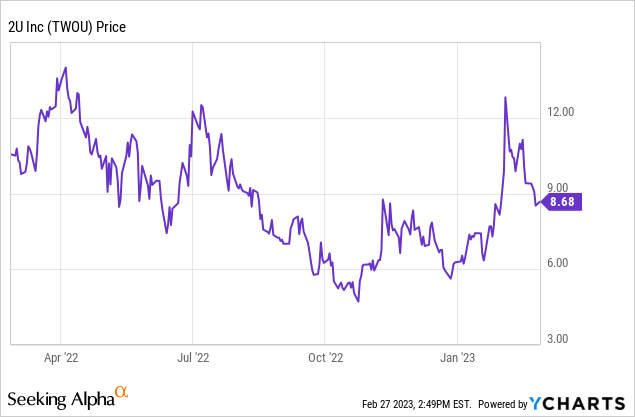

- Shares of 2U, the online education company, are up 40% year to date.

- The stock rallied after the company released rosy profitability plans for 2023.

- 2U is primarily achieving this through driving down sales and marketing costs. As a reminder, 2U shoulders the brunt of marketing its degree programs to prospective students.

- Enrollments are already down and will continue to suffer with lower marketing.

Rockaa/E+ via Getty Images

The early 2023 rally has come under fire in recent weeks, but broadly speaking most technology stocks are still up tremendously year to date. We should be careful, however, not to assume that a rising tide will lift all boats: as there are plenty of stocks that have soared far above their fundamental worth this year.

2U (NASDAQ:TWOU), the online for-profit education company, is one perennially struggling company whose year-to-date rally I find difficult to justify. Just off the back of a Q4 earnings release that showed more disappointing trends in enrollment (which is not what we would hope for in a recession), 2U pleased the markets by guiding to a richer EBITDA margin in 2023. Year to date, the stock is up nearly 40%:

I continue to be very bearish on 2U, especially after parsing through the latest Q4 results. The two key concerns to be aware of:

- 2U relies on economies of scale, and declining enrollment is a major red flag. As a reminder on 2U’s business model, its core degree program calls for 2U to take the brunt of developing/digitizing course content then marketing programs to prospective students. 2U’s one-time course development and setup costs require economies of scale and full course seats in order to make up for the initial investment.

- 2U’s plan for profitability calls on relatively flat revenue for FY23. This may not be feasible if marketing spend is dropping double-digits. A sharper than expected decline in enrollments could sap away the expected margin gains that 2U is planning to achieve.

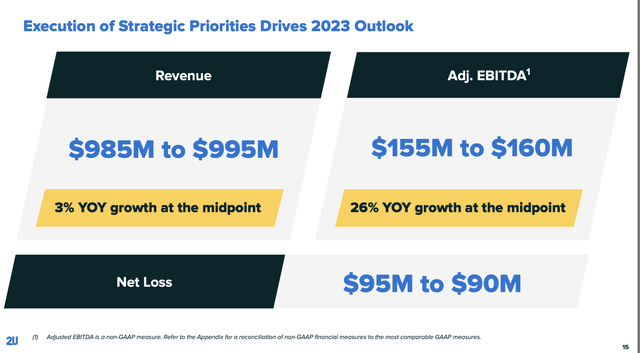

The slide below shows the company’s latest outlook for FY23:

2U outlook (2U Q4 earnings presentation)

The company’s $155-$160 million adjusted EBITDA forecast calls for a ~16% margin, which implies three points of margin improvement from 13% in 2022. This is unrealistic when A) the forecast relies on 3% y/y revenue growth, but one of the main levers to EBITDA expansion is marketing reduction; and B) the more profitable Degree segment is the one that is losing more enrollments.

The bottom line here: 2U remains an incredibly risky company. Even though 2U looks like a value stock after 2022’s sharp declines, I view the stock’s sharp fall as being in-line with the negative trends in enrollment and revenue.

Q4 download: enrollments soften despite recession

One commonly accepted adage is the idea that in times of recession and layoffs, workers go back to school to earn more advanced degrees and wait out the economic storm.

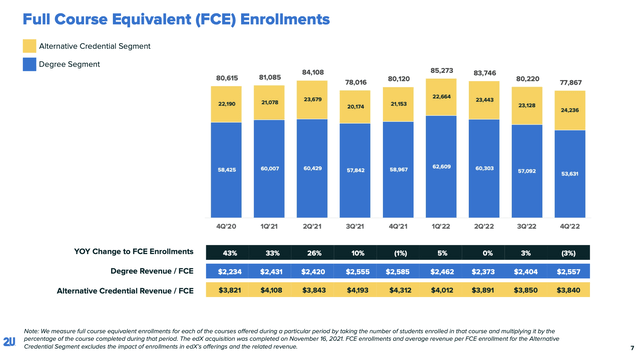

This is not benefiting 2U, however. Q4 saw a -3% y/y decline in total full-course equivalent (FCE) enrollments, as shown in the chart below:

2U enrollments (2U Q4 earnings presentation)

Note as well that from a sequential basis, the company shed 2.3k full course enrollees relative to Q3. This is unusual seasonality, as last year saw a +2.1k increase in FCEs in the fourth quarter.

Also important to understand is the fact that 2U’s core degree programs are seeing the brunt of the declines: down -3.5k from Q3, and down -14% y/y. This was offset by growth in the Alternative Credential (short-form courses and certification) segment.

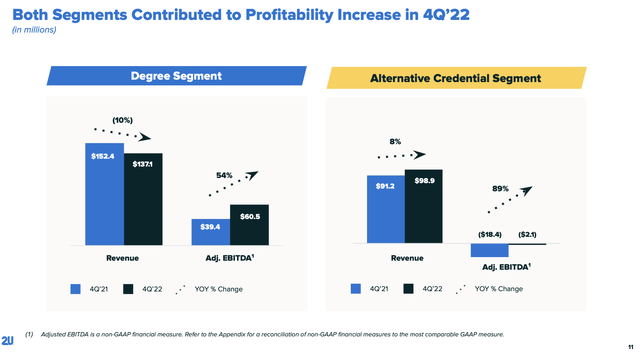

Why the segment breakdown is worth noting is that the degree segment is the more profitable one. Adjusted EBITDA in Q4 grew 54% y/y to $60.5 million (a 44% margin), while the alternative credential segment is still slightly under breakeven. Again, a reminder here that degree programs require significant setup investments from 2U, which is why economies of scale are so critical and the recent declining enrollments are a huge threat to the business.

2U segment profitability (2U Q4 earnings presentation)

Here is context from CEO Chip Paucek on revenue and enrollment trends on the Q4 earnings call, in which he significantly talked up the performance of the AC segment:

Our Alternative Credentials segment is doing very well, delivering almost $400 million of revenue in 2022. This is driven primarily by boot camp growth of 18% versus the prior year, with contributions from both consumer and enterprise. We anticipate this growth will continue as more learners opt for shorter, less expensive and more career specific training to reach that next job, promotion or bump in salary. And we expect that continued growth will offset the near-term declines in the Degree business. Most notably, in 2023, we expect the Alt Cred segment to cross over into profitability for the first time after 6 years of building that business. This is a big deal. No more “empty calories.”

Looking at the top line of our degree business for 2022, revenue slowed by 3% year-over-year to $572 million. We saw the near-term impact of our new marketing framework, which reduced unprofitable spend combined with a strong labor market that increased the opportunity cost of higher education. However, we remain focused on enabling great outcomes, delivering strong profitability and signing new degree programs. We believe that these new degree programs and a cooling labor market will setup the degree segment to return to top line growth in 2024.”

Management believes the alternative credential segment will hit adjusted EBITDA profitability in 2023, but in my view this benefit will get offset by diseconomies of scale in the Degree segment.

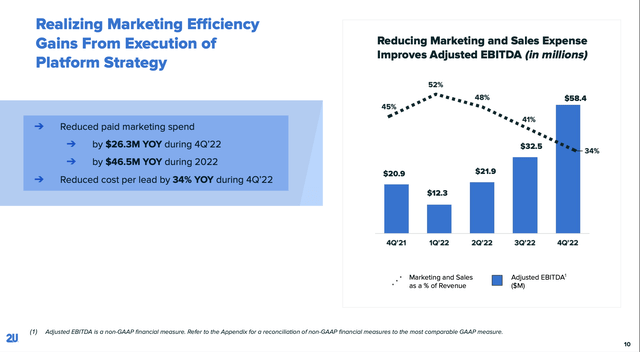

2U reduced marketing spend by $26 million in Q4, down -27% y/y. While cutting spend is definitely a positive for profitability and the company’s belt-tightening is applaudable, I’m worried that reduced brand exposure will have long-tailed impacts on revenue and enrollment that we are currently not seeing in the fourth quarter.

2U marketing spend (2U Q4 earnings presentation)

Key takeaways

It’s incredibly unsettling to me that 2U is calling for revenue growth in 2023, despite expectations of further marketing spend cuts.

Of course, there are upside risks here that could tilt in 2U’s favor. Recessionary impacts may not have kicked in yet in Q4; so the broad layoffs we’ve seen in so-called white-collar professions may lead to a pickup in short-form courses like coding boot camps in 2023.

Still, especially with the generous 40% lift in 2U’s stock since the start of the year, taking extreme caution here is appropriate. Steer clear and invest elsewhere.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.