Summary:

- Bank of America stock fell markedly despite posting a solid earnings release.

- BofA is confident of reaching a bottom in its net interest income in Q2, with a growth inflection in the second half.

- Concerns over its HTM securities portfolio are misplaced, as the headwinds have likely peaked.

- BAC isn’t aggressively valued, offering long-term investors another opportunity to accumulate.

- Investors should consider buying sooner rather than later to avoid regrets.

robwilson39

Bank of America Corporation (NYSE:BAC) investors suffered a rude awakening on April 16, as the stock declined 3.5% for the day after BofA posted its first-quarter earnings release. While Bank of America surpassed analysts’ estimates, it wasn’t enough to withstand the market onslaught as investors parsed whether the rally from BAC’s October 2023 lows had gone too far ahead.

A closer look at BAC’s “C-” valuation grade corroborates my conviction that its undervaluation has normalized. I highlighted BAC’s thesis in my previous article in December 2023, urging investors not to get out too early, notwithstanding its normalized valuation. Its forward EPS multiple of 10.8x suggests BAC isn’t expensive, compared to its 10Y average of 11.6x. As a result, I assessed there’s no need to be unduly concerned about yesterday’s selloff as likely a profit-taking opportunity from earlier investors, given the resurgence in long-term bond yields.

As a reminder, the 10Y (US10Y) surged toward the 4.7% level this week, breaking through levels seen in November 2023. Fed Chair Jerome Powell’s hawkish comments added fuel to the fire that the Fed could reduce the number of rate cuts this year. While the possibility of no rate cuts might seem too extreme, investors face a significantly reduced outlook of six rate cuts at the start of the year to possibly just two in 2024.

However, BofA management reminded us at its conference call that higher-for-longer is generally constructive for the bank. It emphasized that the extent of deposit repricing has slowed and is expected to normalize. Moreover, as lower-rate loans get repriced over this year, they should bolster BofA’s net interest income in the second half. As a result, Bank of America telegraphed its confidence that Q2’s NII guidance of $14B will likely be the low for this year. Furthermore, BofA saw its NII increase sequentially in Q1 to $14.2B (FTE basis), outperforming its previous guidance.

BofA has an inflated HTM securities book, subject to intense scrutiny last year during the regional banking crisis. While investors appeared to have turned their attention away from it over the past six months, the recovery in interest rates also affected the valuation of its HTM portfolio. Accordingly, BofA saw its “unrealized losses widened by $11B to $109B from $98B at the end of 2023.” While we shouldn’t ignore the extent of BofA’s losses, the bank is confident that as the maturities roll off, the losses will be reduced over time. Furthermore, with the Fed expected to have reached peak rates, I assessed that the HTM portfolio will likely be less of a headwind moving ahead. Therefore, the risk-off move in the market, notwithstanding a pretty decent Q1 report card, should be seen as an opportunity for investors to accumulate rather than worrying about unanticipated underlying weakness.

Bank of America’s first quarter release underscored the robustness of its well-diversified business model. BofA posted a 35% increase in investment banking fee revenue, propelled by a timely recovery in dealmaking across the market. In addition, it also notched a resurgence in sales and trading revenue, delivering its best first-quarter performance “in over a decade.” Bolstered by an adjusted RoTCE of 13.8% and a CET1 ratio of 11.8%, I have confidence that BofA seems well-placed to perform well in a higher-for-longer posture. With potential capital releases following the conclusion of the Basel III endgame framework, BofA could have potential upside surprises in store for investors, as the optimism has likely not been reflected in its valuation.

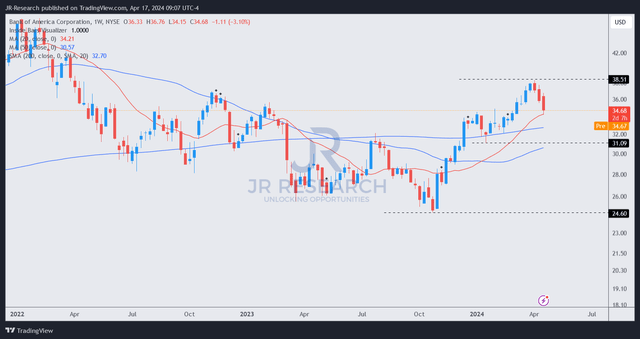

BAC price chart (weekly, medium-term, adjusted for dividends) (TradingView)

BAC’s price action suggests that there could still be near-term downside volatility, although we could find support at the $33 zone, which is close. A steeper pullback toward the low-$31 level would likely appeal to long-term investors to consider adding more aggressively. Hence, I maintain my view that BAC’s risk/reward profile leans increasingly toward the bullish side after the pullback from its April 2024 highs.

Rating: Maintain Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!