Bank of America: Why I Am Going All-In Now (Technical Analysis)

Summary:

- Bank of America is expected to exceed profit estimates in Q1 2024 due to a favorable economic and monetary environment.

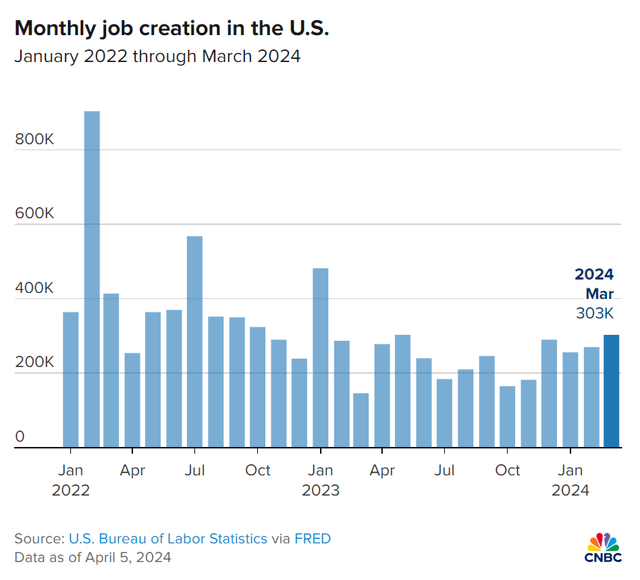

- The bank’s consumer loan origination is expected to benefit from long-term easing of inflation and strong job creation.

- Bank of America’s stock is in a promising technical setup, suggesting a potential breakout to the upside.

Massimo Giachetti/iStock Editorial via Getty Images

Bank of America Corporation (NYSE:BAC) is scheduled to report earnings for the first quarter on April 16, 2024, and the bank has a great chance to sail past profit estimates, in my view.

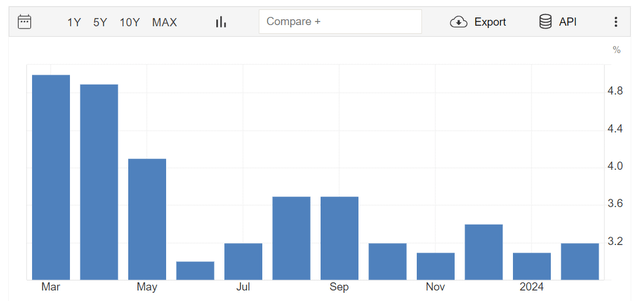

The U.S. economy has seen a long-term easing of inflation (though inflation flared up in early 2024) as well as strong job creation, which should boost Bank of America’s consumer loan origination.

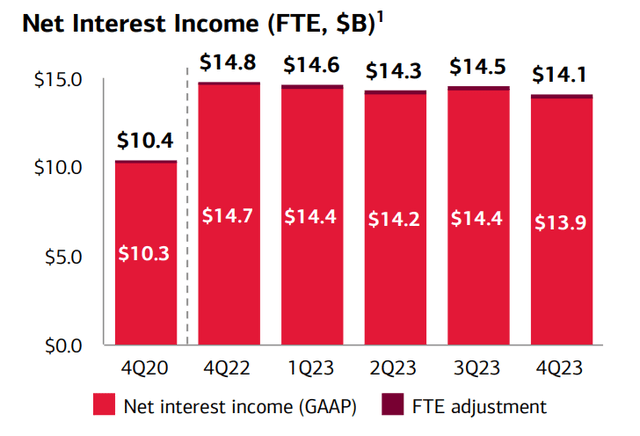

At the same time, the central bank has proven to be highly flexible with its rate cut timeline, creating a higher-for-longer rate environment that equates to a favorable net interest income outlook for Bank of America. Broad economic and monetary support point to ongoing profit and book value growth for Bank of America.

With the stock also being in a promising technical setup, I think that Bank of America could be poised to break out to the upside next week.

My Rating History

After inflation came in hotter-than-anticipated at the beginning of the year, I argued that Bank of America’s stock was a Buy because the central bank was poised to lower rates more slowly in 2024, thereby elevating Bank of America’s net interest income.

Furthermore, I think that recent macro data, such as robust job creation and a low unemployment rate, indicate that the U.S. economy remains in pretty good shape and Bank of America thus has considerable potential to sail past profit estimates next week.

Expectations For Q1’24

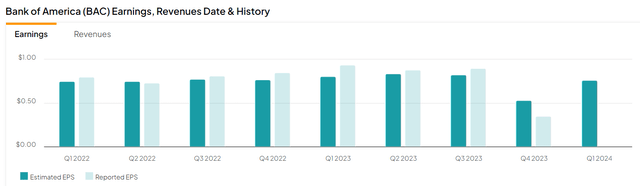

The market models $0.76 per share in profits for the first quarter which represents a more than doubling of profits compared to 4Q-23 which is when Bank of America earned $0.35 per share.

Taking into account the very favorable economic backdrop as well as the central bank’s reluctance to lower short-term interest rates, I think the stars could align for Bank of America next week when earnings are due.

Earnings And Revenues (Yahoo Finance)

Favorable Economic Backdrop For Bank of America

The inflation picture has improved in the last year, though an inflation flare-up early this year rattled investors’ feathers. But inflation, broadly speaking, has moderated a lot, and it is taking pressure off of the economy and freeing up spending power, which leads to an improved outlook for Bank of America’s loan business.

Consumers tend to demand more loans when interest rates are cheap, so in the medium term, Bank of America could see a boost to new loan originations, particularly in its consumer business.

The job market looks great, too, at least as far as job growth and the unemployment rate are concerned. Payrolls, excluding farm jobs, rose 303,000 in March, reflecting a 33,000 increase over the February total. Unemployment, according to the Bureau of Labor Statistics, remained low at 3.8%. Put simply, the U.S. economy as a whole is doing pretty darn great right now, which should help Bank of America’s profit and book value growth prospects.

Monthly Job Creation In The U.S. (U.S. Bureau Of Labor Statistics)

Furthermore, the central bank has so far proven that it acts very responsibly and is adamant to not hurt the economy by raising short-term interest rates too fast. This, at least temporarily, is boosting Bank of America’s net interest income outlook.

Bank of America’s loans produced $14.1 billion in net interest income in the fourth quarter and with short-term interest rates remaining high, I am anticipating a net interest income figure close to $14.0 billion for the first quarter as well.

Obviously, an ongoing inflation flare-up might even be a good thing for Bank of America, as the central bank may continue to delay cuts to short-term interest rates, thereby propping up the bank’s net interest income for longer.

Net Interest Income (Bank Of America)

Technical Situation: Set For A Breakout

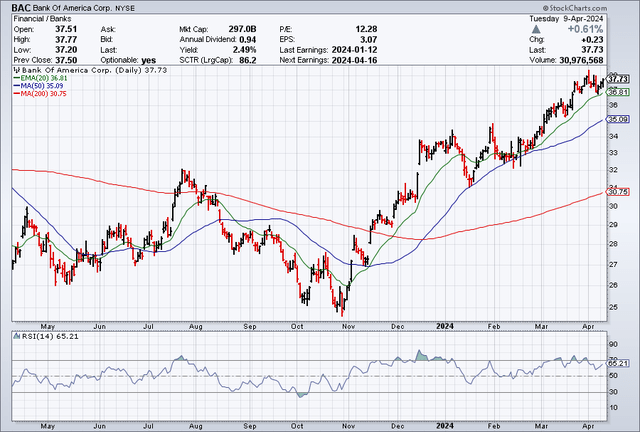

Pretty much since November 2023, Bank of America’s stock has remained above the 50-day and 200-day moving average lines, which already creates a bullish setup for the bank heading into earnings next week.

A stronger-than-anticipated earnings release, driven by net interest income growth and strong consumer spending benefiting the bank’s Consumer business, could unleash pent-up technical strength and drive the stock to new highs.

Bank of America is not overbought yet, despite the up-channel for the stock, as the Relative Strength Index flashes a value of 65.21.

Moving Averages (Stockcharts.com)

Bank of America: Reasonable Price

Bank of America is selling for a moderate 13% premium to book value, and the bank is growing its book value, too.

With a strong economic backdrop, the central bank providing extraordinary support and net interest income remaining higher-for-longer, chances are that Bank of America will be able to continue to grow its book value.

In the last quarter, 4Q-23, the bank’s book value went up to $33.34, reflecting 9% YoY growth. With a 13% premium to book value, I think Bank of America has considerable multiple expansion potential in 2024, particularly as Wells Fargo (WFC) sells for a 25% premium to book value and is subjected to the same growth trajectory as Bank of America.

JPMorgan (JPM) as the largest bank on Wall Street is selling for a 1.91x book value multiple, thanks primarily due to Jamie Dimon’s excellent leadership in recent years. A 1.25x book value multiple is entirely within the realm of possibility in 2024, particularly with a growing book value to boot. This translates into an intrinsic value of $42 (not counting any incremental book value gains in 2024).

Why The Investment Thesis May Not Pan Out As Anticipated

The investment thesis might be challenged by the central bank’s changing rate trajectory. Moderating inflation in the near-term would incentivize the central bank to cut short-term interest rates faster, thereby ending the higher-for-longer rate environment that benefits Bank of America as well as other large banks.

Softening net interest income might be the most severe headwind for Bank of America’s valuation, as would be a substantial deterioration in the bank’s loan quality.

My Conclusion

I think that Bank of America could be on the brink of an imminent stock breakout to the upside. A catalyst for this breakout could be better-than-expected Q1 earnings that are likely to reflect strong net interest income (as short-term interest rates remained high throughout the first quarter) as well as robust results from the Consumer Banking segment.

This segment profits from strong U.S. economic growth and with consumers being in decent financial shape right now, the chance for the bank’s loan quality to have deteriorated is very low as well.

From a technical angle, I think that the setup is extremely compelling (i.e. bullish) and with the economy (as well as the central bank) providing decent support for banks, Bank of America could reach new highs in 2024. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.